Advance payment in construction serves as a critical financial tool that unlocks project success. By understanding the concept of advance payments, contractors and developers can navigate the intricacies of construction financing, ensuring timely access to funding and the seamless execution of construction projects. [- Advance Payment in Construction: Unlocking Funding for Project Success] presents a comprehensive guide to advance payments, empowering stakeholders with the knowledge to make informed decisions and optimize project outcomes.

Key Takeaways:

- Advance payments provide initial funding for construction expenses.

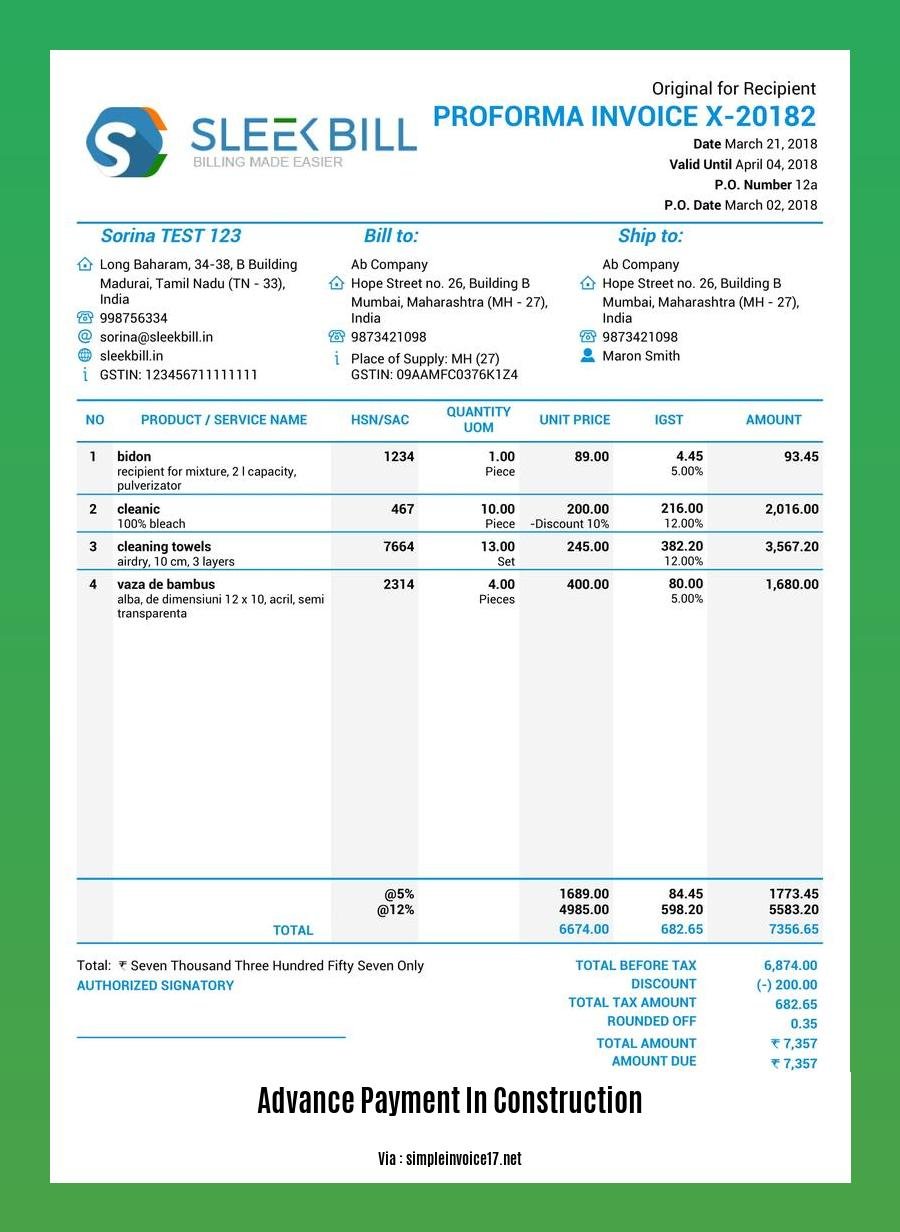

- Common installments typically cover 20% of the contract value.

- Risk assessment, creditworthiness evaluation, and customized financing solutions are crucial in structuring advance payment agreements.

