Uncover the intricacies of home mortgage rates in Singapore with expert insights from John, an experienced financial journalist who delves into the intricacies of the mortgage market, empowering individuals to make well-informed decisions on their homeownership journey. [Home Mortgage Rates Singapore: Expert Insights for Informed Homeownership Decisions] provides a comprehensive guide to navigate the complexities of mortgage products, market trends, and strategies for securing the most favorable home loan deals.

Key Takeaways:

- Home Loan Rate Trends:

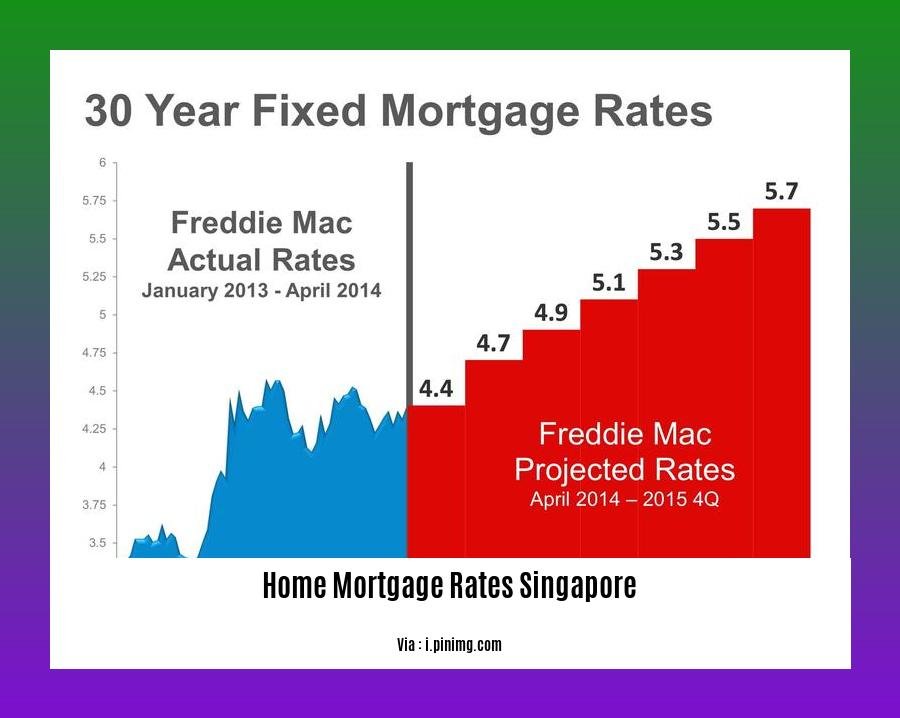

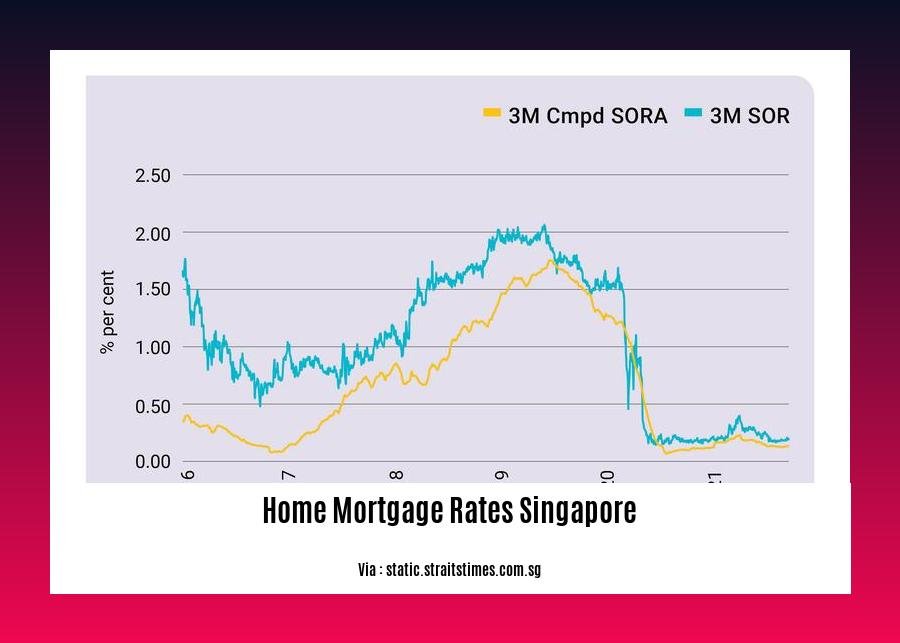

- Mortgage rates in Singapore have been gradually rising in recent years.

