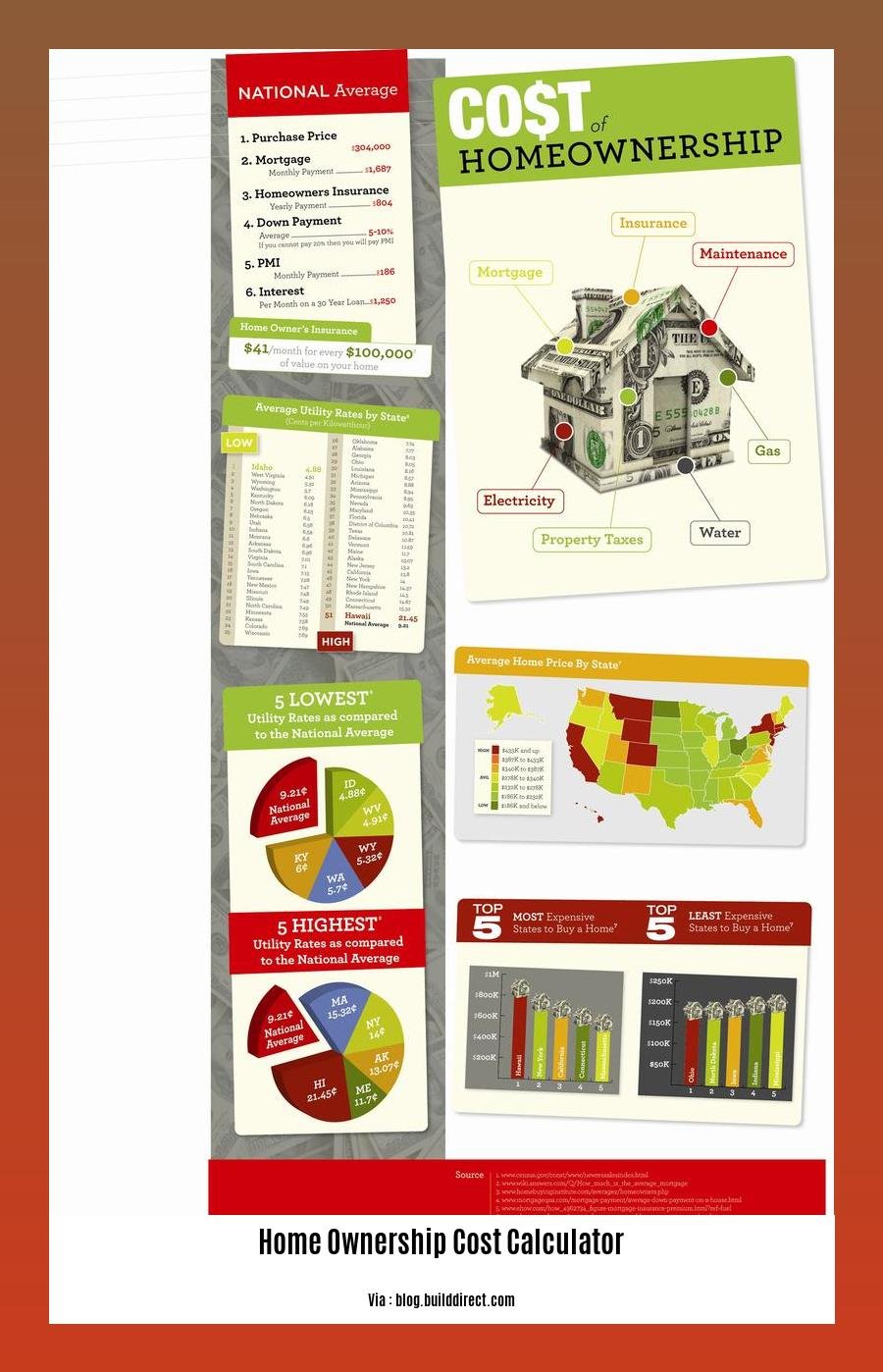

Unveiling [The Ultimate Home Ownership Cost Calculator: A Comprehensive Guide for Informed Decisions]: Embark on a seamless homeownership journey with our meticulously crafted calculator, designed to empower you with accurate insights into the true cost of owning a home. Unlock the secrets behind mortgage payments, property taxes, insurance premiums, and additional expenses. Make informed decisions, avoid costly surprises, and pave the way for a financially secure future.

Key Takeaways:

-

Homeownership expenses go beyond just the monthly mortgage payment.

