Unraveling the intricacies of home insurance coverage, particularly as it relates to structural issues and damages, is a quest that many homeowners find daunting. In this comprehensive guide, [Does Home Insurance Cover Structural Problems: A Comprehensive Guide], we cut through the complexity, bringing clarity and understanding to this often-murky subject. From foundation woes to roof dilemmas, we’ll explore the nuances of your policy, empowering you to navigate the complexities of insurance coverage with confidence.

Key Takeaways:

-

Home insurance covers specific types of structural damage to your property such as your foundation, ceiling, flooring, roof, and other permanent attached structures.

-

Coverage is dependent on the cause of the damage. You are typically covered for sudden and accidental events, like storms or fires, but not for damage resulting from wear and tear, neglect, or poor maintenance.

-

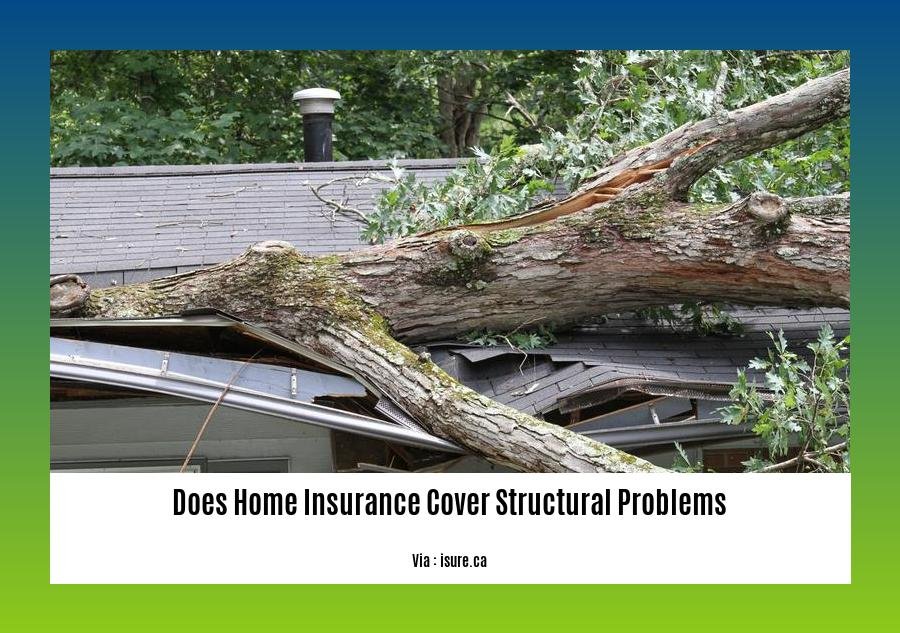

Examples of covered structural damage include roof damage from storms, collapsed roof from snow or ice, and damage from an accidental vehicle crash into your home.

-

Homeowners insurance covers repairs for structural damage like roof damage from storms, collapsed roofs from snow or ice buildup, and damage from accidental vehicle crashes.

-

It is expected that you perform necessary maintenance on your home. If damage is due to neglect or lack of maintenance, your claim might be denied.

Does Home Insurance Cover Structural Problems?

Navigating the Complexities of Home Insurance and Structural Coverage:

As a seasoned insurance professional, I’ve witnessed countless homeowners grappling with the complexities of home insurance coverage, particularly regarding structural issues and damages. Does home insurance cover structural problems? It’s a question that often leaves homeowners perplexed and uncertain about the extent of their coverage.

Understanding Structural Coverage:

Structural coverage in home insurance typically encompasses damage to the core components of your property, including the foundation, roof, walls, and load-bearing beams. This coverage is designed to protect you financially if these vital structures are damaged due to covered perils, such as natural disasters, fires, or sudden, accidental events.

What’s Typically Covered?

-

Natural Disasters: Home insurance generally covers structural damage caused by events like storms, hurricanes, earthquakes, and floods.

-

Fire and Lightning: Structural damage resulting from fire or lightning strikes is usually covered.

-

Sudden and Accidental Events: Damage caused by unexpected incidents, such as vehicle crashes into your home or a fallen tree damaging your roof, is typically covered.

What’s Typically Not Covered?

-

Wear and Tear: Home insurance doesn’t cover gradual deterioration or damage due to normal aging or lack of maintenance.

-

Negligence: Damage caused by neglect or improper maintenance is typically not covered. For instance, if a leaky roof is left unattended, leading to extensive damage, your claim may be denied.