- Strong communication, negotiation, and problem-solving skills navigate the complexities of construction financing.

- Advance payments support seamless funding and project success.

Advance Payment in Construction

In construction, advance payments are crucial for project initiation. They provide contractors with the necessary funds to cover initial expenses like materials and labor, ensuring a project’s smooth takeoff. Here’s a comprehensive guide to advance payments in construction:

Importance of Advance Payments

Advance payments mitigate financial risks for contractors, enabling them to:

- Secure materials and equipment without delays

- Pay for labor costs before project revenue generation

- Enhance bonding capacity by reducing working capital requirements

Determining Advance Payment Amounts

Advance payments typically range from 10-20% of the contract value, though variations exist. Factors influencing the amount include:

- Type and complexity of the project

- Contractor’s financial stability

- Contract terms and conditions

Advance Payment Agreement

A well-drafted advance payment agreement is essential to protect both the contractor and the client. It should clearly outline:

- Amount and timing of advance payments

- Repayment schedule

- Penalties for late repayment

- Ownership of materials purchased with advance funds

Benefits of Advance Payments

Advance payments offer several advantages, including:

- Reduced working capital requirements for contractors

- Accelerated project timelines by eliminating funding delays

- Improved project coordination due to early procurement of materials

Drawbacks of Advance Payments

Despite their benefits, advance payments also pose some potential risks:

- Potential for misuse of funds by contractors

- Increased financial burden on clients if payments are not repaid

- Delays in project completion if contractors fail to repay advance payments

Conclusion

Advance payments are a crucial aspect of construction financing, providing contractors with essential funding for project initiation. By understanding the importance, determining appropriate amounts, and drafting a comprehensive agreement, you can harness the benefits of advance payments while mitigating associated risks.

If you want to be aware of the 18 high risk construction work activities that are essential to avoid accidents and injuries on a construction site.

To gain confidence after 3 months of having ACL reconstruction surgery, it is important to perform the right set of exercises discussed here.

In this article here, you will find the conditions that may lead to a construction contract termination.

These are the 6 ways that can help you in reducing construction costs.

For those who are interested in Action Construction Equipment’s share price target, this article can be useful.

Risk Assessment and Mitigation Strategies for Advance Payments in Construction

Despite their importance in initiating projects and easing financial burdens, advance payments pose risks that need to be carefully assessed and mitigated. These payments often account for a substantial portion of a project’s budget, and if not managed properly, can lead to financial losses or even project failure.

To ensure successful outcomes, it’s crucial to implement risk assessment and mitigation strategies.

Key Takeaways:

- Advance payments can be risky if not managed effectively.

- Risk assessment: Evaluating factors such as project scope, contractor’s financial stability, and payment terms.

- Mitigation strategies: Including detailed contracts, performance bonds, escrow accounts, and regular monitoring.

- Proper risk management enhances project success and minimizes financial risks.

Risk Assessment

Thorough risk assessment involves examining factors that could impact the timely completion and repayment of advance payments. These factors include:

- Project scope and timeline

- Contractor’s financial health and track record

- Advance payment amount and terms

- Contractual obligations and protection clauses

Mitigation Strategies

Once risks are identified, implementing mitigation strategies becomes essential. Here are some key strategies:

- Detailed Contracts and Payment Schedules: Clear and comprehensive contracts outline payment terms, ownership of materials, and repayment schedules, reducing potential disputes.

- Due Diligence on Contractors: Conducting background checks and evaluating the contractor’s financial stability, track record, and insurance coverage ensures their ability to fulfill obligations.

- Escrow Accounts or Performance Bonds: Holding advance payments in escrow or obtaining performance bonds provides financial protection in case the contractor fails to deliver as agreed.

- Regular Monitoring and Reporting: Establishing a system for regular monitoring of project progress and financial status allows timely identification and proactive mitigation of any issues.

Conclusion

By adopting a comprehensive approach to risk assessment and mitigation strategies, project stakeholders can minimize the potential risks associated with advance payments. By carefully assessing risks and implementing appropriate mitigation measures, projects can be initiated and completed successfully, ensuring financial stability and timely project delivery.