-

You’ll also need to account for property taxes, homeowners insurance, maintenance and repairs, and utilities.

-

The total cost of owning a home can vary significantly depending on factors like location, size, and age of the property.

-

Budgeting for homeownership is crucial to avoid financial surprises down the road.

-

A homeownership expense calculator can help you estimate monthly expenses and determine how much you can afford.

Home Ownership Cost Calculator

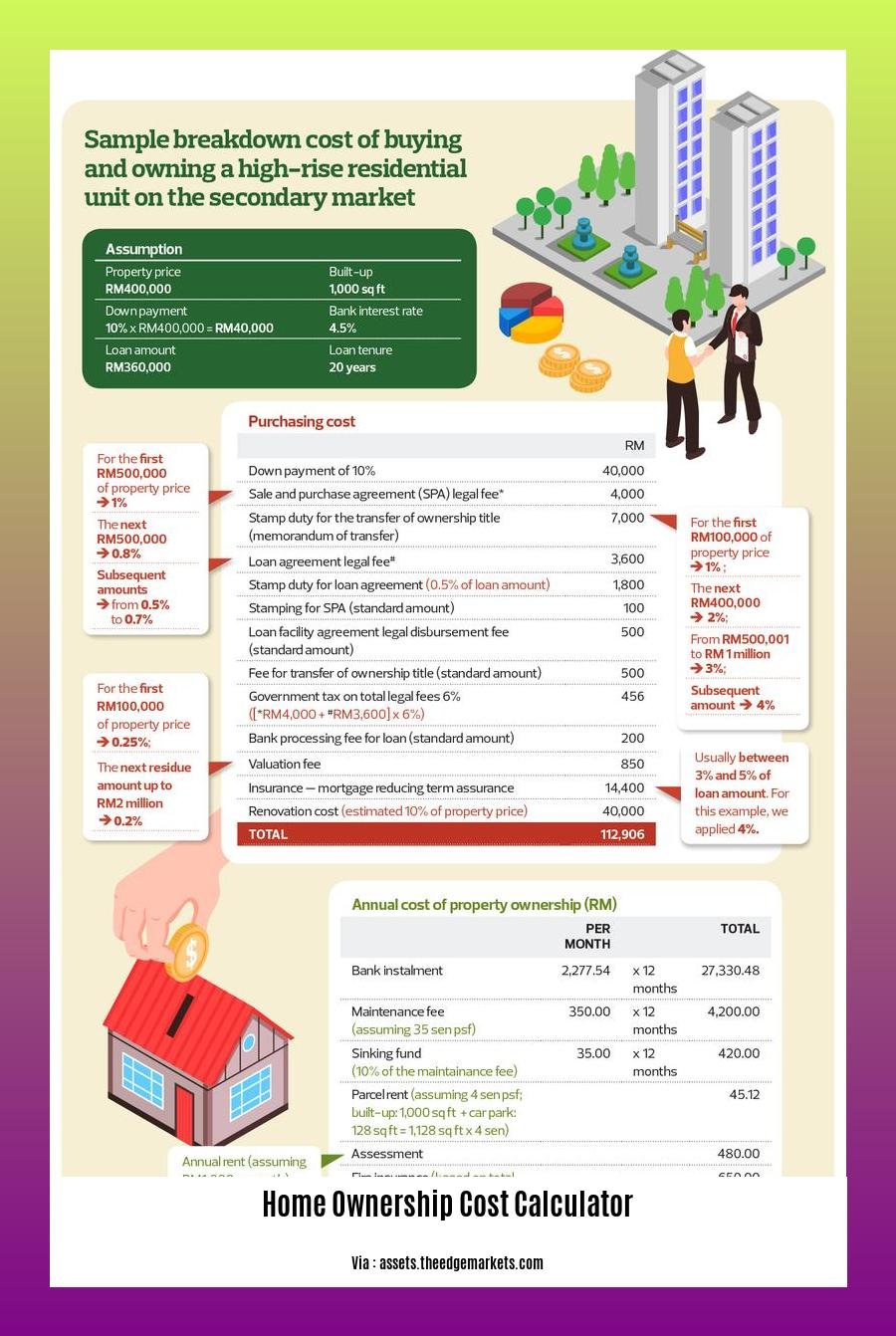

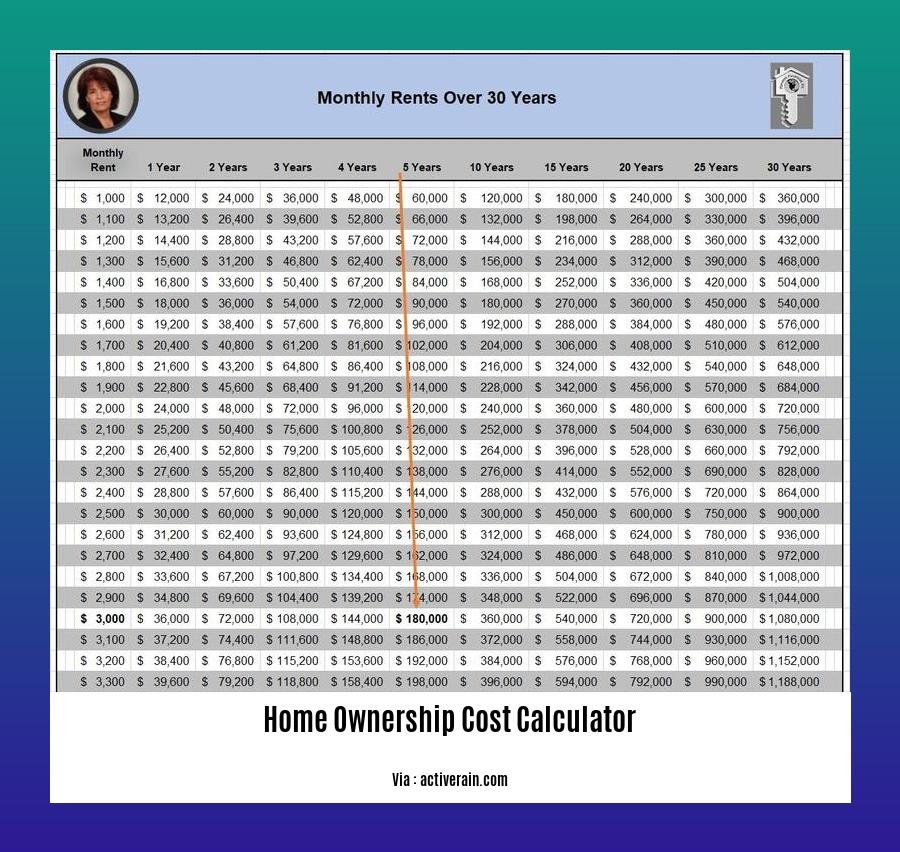

Calculating the total cost of homeownership is a complex process that goes beyond the monthly mortgage payment. It encompasses a multitude of factors that can significantly impact your financial well-being. This comprehensive guide will help you navigate the complexities of homeownership costs, empowering you to make informed decisions with our easy-to-use home ownership cost calculator.

Step-by-Step Guide to Using Our Calculator

-

Gather Property Information:

- Input the property’s purchase price, down payment amount, and current mortgage balance, if applicable.

- Provide details like the property’s location, size, and age.

-

Estimate Monthly Mortgage Payments:

- Enter the mortgage interest rate, loan term, and property taxes.

- Our calculator will provide an accurate estimate of your monthly mortgage payments.

-

Factor in Additional Homeownership Expenses:

- Include estimated costs for homeowners insurance, maintenance and repairs, and utilities.

- Consider additional expenses like HOA fees, mortgage insurance, and property management fees.

-

Calculate Total Cost of Ownership:

- Combine the monthly mortgage payments with all additional expenses to determine the total cost of homeownership.

- Our calculator will present a comprehensive breakdown of these costs.

Key Considerations for Analyzing Results

-

Location and Property Value:

- Homeownership costs can vary dramatically depending on the property’s location and market value.

- Consider factors like proximity to amenities, school districts, and job opportunities.

-

Age and Condition of the Property:

- Older properties may require more maintenance and repairs compared to newer ones.

- Evaluate the property’s condition thoroughly before making a purchase decision.

-

Homeowners Association Fees:

- If the property is part of a homeowners association, factor in HOA fees which can cover common area maintenance, amenities, and other expenses.

-

Long-Term Financial Planning:

- Consider your long-term financial goals and how homeownership fits into your overall financial plan.

- Evaluate if you’re prepared for potential market fluctuations and unexpected costs.

-

Affordability:

- Use our calculator to determine if the property is within your budget.

- Consider your current income, savings, and debt obligations to ensure you can comfortably afford the home.

