Explore the dynamic Australian housing market and delve into the intricacies of average home loan interest rates over the past decade with [Navigating Australian Housing Market: Average Home Loan Interest Rates Over the Last Decade]. As a seasoned finance and economics journalist, I’ll provide a comprehensive analysis of how these rates have evolved, the underlying factors that influenced them, and their impact on homeowners and investors alike. Get ready to navigate the ever-changing landscape of Australian housing finance and gain valuable insights into making informed decisions about your home loan choices.

Key Takeaways:

-

In November 2023, Australia’s mortgage rate increased from 6.56% to 6.80%.

-

From 1990 to 2023, Australia’s average mortgage rate was 6.86%, with a maximum of 15.50% in 1990 and a minimum of 2.14% in 2021.

-

Lenders commonly utilize three-year interest rates when reviewing historical mortgage rates, considering most home loans fall within this period.

-

Australia’s interest rates considerably rose in 2022 due to the Reserve Bank of Australia’s numerous rate increases.

-

Comparisons between different interest rates may prove beneficial, particularly given the rising interest rate environment and its impact on home loan repayments.

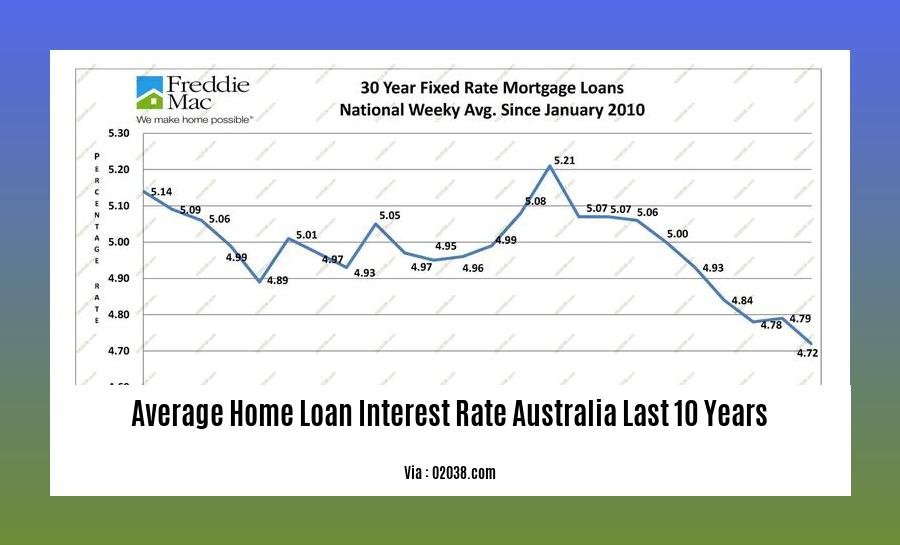

Average Home Loan Interest Rate Australia Last 10 Years

The average home loan interest rate in Australia has experienced significant fluctuations over the last decade. Understanding these changes can help homeowners, investors, and aspiring buyers make informed decisions about their borrowing.

Factors Influencing Home Loan Interest Rates

- Reserve Bank of Australia (RBA) Cash Rate: The RBA cash rate is the benchmark interest rate that banks use to set their variable home loan interest rates. Changes in the cash rate directly impact variable rate home loans.

- Economic Conditions: Economic factors such as inflation, unemployment, and GDP growth can influence the RBA’s decision on interest rates.

- Global Financial Markets: Global economic and financial events can also affect Australian interest rates.

- Competition Among Lenders: Competition in the home loan market can lead to lenders offering lower interest rates to attract customers.