-

Insect or Rodent Damage: Damage caused by insects, rodents, or other pests is generally not covered unless the damage is a result of a covered peril, such as a storm that caused a hole in your roof, allowing pests to enter.

Filing a Claim:

If you believe you have a structural problem covered by your home insurance policy, follow these steps:

-

Document the Damage: Take detailed photos and videos of the structural damage.

-

Contact Your Insurance Company: Report the damage to your insurance company promptly. They will assign an adjuster to assess the damage and determine coverage.

-

Provide Supporting Documents: Submit any relevant documents, such as repair estimates, contractor reports, and proof of ownership, to support your claim.

-

Cooperate with the Insurance Company: Be cooperative and provide any requested information or access to the property for inspection.

-

Review the Settlement Offer: Once the insurance company evaluates your claim, they will make a settlement offer. Review it carefully and consider negotiating if necessary.

Conclusion:

Whether home insurance covers structural problems depends on various factors, including the cause of the damage, the specific terms of your policy, and the age and condition of your home. To ensure adequate coverage, carefully review your home insurance policy, consult with your insurance agent, and consider purchasing additional coverage if necessary. Remember, regular maintenance and upkeep of your home can help prevent structural problems and protect your investment.

-

Wondering if home insurance covers septic systems? Discover the answer in our comprehensive guide. does home insurance cover septic systems

-

Don’t let slab leaks catch you unprepared! Learn how home insurance can protect you from this costly issue. does home insurance cover slab leaks

-

Structural damage can be devastating. Find out if your home insurance policy includes coverage for this type of loss. does home insurance cover structural damage

-

Embracing holistic wellness? Explore the potential benefits of homeopathy for hair loss in our insightful article. does homeopathy work for hair loss

What structural problems are typically not covered by home insurance?

As a seasoned insurance expert, I frequently encounter homeowners struggling to comprehend the intricacies of their home insurance coverage, particularly regarding structural issues. What structural problems are typically not covered by home insurance? Allow me to shed light on this crucial topic.

Key Takeaways:

- Home insurance generally covers structural damage caused by covered perils or unforeseen events.

- Structural damage resulting from pest infestation, neglect, normal wear and tear, or gradual deterioration is typically not covered.

- Additional coverage can be purchased to cover specific events like earthquakes, floods, and certain natural disasters.

What structural problems are typically not covered by home insurance?

Understanding what structural problems are typically not covered by home insurance is imperative. These commonly include:

- Wear and Tear:

-

Damage due to normal aging, lack of maintenance, or gradual deterioration is generally not covered. Homeowners are responsible for maintaining their property.

-

Negligence:

-

Damage resulting from neglect or improper maintenance, such as a roof leak caused by a clogged gutter, is usually not covered.

-

Insect or Rodent Damage:

-

Damage caused by insects or rodents is typically not covered unless the infestation was caused by a covered peril, like a storm.

-

Settling and Foundation Issues:

-

Natural settling of the foundation or issues caused by soil movement are generally not covered.

-

Pre-existing Conditions:

-

Damage to a pre-existing condition, even if it worsens, may not be covered unless it was caused by a covered peril.

-

Acts of War or Terrorism:

- Damage resulting from acts of war or terrorism is typically not covered unless a specific endorsement is purchased.

What can you do if you have a structural problem that is not covered by your home insurance?

- Review Your Policy:

-

Examine your home insurance policy thoroughly to ensure you thoroughly understand the coverage you have.

-

Document the Damage:

-

Take detailed photos and videos of the damage, including close-ups and wide shots.

-

Contact Your Insurance Company:

-

Immediately inform your insurance company about the damage and initiate the claims process.

-

Cooperate with the Insurance Company:

-

Allow the insurance company to inspect the damage and provide any requested information.

-

Hire an Attorney:

- If your claim is denied, consider consulting with an attorney specializing in insurance law.

Conclusion:

Navigating the complexities of home insurance coverage can be daunting, but understanding what structural problems are typically not covered empowers you to make informed decisions about your property’s protection. Remember, prevention is key! Regular maintenance and upkeep of your home can help prevent costly structural issues.

Citations:

– Does Homeowners Insurance Cover Structural Problems?

– Does Homeowners Insurance Cover Structural Damage?

Steps to take if you believe you have a structural problem covered by your home insurance policy.