Our home ownership cost calculator provides a valuable tool to estimate the true cost of homeownership. By carefully considering all factors and analyzing the results, you can make informed decisions that align with your financial goals and aspirations. Remember, homeownership is a significant financial commitment, and it’s essential to approach it with a comprehensive understanding of the associated costs.

Are you determining the most suitable heating and cooling system for your mobile home? Explore the best choices available and ensure optimal comfort in all seasons. best heating and cooling system for mobile homes

Are the ongoing doubts about basements in manufactured homes clouding your decision? Unravel the mysteries surrounding this question and find the truth behind the existence of basements in manufactured homes. do manufactured homes have basements

If you’re considering modular homes, the basement question may arise. Delve into the topic and gain insights into the prevalence of basements in modular homes, uncovering the various factors that determine their presence or absence. do modular homes have basements

When it comes to long-term investments, understanding the value retention of modular homes is crucial. Discover if modular homes maintain their worth over time and delve into the factors that influence their resale value. does a modular home hold its value

Considering the integration of Blink with Apple HomeKit? Unveiling the seamless integration between Blink and Apple HomeKit, explore the benefits of controlling your Blink devices effortlessly through the Apple Home app, enhancing your smart home experience. does blink work with apple homekit

Calculating Monthly Housing Expenses: Breaking Down Mortgage, Taxes, Insurance, and Utilities

Hey there, homebuyers! Are you ready to dive into the nitty-gritty of Calculating Monthly Housing Expenses? It’s not just about the monthly mortgage payments; it’s about understanding the complete picture of costs associated with owning a home. Let’s break it down and crunch some numbers, shall we?

Key Takeaways:

-

Homeownership costs extend beyond monthly mortgage payments and include other expenses like taxes, insurance, HOA fees, utilities, and maintenance.

-

The total housing expense is the sum of all monthly housing-related costs and should generally not exceed 30% of your gross income.

-

Understanding the true cost of homeownership helps you make informed decisions aligned with your financial goals.

-

Location, property value, and age of the property impact the total housing expense.

Mortgage Breakdown:

-

Principal: The money you pay towards the loan amount.

-

Interest: The cost of borrowing the money, calculated as a percentage of the loan amount.

-

Taxes: Property taxes paid to local governments.

-

Insurance: Homeowner’s insurance protects against damage or loss.

-

PMI: Required for certain loans with low down payments to protect the lender.

Calculating Total Housing Expense:

-

Gather Your Info: Have details like property price, down payment, mortgage terms, tax rates, insurance premiums, and HOA fees ready.

-

Use a Calculator: Many online homeownership cost calculators can help you estimate your monthly housing expense.

-

Run the Numbers: Input your details, and the calculator will spit out your estimated monthly housing expense.

Affordability and Financial Planning:

-

Check Your DTI: Compare your projected housing expense with your gross income. Aim for a debt-to-income (DTI) ratio below 30%.

-

Plan for the Long Haul: Consider future expenses like maintenance, repairs, and potential HOA fee increases.

-

Stay Within Budget: Make sure your total housing expense aligns with your overall financial goals and budget.

Location, Property, and Fees:

-

Location Matters: Property taxes, insurance rates, and HOA fees vary by location.

-

Property Age and Condition: Older properties may have higher maintenance costs.

-

HOA Fees: If applicable, factor in monthly HOA fees for common area maintenance.

By understanding the Calculating Monthly Housing Expenses: Breaking Down Mortgage, Taxes, Insurance, and Utilities, you’re empowered to make informed decisions about your homeownership journey. It’s not just about the monthly mortgage payments; it’s about creating a sustainable financial plan that aligns with your long-term goals. So, grab your calculator, crunch the numbers, and let’s make you a confident homeowner!

Sources:

-

SmartAsset – Mortgage Calculator

Additional Costs of Homeownership: Maintenance, Repairs, and Other Fees

When budgeting for your home purchase, it’s not just the monthly mortgage payment you need to think about. There are also a slew of additional costs of homeownership: maintenance, repairs, and other fees that can add up quickly.

Maintenance and Repairs

As a homeowner, you’re responsible for the upkeep and maintenance of your property. This includes everything from mowing the lawn and cleaning the gutters to fixing leaky faucets and replacing old appliances. While some of these tasks you can DIY, others may require hiring professionals, which can be costly.

Other Fees and Expenses

In addition to maintenance and repairs, you’ll also need to pay for other ongoing expenses associated with homeownership, such as:

- Utilities: This includes electricity, water, sewer, and garbage.

