Welcome to the CBA Home Loan Contact Centre, your trusted source for personalized mortgage solutions and expert guidance in all matters related to home financing. Our dedicated team of Home Loan Experts is available 24/7 to assist you throughout your home loan journey, providing tailored advice and support to meet your unique financial aspirations.

Key Takeaways: Contact CBA Home Loan Experts for Personalized Mortgage Solutions

-

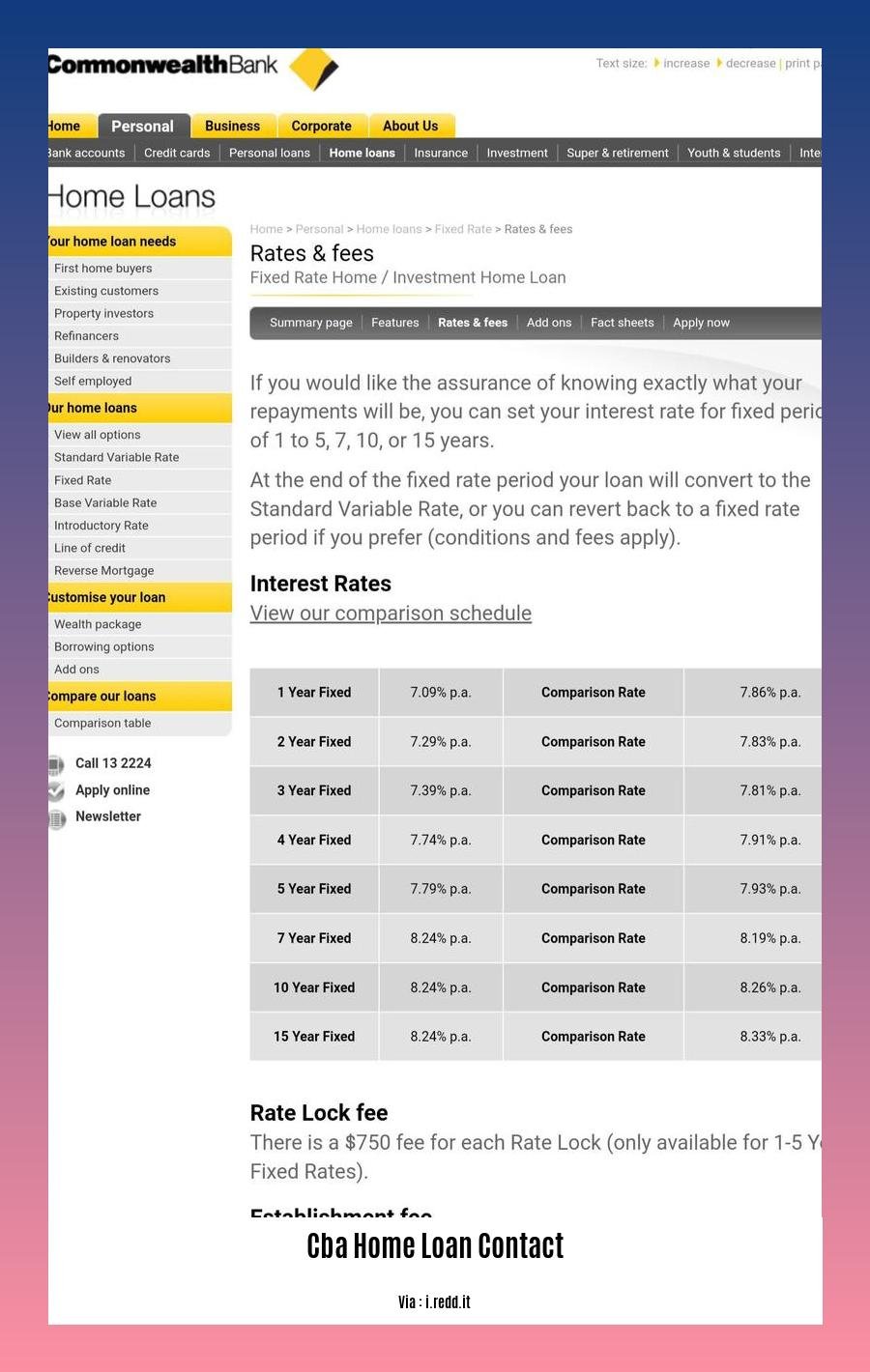

CommBank provides diverse home loan types, including standard variable rate, flexible Wealth Package, and fixed-rate mortgages (1-7 years) to accommodate varied needs.

-

The CommBank Home Loan Compassionate Care program offers support to eligible owner-occupied borrowers experiencing unforeseen life events, without the need for sign-up or activation.

