[Are Homeowners Association Tax Exempt?] Navigating the complexities of homeowners association (HOA) taxation can be a daunting task. This article delves into the intricacies of HOA tax-exempt status, providing a comprehensive guide for HOA boards and members.

Key Takeaways:

- HOAs are not tax-exempt despite their nonprofit status.

- HOAs must file tax returns, but can exclude exempt function income from their gross income.

- Some HOAs may qualify for tax exemption in rare cases with strict regulations and IRS approval.

Are Homeowners Associations (HOAs) Tax Exempt?

Nope, they’re not.

Nonprofit but Not Tax-Exempt

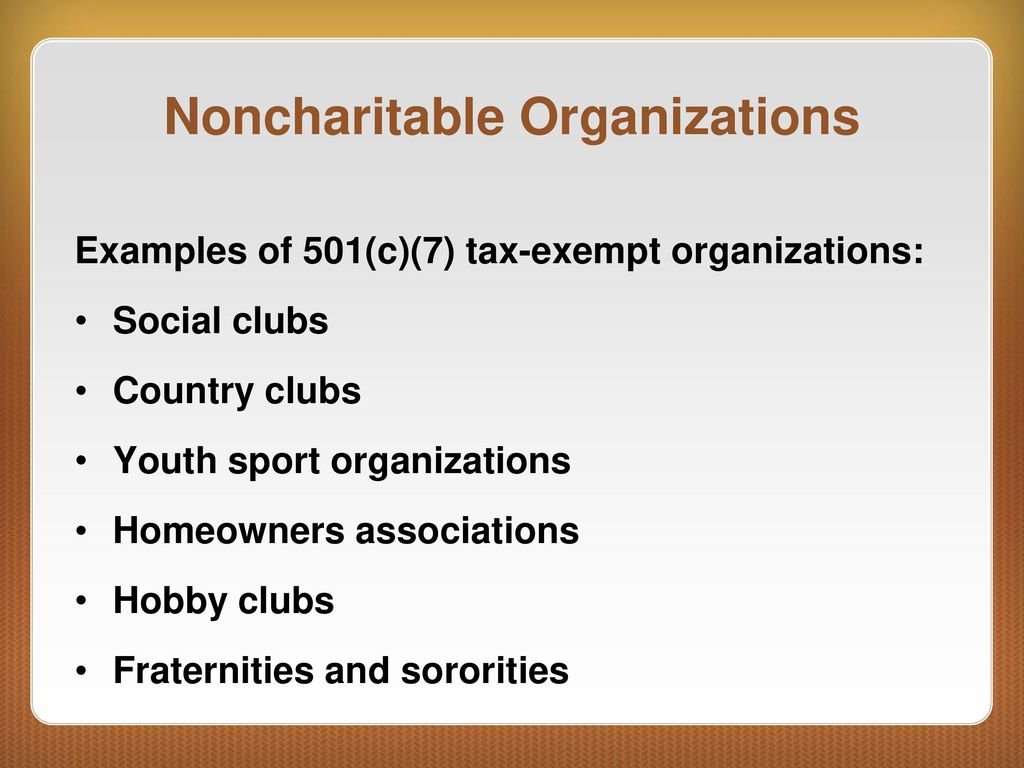

Even though HOAs are classified as nonprofits, they don’t qualify for tax-exemption under the IRS’s 501(c)(3) status.

HOA Tax Returns

HOAs are still required to file tax returns, but they can exclude exempt function income from their taxable income. This income includes membership dues, assessments, and fees for common areas.

Rare Cases of HOA Tax Exemption

In exceptional circumstances, HOAs can become tax-exempt if they meet specific regulations and submit supporting documentation for IRS approval. These cases tend to be rare, so HOA exemption is not the norm.

Investing in affordable kit homes can be a great way to save money on your dream home. Check out our article on affordable kit homes to learn more about this cost-effective housing option.

In need of quality home healthcare but don’t want to leave the comfort of your own home? Consider alternative home health care services.

Protect your home and loved ones with a home alarm system. Our article on are home alarms worth it discusses the benefits and drawbacks of home alarms to help you make an informed decision.

HOA Tax Exemption Requirements

While HOAs may not qualify for tax-exempt status under Section 501(c)(3), they can seek quasi-exemption under IRC 528. This exemption allows HOAs to exclude certain income, such as dues and assessments, from taxation. To qualify for this exemption, HOAs must meet specific requirements, including:

- Be organized and operated exclusively for the purpose of providing management, maintenance, and improvement of common areas and facilities for its members.

- Not engage in any substantial unrelated business activities except those that are incidental to their exempt purposes.

- Annually elect for exemption by filing an Internal Revenue Service Form 1120H.

Key Takeaways:

* HOAs are not automatically tax-exempt.

