Welcome to your comprehensive guide to homeowners insurance costs in Cape Coral, FL! As a seasoned expert in the local market, I will provide an in-depth overview of the [Average Homeowners Insurance Cost in Cape Coral, FL: A Comprehensive Overview]. I’ll help you unravel the mysteries of insurance policies, guide you through risk assessment, assist with claims handling, and reveal insider tips for optimizing your premiums. Let’s dive right in and navigate the world of property insurance together!

Key Takeaways:

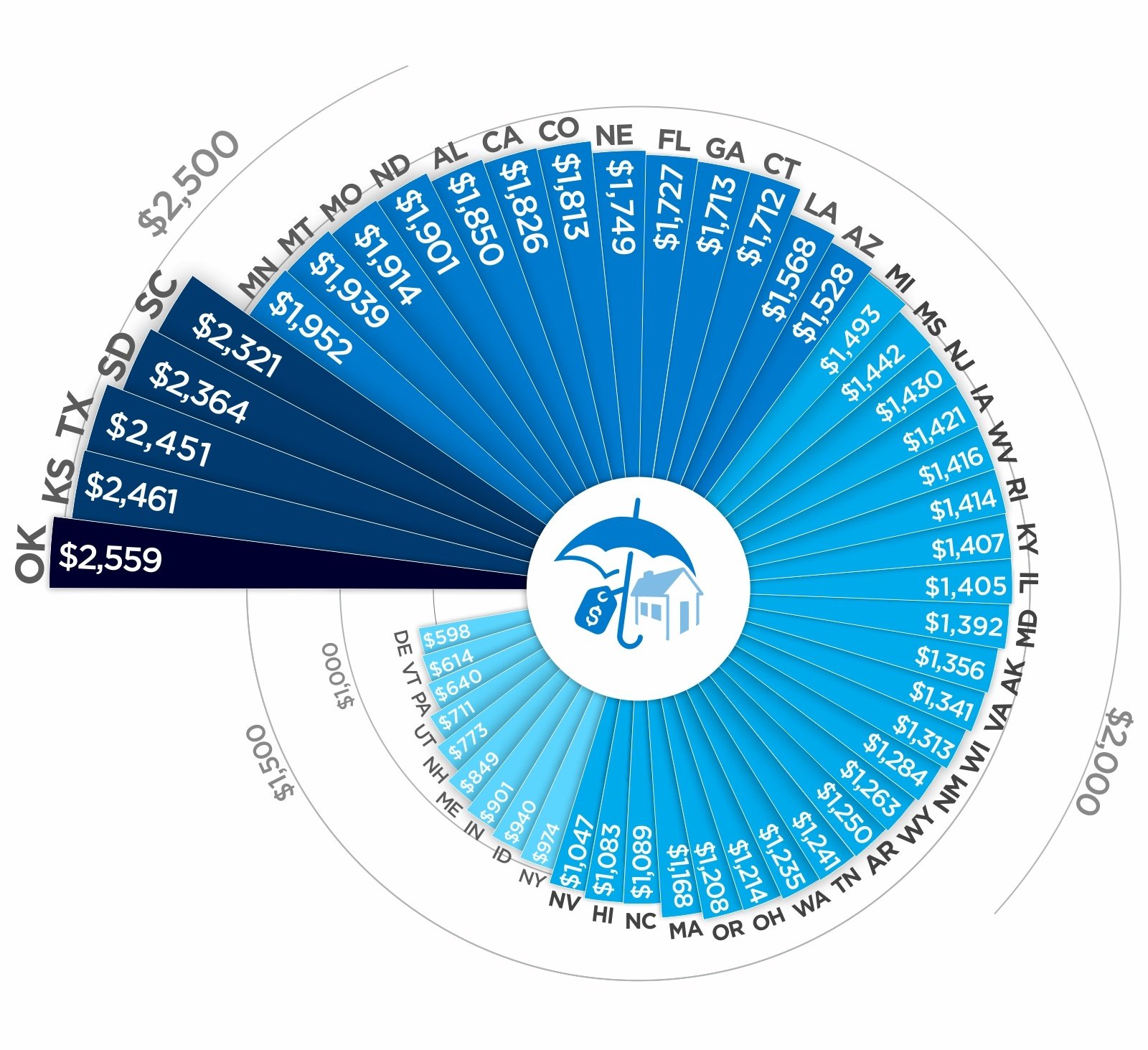

- The average annual homeowners insurance premium in Cape Coral, FL is $2,165.