-

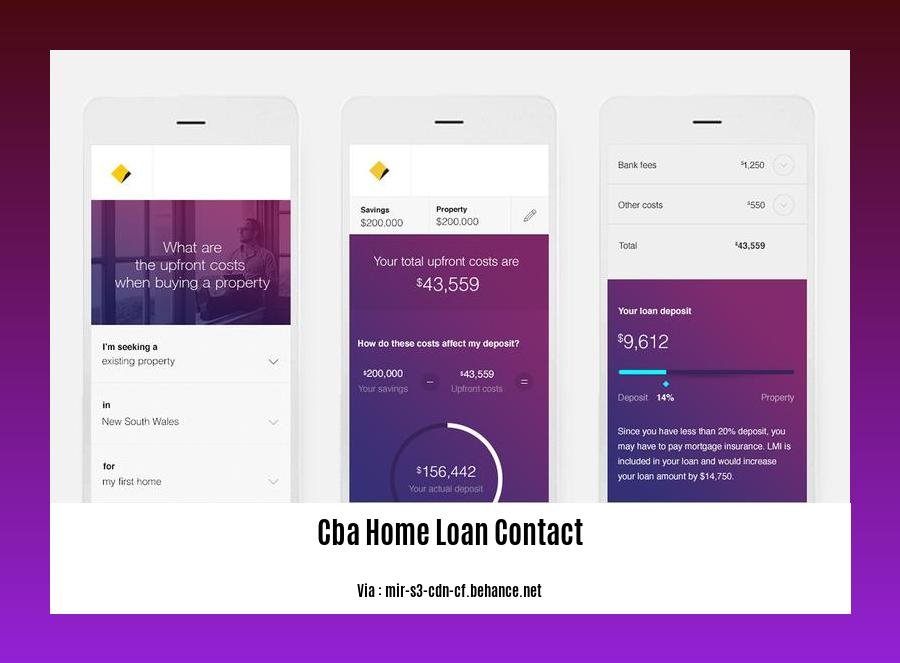

CommBank customers can conveniently manage their home loans via NetBank and the mobile app, allowing easy access to details, transactions, and scheduled payments.

-

Customers can apply for home loans through brokers, who assist in selecting the appropriate loan option and managing the application process at no extra cost.

-

CommBank’s Compassionate Care program extends assistance to borrowers facing life challenges, catering to diverse situations without requiring sign-up or activation.

CBA Home Loan Contact: Getting in Touch with Mortgage Specialists

CBA, also known as Commonwealth Bank, offers a diverse range of home loan options to cater to the varying needs and financial situations of its customers. Whether you’re purchasing a new property, refinancing your existing loan, or exploring equity release possibilities, reaching out to CBA’s experienced home loan experts can provide you with personalized guidance and assistance.

Contacting CBA Home Loans is simple and convenient:

-

Direct Phone Call:

-

CBA offers dedicated phone lines for home loan inquiries.

- Speak directly with a knowledgeable mortgage specialist to discuss your requirements.

- Get prompt responses to your queries and receive tailored recommendations.

-

Phone numbers for different regions and departments are available on the CBA website.

-

Secure Online Form:

-

Visit the CBA home loan website and locate the “Contact Us” section.

- Fill out the online form with your name, contact details, and a brief description of your inquiry.

- Submit the form and expect a prompt response from a CBA representative via email or phone.

-

This option is particularly useful for non-urgent inquiries or if you prefer written communication.

-

In-Branch Appointment:

-

Visit a CBA branch near you to speak with a home loan specialist in person.

- Discuss your specific needs and circumstances face-to-face for a more personalized consultation.

- Bring relevant documents and be prepared to provide additional information as required.

-

This approach allows for a deeper understanding of your financial situation and tailored loan recommendations.

-

Email Communication:

-

Draft an email outlining your home loan inquiry and send it to the designated CBA home loan email address.

- Provide your contact details, property details (if applicable), and a summary of your loan requirements.

- Expect a response within 24 business hours from a CBA representative.

- This method is convenient for detailed inquiries that require comprehensive explanations or document sharing.

Explore CBA Home Loan Options:

CBA offers a diverse portfolio of home loan products, including:

-

Standard Variable Rate Home Loan: This flexible option allows you to adjust your repayments based on market conditions and interest rate fluctuations.

-

Low-Fee Wealth Package: Bundle your home loan with other CBA products and services to enjoy exclusive benefits and competitive interest rates.

-

Fixed-Rate Mortgages: Secure a stable interest rate for a predetermined term, providing certainty in your monthly repayments.