-

Rates are expected to continue rising due to factors like rising U.S. interest rates and inflation.

-

Factors Affecting Mortgage Interest Rates:

- Central Bank Policies: MAS’s policies, like SIBOR and overnight policy rate, influence rates.

- Economic Conditions: Inflation and unemployment rates impact banks’ borrowing costs.

- Global Market Conditions: Geopolitical events and global economic growth can affect rates.

- Bank’s Funding Cost: Banks’ own borrowing costs and liquidity affect offered rates.

-

Competition Among Lenders: Competition among banks can influence mortgage rates.

-

Tips for Securing a Favorable Mortgage Rate:

- Compare Rates: Use online tools to compare rates offered by different lenders.

- Improve Credit Score: A good credit score increases chances of a lower interest rate.

- Consider Fixed-Rate Mortgages: Stable interest rates throughout the loan period provide payment certainty.

- Opt for Shorter Loan Tenure: Shorter tenures usually mean lower interest rates.

-

Make a Larger Down Payment: A larger down payment can lead to lower interest rates.

-

Conclusion:

- Home mortgage rates in Singapore are influenced by various factors.

- By comparing rates, maintaining a good credit score, considering fixed-rate mortgages, opting for shorter tenures, and making a larger down payment, borrowers can work towards securing a favorable mortgage rate.

Home Mortgage Rates Singapore: Expert Insights for Informed Homeownership Decisions

Hello there, homebuyers! Are you navigating the home mortgage rates singapore maze and feeling overwhelmed?

Home Mortgage Rates Singapore: A Nutshell

In Singapore, home mortgage rates singapore are influenced by various factors like the Monetary Authority of Singapore’s policies, economic conditions, and global market dynamics. Understanding these factors can help you make informed decisions when choosing a home loan.

Central Bank Policies:

The Monetary Authority of Singapore (MAS) plays a crucial role in setting interest rates, impacting home mortgage rates singapore.

Economic Conditions:

Singapore’s economic indicators, such as inflation and unemployment, affect banks’ cost of funds and subsequently home mortgage rates singapore.

Global Market Conditions:

International events and global economic growth can influence Singapore’s home mortgage rates singapore.

Bank’s Funding Costs:

Banks’ own borrowing costs and liquidity impact the interest rates offered to borrowers.

Level of Competition:

Competition among banks and financial institutions can influence home mortgage rates singapore.

Securing a Favorable Mortgage Rate: Expert Tips

Compare Rates:

Use online comparison tools to find the best home mortgage rates singapore.

Credit Score:

Maintain a good credit score to increase your chances of securing a lower interest rate.

Fixed-Rate Mortgages:

Consider fixed-rate mortgages for stable interest rates over the loan period.

Loan Tenure:

Opt for shorter loan tenures to potentially secure lower interest rates.

Larger Down Payment:

Increase your down payment to reduce the loan amount and potentially lower the interest rate.

Keep in mind, home mortgage rates singapore are subject to change, so staying updated on market trends and consulting with financial advisors can help you make informed decisions.

That’s it! Now, go forth and conquer the world of Singapore homeownership!

-

Curious to know the lyrics of Home Minister Title Song? Find the lyrics here: home minister title song lyrics

-

While planning to renovate your home, don’t forget about the comfort of elderly and disabled people. Explore home modification companies for elderly and disabled for guidance.

-

If you’re curious about the meaning of “home” in Tamil, follow this link: home meaning in tamil to discover it.

Comparing Home Mortgage Rates:

Consider this: You’re on a mission to find your perfect home in Singapore, but navigating the world of home mortgage rates can feel like wandering through a labyrinth. Fear not, mortgage explorers!

Key Takeaways:

-

Comparing apples to apples: Before your rate hunt, understand the different types of interest rates. Fixed rates stay put, while floating rates can bob and weave with market conditions.

-

Current climate: As of December 8, 2023, the average 30-year fixed home loan rate for private properties and HDB sits at 2.95%. Market winds can shift though, so keep an eye out for changes.

-

Fixed vs. floating: Choosing between these two rate types is like deciding if you prefer a steady heartbeat or a rollercoaster ride. Fixed rates offer stability, while floating rates bring the thrill of potential ups and downs.