Historical Context of Home Loan Interest Rates

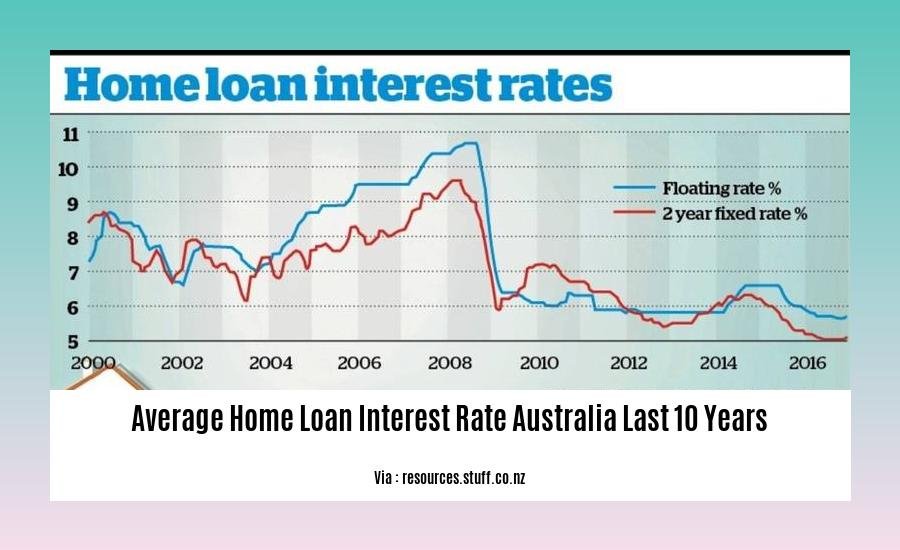

From 1990 to 2023, the average home loan interest rate in Australia averaged 6.86%, reaching a high of 15.50% in 1990 and a low of 2.14% in 2021. The RBA cash rate has been the primary driver of these changes.

Recent Trends in Home Loan Interest Rates

In recent years, home loan interest rates have been on a rising trend. The RBA has raised the cash rate eight times since May 2022 to combat rising inflation. As a result, many banks have passed on these increases to their variable rate home loan customers.

Impact of Rising Interest Rates on Homeowners

Rising interest rates can have a significant impact on homeowners with variable rate home loans. Higher interest rates mean higher monthly repayments, which can strain household budgets. Homeowners may also find it more difficult to refinance their loans or take out additional debt.

Tips for Managing Rising Interest Rates

- Consider Refinancing: If you have a variable rate home loan, shopping around for a lower interest rate can be beneficial. Refinancing to a lower rate can reduce your monthly repayments and save you money in the long run.

- Pay Extra on Your Mortgage: If you can afford it, making extra payments on your mortgage can help you pay down your loan faster and reduce the total interest you pay.

- Create a Budget: Creating a budget can help you track your spending and identify areas where you can cut back. This can free up more money to put towards your mortgage payments.

- Talk to Your Lender: If you’re struggling to make your mortgage payments, talk to your lender. They may be able to offer you assistance or a payment plan that fits your financial situation.

Conclusion

The average home loan interest rate in Australia has experienced significant changes over the last decade. Understanding the factors that influence interest rates and how they have changed in recent years can help homeowners, investors, and aspiring buyers make informed decisions about their borrowing.

Looking ahead, it’s important to stay informed about economic conditions and the RBA’s monetary policy decisions. By doing so, you can be prepared for potential changes in interest rates and adjust your financial plans accordingly.

-

Looking for inspiration for your upcoming alumni homecoming speech? Check out our collection of sample speeches that will leave a lasting impression on your audience. alumni homecoming speech sample

-

Planning to build a home pool? Learn about the average home pool size, taking into account factors such as budget, backyard space, and desired features. average home pool size

-

Designing your dream backyard oasis? Discover the average home swimming pool size to ensure you have ample space for relaxation and enjoyment. average home swimming pool size

Comparison of average home loan interest rates between Australia and other countries

Have you thought about what it would be like to witness a financial journey through Australia’s housing market? Join us as we dive into the world of home loan interest rates in Australia over the last decade. Grab your economic compass, and let’s set sail!

Key Takeaways:

- Australia’s home loan interest rates: Compared to other countries, Australia has generally had lower home loan interest rates over the last decade.

- Factors influencing rates: The Reserve Bank of Australia (RBA) cash rate, economic conditions, and global financial markets have influenced interest rates in both Australia and other countries.

- Effects of rising rates: Rising interest rates can strain household budgets, making it more challenging to refinance or take on additional debt.

- Taking control: To manage variable rate home loans effectively, consider refinancing, making extra payments, budgeting, and communicating with lenders.

- Staying informed: Keeping up with economic conditions and the RBA’s monetary policy decisions can help homeowners plan for potential interest rate changes.