Relevant URL Sources:

- ProjectManagement.com: Managing Risks of Advanced Payments in Projects

- Control Risks: Construction risks and mitigation strategies – An overview

Negotiating and Structuring Advance Payment Agreements

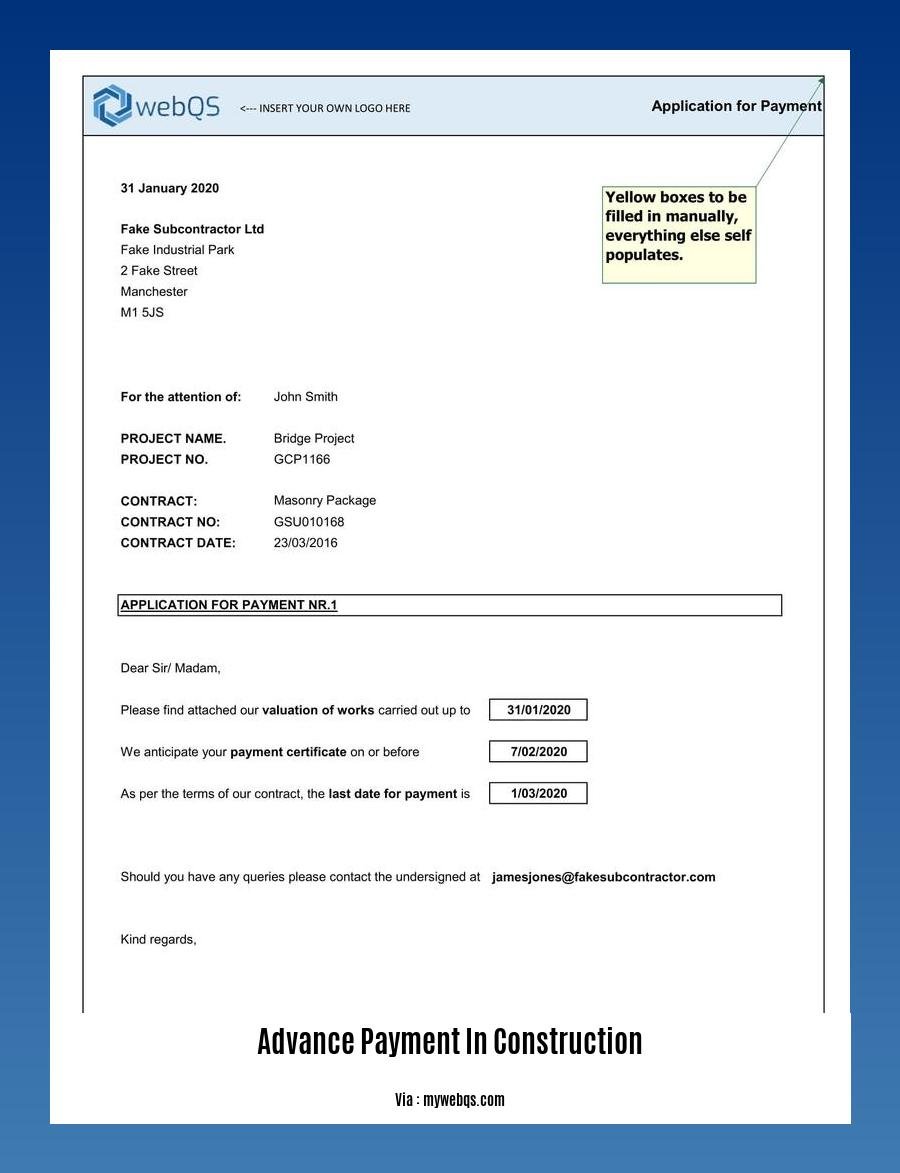

When it comes to construction financing, negotiating and structuring advance payment agreements is of paramount importance. An advance payment is an interest-free loan given by clients to contractors to kick-start project expenses.

To ensure a smooth financing process and project success, here are some key considerations:

-

Assess Project Risk: Evaluate the project’s complexity, schedule, and potential risks. This assessment helps determine the appropriate amount and timing of advance payments.

-

Evaluate Borrower Creditworthiness: Conduct thorough due diligence on the contractor, assessing their financial health, track record, and bonding capacity.

-

Tailor the Agreement: Develop a customized agreement that outlines the advance payment amount, repayment schedule, performance milestones, and potential consequences for non-performance.

-

Communicate Clearly: Establish open and frequent communication with all parties involved, keeping everyone informed about the advance payment process and any changes.