- Property taxes: These are levied by your local government and are based on the assessed value of your home.

- Homeowners insurance: This protects you financially in case of damage to your home or your belongings.

- HOA fees: If you live in a homeowners association, you’ll need to pay monthly or annual dues that cover common area maintenance and amenities.

Key Takeaways:

- Maintenance and repairs are ongoing expenses that can add up quickly.

- Other fees and expenses include utilities, property taxes, homeowners insurance, and HOA fees.

- It’s important to factor these additional costs into your budget when considering homeownership.

Sources:

Investopedia – Total Housing Expense

SmartAsset – Mortgage Calculator

Comparing Calculator Results with Your Financial Goals: Making Informed Decisions About Homeownership

When you’re considering buying a home, it’s easy to get caught up in the excitement of the process. But before you take the plunge, it’s crucial to Compare Calculator Results with Your Financial Goals: Making Informed Decisions About Homeownership and make sure you’re making a sound financial decision.

Key Takeaways:

- A homeownership cost calculator is a valuable tool for estimating the true cost of homeownership.

- It’s essential to compare the results of different calculators to get a well-rounded view of your financial obligations.

- Consider your financial goals and long-term plans when making homeownership decisions.

- Homeownership is a significant financial commitment, so it’s crucial to make informed decisions.

There are many different home ownership cost calculators available online, and they can be a helpful tool for getting a general idea of what your monthly payments will be. However, it’s important to remember that these calculators are just estimates, and the actual cost of homeownership can vary depending on a number of factors, including the location of the property, the age and condition of the home, and the HOA fees.

That’s why it’s essential to compare the results of different calculators to get a well-rounded idea of your financial obligations. You should also consider your financial goals and long-term plans when making homeownership decisions. For example, if you’re planning on selling the home in a few years, you’ll need to factor in the costs of selling, such as real estate commissions and closing costs.

Homeownership is a significant financial commitment, so it’s crucial to make informed decisions. By Comparing Calculator Results with Your Financial Goals: Making Informed Decisions About Homeownership, you can increase your chances of making a sound financial decision that will benefit you for years to come.

Citations:

Investopedia – Total Housing Expense

SmartAsset – Mortgage Calculator

FAQ

Q1: How can a Home Ownership Cost Calculator help me make informed decisions?

A1: A Home Ownership Cost Calculator provides a comprehensive estimate of all expenses associated with owning a home, allowing you to accurately assess your financial readiness and make informed decisions about your home purchase. It helps you determine how much you can afford to spend on a home and ensures you’re prepared for the ongoing costs of homeownership.

Q2: What factors does a Home Ownership Cost Calculator typically consider?

A2: A Home Ownership Cost Calculator typically considers various factors to estimate the total cost of homeownership, including the purchase price, mortgage terms, property taxes, homeowners insurance, maintenance and repair costs, utilities, and homeowners association fees (if applicable). It allows you to customize these inputs to reflect your specific situation and location.

Q3: Why is it essential to consider all costs when using a Home Ownership Cost Calculator?

A3: Considering all costs when using a Home Ownership Cost Calculator is crucial because it provides a realistic picture of the financial commitment involved in homeownership. By factoring in all expenses, you can avoid surprises and ensure you have a clear understanding of the ongoing costs associated with owning a home. This helps you make informed decisions and budget effectively for your future.

Q4: How can I use a Home Ownership Cost Calculator to determine my affordability?

A4: To determine your affordability using a Home Ownership Cost Calculator, input your income, debts, and the estimated costs associated with the home you’re considering. The calculator will provide an estimate of your monthly housing expenses and help you assess how much of your income will be allocated to housing costs. This allows you to determine if the home falls within your budget and if you can comfortably afford the ongoing expenses of homeownership.

Q5: Are there any additional resources or tools available to help me with my homeownership journey?

A5: In addition to using a Home Ownership Cost Calculator, there are various resources and tools available to assist you on your homeownership journey. These include online resources, financial advisors, real estate agents, and mortgage lenders. These resources can provide valuable guidance, advice, and support throughout the process of buying and owning a home.

- The Best Battery Picture Lamps for Effortless Artwork Illumination - April 1, 2025

- Double Sink Bath Vanity Tops: A Buyer’s Guide - April 1, 2025

- Bath Towel Measurements: A Complete Guide to Choosing the Right Size - April 1, 2025