In Australia, the last decade has witnessed a dynamic landscape of home loan interest rates. In 2021, we saw record lows, with average rates dipping below 2.5%. However, the tide has turned since then, and rates have been on an upward trajectory, influenced by a cocktail of factors both local and global. What’s the driving force behind these changes, you ask? Let’s find out.

The Reserve Bank of Australia (RBA)

The RBA plays a pivotal role in setting the cash rate, which serves as a benchmark for home loan interest rates. When the RBA increases the cash rate, banks typically pass on at least a portion of this increase to their customers, leading to higher home loan interest rates.

Economic Conditions

Economic conditions can also impact interest rates. In times of economic growth, demand for housing tends to rise, which can put upward pressure on interest rates. Conversely, during economic downturns, demand for housing may decrease, leading to lower interest rates.

Global Financial Markets

The global financial markets also exert an influence on interest rates in Australia. When the global economy is in a state of uncertainty or volatility, investors often seek out safe havens like the Australian dollar. This increased demand for the Australian dollar can lead to higher interest rates.

How do Australian interest rates compare to those in other countries?

To put things in perspective, let’s compare Australia’s home loan interest rates to those in other countries. Historically, Australia has enjoyed lower rates compared to many developed nations. In recent years, this gap has narrowed somewhat, but Australia still remains relatively attractive in terms of home loan interest rates.

Managing rising interest rates

What can homeowners do in the face of rising interest rates? Fear not, there are strategies you can employ to manage this situation. Here’s a quick guide:

- Refinancing: Explore refinancing options to secure a more favorable interest rate.

- Extra payments: Make extra payments when possible to reduce your loan balance faster.

- Create a budget: Develop a detailed budget to ensure you can meet your financial obligations, including your mortgage payments.

- Talk to your lender: If you’re struggling to make payments, communicate with your lender to discuss potential solutions.

Staying informed

Knowledge is power, especially when it comes to managing your finances. Stay informed about economic conditions and the RBA’s monetary policy decisions. This information can help you anticipate potential changes in interest rates and plan accordingly.

As you embark on your homeownership journey, remember that interest rates are just one piece of the puzzle. It’s crucial to have a comprehensive understanding of your financial situation, including your income, expenses, and risk tolerance. With careful planning and informed decisions, you can navigate the Australian housing market and achieve your homeownership goals.

Citations

Canstar: Home Loan Comparison

Mozo: Home Loan Statistics in Australia

Forecasting future movements in home loan interest rates in Australia

The Australian housing market has been on a rollercoaster ride in recent years. Interest rates have been at historic lows, making it easier for people to get on the property ladder. But, with inflation on the rise, there are signs that interest rates may start to increase again. So, what does this mean for homeowners and prospective buyers?

Key Takeaways:

- Interest rates in Australia are expected to continue rising in 2024, with predictions of up to 6 rate hikes by March 2024.

- If the RBA raises the cash rate to 4.60% in 2023, a $500,000 home loan with a 25-year term could witness a monthly repayment increase of $1,287.

- The RBA projects inflation to decrease to roughly 3%, reaching the target range by mid-2025, potentially signaling the cessation of rate hikes.

What Factors Influence Interest Rates?

A number of factors can influence interest rates, including:

- The RBA cash rate: This is the rate at which banks borrow money from each other. The RBA adjusts the cash rate to control inflation.

- Economic conditions: Interest rates are typically higher when the economy is strong and lower when the economy is weak.

- Global financial markets: Interest rates can also be influenced by events in global financial markets.

- Competition among lenders: Competition among lenders can sometimes lead to lower interest rates.

What Does This Mean for Homeowners?

If interest rates rise, it will mean that homeowners with variable rate loans will see their monthly repayments increase. This could make it more difficult to make ends meet, and it could even lead to some homeowners being forced to sell their properties.

What Does This Mean for Prospective Buyers?

If interest rates rise, it will make it more expensive to borrow money to buy a home. This could make it more difficult for prospective buyers to get on the property ladder.

What Can You Do?

If you’re worried about rising interest rates, there are a number of things you can do to prepare:

- Consider refinancing your loan to a fixed rate loan. This will lock in your interest rate for a set period of time, protecting you from future rate increases.

- Make extra repayments on your loan. This will help you pay down your loan faster and reduce the amount of interest you pay.