-

First Home Buyer Loans: Access tailored solutions designed to assist first-time buyers in realizing their property ownership dreams.

Exceptional Customer Service:

CBA prides itself on delivering exceptional customer service, ensuring a smooth and stress-free home loan experience. Their team of home loan experts is dedicated to:

-

Providing Personalized Advice: Understanding your unique financial situation and tailoring recommendations to meet your specific needs.

-

Guiding You Through the Process: Offering expert assistance at every stage of the home loan journey, from initial application to final settlement.

-

Keeping You Informed: Providing regular updates and transparent communication throughout the loan process, empowering you to make informed decisions.

-

Supporting You Beyond Settlement: Offering ongoing support and guidance even after your loan has been approved, ensuring you continue to make the most of your homeownership journey.

Connect with CBA home loan experts today to unlock a world of mortgage possibilities and find the perfect loan solution tailored to your financial aspirations.

-

Wondering how to contact CBA about home loans? Learn their contact hours at CBA Home Loan Contact Hours.

-

Have questions about CBA’s home loan process? Get the CBA Home Loan Contact Number to speak to a representative.

-

Explore the steps to update the home directory in Git Bash by visiting Change Git Bash Home Directory.

-

Unveiling the crucial elements of a comfortable and harmonious living space at Characteristics of a Good Home.

-

Discover the essential qualities that define an ideal Christian home at Characteristics of an Ideal Christian Home.

Commonwealth Bank Contact

To secure your dream home, contacting Commonwealth Bank‘s mortgage experts is a crucial step. Their personalized mortgage solutions cater to your unique financial needs. Whether you’re a first-home buyer, considering refinancing, or wanting to discuss home equity loans, reach out to their knowledgeable team through various channels.

Key Takeaways:

- CommBank App and Website: Access Commonwealth Bank‘s comprehensive online resources to initiate contact. Utilize the CommBank app or visit their website to connect with mortgage experts via phone, secure messaging, or video call.

- Book an Appointment: Schedule a convenient appointment at your preferred branch or virtually. Select a location, time, and communication mode that suits your availability, whether in person, over the phone, or through video call.

- Visit a Branch: Locate a Commonwealth Bank branch near you using their branch locator tool. Meet with a home loan specialist face-to-face to discuss your mortgage requirements and explore tailored solutions.

- Phone Call: For immediate assistance, call the dedicated home loan hotline. Connect with a mortgage specialist who can guide you through the home loan process, answer your queries, and provide personalized recommendations.

Contacting Commonwealth Bank‘s home loan experts is a breeze. Whether you prefer the convenience of online platforms, the personal touch of in-branch meetings, or the ease of phone calls, rest assured that their experienced team is ready to assist you every step of the way.

Citations:

Commonwealth Bank Contact Us

Bank Commonwealth Home Financing

FAQ

Q1: How do I contact the CBA Home Loan contact center?

A1: You can contact the CBA Home Loan contact center through various channels. Immediate assistance is available via the CommBank app by contacting Ceba, the virtual assistant, or a specialist. Alternatively, you can find a branch or ATM near you using an address, BSB, postcode, or landmark. Booking an appointment can be done in-branch, over the phone, at a convenient location, or via video call. You can also send a message to CommBank through the CommBank app.

Q2: What is the Commonwealth Bank Phone Number for Home Loans?

A2: For inquiries related to home loans, you can directly call the Commonwealth Bank at 15000 30. This phone number provides a direct connection to a home loan specialist who can assist you with your queries.

Q3: Does CBA offer a compassionate care program for home loans?

A3: Yes, CBA offers the Home Loan Compassionate Care program. This program provides support to eligible owner-occupied home loan customers aged 18 to 59 who are facing unforeseen life events. It offers assistance without requiring sign-up or activation.

Q4: Can I apply for a home loan through a broker?

A4: Yes, you can apply for a home loan through a broker. CBA allows customers to work with brokers who can help find the right loan option and manage the application process at no additional cost. Brokers can provide personalized advice and guide you through the home loan process.

Q5: How long does it take to process a home loan application with CBA?

A5: The processing time for a home loan application with CBA can vary depending on the complexity of the loan and the availability of all required documentation. Generally, the bank aims to provide an initial assessment within 24 hours and a final decision within ten business days. However, it’s important to note that this timeline can vary based on individual circumstances and the volume of applications being processed.

- Kitchen Counter Corner Ideas: Style Your Awkward Angles Now - December 31, 2025

- Best Finish for Butcher Block Countertops: Choosing the Right Option - December 30, 2025

- Seal for butcher block: Find the best food-safe finish - December 29, 2025