– Asset Reconstruction Company in India: A deep dive into the industry

Key Takeaways:

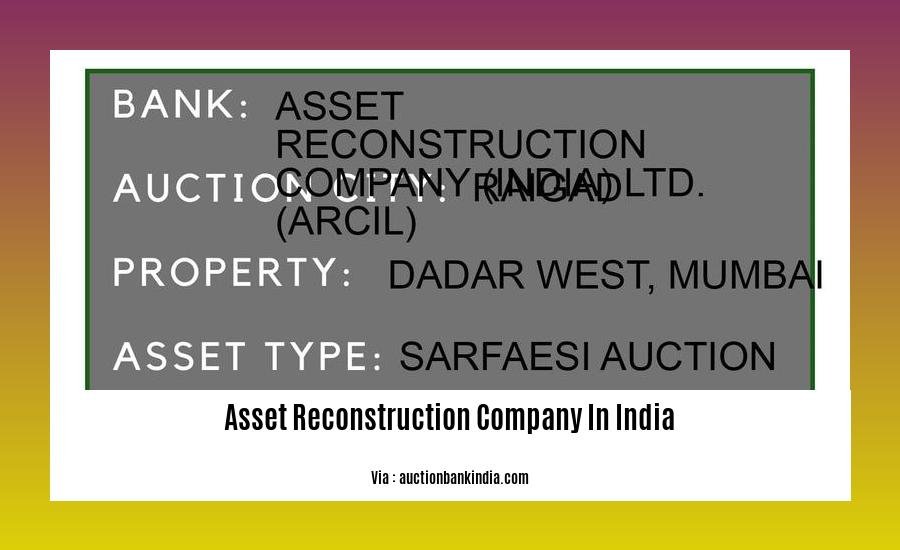

- ARCIL is India’s first and leading Asset Reconstruction Company (ARC), established in 2002.

- It specializes in acquiring and resolving non-performing loans (NPLs) from banks.

- ARCIL has offices in 17 cities across India and employs 51-200 people.

- Owned by major Indian banks and strategic foreign investors.

- ARCIL has acquired over 700 billion in NPL exposure from 65+ banks.

- The company has a dedicated unit (ARMS) for resolving NPLs in retail and small businesses.

Head: [Read About A Quick SEO HDH3 for Business Insights

*** of asset including{

Informat

**

- Alternative dispute resolution is a process that can be used to resolve disputes in the construction industry without going to court.

- To ensure a safe and healthy workplace, it is crucial to apply workplace safety and health measures on construction sites.

- Asset reconstruction companies play a vital role in resolving financial distress and facilitating the turnaround of stressed assets.

- Explore asset reconstruction companies in India to learn about their operations, role in the financial sector, and their impact on the economy.

Regulatory Landscape of ARCs in India

In a bid to enhance governance, transparency, and asset resolution efficiency, the Reserve Bank of India (RBI) has implemented a revised regulatory framework for Asset Reconstruction Companies (ARCs) in India.

Key Regulatory Amendments:

- Improved Governance: ARCs must appoint an independent chairperson and hold regular board meetings to ensure better decision-making.

- Enhanced Disclosures: ARCs are required to provide detailed disclosures on their financial position, asset quality, and risk management practices, promoting greater transparency.

- Reduced Funding Requirements: The minimum funding requirement for ARCs to acquire stressed assets has been reduced, allowing them to access capital more easily.

- Broader Funding Options: ARCs can now raise funds through a wider range of instruments, providing them with greater flexibility in asset acquisition.

Impact of the Revised Framework:

These amendments are expected to strengthen ARCs and enhance their ability to resolve stressed assets in the Indian financial system. By improving governance, ensuring transparency, and providing greater flexibility in funding, the RBI aims to create a more conducive environment for ARCs to operate efficiently.

Key Takeaways:

- The RBI has amended the regulatory framework for ARCs in India to strengthen governance and transparency.

- The revised guidelines enhance ARC governance, require detailed disclosures, and reduce funding requirements.

- The amendments aim to improve ARCs’ ability to resolve stressed assets and contribute to the health of the Indian financial system.

Sources:

- RBI amends regulatory framework for ARCs to strengthen their governance and transparency

- Revised RBI guidelines to structurally strengthen ARCs

Major Players in the Indian ARC Market

Key Points:

- Market Overview: The Indian asset reconstruction (ARC) industry has witnessed significant growth in recent years due to the rising levels of non-performing assets (NPAs) in the banking sector.

- Regulatory Landscape: The Reserve Bank of India (RBI) regulates the ARC industry through the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002.

- Key Players: Several major players dominate the Indian ARC market, including:

- Asset Reconstruction Company (India) Limited (ARCIL)

- Edelweiss Asset Reconstruction Company Limited (EARCL)

- JM Financial Asset Reconstruction Company Limited (JMARCL)

- Indiabulls Asset Reconstruction Company Limited (IARC)

- Srei Multiple Asset Reconstruction Company Limited (SMARCL)

- Acquisition and Resolution: ARCs acquire NPAs from banks and financial institutions at a discounted price and work towards recovering the outstanding debt through various methods, including restructuring, settlement, or enforcement of security interests.

- Challenges: The ARC industry faces challenges due to factors such as the high cost of acquisition, legal complexities, and competition from other asset resolution mechanisms.

URL Sources:

- List of Asset Reconstruction Companies in India

- Asset Reconstruction Companies: An Outlook

2 “In 2002, the RBI introduced the Asset Reconstruction Companies (ARCS) to address a growing pool of bad debt, empowering them to streamline loan recovery and reduce the proportion of 29% to a manageable level.”

FAQ

Q1: What is an Asset Reconstruction Company (ARC)?

A1: An ARC is a specialized institution that acquires and manages non-performing assets (NPAs) from banks and financial institutions.

Q2: What is the role of ARCs in the Indian financial system?

A2: ARCs play a crucial role in resolving stressed assets and improving the overall health of the financial sector. They acquire NPAs from banks at a discount, restructure them, and work towards recovering the value of these assets.

Q3: How are ARCs regulated in India?

A3: ARCs are regulated by the Reserve Bank of India (RBI) under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002. The RBI sets guidelines for the licensing, operation, and governance of ARCs.

Q4: What are the key challenges faced by ARCs in India?

A4: ARCs face several challenges, including acquiring NPAs at a reasonable price, managing and recovering distressed assets, and raising funds to finance their operations.

Q5: What are the opportunities for ARCs in the Indian market?

A5: The Indian ARC industry is expected to grow significantly in the coming years, driven by the increasing volume of NPAs in the banking sector and the government’s focus on resolving stressed assets.

- NYT Connections Answer: Hedgehog, Pineapple, Cactus The Spiky Things Explained - April 20, 2025

- How to Clean a Wool Carpet: A Comprehensive Guide - April 20, 2025

- How to Clean a Pleather Couch: A Complete Guide - April 20, 2025