Embark on the path to homeownership with the Clayton Homes Mortgage Calculator, your trusted companion in calculating the financial blueprint for your dream home. Our advanced tool provides accurate estimates for monthly payments, interest rates, and loan terms, empowering you with the knowledge to make informed decisions.

Key Takeaways:

- Use the Clayton Homes Mortgage Calculator to estimate monthly payments.

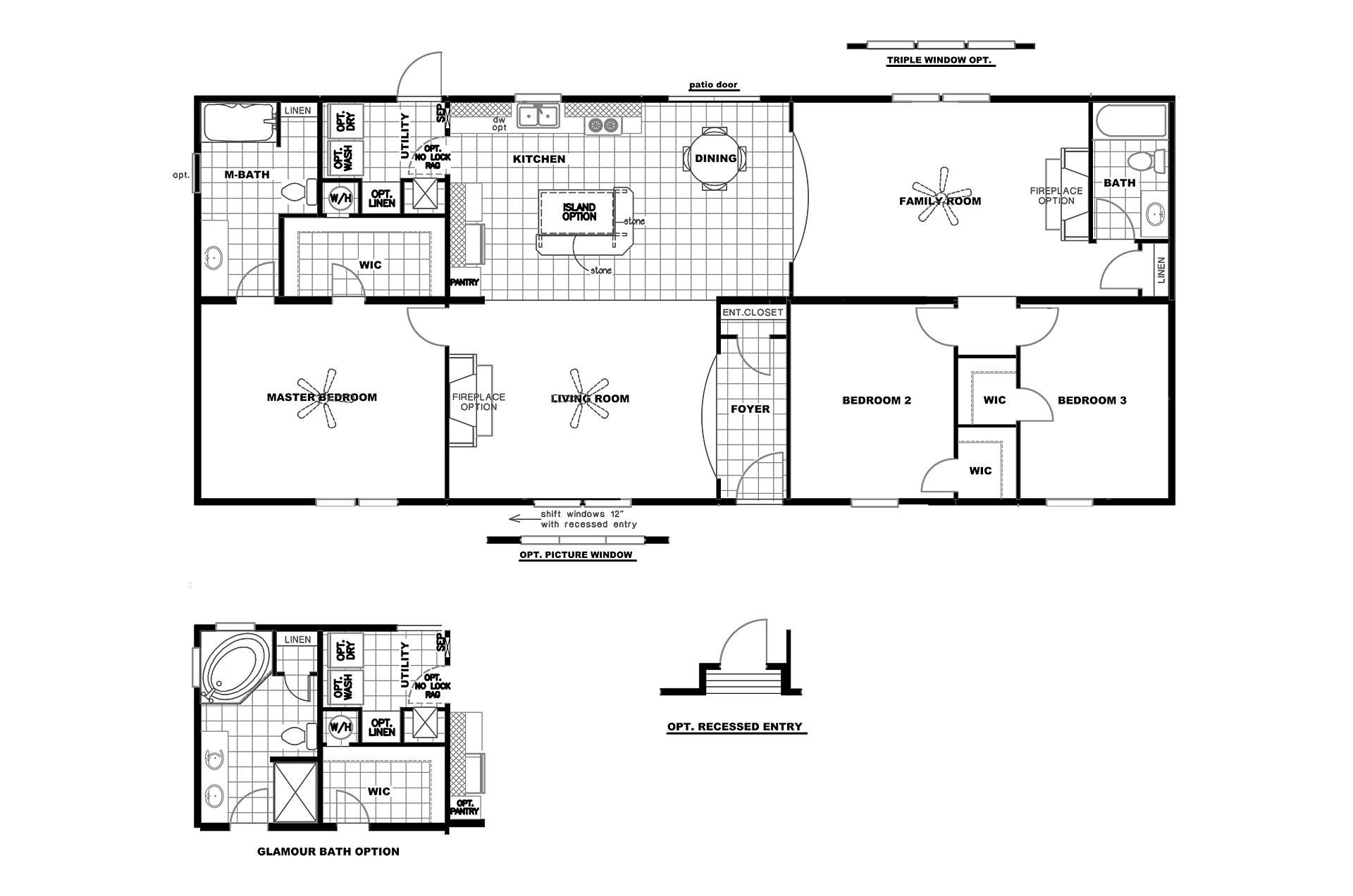

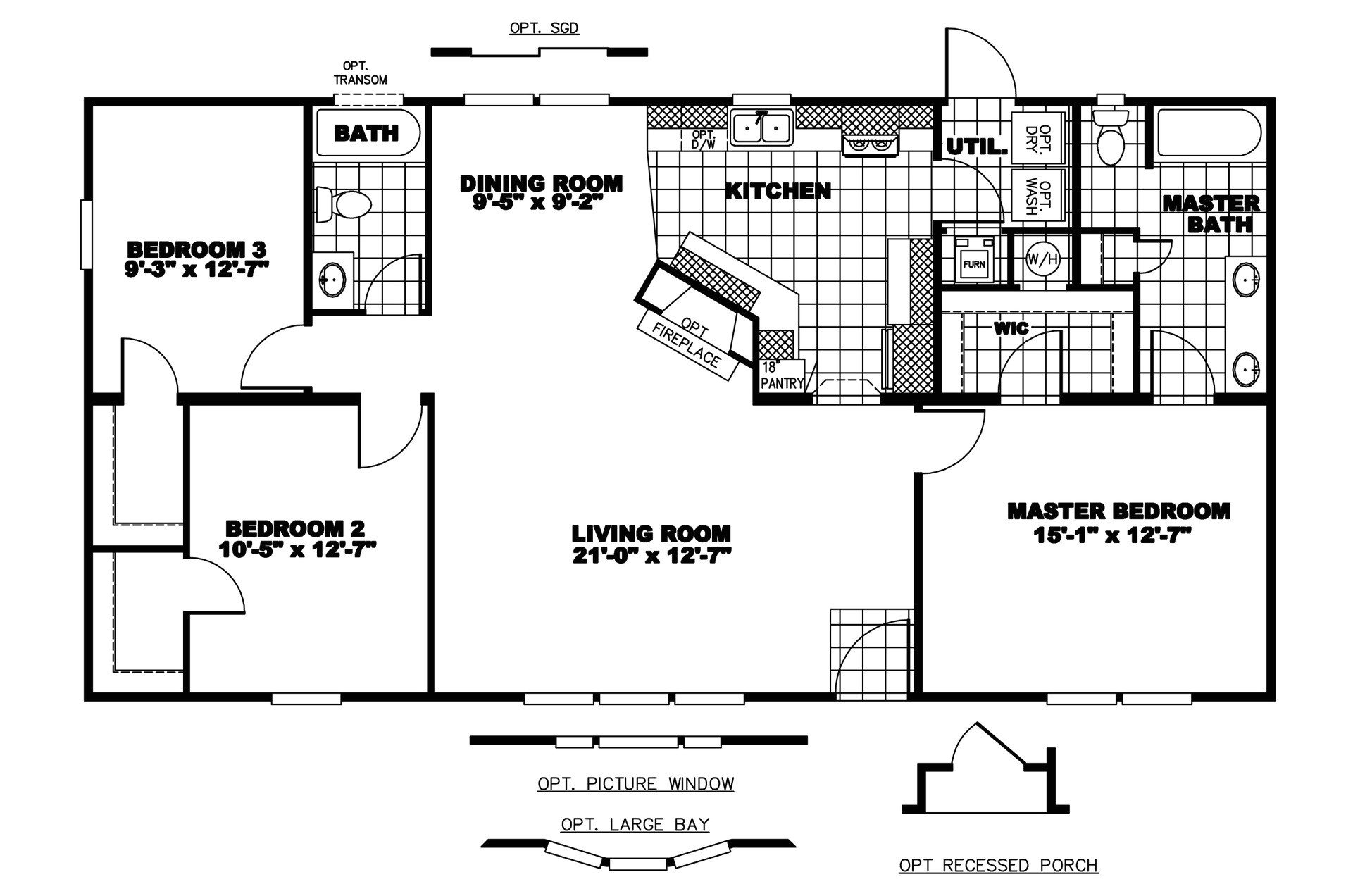

- Access the Clayton MyHome Account to save floor plans, track progress, and connect with specialists.

- Zillow’s Mortgage Calculator provides comprehensive estimates including taxes, insurance, and HOA fees.

- Mortgage insurance (PMI) depends on credit score and down payment.

- The monthly mortgage payment is determined by loan term, interest rate, and loan amount.

