Discover the ultimate guide to home loan rates in Singapore, providing you with the most comprehensive insights and expert recommendations to secure your ideal mortgage. Whether you’re navigating the market for the first time or seeking competitive rates for your existing property, this guide will empower you with the knowledge and strategies to make informed decisions. Delve into the intricacies of home loan options, including those specifically tailored for properties under construction, and unlock the secrets to securing the best mortgage loan refinancing rates. Our comprehensive analysis covers both jumbo-sized home loans and the broader landscape, ensuring that you find the perfect fit for your financial goals.

Key Takeaways:

– Current 30-year fixed home loan rates: 2.85% for private properties, 2.85% for HDBs.

– Home loan criteria and terms vary among lenders.

– Compare rates from multiple sources to find the best deals.

– Consider fixed vs. adjustable rate mortgages.

– Evaluate factors like interest rate, repayment period, and financial situation when choosing a home loan.

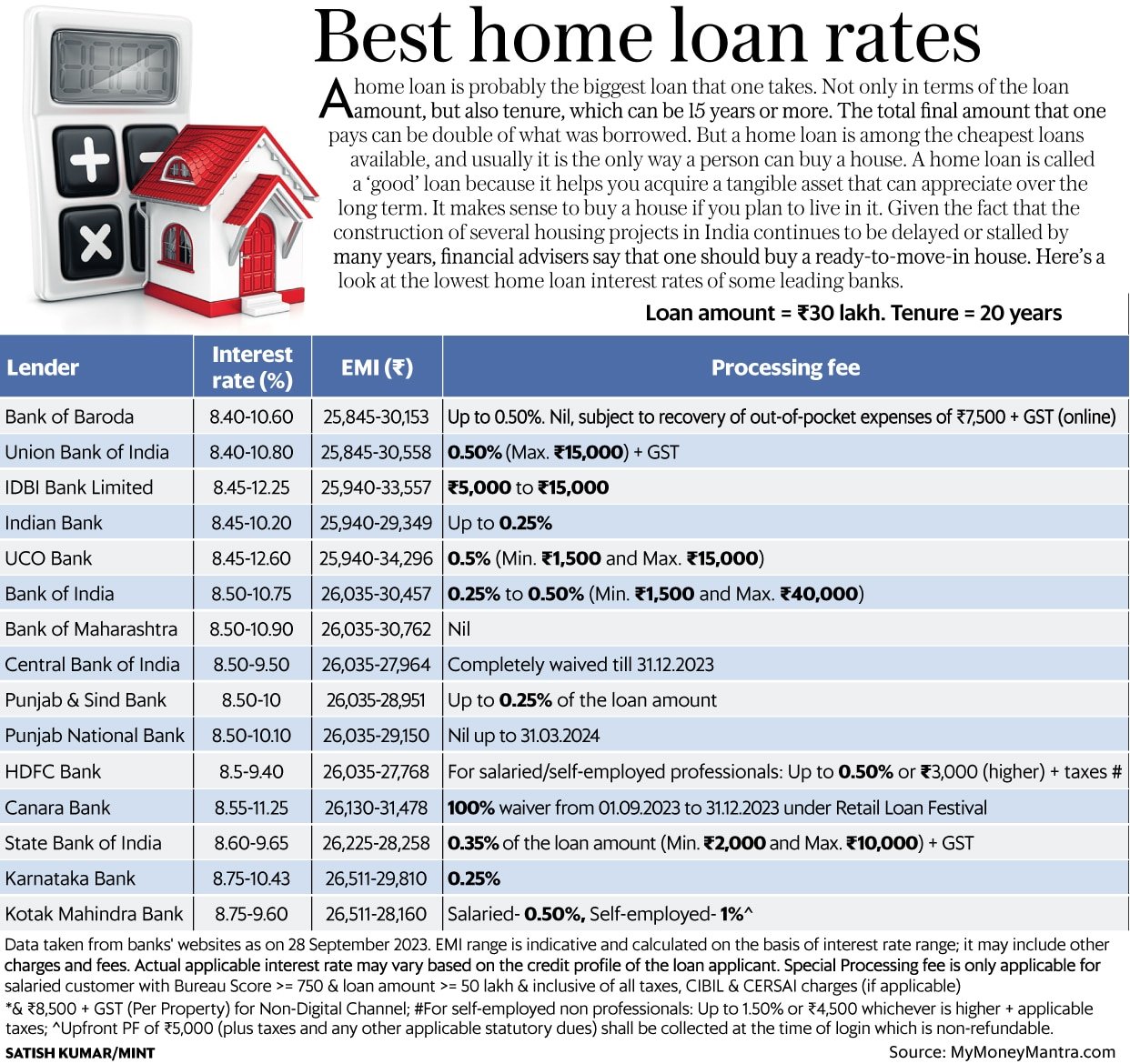

Best Home Loan Rates in Singapore

Securing a home loan is a significant financial decision that requires careful consideration. Navigating the vast array of mortgage options can be daunting, but it’s crucial to find the best rate for your specific needs. Here’s a comprehensive guide to help you understand the dynamics of Singapore’s home loan market and secure the best home loan rates in Singapore.

How to Find the Best Home Loan Rates

- Compare Lender Rates: Research different banks and financial institutions to compare interest rates, fees, and terms. Utilize online comparison tools or seek professional advice from mortgage brokers.

- Consider Fixed and Adjustable Rates: Fixed-rate loans offer stability, while adjustable-rate loans may fluctuate over time. Evaluate your risk tolerance and financial situation to determine the optimal choice.

- Assess Your Credit History: Your credit score significantly influences loan eligibility and interest rates. Maintain a positive credit history to qualify for lower rates.

- Calculate Loan-to-Value (LTV) Ratio: LTV measures the amount of your loan compared to the property’s value. Lower LTVs generally result in lower interest rates.

Factors Affecting Home Loan Rates

- Interest Rates: Prevailing interest rates set by the Central Bank of Singapore impact home loan rates.

- Loan Tenure: Shorter loan tenures typically have lower interest rates than longer tenures.

- Property Type: HDB flats and private properties have different home loan rates.

- Loan Amount: Larger loan amounts may qualify for higher interest rates.

Tips for Getting the Best Home Loan Rates

- Negotiate with Lenders: Don’t settle for the first rate offered. Be prepared to negotiate with lenders to secure the best possible terms.

