Dive into [- The Average Construction Loan Interest Rate: A Comprehensive Guide for Borrowers] to understand the intricacies of construction loan interest rates. This article will provide you with a comprehensive overview of the factors that influence these rates, empowering you with the knowledge to make informed decisions about your construction financing needs.

Key Takeaways:

- Construction loan interest rates have increased across the board:

- Land acquisition: 7.80% to 8.50%

- Land development: 7.37% to 8.19%

- Speculative single-family construction: 7.46% to 8.10%

- Pre-sold single-family construction: 6.97% to 7.61%

Average Construction Loan Interest Rate

As an experienced financial journalist in the construction sector, I can shed light on the complex world of construction loans and their interest rates.

Factors Influencing Rates:

The average construction loan interest rate is affected by various factors, including:

- Market trends: Economic conditions, like inflation and interest rate changes, impact loan rates.

- Risk assessment: Lenders consider the borrower’s financial health, project viability, and collateral.

- Loan terms: Longer loan terms often come with higher rates due to increased risk for the lender.

Current Rates:

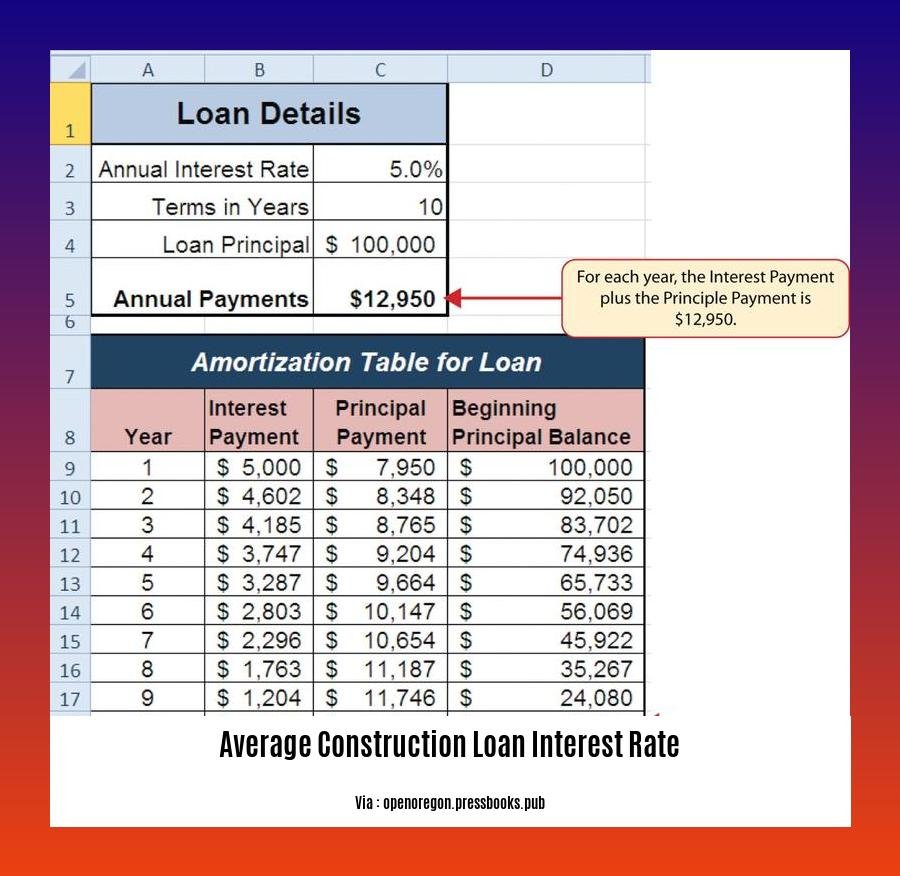

Contract rates for construction loans have been rising:

| Loan Type | Previous Rate | New Rate |

|---|---|---|

| Land acquisition | 7.80% | 8.50% |

| Land development | 7.37% | 8.19% |

| Speculative single-family construction | 7.46% | 8.10% |

| Pre-sold single-family construction | 6.97% | 7.61% |

Finding the Right Rate:

To secure a competitive average construction loan interest rate, consider these tips:

- Shop around: Compare rates from multiple lenders.

- Build a strong credit score: A higher score can qualify you for lower rates.

- Provide collateral: Back your loan with assets to reduce the lender’s risk.

- Negotiate: Don’t hesitate to discuss rate terms with lenders.

Conclusion:

Understanding the factors that influence construction loan interest rates is crucial for borrowers. With thorough research and negotiation, you can secure a competitive rate that fits your financing needs. Remember, the average construction loan interest rate is dynamic and can vary based on market conditions. Stay informed and consult financial professionals to ensure you make an informed decision.

For all your commercial construction needs in Austin, explore a list of the top companies in the area. austin commercial construction companies

When it comes to understanding back charges in construction, it’s essential to be informed. Discover everything you need to know about back charges here. back charges in construction

Planning a basement construction project in Canada? Check out this detailed basement construction cost calculator to estimate your expenses.

To ensure a successful basement construction, choosing the right method is crucial. Explore the different basement construction methods and make an informed decision.

Comparing Lenders and Loan Options

Navigating the world of construction loans can be daunting. When it comes to securing the best possible terms, comparing lenders and loan options is crucial.