-

Monitor Progress Regularly: Implement a system to monitor project progress and ensure that advance payments are being used as intended.

Negotiating these agreements effectively requires a combination of technical expertise and negotiation skills. By understanding the project’s requirements, assessing risks, and communicating transparently, you can ensure that advance payments support project success while protecting the interests of all parties involved.

Key Takeaways:

- Advance payments are integral to construction financing, facilitating initial project expenses.

- A well-structured agreement protects both contractors and clients.

- Careful evaluation of project risk and borrower creditworthiness is essential.

- Open communication and regular monitoring ensure proper utilization of advance payments.

- Negotiating and structuring advance payment agreements require a blend of expertise and negotiation skills.

Relevant URL Sources:

Legal Considerations and Documentation

When it comes to advance payments in construction, getting the legal side of things right is crucial for safeguarding both parties involved. Watertight agreements and meticulous documentation serve as the foundation for smooth project execution and timely fulfillment of financial obligations.

Key Considerations

-

**Advance Payment Agreement: The cornerstone of any advance payment arrangement, outlining the terms, conditions, and repayment schedule. Ensure it’s crystal clear about the amount, timing, and purpose of the advance.

-

**Collateral and Guarantees: Assess the contractor’s financial stability and consider requesting collateral or guarantees to mitigate potential risks.

-

**Lien Waivers: Protect your interests by requiring lien waivers upon payment, ensuring that contractors have no outstanding claims.

-

**Legal Counsel Involvement: Seek advice from an experienced construction attorney to review and draft the advance payment agreement, ensuring it complies with all relevant laws and regulations.

Documentation Essentials

-

**Written Agreement: A well-drafted written agreement is the backbone of any advance payment arrangement, safeguarding the rights and obligations of both parties.

-

**Payment Schedules: Clearly outline the payment schedule, including the amount, timing, and method of payment.

-

**Progress Reports: Regular progress reports provide transparency and enable the client to monitor the project’s progress and ensure that the advance payment is used as intended.

-

**Lien Waivers: Collect and maintain lien waivers as evidence of the contractor’s fulfillment of obligations, protecting the project from potential liens.

Key Takeaways:

- Advance payment agreements should be tailored to the specific project and parties involved.

- Legal documentation is paramount for defining the terms and conditions of advance payments.

- Collateral and guarantees can provide additional safeguards against financial risks.

- Seek professional legal advice to ensure compliance with all relevant laws and regulations.

- Meticulous documentation ensures transparency and protects the interests of both parties.

Relevant URL Sources:

- Advance Payments Under Construction Contracts: Legal Considerations and Documentation

- Advance Payments in Construction: Legal Documentation and Risk Management

FAQ

Q1: What are advance payments in construction contracts?

A1: Advance payments are lump sums paid by clients to contractors before the commencement of work to cover initial expenses such as materials and labor. They typically constitute a percentage of the contract value.

Q2: What are the key considerations for advance payment agreements?

A2: Key considerations include the amount of the advance payment, the client’s financial stability, the contractor’s track record, and the project scope and timeline.

Q3: What are the advantages of advance payments?

A3: Advance payments provide contractors with financial support to cover initial expenses and maintain cash flow during project execution.

Q4: What are the potential risks associated with advance payments?

A4: Advance payments can lead to financial losses, project delays, or legal disputes if not managed properly. To mitigate these risks, robust contracts, due diligence, escrow accounts, and performance bonds are advisable.

Q5: What are the payment provisions related to advance payments?

A5: Payment provisions for advance payments vary depending on the contract. They typically outline the amount, timing, and conditions for advance payments, as well as any applicable escalation clauses.

– Advance Payment in Construction: A Guide to Timely Payments and Risk Mitigation

Welcome to the comprehensive guide on Advance Payment in Construction: A Guide to Timely Payments and Risk Mitigation. As a skilled construction professional with over a decade of experience, I will provide valuable insights and best practices to ensure timely payments and minimize financial risks in construction projects. Understand the importance of advance payment, explore payment mechanisms, and discover strategies to enhance project success.

Key Takeaways:

- Advance payments in construction are upfront payments made to contractors before work begins.

- Advance payments cover initial costs like materials and expenses.

- Payments are typically made in installments.

- A common advance payment percentage is 20% of the contract value.

Advance Payment in Construction: A Guide to Risk Management

What is an Advance Payment?

