In Singapore, bank home loan rates are pivotal factors shaping the financial decisions of homeowners and investors. Understanding the dynamics that influence these rates is crucial for making informed choices. Dive into [Bank Home Loan Rates Singapore: Key Factors and Impact on Homeowners and Investors] to gain insights into the intricacies of mortgage rates and how they impact your financial trajectory.

Key Takeaways:

- Eligibility:

-

To be eligible for a home loan in Singapore, you must be at least 21 years old, be a Singaporean, Permanent Resident, or Foreigner, be employed or self-employed, have sufficient income to cover loan repayments, and the property must be residential and located in Singapore.

-

Application Process:

-

To apply for a home loan, you must contact a mortgage lender or broker, provide personal and financial information, submit required documents, undergo a credit assessment and loan approval, and finally sign loan documents and receive loan proceeds.

-

Interest Rates:

-

Home loan interest rates in Singapore can be either variable, which can change over time, or fixed, which remain the same for a specific period.

-

Repayment Period:

- The typical repayment period for a home loan in Singapore ranges from 25 to 30 years.

Bank Home Loan Rates Singapore:

Navigating the complexities of bank home loan rates singapore can be daunting for prospective homeowners and property investors. This comprehensive guide unpacks the essential factors that shape these rates and their overarching impact on financial decisions.

Understanding Bank Home Loan Rates Singapore:

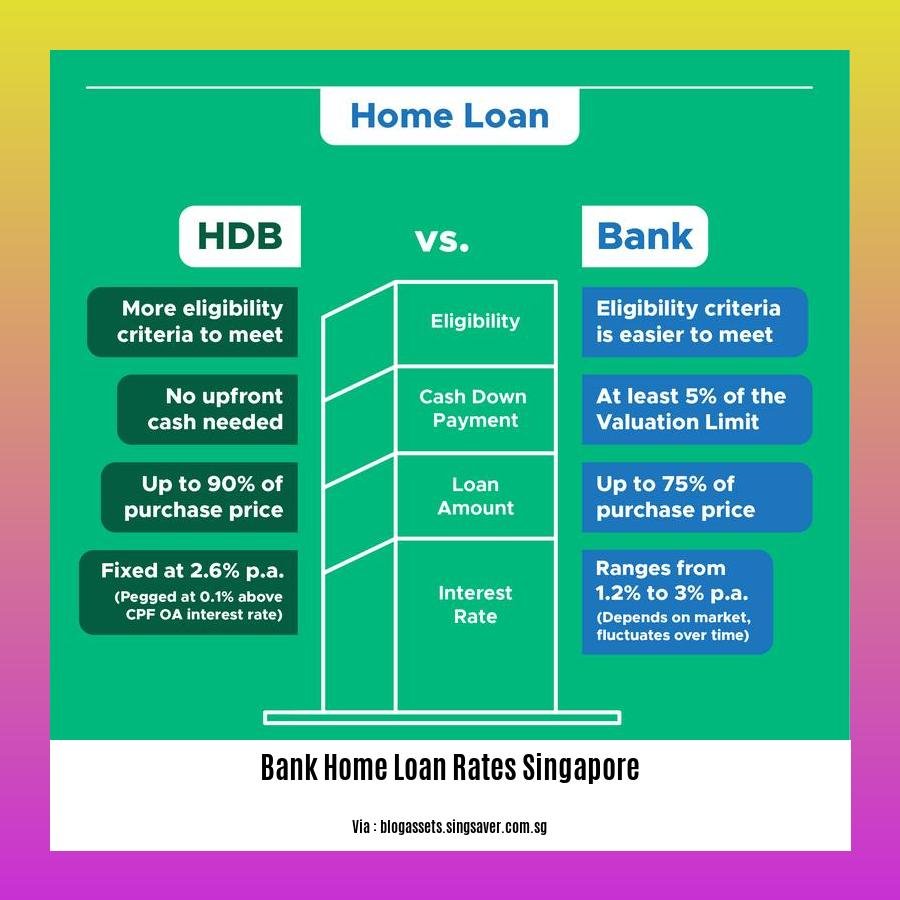

Bank home loan rates singapore are the interest rates charged by financial institutions for borrowing money to purchase a residential property. These rates can either be fixed or variable, each with its own advantages and considerations.