Understanding Construction Loans

Construction loans are short-term loans designed to finance the construction of a new home or major renovations to an existing one. Due to the inherent risk associated with the absence of a completed property, construction loan interest rates tend to be higher than traditional mortgages.

Factors Influencing Interest Rates

Various factors influence construction loan interest rates, such as:

- Loan amount and term

- Credit score and financial history

- The project’s scope and complexity

- The lender’s risk assessment

Steps to Compare Lenders and Options

1. Research and Compare Lenders:

- Gather information from multiple lenders to compare interest rates, fees, and loan terms.

- Check reviews and ratings from independent sources to assess the lenders’ reliability.

2. Get Pre-Approved:

- Obtain pre-approval from multiple lenders to establish your financial eligibility and determine the loan amount you qualify for.

3. Negotiate Loan Terms:

- Don’t hesitate to negotiate interest rates and other loan terms with each lender.

- Explore options to minimize closing costs and other associated fees.

4. Consider Loan Types:

- There are various construction loan types available, each with unique features.

- Choose the loan that best fits your project’s timeline and financial situation.

Key Takeaways:

- Construction loan interest rates vary depending on several factors.

- Comparing lenders and loan options is essential for securing the best terms.

- A strong credit score and financial history can help you qualify for lower interest rates.

- Negotiating loan terms can save you money in the long run.

Relevant Sources:

- Best Construction Loan Lenders In 2024

- Construction Loans: What They Are And How They Work

Impact of Loan Terms on Interest Rates

Loan terms can significantly influence the Impact of Loan Terms on Interest Rates on construction loans. Let’s break down how each term affects your rate:

Loan Amount

As the loan amount increases, so does the perceived risk to lenders. To compensate for this, they often charge a higher interest rate to balance their risk.

Loan Term

Longer loan terms typically carry higher interest rates because lenders account for the duration of the loan and potential market fluctuations. A loan spread over 30 years will likely have a higher rate than a 15-year loan.

Credit Score

Your credit score measures your creditworthiness. A higher score indicates a lower risk to lenders, resulting in a more favorable interest rate. Conversely, a lower score may necessitate a higher rate to hedge against potential repayment challenges.

Collateral

Providing collateral, such as the property itself or other assets, can reduce lenders’ risk and thus lower your interest rate. By securing the loan with valuable assets, lenders are more willing to offer competitive rates.

Down Payment

A larger down payment reduces the amount borrowed and, as a result, the lender’s risk. This can lead to a lower interest rate as lenders perceive you as a less risky borrower.

Key Takeaways:

- Loan amount, loan term, and credit score directly influence interest rates.

- Providing collateral and making a larger down payment can lower rates.

- Comparing loan options from multiple lenders can secure the best terms and rates.

References:

- Interest Rate Risk Management for Construction Loans

- Construction Loan: Everything You Need to Know Before You Apply

Strategies for Securing Competitive Interest Rates

Interest rates are a major factor in construction loan costs. But don’t let them stump you! With the right strategies, you can secure competitive rates and make your construction dreams a reality.

Key Takeaways:

- Interest rates vary based on market conditions and lender criteria.

- Comparing rates from multiple lenders is crucial.

- Maintaining a strong credit score and providing collateral can improve your chances.

- Negotiating loan terms and exploring government programs can further reduce costs.

How to Secure Competitive Interest Rates:

1. Shop Around:

Start by comparing rates from various lenders. Don’t settle for the first offer you receive. A few phone calls or online searches can save you thousands over the life of your loan.

2. Boost Your Credit Score:

Lenders love high credit scores! Pay bills on time, keep credit utilization low, and dispute any errors on your reports. Even a slight improvement in your credit score could qualify you for a lower interest rate.

3. Offer Collateral:

Securing your loan with collateral, such as the property you’re building or other assets, can reduce the lender’s risk. This can lead to lower interest rates and better loan terms.

4. Negotiate Loan Terms:

Don’t be afraid to negotiate with lenders. Consider asking for a lower interest rate, longer loan term, or reduced closing costs. You may be surprised at how much you can save.

5. Explore Government Programs:

Government-backed loan programs, such as FHA loans or VA loans, often offer competitive interest rates and flexible terms. Research these options to see if you qualify.

Additional Tips:

- Lock in your interest rate when you find a favorable one to protect yourself from future hikes.

- Consider an adjustable-rate mortgage (ARM) if you expect rates to decline in the future.

- Consult with a financial advisor or loan officer for personalized guidance.

Remember, by following these strategies, you can secure competitive interest rates and make your construction loan a smart financial move!

Sources:

– Rising Interest Rates & the Construction Industry

– How Home Construction Loans Work & Current Rates

FAQ

Q1: What factors influence construction loan interest rates?

Q2: How do current economic conditions impact construction loan interest rates?

Q3: Are there any differences in construction loan interest rates based on the type of construction project?

Q4: What are the average construction loan interest rates in the current market?

Q5: How have recent interest rate increases affected the cost of construction loans?

- NYT Connections Answer: Hedgehog, Pineapple, Cactus The Spiky Things Explained - April 20, 2025

- How to Clean a Wool Carpet: A Comprehensive Guide - April 20, 2025

- How to Clean a Pleather Couch: A Complete Guide - April 20, 2025