An advance payment is a sum of money paid by the client to the contractor upfront, before any work begins. This payment typically covers initial project costs, such as materials and mobilization expenses. Advance payments are often made in installments.

Benefits of Advance Payments

- Facilitate project start-up costs.

- Help build trust between the client and contractor.

- Reduce the financial burden on contractors.

Risks of Advance Payments

- Potential for misuse or misappropriation of funds by the contractor.

- Increased client exposure to financial loss if the contractor defaults or goes bankrupt.

- Potential delays or disputes over the timing and amount of advance payments.

Mitigating Risks

To mitigate the risks associated with advance payments, consider the following strategies:

- Conduct thorough due diligence on the contractor’s financial health and reputation.

- Require detailed financial statements and project plans from the contractor.

- Establish clear payment schedules and milestones.

- Use escrow accounts or other mechanisms to safeguard advance payments.

- Regularly monitor project progress and contractor performance.

- Seek legal advice if any disputes arise.

Best Practices

- Determine the appropriate amount of advance payment based on the project scope and complexity.

- Use a contract amendment to document the terms of the advance payment.

- Disburse advance payments in installments tied to specific project milestones.

- Monitor contractor performance and adjust advance payment schedule as needed.

Conclusion

Advance payments can be a valuable tool in construction projects, but it’s important to be aware of the potential risks involved. By carefully following best practices and implementing risk mitigation strategies, clients and contractors can ensure that advance payments are used effectively and protect their financial interests.

-

Concerned about dangerous activities on the construction site? Read more about the 18 High-risk Construction Work Activities that you need to know and avoid.

-

Recovering from an ACL injury? Check out these 3 Months Post-ACL Surgery Exercises to help you regain your strength and mobility.

-

Want to know how a construction contract can be terminated? Explore the 3 Ways a Construction Contract Can Be Terminated and protect your interests.

-

Looking for ways to save money on your construction project? Discover 6 Ways to Reduce Construction Costs and maximize your budget.

-

Interested in the latest financial performance of Action Construction Equipment? Get the Action Construction Equipment Share Price Target and make informed investment decisions.

Structuring Payment Terms

While Structuring Payment Terms in construction contracts is essential, it can be tricky. But fear not! Here’s a guide to help you navigate the complexities and ensure timely payments and risk mitigation.

Key Takeaways:

- Advance payments provide financial support to contractors, enabling project commencement.

- Bonding secures advance payments, reducing financial burden on employers.

- Contractors utilize advance payments for mobilization expenses and material procurement.

- Repayment mechanisms vary, often deducted from subsequent progress payments.

Steps for Successful Payment Structuring:

Step 1: Determine Advance Payment Amount

Assess project costs, contractor capabilities, and financial stability to determine an appropriate advance amount.

Step 2: Secure Payment with Performance Bonds

Require contractors to secure advance payments with bonds that diminish as payments are repaid.

Step 3: Establish Clear Payment Schedules

Outline payment milestones and due dates to ensure timely contractor payments.

Step 4: Monitor Project Progress

Track project progress regularly to ensure completion aligns with payment milestones.

Step 5: Adjust Payment Schedule When Necessary

Modify payment schedules when project delays or changes occur, ensuring contractors receive payments commensurate with work completed.

Remember, effective payment structuring is crucial for project success. By following these steps, you mitigate risks, foster collaboration, and ensure timely payments, paving the way for smooth and successful construction projects.

Sources:

Advance Payments Under Construction Contracts: A Guide

Advance Payments in Construction: What Are They and How Do They Work?

Managing Risk and Mitigation Strategies

In the realm of construction, effectively Managing Risk and Mitigation Strategies is pivotal for safeguarding projects and fostering success. As an experienced construction professional, I’ve seen firsthand how advance payments in construction contracts can be a double-edged sword. While they provide contractors with financial support, they also introduce potential risks. Here’s a guide to navigating this aspect of contract management:

Understanding Advance Payments

Advance payments are funds released to contractors before initiating work. They cover initial expenses like equipment purchases and material procurement. These payments expedite project commencement and demonstrate trust between parties.

Assessing Risks

Before issuing advance payments, it’s crucial to assess potential risks:

- Misappropriation: Funds could be diverted for unauthorized purposes.

- Financial Loss: In case of contractor default, the client bears the financial burden.