- Create a budget and stick to it. This will help you make sure that you have enough money to cover your living expenses and your loan repayments.

- Talk to your lender. If you’re struggling to make your loan repayments, talk to your lender about your options. They may be able to help you find a solution that works for you.

Conclusion

Forecasting the future movements of home loan interest rates in Australia is not an exact science but by following the economic indicators and staying informed about the latest news, homeowners and prospective buyers can make informed decisions about their mortgage choices.

Citations:

Westpac predicts six interest rate rises by March 2024

High will interest rates go in 2023?

Strategies for homeowners to secure the best possible home loan interest rates

In a fluctuating housing market, savvy homeowners seek strategies to secure the best home loan interest rates to maximize their financial advantage. Here’s a guide to help you navigate the complexities of securing a favorable interest rate:

1. Research, Research, Research:

- Dive into the depths of the housing market, comparing rates from multiple lenders to find the one that aligns with your financial goals and circumstances. Don’t just settle for the first option; explore and negotiate until you find the best deal.

2. Improve Your Credit Score:

- A higher credit score is like a magnet for lower interest rates. Work on improving it by paying bills on time, reducing debt, and maintaining a healthy credit utilization ratio. Every point counts, so make it a priority.

3. Consider Adjustable-Rate Mortgages (ARM):

- ARMs may offer lower initial interest rates, providing short-term savings. However, be prepared for potential rate adjustments in the future. Weigh the pros and cons carefully to see if an ARM is the right choice for you.

4. Lock in Your Rate:

- If you anticipate rising interest rates, locking in a rate can provide peace of mind. This ensures that even if rates climb, your interest rate remains the same throughout the loan term.

5. Make a Larger Down Payment:

- Put down a hefty down payment to reduce the loan amount, thereby lowering your monthly payments and potentially securing a better interest rate. It’s a strategic move that can pay off in the long run.

6. Explore Government-Backed Loans:

- Government-backed loans, like FHA, VA, and USDA loans, often come with lower interest rates than conventional loans. If you qualify, these loans can be a gateway to more affordable homeownership.

7. Ask About Lender Credits:

- Some lenders offer lender credits to offset closing costs, effectively lowering the overall cost of the loan. Be sure to inquire about this option during your loan application process.

Remember, securing a favorable home loan interest rate is a marathon, not a sprint. By implementing these strategies and staying vigilant in your pursuit of the best deal, you can cross the finish line with a home loan tailored to your financial aspirations.

Key Takeaways

- Research and compare: Explore multiple lenders and negotiate for the best interest rate.

- Boost your credit score: Improve your creditworthiness for better loan terms.

- Consider an ARM: Weigh the pros and cons of adjustable-rate mortgages.

- Lock in your rate: Secure a fixed rate to shield yourself from future rate hikes.

- Increase your down payment: Reduce loan amount for lower payments and better rates.

- Explore government-backed loans: FHA, VA, and USDA loans may offer lower rates.

- Ask about lender credits: Offset closing costs with lender-provided credits.

Canstar

Mozo

FAQ

Q1: What was the average home loan interest rate in Australia over the past decade?

A1: From 1990 to 2023, Australia’s mortgage rate averaged 6.86%, reaching a high of 15.50% in 1990 and a low of 2.14% in 2021.

Q2: How have interest rates changed in recent years?

A2: Interest rates in Australia started rising rapidly in 2022, with the Reserve Bank of Australia raising the cash rate eight times in eight months and five times in 2023.

Q3: What is the current average home loan interest rate in Australia?

A3: As of November 2023, Australia’s Mortgage Rate rose to 6.80% from 6.56% in October.

Q4: How can I get a lower interest rate on my home loan?

A4: Shopping around for a lower interest rate can be beneficial as interest rates rise and home loan repayments increase.

Q5: What are some factors that affect home loan interest rates?

A5: Factors that influence home loan interest rates include the Reserve Bank of Australia’s cash rate, inflation, economic conditions, and the lender’s risk assessment of the borrower.

- Kitchen tiling wall: Elevate your kitchen with stylish wall tiles - December 16, 2025

- Gray Kitchen Backsplash Tile: Ideas for a Stylish Upgrade - December 14, 2025

- Backsplash For Gray Cabinets: Choosing the Right Backsplash Style - December 13, 2025