Fixed rates: These rates remain constant throughout the loan tenure, offering stability and predictability in monthly repayments. However, they typically come with higher interest rates compared to variable rates.

Variable rates: These rates fluctuate based on prevailing market conditions, such as changes in the central bank’s benchmark interest rates. While they may offer lower initial rates, they carry the risk of potential increases in monthly repayments should interest rates rise.

Factors Influencing Bank Home Loan Rates Singapore:

A multitude of factors contribute to the determination of bank home loan rates singapore. Understanding these elements is crucial for borrowers to make informed decisions:

-

Loan-to-Value Ratio (LTV): LTV represents the percentage of the property’s value that the borrower is financing through the loan. A higher LTV typically results in a higher interest rate due to the perceived increased risk to the lender.

-

Credit Score: A borrower’s credit score is a numerical representation of their credit history and repayment behavior. A higher credit score generally translates to a lower interest rate, as lenders view such borrowers as less risky.

-

Property Type: The type of property being purchased can also affect the interest rate. For instance, residential properties typically attract lower interest rates compared to commercial properties, which are considered riskier.

-

Loan Tenure: The duration of the loan, also known as the loan tenure, influences the interest rate. Longer loan tenures often come with higher interest rates due to the extended risk exposure for the lender.

The Impact of Bank Home Loan Rates Singapore on Homeowners and Investors:

The prevailing bank home loan rates singapore have a direct bearing on both homeowners and property investors:

-

Homeowners: Higher interest rates can lead to increased monthly mortgage payments, potentially straining household finances. Conversely, lower interest rates can provide homeowners with more disposable income and financial flexibility.

-

Property Investors: Interest rates play a crucial role in determining the profitability of property investments. Higher interest rates can erode rental yields, potentially reducing the investment’s attractiveness. On the other hand, lower interest rates can enhance rental yields, making property investments more lucrative.

Strategies for Securing Favorable Bank Home Loan Rates Singapore:

-

Improve Credit Score: Maintaining a healthy credit score by paying bills on time and managing debt responsibly can significantly improve chances of securing a lower interest rate.

-

Compare Rates from Multiple Lenders: Shopping around and comparing bank home loan rates singapore from different financial institutions can help borrowers find the most competitive rates.

-

Consider Shorter Loan Tenure: Opting for a shorter loan tenure, while requiring higher monthly repayments, can lead to lower overall interest payments due to the reduced borrowing period.

-

Make a Larger Down Payment: Increasing the down payment amount reduces the loan amount required, which can potentially result in a lower interest rate.

-

Explore Government Schemes and Grants: Various government initiatives and grants are available to first-time homebuyers and eligible property purchasers. These schemes can provide financial assistance, including reduced interest rates.

-

Looking to buy a home in Singapore? Take advantage of the best bank home loan interest rates available and turn your dream into a reality. Bank home loan interest rate singapore

-

Are you considering buying a mobile home with land in Florida? Learn about the banks that finance mobile homes with land in Florida and make an informed decision.