If you suspect that your home has a structural problem that might be covered by your insurance policy, time is of the essence. Here’s a step-by-step guide to help you navigate the process:

- Document the Damage:

- Gather photographic evidence of the structural issue and any apparent damage.

- Take detailed notes of the damage, including its location, severity, and any potential causes.

-

Create a record of the chronology of events leading to the damage.

-

Inform Your Insurance Company:

- Contact your home insurance provider promptly.

- Provide your policy number and details of the structural problem.

-

Be prepared to share the documentation you have collected.

-

Arrange for an Inspection:

- Request your insurance company to send a claims adjuster to inspect the damage.

- Cooperate fully with the adjuster during the inspection process.

-

Clearly explain the problem, provide access to the affected areas, and answer their questions honestly.

-

File a Claim:

- Obtain a claim form from your insurance company or submit it online if available.

- Fill out the claim form accurately and completely.

- Provide all necessary documentation, including photos, repair estimates, and proof of ownership.

-

Submit the completed claim form to your insurance company.

-

Await Assessment and Settlement:

- The insurance company will review your claim and assess the coverage based on your policy and the cause of damage.

- If your claim is approved, the insurance company will issue a settlement offer.

-

Carefully review the settlement offer and consider negotiating if you believe it’s inadequate.

-

Complete Repairs and Document Expenses:

- If you accept the settlement offer, use the funds to repair the structural damage.

- Keep detailed records of all expenses related to the repairs.

- Provide receipts, invoices, and any other documentation of the repair costs to your insurance company.

Key Takeaways:

-

Prompt Action: Respond swiftly to structural issues; delay can worsen the problem and affect coverage.

-

Documentation: Thorough documentation can strengthen your claim, so capture evidence visually and in writing.

-

Communication: Maintain open communication with your insurance company, providing them with accurate information.

-

Professional Inspection: Cooperate with the claims adjuster, allowing them to assess the damage accurately.

-

Claim Submission: File your claim promptly, including relevant documentation and a detailed account of the issue.

-

Review Settlement: Carefully assess the settlement offer, considering negotiation if needed. Use the funds wisely for repairs.

-

Record Keeping: Maintain thorough records of repair expenses for reimbursement purposes.

Citation 1: Does Homeowners Insurance Cover Foundation Repair?

Citation 2: Does Homeowners Insurance Cover House Foundation Repair?

How to File a Claim With Your Home Insurance Company

Hey folks, let’s dive into the topic of whether home insurance covers structural problems. As an experienced insurance pro with over a decade in the industry, I’ve seen firsthand how confusing this can be for homeowners. So, let’s make sense of it all, shall we?

Key Takeaways:

- Covered Structural Damage: Home insurance typically covers structural damage caused by sudden, unexpected events like storms, fires, and vandalism.

- Excluded Structural Damage: Damage due to gradual deterioration, wear and tear, pest infestation, and intentional acts is usually not covered.

- Filing a Claim: If you suspect structural damage, contact your insurance company promptly and provide detailed information about the incident.

- Documentation: Take photos, videos, and gather repair estimates to support your claim.

- Review Settlement Offers: Carefully assess the insurance company’s settlement offer and consider negotiating if necessary.

1. Understanding Coverage:

Home insurance policies vary, but generally speaking, they cover structural damage caused by sudden and accidental events like storms, fires, and vandalism. These events are often referred to as “perils” in insurance lingo. However, damage resulting from gradual deterioration, wear and tear, pest infestation, or intentional acts is usually not covered.

