**Protecting Your Home Construction Investment: A Guide to Home Construction Insurance** Embark on a comprehensive journey into the realm of home construction insurance, where you’ll discover the crucial role it plays in safeguarding your residential construction projects.

Key Takeaways:

- Understand the different types of construction insurance, including general liability, workers’ compensation, and builders risk.

- Recognize that construction insurance may be legally required, such as commercial auto insurance.

- Coverage provided by insurance policies includes property damage, equipment losses, worker injuries, and legal liability.

- Insurance costs vary based on project size, complexity, and coverage limits.

Home Construction Insurance: A Comprehensive Guide

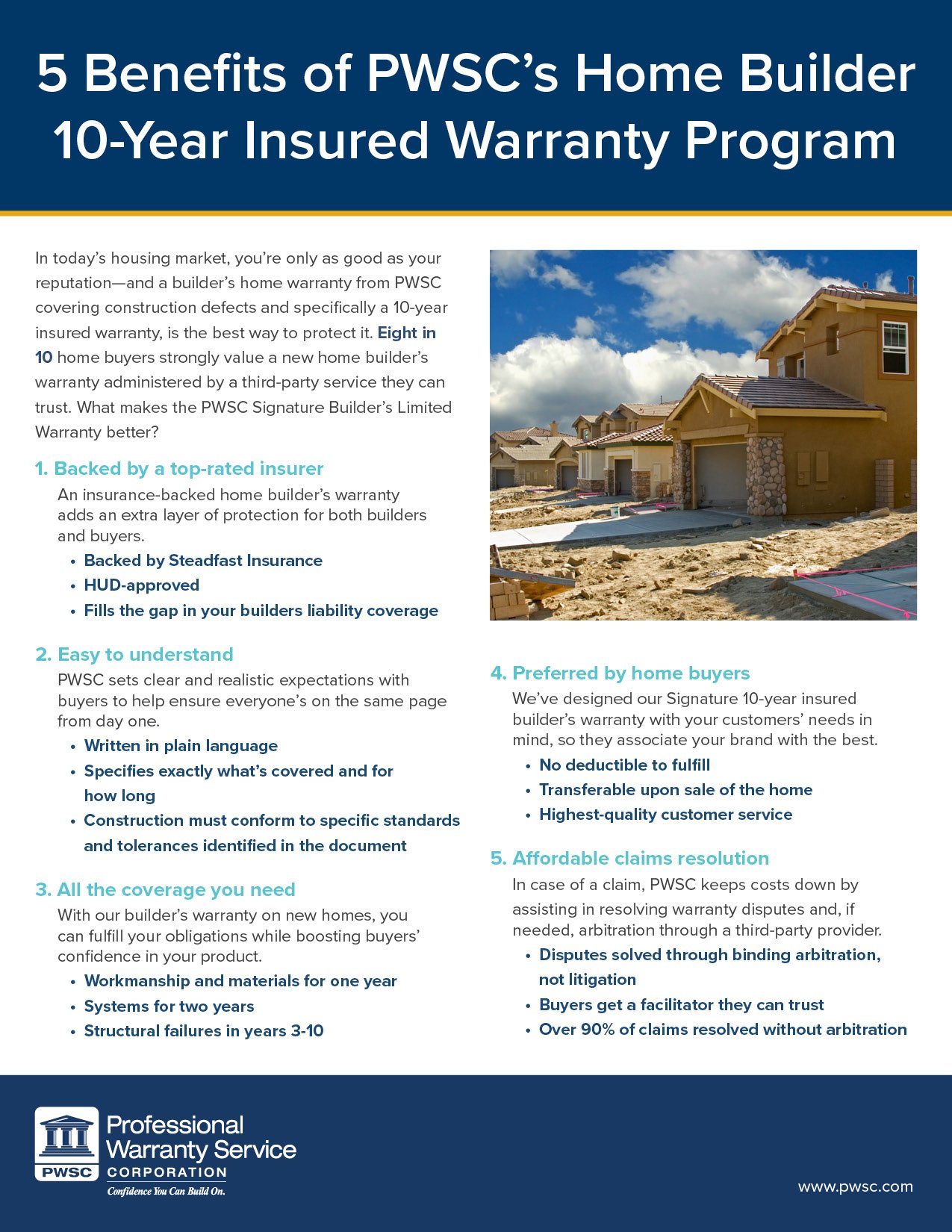

As homeowners venture into the realm of construction, navigating the intricacies of home construction insurance becomes paramount. This guide aims to demystify insurance coverage, empower homeowners, and ensure that their investments are adequately protected.