-

Shop for stylish and comfortable furniture at Best Buy to transform your house into a home. Discover great deals on everything from sofas and chairs to dining tables and beds. Best buy home furniture

How to compare home loan rates

Gone are the days when you had to go from bank to bank, collecting brochures and comparing home loan rates. Today, with the advent of online comparison tools and resources, comparing home loan rates has become a breeze. Here’s a step-by-step guide to help you find the best home loan rate in Singapore:

-

Get a clear idea of your budget:

Before you start comparing home loan rates, it’s important to have a clear idea of how much you can afford to borrow. Consider your income, expenses, and other financial commitments. This will help you narrow down your search to home loans that fit your budget. -

Check your credit score:

Your credit score is a crucial factor that lenders consider when determining your home loan interest rate. A higher credit score typically means a lower interest rate. Check your credit score before you apply for a home loan to see where you stand. -

Shop around and compare rates:

Don’t just settle for the first home loan rate you see. Take some time to shop around and compare rates from multiple lenders. You can use online comparison tools or speak to mortgage brokers to get quotes from different lenders. -

Consider the type of interest rate:

Home loans typically offer two types of interest rates: fixed and floating. Fixed interest rates remain the same throughout the loan tenure, while floating interest rates fluctuate with market conditions. Choose the type of interest rate that suits your risk appetite and financial situation. -

Look at the loan-to-value (LTV) ratio:

The LTV ratio is the amount of your home loan divided by the value of your property. A higher LTV ratio means you’re borrowing more money relative to the value of your property, which can lead to a higher interest rate. -

Consider the loan tenure:

The loan tenure is the period over which you’ll be repaying your home loan. A shorter loan tenure typically means a lower interest rate, but higher monthly repayments. Choose a loan tenure that suits your financial situation and repayment capacity. -

Read the fine print:

Before you sign on the dotted line, carefully read the terms and conditions of your home loan. Pay attention to the interest rate, fees, penalties, and any other conditions that may apply. Make sure you understand all the details before you commit to a home loan.

By following these steps, you can compare home loan rates effectively and find the best deal that suits your needs.

Key Takeaways:

- Home loan rates are influenced by several factors, including your credit score, loan-to-value ratio, loan tenure, and the type of interest rate (fixed or floating).

- Shop around and compare rates from multiple lenders to find the best deal.

- Consider the type of interest rate (fixed or floating) that suits your risk appetite and financial situation.

- Read the fine print carefully before signing on the dotted line.

Sources:

1. MoneySmart.sg: Compare The Best Mortgage Home Loan Rates

2. PropertyGuru: Best Home Loan Interest Rates in Singapore

The process of applying for a home loan

Getting a home loan can be a daunting task, but it doesn’t have to be. By following these steps, you can make the process as smooth and stress-free as possible:

1. Determine Your Budget

– Before you start looking for a home, it’s essential to determine how much you can afford to borrow. This will help you narrow down your search and avoid getting in over your head financially.

2. Research Different Types of Home Loans

– There are many different types of home loans available, each with unique features and benefits. Do your research to find the loan that’s right for you.

3. Get Pre-Approved for a Home Loan

– Getting pre-approved for a home loan is a great way to show sellers that you’re a serious buyer. It can also help you negotiate a better interest rate.

4. Find a Home

– Once you’ve been pre-approved for a home loan, you can start looking for a home. Be patient and take your time. The right home for you is out there.

5. Make an Offer

– When you find a home you want to buy, it’s time to make an offer. Be prepared to negotiate with the seller to get the best price possible.

6. Get a Home Inspection

– Before you close on your home, get a home inspection to check for any major problems. This will help you avoid any surprises down the road.

7. Sign the Mortgage Documents

– Once you’re satisfied with the home inspection, it’s time to sign the mortgage documents. This is a legal process, so make sure you understand everything before you sign anything.

8. Move In!

– Once you’ve signed the mortgage documents, you can move into your new home! This is an exciting time, so enjoy it.

Key Takeaways:

-

Determine your spending plan: Before beginning your home search, determine how much you can reasonably borrow. This restricts your choices and keeps you from going too far financially.

-

Inquire about various home loan options: Many home loans vary in features and benefits. Research to locate the ideal one for you.

-

Get pre-approval for a home loan: This demonstrates to sellers that you are a serious buyer and can help you negotiate a more favorable interest rate,

-

Find a home: Patiently look for the perfect home. Don’t settle for less.

-

Negotiate the offer: When you find a home you want, make an offer and negotiate with the seller to secure the best price.