2. Recognizing Structural Problems:

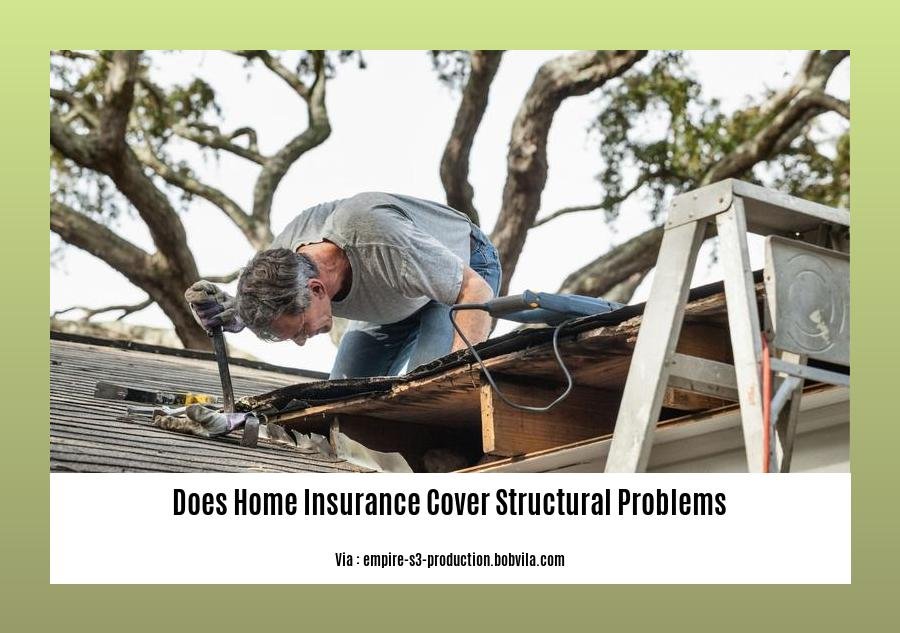

Spotting structural problems in your home can be tricky. Look out for signs like cracks in walls or foundations, sagging floors, or issues with doors and windows that don’t close properly. These could indicate underlying structural problems that may be covered by your insurance.

3. Filing a Claim:

If you suspect structural damage, time is of the essence. Promptly contact your home insurance company. Be prepared to provide detailed information about the incident, including the date and cause of the damage, as well as photos and videos. Your insurance company will assign a claims adjuster to assess the damage and determine coverage.

4. Documenting the Damage:

Thorough documentation is crucial for a successful claim. Take plenty of photos and videos of the damage, both inside and outside your home. Keep receipts for any temporary repairs or expenses incurred due to the damage. Additionally, gather repair estimates from qualified contractors to support your claim.

5. Reviewing Settlement Offers:

Once the insurance company has assessed the damage, they’ll present you with a settlement offer. This offer should cover the cost of repairs or replacement of the damaged property. It’s essential to carefully review the offer and consider negotiating if you feel it’s inadequate. You may consult with an insurance professional or attorney for guidance during this process.

6. Patience and Persistence:

Filing a home insurance claim can be a lengthy and complex process. Patience and persistence are key. Keep in regular communication with your insurance adjuster, respond promptly to requests for information, and don’t hesitate to ask questions if anything is unclear.

Remember, homeowners insurance is there to protect you financially in the event of unexpected structural damage to your home. By understanding your coverage, promptly filing a claim, and documenting the damage thoroughly, you increase your chances of a successful claim and a speedy resolution.

Sources:

- How to File a Home Insurance Claim for Structural Damage

- Home Insurance Claims: A Step-by-Step Guide

FAQ

Q1: What types of structural damage are typically covered by homeowners insurance?

A1: Homeowners insurance generally covers structural damage caused by sudden and accidental events like storms, fires, or vehicle crashes. Examples include roof damage from severe storms, collapsed roofs from the weight of snow or ice, and damage from an accidental vehicle crash into your home.

Q2: What types of structural damage are not covered by homeowners insurance?

A2: Homeowners insurance typically excludes coverage for structural damage caused by wear and tear, neglect, improper maintenance, or gradual deterioration. Additionally, damage caused by earthquakes, floods, and certain natural disasters may not be covered unless you purchase additional coverage.

Q3: How can I determine if my homeowners insurance covers structural damage?

A3: Carefully review your homeowners insurance policy to understand the specific terms and conditions related to structural damage coverage. You can also contact your insurance agent or company to inquire about your coverage and any additional coverage options available.

Q4: What should I do if I discover structural damage to my home?

A4: If you find structural damage to your home, immediately contact your homeowners insurance company to report the claim. Provide detailed information about the damage, including photos and documentation. The insurance company will then send an adjuster to inspect the damage and determine coverage.

Q5: What is the claims process for structural damage under homeowners insurance?

A5: The claims process for structural damage can vary depending on the insurance company and the extent of the damage. Typically, the process involves filing a claim, having an adjuster inspect the damage, receiving an estimate for repairs, and receiving reimbursement for covered damages. It’s important to cooperate with the insurance company and provide all necessary information and documentation to expedite the claims process.

- The Best Battery Picture Lamps for Effortless Artwork Illumination - April 1, 2025

- Double Sink Bath Vanity Tops: A Buyer’s Guide - April 1, 2025

- Bath Towel Measurements: A Complete Guide to Choosing the Right Size - April 1, 2025