-

Loan tenure: The duration of your mortgage journey impacts your rates too. Shorter tenures may mean lower interest rates but demand higher monthly payments. Longer tenures ease your monthly burden but might come with slightly higher rates.

-

Your financial health: Lenders love a good credit score and manageable debt-to-income ratio. Keep these in tip-top shape to boost your chances of securing favorable rates.

-

Shop around: Don’t get hitched to the first rate you see! Compare offers from multiple lenders like you’re choosing your favorite flavor of ice cream. Online comparison tools can be your trusty guides in this quest.

Remember, buying a home is a marathon, not a sprint. Take your time, compare rates, and make informed decisions. Your future self, sipping tea in your dream home, will thank you.

Tips for Getting the Best Home Mortgage Rate

Hello there, folks!

In this article, we’ll dive into the world of Singapore home mortgage rates, deciphering the complexities and empowering you with knowledge to secure the best home loan deal. From understanding the factors that influence rates to uncovering expert tips for navigating the mortgage landscape, we’ve got you covered. So, let’s get started on your homeownership journey!

What Determines the Home Mortgage Rates?

Several factors dance together to determine home mortgage rates:

-

Economic Conditions: Global economic conditions, interest rate trends, and government policies impact mortgage rates.

-

Loan-to-Value (LTV) Ratio: The ratio of your loan amount to your property’s value affects your interest rate. Lower LTV usually means lower interest rates.

-

Credit History: Your credit score is a crucial indicator of your creditworthiness, with a higher score typically leading to lower interest rates.

-

Property Type: Whether you’re buying an HDB flat, a condo, or a landed property, the type of property you’re purchasing can influence your mortgage rate.

Tips for Getting the Best Home Mortgage Rates:

-

Start with a Stellar Credit Score: Your credit score is like a financial report card, so aim for a high score before applying for a mortgage. Pay your bills on time, keep your credit utilization low, and avoid taking on new debt.

-

Shop Around and Compare: Don’t settle for the first mortgage offer you come across. Compare rates and terms from multiple lenders to find the best deal. Online comparison tools can make this process a breeze.

-

Consider a Shorter Loan Tenure: Opting for a shorter loan tenure, say 20 years instead of 30 years, may result in a lower interest rate. Remember, the shorter the loan period, the more you save in interest.

-

Increase Your Down Payment: Increasing your down payment not only reduces the loan amount you need to borrow but can also lower your interest rate. Aim for at least 10%-20% down payment to enjoy potential savings.

-

Lock in a Fixed Rate: If you’re risk-averse and prefer the stability of a consistent interest rate, consider a fixed-rate mortgage. Fixed rates shield you from future rate fluctuations, ensuring your monthly payments remain predictable.

Key Takeaways:

- Economic conditions, LTV ratio, credit history, and property type influence mortgage rates.

- A high credit score, loan comparison, shorter loan tenure, increased down payment, and opting for a fixed rate can improve your mortgage rate.

- Stay updated on market trends to make informed decisions about your mortgage.

Sources:

- Mortgage Rates Singapore – Latest Home Loan Rates in SG

- 6 Effective Ways to Get a Lower Home Mortgage Interest Rate in Singapore

Current Home Mortgage Rates in Singapore: Making Informed Decisions for Homeownership

Key Takeaways:

- Current rates: Home loan rates in Singapore begin from 3.00% (fixed) for a minimum loan of $500,000 [MortgageWise.sg].

- Key factors: Factors like MAS policies, economic conditions, and bank funding costs can affect rates.

- Comparing loans: Use comparison tools and consider fixed rates for stability.

- Maximize savings: Make extra payments, pay off loans early, and learn how to manage your finances better.

Considering a Mortgage? Here’s the Scoop:

Are you daydreaming about your future abode or perhaps thinking about refinancing? Hold your horses, savvy homebuyer, because knowing about mortgage rates in Singapore will be your compass in this adventure. Let’s delve into the details, shall we?

Mortgage Rates: A Breakdown

In Singapore, you’ve got options when it comes to mortgage rates – fixed, variable (floating), and blended. It’s like picking a dance partner – each type has its own moves. Fixed rates stay steady throughout the loan period, while variable rates sway with the market’s rhythm. Got a steady beat you prefer? Fixed rates might be your groove. Craving some flexibility? Variable rates let you two-step with the market. Now, what makes these rates boogie?