Understanding Construction Insurance Coverage

Home construction insurance encompasses a suite of policies tailored to the specific risks associated with construction projects. These include:

- General Liability Insurance: Covers bodily injury and property damage caused by the project.

- Commercial Auto Insurance: Protects against accidents involving vehicles used for construction.

- Builder’s Risk Insurance: Safeguards the structure during the construction phase.

- Workers’ Compensation Insurance: Provides financial support to workers injured on the job.

- Surety Bonds: Guarantees the completion of the project according to the specifications.

Importance of Home Construction Insurance

Home construction insurance plays a crucial role in:

- Legal Compliance: Many states and municipalities require certain types of insurance for construction projects.

- Financial Protection: Covers the costs of repairs, medical expenses, and potential lawsuits arising from accidents or damage.

- Peace of Mind: Provides homeowners with the confidence that their investment is secured against unforeseen events.

Selecting the Right Home Construction Insurance

To determine the appropriate home construction insurance coverage, consider factors such as:

- Project size and complexity

- Type of construction

- Contractual requirements

- Local regulations

Steps for Choosing Construction Insurance:

- Identify the required coverage types.

- Obtain quotes from multiple insurance providers.

- Compare coverage limits, deductibles, and premiums.

- Review policy language carefully.

- Choose the insurer that offers the best balance of coverage and affordability.

Conclusion

Home construction insurance is a crucial aspect of any construction project. By understanding the types of coverage available, assessing project risks, and selecting the right insurance, homeowners can safeguard their investments, comply with legal requirements, and enjoy peace of mind throughout the construction process.

Unleash your creativity and delve into the realm of home construction by exploring our comprehensive guide on home construction materials here. From innovative materials to traditional favorites, discover everything you need to build a home that endures the test of time.

Enhance your construction knowledge with our in-depth analysis of home construction methods here. Learn about the latest techniques, from energy-efficient to disaster-resistant designs, empowering you to create a home that meets your every need and desire.

Risk Management in Home Construction: Strategies for Mitigating Potential Losses

Navigating the complexities of home construction can be daunting, but implementing effective risk management strategies can safeguard your investment and ensure a successful project outcome. Here’s a comprehensive guide to help you identify and mitigate potential risks during the construction process:

Identify Potential Risks

The first step towards risk management is recognizing potential hazards that could hinder your project. Engage in thorough due diligence to pinpoint specific risks associated with your construction site, materials, and subcontractors. Assess factors like weather conditions, safety concerns, and financial constraints.

Prioritize Risks

Once risks have been identified, prioritize them based on their likelihood of occurrence and potential impact on the project. This prioritization process helps you focus resources on mitigating the most critical risks.

Develop Mitigation Strategies

For each identified risk, devise mitigation strategies to minimize or eliminate their impact. These strategies could include:

- Site Management: Implement safety protocols, ensure proper drainage, and manage hazardous materials responsibly.

- Material Sourcing: Source high-quality materials from reputable suppliers, conduct thorough inspections, and establish clear quality control measures.

- Contractor Selection: Thoroughly vet potential contractors, check references, and ensure they have adequate insurance and experience.

Contingency Planning

Even with sound risk management practices, unforeseen events can occur. Develop contingency plans for potential emergencies, such as weather delays, material shortages, or accidents. These plans should outline alternative solutions, communication channels, and the allocation of resources.

Ongoing Monitoring and Evaluation

Risk management is an ongoing process that requires continuous monitoring and evaluation. Regularly revisit your risk assessment and mitigation strategies to ensure they remain effective throughout the construction project. Make adjustments as needed based on changing conditions and evolving risks.

Key Takeaways:

- Identifying and mitigating risks is crucial for successful home construction projects.

- Prioritize risks based on their likelihood and potential impact.

- Develop effective mitigation strategies to minimize risk exposure.

- Implement contingency plans for unforeseen events.

- Continuously monitor and evaluate risk management strategies to ensure effectiveness.