- Provide Financial Documents: Submit accurate and complete financial documentation to demonstrate your financial stability.

- Consider Government Grants: Utilize government grants, such as the Enhanced CPF Housing Grant, to reduce up-front costs and potentially lower interest rates.

- Consult a Mortgage Broker: Seek professional advice from qualified mortgage brokers who have access to a wider range of loan products and can guide you through the process.

Did you know that there are professional home maintenance companies in Dubai? If you’re tired of doing home maintenance, you can hire the best home maintenance company in Dubai for a seamless and professional home maintenance service.

For those struggling with body pain there are many home remedies that can alleviate pain. If you’re looking for natural remedies for your body pain, here’s a helpful article on the best home remedies for body pain.

In need of home nursing services in Bangalore? Opt for the best home nursing services in Bangalore for trustworthy and experienced home nurses.

If you’re struggling with ingrown toenails, you might want to try these home remedies. Find out more about the best home remedies for ingrown toenails.

Best Home Mortgage Loan Refinancing Rates (May 15, 2024)

Key Takeaways:

- Home loan refinancing can save you money by lowering interest rates, shortening loan terms, or accessing home equity.

- Different types of refinancing exist, tailored to specific financial goals.

- Compare rates from multiple lenders to secure the most competitive offers.

- Consider loan amount, terms, credit score, and closing costs when evaluating refinancing options.

Types of Refinancing:

- Cash-out refinance: Convert home equity into cash for large expenses or debt consolidation.

- Rate-and-term refinance: Lower interest rates or adjust loan terms to reduce monthly payments or pay off the loan faster.

- Adjustable-rate mortgage (ARM): Loans with interest rates that fluctuate based on market conditions, offering potential savings during low-rate periods.

Mortgage Lenders:

- New American Funding

- NBKC Bank

- Flagstar Bank

- PNC Bank

- Chase

Refinancing Considerations:

- Loan amount and terms: Determine the refinancing amount and preferred loan term that meets your financial needs.

- Credit score: Lenders consider your credit score to determine interest rates and eligibility.

- Appraisal costs: Refinancing often requires a new home appraisal, which incurs additional costs.

- Closing costs: Expenses associated with refinancing, including origination fees, title insurance, and recording fees.

Steps to Refinance Your Home Loan:

- Review your financial situation: Assess your current mortgage, expenses, and financial goals to determine if refinancing is right for you.

- Shop for lenders: Compare interest rates, fees, and terms from multiple lenders to find the best deal.