Factors That Sway Rates

Just like a dance floor has its unique vibes, mortgage rates are influenced by factors like MAS policies, economic conditions, bank funding costs, and the level of competition among lenders. These factors do a little dance of their own, affecting the overall cost of borrowing and your monthly payments.

Comparing Loans: A Tango With Options

When it comes to choosing a mortgage loan, it’s time to put on your dancing shoes and compare different options. Online comparison tools are your secret weapon – use them to find the best rates and terms from multiple lenders. Just remember: it’s not just about the interest rate, but also the fees and conditions. Think of it like choosing a dance partner – finding the right fit is key.

Securing the Best Mortgage: A Waltz of Preparation

Ready to seal the deal on your dream home? Here are some moves to master:

- Improve Your Credit Score: Polish that credit score like it’s a ballroom floor – a higher score can lead to lower interest rates.

- Increase Your Down Payment: Boost your down payment? You’ll reduce your loan amount and potentially secure a lower interest rate. It’s like starting a dance with a better position on the floor.

- Opt for a Shorter Loan Tenure: Shorter loans can mean lower interest rates, so think about a shorter dance floor. Just make sure you’re comfortable with the monthly payments.

Making the Most of Your Mortgage: A Smooth Cha-Cha

Now that you’ve got your mortgage loan, let’s make the most of it and dance to the beat of financial freedom:

- Consider additional repayments: When you’ve got extra cash, put it towards your mortgage and watch that loan balance shrink.

- Pay off your mortgage early: Break free from your mortgage sooner by paying it off early. Just remember, you might face prepayment penalties – so read the fine print!

- Manage your finances wisely: Get your finances in shape – create a budget, reduce debts, and invest wisely. It’s like learning the art of financial choreography. Your future self will thank you!

With a bit of knowledge about Current Home Mortgage Rates in Singapore, you’re all set to secure a home loan that fits your rhythm and life. Just remember, understanding the factors that influence rates, comparing loans, and making smart financial decisions will help you navigate the mortgage maze gracefully. Happy house hunting, my friend!

Mortgage Rates Singapore – MortgageWise.sg

Home Loan Packages – DBS

FAQ

Q1: What is the average home mortgage rate in Singapore?

A1: As of December 8th, 2023, the prevailing interest rates for financing a 30-year fixed home loan stand at 2.95% for private properties and 2.95% for HDB’s. However, it’s important to note that mortgage interest rates can change over time, so borrowers should compare rates from multiple lenders before choosing a loan.

Q2: What determines the interest rate on a home loan in Singapore?

A2: Interest rates on home loans in Singapore are influenced by various factors such as the Monetary Authority of Singapore’s policies, economic conditions, global market conditions, banks’ funding costs, and the level of competition among lenders. Additionally, an individual’s credit score and loan-to-value ratio can also affect the interest rate offered.

Q3: What is a fixed-rate mortgage and how does it work?

A3: A fixed-rate mortgage is a type of home loan where the interest rate remains the same for the entire loan tenure, regardless of changes in market conditions. This provides borrowers with certainty and stability in their monthly payments. Fixed-rate mortgages are often preferred by borrowers who want to lock in a favorable interest rate and protect themselves against potential rate increases in the future.

Q4: What are the benefits of refinancing a home loan in Singapore?

A4: Refinancing a home loan can provide several benefits, such as securing a lower interest rate, reducing monthly payments, shortening the loan tenure, or accessing equity from the property. By refinancing, homeowners can potentially save money over the long term and improve their financial situation. However, it’s important to consider factors like prepayment penalties, closing costs, and the prevailing market interest rates before deciding to refinance.

Q5: How can I improve my chances of getting a lower interest rate on a home loan?

A5: There are several strategies borrowers can employ to improve their chances of securing a lower interest rate on a home loan. These include maintaining a good credit score, comparing mortgage rates from multiple lenders, opting for a shorter loan tenure, increasing the down payment, and reducing debt-to-income ratio. By taking these steps, borrowers can position themselves to obtain a more favorable interest rate and potentially save money on their monthly mortgage payments.

- Doubling 1/3 Cup: Quick Answer and Easy Kitchen Conversions - March 22, 2025

- J Middleton Unit (Abilene, TX): Inmate Search, Visitation, and Contact Information - March 22, 2025

- Ivermectin Dosage for Dogs: A Weight-Based Guide - March 22, 2025