Sources:

- Construction Risk Management: 5 Steps to Reduce & Mitigate Risk

- Top Construction Risks and How to Mitigate Them

Claims Process for Home Construction Insurance: A Step-by-Step Guide

Navigating the claims process after a construction mishap can be daunting. Here’s a clear guide to help you navigate this journey:

Filing a Claim

- Report the Incident: Promptly notify your insurance provider about the incident, providing a detailed description of the damage.

- Submit a Formal Claim: Complete the necessary paperwork and submit it to your insurer, along with supporting documentation.

Assessment and Adjustment

- Adjuster Inspection: An insurance adjuster will inspect the damage to assess its extent and determine coverage.

- Estimate and Settlement: Based on the inspection, the adjuster will provide an estimate of the covered costs and present a settlement offer.

Negotiating and Settlement

- Review the Settlement: Carefully review the settlement offer to ensure it fairly compensates for the damage.

- Negotiate if Needed: If you disagree with the offer, present your reasoning and documentation to support your claim.

- Accept the Settlement: Once you’re satisfied with the terms, sign and accept the settlement agreement.

Post-Settlement

- Rebuild and Repair: Use the settlement funds to repair or replace the damaged property.

- Document the Process: Keep receipts and photos for future reference.

- Maintain Communication: Stay in touch with your adjuster throughout the process for updates and assistance.

Key Takeaways:

- Promptly file a claim to avoid delays in coverage.

- Provide detailed documentation to support your claim.

- Review the settlement offer carefully before accepting.

- Negotiate with your adjuster if you believe the offer is inadequate.

- Keep records of all communication and documentation related to your claim.

Relevant URL Sources:

- Homeowners Insurance Claims: Step-by-Step Process

- How to File a Home Insurance Claim

Choosing a Home Construction Insurance Provider: Factors to Consider for Optimal Protection

Key Takeaways:

- Home construction insurance safeguards construction projects from risks during the build.

- Builder’s risk insurance covers the structure and materials from damage.

- General liability insurance protects against injuries or property damage to third parties.

- Commercial property insurance covers equipment, tools, and materials stored on-site.

- Workers’ compensation insurance provides coverage for work-related injuries or illnesses.

- Choose an insurer with a strong financial rating, industry experience, and clear policy terms.

- Get quotes from multiple providers to compare coverage and premiums.

- Read policy details carefully to ensure they meet your specific project needs.

Understanding Choosing a Home Construction Insurance Provider is vital for Optimal Protection

Deciding on an insurance provider for your home construction project is no small task. Here’s how to make an informed choice:

-

Assess Your Needs: Determine the specific coverage you need based on the size and complexity of the project, as well as contractual requirements.

-

Shop Around: Don’t settle for the first quote. Gather quotes from several reputable insurers to compare coverage, limits, and premiums.

-

Review Insurer History: Check the financial stability and experience of potential insurers. A strong financial rating indicates their ability to meet claims and industry experience ensures their understanding of construction risks.

-

Scrutinize Policy Details: Pay close attention to policy language, coverage limits, and exclusions. Ensure the policy aligns with your project requirements and provides adequate protection.

-

Consider Value-Added Services: Some insurers offer additional services like loss prevention and risk management support, which can enhance the overall value of your coverage.

-

Build a Relationship: Find an insurer who is responsive, knowledgeable, and committed to providing ongoing support throughout the construction process.

FAQ

Q1: What types of insurance coverage are available for home construction?

A1: Home construction insurance policies typically include coverage for property damage, loss or theft of equipment, injuries to workers, and legal liability.

Q2: Is construction insurance required by law?

A2: Certain types of construction insurance, such as commercial auto insurance, may be required by law depending on the jurisdiction.

Q3: What is the difference between home builders insurance and all risks insurance?

A3: Home builders insurance covers construction projects against losses from theft, vandalism, fire, and other risks, while all risks insurance provides broader coverage for unforeseen physical damage and material loss on site.

Q4: How much does construction insurance cost?

A4: The cost of construction insurance varies depending on factors such as project size, type of work, and coverage limits.

Q5: What are the benefits of having construction insurance?

A5: Construction insurance provides financial security and peace of mind, allowing contractors to focus on their work without the worry of unexpected events or liabilities.

- The Best Battery Picture Lamps for Effortless Artwork Illumination - April 1, 2025

- Double Sink Bath Vanity Tops: A Buyer’s Guide - April 1, 2025

- Bath Towel Measurements: A Complete Guide to Choosing the Right Size - April 1, 2025