-

Request a home inspection: Before closing on your home, request an inspection to uncover any major issues and avoid unpleasant surprises later.

-

Complete the mortgage paperwork: When the inspection is satisfactory, sign legal mortgage documents after carefully reviewing all the terms and conditions.

-

Celebrate: Move into your new home and relish this exciting milestone.

Relevant URLs:

– ohmyhome.com/en-sg/blog/6-steps-apply-home-loan-foreigners-singapore/

– financeguru.sg/home-loan-singapore-getting-started/

Tips for getting a better home loan rate

Hi there, homeowners and property enthusiasts! Getting a home loan is a big financial decision that can significantly impact your budget and financial well-being. If you’re in the market for a new home loan, you’ll want to get the best rate possible. Here are a few tips to help you secure a better home loan rate:

Key Takeaways:

-

Check your credit score: Lenders use your credit score to assess your creditworthiness and determine the interest rate you’ll qualify for. Before you apply for a home loan, pull your credit report and make sure it’s accurate and up-to-date. If you find any errors, dispute them immediately. You can improve your credit score by paying your bills on time, keeping your credit utilization low, and avoiding taking on new debt.

-

Shop around for the best interest: rates Don’t just accept the first interest rate that a lender offers you. Take the time to shop around and compare rates from multiple lenders. You can use online mortgage calculators to get an idea of what you can afford to borrow. When you’re comparing rates, be sure to factor in the fees and closing costs associated with each loan.

-

Consider a shorter loan term: The shorter your loan term, the less interest you’ll pay over time. If you can afford it, choose a shorter loan term to save money on interest.

-

Make a larger down payment: The larger your down payment, the smaller your loan amount will be. This means you’ll pay less interest over the life of the loan. If you can afford it, make a larger down payment to save money and get a better interest rate.

-

Explore government schemes and grants: The government offers several schemes and grants to help first-time homebuyers and low-income families get a home loan. If you qualify for one of these programs, you may be able to get a lower interest rate or down payment assistance.

By following these tips, you can improve your chances of getting a better home loan rate and saving money on your monthly mortgage payments.

Sources

Sources

FAQ

Q1: What are the key factors influencing home loan rates in Singapore?

A1: The key factors that influence home loan rates in Singapore include the prevailing interest rate environment, economic conditions, and government policies. Changes in these factors can cause fluctuations in mortgage rates.

Q2: How do fixed and floating interest rates differ, and which one should I choose?

A2: Fixed interest rates remain unchanged throughout the loan tenure, while floating interest rates fluctuate with market conditions. Choosing between them depends on individual circumstances, risk tolerance, and whether you prioritize stability or the potential for lower rates.

Q3: As a foreigner, what are the requirements for obtaining a home loan in Singapore?

A3: As a foreigner, you must meet specific legal requirements and income criteria to obtain a home loan in Singapore. These include having a valid employment pass, a certain minimum income, and adhering to the loan-to-value (LTV) ratio limits set by the Monetary Authority of Singapore (MAS).

Q4: What are the current prevailing home loan rates in Singapore?

A4: As of December 8th, 2023, the prevailing interest rates for a 30-year fixed home loan are 2.95% for private properties and 2.95% for HDB’s. However, it’s important to note that these rates are subject to change based on market conditions and individual circumstances.

Q5: What are the best home loan packages available in Singapore?

A5: Banks and financial institutions in Singapore offer a range of home loan packages with varying interest rates and features. It’s essential to compare these packages thoroughly, considering factors such as interest rates, tenure, fees, and other terms and conditions, to find the one that best suits your needs and financial situation.

- Modern Butcher Block Kitchen: Warmth and Style with White Cabinets - January 6, 2026

- White Cabinets with Butcher Block Countertops: A Kitchen Classic - January 5, 2026

- White Kitchen With Butcher Block Countertops: A Warm, Inviting Design - January 4, 2026