- Disputes: Misunderstandings over payment timing and amounts can arise.

Mitigation Strategies

To mitigate these risks, consider the following strategies:

- Due Diligence: Conduct thorough background checks on contractors, including financial reviews and project references.

- Financial Security: Require contractors to submit financial statements and project plans to assess their financial health.

- Payment Schedules: Establish clear payment schedules and milestones to align payments with project progress.

- Escrow Accounts: Utilize escrow accounts to safeguard payments until specific milestones are met.

- Performance Monitoring: Regularly monitor progress and contractor performance to ensure timely delivery and quality control.

Best Practices

To ensure advance payments are managed effectively:

- Determine the appropriate advance payment amount based on project scope and contractor capabilities.

- Document terms in a contract amendment outlining payment schedules and conditions.

- Disburse payments tied to milestones and hold back a portion until project completion.

- Adjust payment schedules if necessary, based on performance and progress assessments.

Key Takeaways:

- Advance payments provide financial support to contractors but introduce potential risks.

- Assess risks thoroughly before issuing advance payments.

- Implement mitigation strategies such as due diligence, payment schedules, and escrow accounts.

- Establish clear terms and monitor performance to ensure timely and safe payments.

Sources:

- Risk Management in Construction Projects – ScienceDirect

- Construction Risks and Mitigation Strategies – An Overview

Legal and Contractual Considerations

Advance payments in construction contracts are a common way to provide contractors with the upfront capital they need to initiate projects. However, these payments can also introduce legal and contractual complexities that both parties should carefully consider. Here are some of the key considerations:

- Advance payment amounts:

- Determine the appropriate amount of the advance payment based on the project’s scope, timeline, and estimated material and labor costs.

-

Ensure that the advance payment is reasonable and does not unduly burden either party.

-

Timing of payments:

- Establish clear timelines for when advance payments will be made and how they will be disbursed.

-

Consider including milestones or performance-based triggers for releasing subsequent payments.

-

Security for payments:

- Consider requiring the contractor to provide security for the advance payment, such as a surety bond or irrevocable letter of credit.

-

This helps mitigate the risk of financial loss if the contractor fails to complete the project or defaults on the contract.

-

Contractual language:

-

Draft the contract carefully to clearly outline the terms and conditions of the advance payments, including:

- The amount of the payment

- The timing of payments

- The security provided

- The consequences of default

-

Dispute resolution:

- Include a dispute resolution mechanism in the contract to address any disagreements or disputes that may arise regarding advance payments.

Key Takeaways:

- Advance payments can provide contractors with the upfront capital they need to initiate projects.

- It’s crucial to consider legal and contractual aspects of advance payments to mitigate risks and ensure compliance.

- Carefully determine the advance payment amount, timing, and security measures.

- Draft clear and comprehensive agreements outlining the terms and conditions of advance payments.

- Include a dispute resolution mechanism to address potential disagreements or disputes.

Citations:

Advance Payments Under Construction Contracts

Advance Payments in Construction – What Are They and How

FAQ

Q1: What is an advance payment in construction?

A1: An advance payment is an upfront payment made by a client to a contractor before any work has commenced. It is typically a percentage of the total contract value and is intended to cover initial costs like materials and expenses.

Q2: What are the benefits of advance payments for contractors?

A2: Advance payments provide contractors with an interest-free loan to facilitate project commencement and cover immediate costs like mobilization expenses and materials procurement.

Q3: How are advance payments typically secured?

A3: Advance payments are usually secured by a bond of equivalent value that diminishes as the payment is repaid. This reduces the employer’s risk and ensures the contractor’s financial stability.

Q4: How can advance payments be used to mitigate risk?

A4: Advance payments can mitigate risk by providing contractors with a financial cushion to cover unexpected costs or delays, reducing the likelihood of project failure or financial distress.

Q5: What considerations should be made when negotiating advance payment terms?

A5: When negotiating advance payment terms, it’s important to consider factors such as the contractor’s financial health, the project’s complexity, the payment schedule, and the terms of the bond.

- Pontoon Boat Seat Covers: The Ultimate Guide to Protection & Buying - April 17, 2025

- Covers for Pipework: A Complete Guide to Materials, Installation & More - April 17, 2025

- Dog Patio Door Inserts: A Comprehensive Guide to Choosing & Installing - April 17, 2025