- Comparing quotes from multiple insurers can result in savings of up to $3,278 per year.

Average Homeowners Insurance Cape Coral, FL

Homeowners in Cape Coral, Florida, face unique challenges when it comes to securing reliable and affordable insurance coverage. The average homeowners insurance Cape Coral, FL is around $2,165 per year, but premiums can vary widely depending on several factors including the location, age, and size of your home; its claims history; and the amount of coverage you need.

Understanding these factors can help you make informed decisions about your homeowners insurance policy.

Here are some tips for finding affordable homeowners insurance in Cape Coral, FL:

- Shop around for quotes: Don’t just stick with the first insurance company you find. Get quotes from multiple insurers to compare rates and coverage.

- Ask for discounts: Many insurance companies offer discounts for things like bundling your home and auto insurance, installing security systems, and having a good claims history.

- Increase your deductible: If you can afford to pay a higher deductible, you’ll typically get a lower premium.

- Consider a higher coverage limit: While you want to make sure you have enough coverage to protect your home and belongings, you don’t want to over-insure either. Talk to an insurance agent to determine the right amount of coverage for your needs.

By following these tips, you can find affordable homeowners insurance in Cape Coral, FL, that meets your needs and protects your home.

-

Wondering about the accuracy of home mold test kits? Discover the truth to save time and money.

-

Uncover the average cost of homeowners insurance in Cape Coral, Florida, and make an informed decision about protecting your home.

-

Explore the average size of mobile home doors to ensure a perfect fit and optimal security.

-

Learn about the average size of single-wide mobile homes to find the perfect fit for your needs.

Understanding Insurance Deductibles and Coverage Limits

When it comes to homeowners insurance, Understanding Insurance Deductibles and Coverage Limits is crucial. A deductible is the amount you pay out-of-pocket before insurance kicks in. Higher deductibles lower premiums but increase your financial responsibility for claims.

Coverage limits, on the other hand, determine the maximum amount your insurance policy will pay for covered losses. It’s essential to find the right balance between affordable premiums and adequate coverage.

Key Takeaways:

- Deductibles reduce premiums but increase out-of-pocket costs.

- Coverage limits determine the maximum amount insurance will pay.

- You can choose deductibles ranging from $250 to $2,000 or even a percentage of your home’s value.

- Consider your financial situation and risk tolerance when choosing a deductible.

- Ensure coverage limits align with your home’s replacement cost to avoid underinsurance.

By understanding these concepts, you can make informed decisions to protect your home and finances effectively. For further information, refer to reputable sources like NerdWallet and Policygenius.

Tips for Lowering Homeowners Insurance Premiums in Cape Coral, FL

Navigating the world of homeowners insurance can be daunting, especially in a hurricane-prone area like Cape Coral, FL. To help you secure affordable coverage, here are some expert-backed tips:

Improve Your Credit Score

Your credit history plays a significant role in determining your insurance premiums. A higher credit score indicates lower risk, leading to lower premiums. Make an effort to improve your credit score by paying bills on time, reducing debt, and avoiding unnecessary credit inquiries.

Maintain Your Home

Regular home maintenance is crucial for preventing costly damage. Conduct routine inspections of your roof, plumbing, and electrical systems to identify potential issues before they become major problems. This proactive approach can save you money on repairs and lower your insurance premiums.

Choose a Higher Deductible

A higher deductible means you pay a larger amount out-of-pocket before your insurance kicks in. While a higher deductible may seem counterintuitive, it can significantly reduce your premiums. Choose a deductible that you can comfortably afford without compromising your financial stability.