* HOAs can achieve quasi-exemption under IRC 528.

* To qualify for exemption, HOAs must meet specific requirements, including providing management, maintenance, and improvement services to their members and filing an IRS Form 1120H annually.

Source URLs:

– https://www.irs.gov/…/homeowners-associations

–

HOA Financial Record-keeping for Tax Exemption

HOAs can’t get away with poor financial record-keeping, especially if they seek tax exemption. The IRS is keen-eyed when it comes to financial matters, and HOAs must have their ducks in a row to avoid any tax-related headaches.

What You Need to Know

- Keep meticulous records: Track every penny that comes in and goes out. This includes dues, assessments, common area fees, and any other income or expenses.

- Use a separate bank account: Don’t mix HOA funds with personal or business accounts.

- Prepare financial statements: Generate income statements, balance sheets, and cash flow statements regularly.

- Stay organized: Keep all financial documents organized and accessible for easy IRS review.

Benefits of Good Record-keeping

- Tax exemption: Proper record-keeping helps HOAs maintain their tax-exempt status if they qualify.

- Financial transparency: It ensures that all homeowners have access to accurate financial information.

- Accountability: It holds the HOA board accountable for their financial decisions.

- Prevents misappropriation: Detailed records reduce the risk of fraud or misuse of funds.

Consequences of Poor Record-keeping

- Loss of tax exemption: The IRS can revoke tax-exempt status if it finds discrepancies in financial records.

- Fines and penalties: The IRS can impose fines and penalties for non-compliance with tax laws.

- Damage to reputation: Poor record-keeping can undermine HOA credibility and damage relationships with homeowners.

Key Takeaways:

- HOAs must maintain accurate and organized financial records for tax exemption purposes.

- Proper record-keeping ensures transparency, accountability, and reduces the risk of misappropriation.

- The IRS can revoke tax exemption and impose penalties for non-compliance with financial record-keeping requirements.

Sources:

- IRS: Homeowners’ Associations

- Can My HOA Get Tax-Exemption from the IRS? – Apex Law Group

Consequences of losing HOA tax exemption

Losing tax exemption status for homeowners associations (HOAs) can have far-reaching consequences. Here’s how it can impact your HOA:

Increased financial burden

- Higher taxes: An HOA that loses its tax exemption is subject to paying taxes on its income and assets, including property taxes, income taxes, and sales taxes.

- Dues and assessments: To cover the increased tax liability, HOAs may have to increase dues and assessments for homeowners, potentially placing a financial strain on residents.

Loss of community benefits

- Limited services: With reduced funding due to increased taxes, essential HOA services such as maintenance, security, and amenities may be cut back or eliminated.

- Lower property values: HOAs provide benefits that enhance property values, such as landscaping, architectural guidelines, and community amenities. Losing tax exemption can jeopardize these benefits, potentially leading to a decline in property values.

Legal challenges

- IRS penalties: Failing to comply with tax filing requirements or losing tax exemption status can result in fines and penalties from the Internal Revenue Service (IRS).

- Lawsuits: Homeowners may file lawsuits if they feel that the HOA is improperly using funds or failing to meet its legal obligations due to a loss of tax exemption.

Key Takeaways:

- HOAs that lose tax exemption face higher taxes and reduced funding.

- Homeowners may experience increased dues, reduced services, and lower property values.

- Noncompliance with tax laws can lead to IRS penalties and legal challenges.

Sources:

- Consequences of Losing HOA Tax Exemption

- Tax Implications for Homeowners Associations

FAQ

Q1: Are HOAs tax-exempt under 501(c)(3)?

A1: No, HOAs are generally not tax-exempt under 501(c)(3). However, they may qualify for tax exemption under other sections of the Internal Revenue Code, such as IRC 528.

Q2: Do HOAs have to file tax returns?

A2: Yes, HOAs must file tax returns, but they can exclude exempt function income from their gross income.

Q3: Can HOAs apply for tax exemption?

A3: Yes, HOAs can apply for tax exemption by filing an Internal Revenue Service Form 1120H and meeting specific requirements.

Q4: Do HOA fees typically cover property taxes?

A4: No, HOA fees do not typically cover property taxes for individual properties, but they may be subject to taxes on non-exclusive common property.

Q5: Can homeowners deduct HOA fees on their primary residences?

A5: No, homeowners cannot deduct HOA fees on their primary residences, but deductions may be available if the property is held for investment purposes.

- Stove Backsplash Design: Ideas to Elevate Your Kitchen Style - December 26, 2025

- Backsplash For Cooktop: Stylish Ideas To Protect and Enhance - December 25, 2025

- Stove Backsplash Ideas: Find Your Perfect Kitchen Style - December 24, 2025