- Get pre-approved: Obtain a pre-approval to demonstrate your creditworthiness and determine the amount you can borrow.

- Submit a formal application: Provide detailed financial information to the lender for loan approval.

- Lock in your rate: Secure your interest rate once approved to protect against potential rate fluctuations.

- Complete the closing: Sign loan documents and pay closing costs to finalize the refinancing process.

Sources:

- U.S. News: Best Mortgage Refinance Lenders of May 2024

- Forbes: Best Mortgage Refinance Lenders Of May 2024

Best Jumbo-Size Home Loans (May 15, 2024)

Key Takeaways:

- Jumbo loans exceed conforming loan limits set by the FHFA.

- Jumbo loan rates tend to be higher than conforming loan rates.

- Factors affecting jumbo loan rates include loan amount, credit score, and loan-to-value ratio.

- Jumbo loan lenders offer competitive interest rates, manageable down payments, and unique loan offerings.

Factors to Consider When Securing a Jumbo Loan:

- Loan Amount: Jumbo loans exceed conforming loan limits, which vary by location.

- Credit Score: A higher credit score typically qualifies you for lower interest rates.

- Loan-to-Value Ratio (LTV): The LTV is the ratio of your loan amount to the value of your home. A lower LTV can lead to more favorable rates.

- Debt-to-Income Ratio (DTI): Lenders will assess your monthly debt payments relative to your income. A lower DTI indicates a higher capacity for repayment.

- Debt Servicing Coverage Ratio (DSCR): For investment properties, lenders may consider your rental income to determine your ability to cover mortgage payments.

Steps to Secure the Best Jumbo Loan:

- Get Pre-Approved: Determine your eligibility and loan amount by getting pre-approved with a lender.

- Compare Lenders: Research and compare interest rates, fees, and loan terms from multiple lenders.

- Negotiate: Don’t hesitate to negotiate with lenders to secure the most competitive rates and terms.

- Lock in Your Rate: Once you’ve found the best offer, lock in your interest rate to protect against future rate increases.

- Complete the Application: Submit your loan application and provide required documentation.

- Closing: Once your loan is approved, attend the closing to sign the mortgage documents and finalize the purchase.

Benefits of Jumbo Loans:

- Access to higher loan amounts for luxury homes or larger properties.

- Competitive interest rates from specialized lenders.

- Flexible loan terms and down payment options.

- Potential tax benefits on interest payments.

Citations:

- Forbes Advisor: Best Jumbo Loan Lenders 2024

- NerdWallet: Best Mortgage Lenders of May 2024 for Jumbo Loans

FAQ

Q1: What types of home loans are available in Singapore?

A1: In Singapore, there are various types of home loans available, including fixed-rate loans, adjustable-rate loans, and special loans such as HDB loans and bank loans. Each type of loan has its own set of features and benefits, so it’s important to compare and choose the one that best suits your individual needs and financial situation.

Q2: What are the prevailing home loan interest rates in Singapore as of May 15, 2024?

A2: As of May 15, 2024, the prevailing 30-year fixed home loan interest rates are 2.85% for private properties and 2.85% for HDBs. However, it’s important to note that interest rates can fluctuate over time, so it’s essential to check with multiple lenders to get the most up-to-date rates.

Q3: What are some of the factors that affect jumbo loan rates?

A3: Jumbo loan rates are typically influenced by a number of factors, including the loan amount, credit score, loan-to-value ratio, and the lender’s own underwriting criteria. Lenders may offer more favorable rates to borrowers with higher credit scores, lower loan-to-value ratios, and a proven track record of financial responsibility.

Q4: What should I consider when refinancing my mortgage?

A4: When refinancing your mortgage, it’s important to consider factors such as the loan amount and terms, your credit score, any appraisal costs, and the closing costs associated with the refinance. It’s also important to compare refinancing options from multiple lenders to ensure you’re getting the best possible deal.

Q5: What are the benefits of refinancing my mortgage?

A5: Refinancing your mortgage can offer a number of benefits, including lowering your interest rate, shortening your loan term, accessing home equity through a cash-out refinance, or adjusting the terms of your loan to better suit your changing financial needs.

- Does 100% Polyester Shrink? A Complete Guide to Washing & Drying - April 16, 2025

- Elegant Drapery Solutions for Arched Windows: A Complete Guide - April 16, 2025

- The Best Dining Room Tables with Drop Leaves: A Buyer’s Guide - April 16, 2025