Increase Your Hurricane Deductible

Cape Coral is particularly vulnerable to hurricanes. By increasing your hurricane deductible, you can lower your overall premiums. However, ensure you can reasonably afford this deductible if a hurricane strikes.

Review Your Home’s Features

Factors like the age of your home, roof condition, building materials, and prior claims history can impact your premiums. Consider investing in upgrades that improve your home’s safety and resilience, such as hurricane impact windows or a new roof.

Key Takeaways:

- Improve your credit score for lower premiums.

- Maintain your home to prevent costly repairs.

- Choose a higher deductible to reduce premiums.

- Increase your hurricane deductible to save money.

- Review your home’s features to identify opportunities for upgrades that lower premiums.

Relevant URL Sources:

- Cape Coral, FL Homeowners Insurance | Clovered

- 10 Tips For Florida Residents to Save Money on Homeowners Insurance

Filing and Settling Homeowners Insurance Claims in Cape Coral, FL

Let’s simplify navigating the claims process for homeowners in Cape Coral, Florida. I’ll take you through the steps to effectively file and settle homeowners insurance claims.

Key Takeaways:

- Report the claim promptly.

- Be organized and provide supporting documents.

- Understand your policy and coverage limits.

- Communicate regularly with your insurer.

- Be patient and persistent throughout the process.

Steps for Filing a Claim:

- Contact your insurance company. Report the claim as soon as possible, providing a detailed description of the incident and any damage sustained.

- Gather evidence. Take photos and videos of the damage and collect receipts for any expenses related to the incident.

- File a formal claim. Complete the necessary forms and submit them to your insurer, along with any supporting documentation you’ve gathered.

Settling the Claim:

- Discuss the settlement amount. Negotiate with your insurer to reach a fair and reasonable settlement that covers the damage and expenses.

- Review the settlement agreement. Ensure that the agreement clearly outlines the amount of coverage, repair costs, and any deductibles or exclusions.

- Sign and return the settlement agreement. Once you’re satisfied with the terms, sign and return the agreement to your insurer.

Tips for Success:

- Keep a record of all communication with your insurer.

- Seek professional assistance from a public adjuster if you encounter difficulties.

- Understand that the claims process can take time, so be patient and persistent.

By following this guidance and staying organized throughout the process, you can increase your chances of a successful filing and settlement of your homeowners insurance claim in Cape Coral, FL.

Relevant URL Sources:

- Herman Wells: How Long Do Florida Home Insurance Claims Take to Settle?

- Clovered: Cape Coral, FL Homeowners Insurance

FAQ

Q1: What is the average cost of homeowners insurance in Cape Coral, FL?

A1: The average annual homeowners insurance premium in Cape Coral, FL is approximately $2,165. However, costs can vary depending on factors such as the value of your home, its age, and your claims history.

Q2: What are some ways to lower my homeowners insurance premium in Cape Coral, FL?

A2: There are several ways to lower your homeowners insurance premium in Cape Coral, FL. These include improving your credit score, performing regular home maintenance, choosing a higher deductible, and considering your home’s age, roof condition, building materials, and prior claims history.

Q3: What are the top home insurance companies in Cape Coral, FL?

A3: Some of the top home insurance companies in Cape Coral, FL, include Citizens, Florida Penn, Liberty Mutual, FedNat, ASI, and Universal Property & Casualty Insurance Company.

Q4: What is the claim settlement timeframe for homeowners insurance in Cape Coral, FL?

A4: Insurers in Cape Coral, FL, have 30 days to confirm coverage, partial coverage, or the ongoing investigation status of a claim after receiving a written request from the consumer.

Q5: What are the most common homeowners insurance claims in Cape Coral, FL?

A5: The context provided does not specify the most common homeowners insurance claims in Cape Coral, FL.

- How to Get Urine Smell Out of Your Couch: A Complete Guide - April 23, 2025

- How to Get Pee Smell Out of Your Couch: A Complete Guide - April 23, 2025

- What Happened to Lane Furniture in Mississippi? - April 23, 2025