Clayton Homes Mortgage Calculator

Ready to make your dream home a reality? Clayton Homes mortgage calculator is your go-to resource for estimating monthly payments and understanding the mortgage process. We’ll walk you through the essential features and guide you towards homeownership.

Key Features of the Clayton Homes Mortgage Calculator

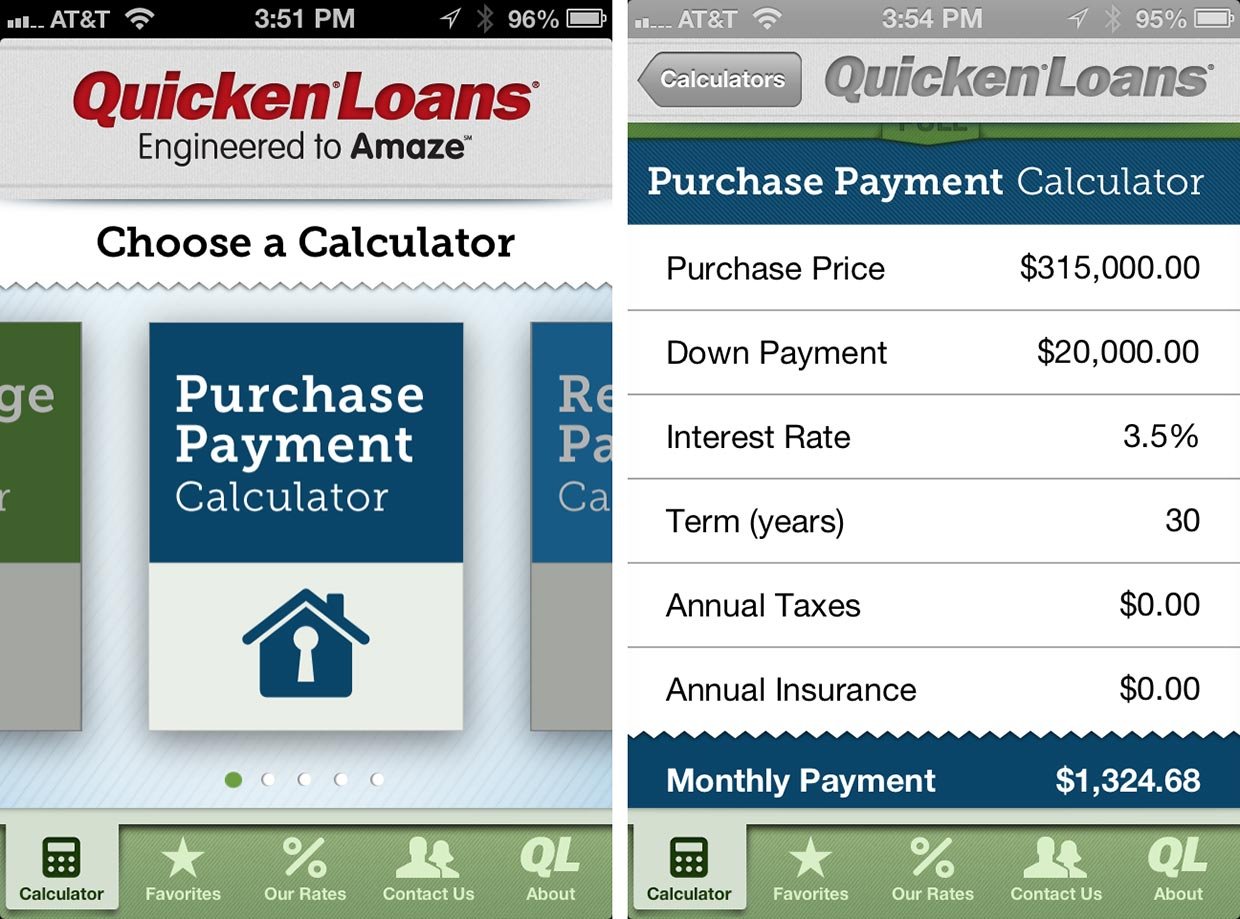

- Estimate Monthly Payments: Input your loan amount, interest rate, and loan term to calculate your estimated monthly payments.

- Save Floor Plans and Track Progress: Create a MyHome Account to save your favorite floor plans, track your buying progress, and connect with Clayton Homes specialists.

- Get Detailed Cost Estimates: Use Zillow’s mortgage calculator to estimate your total monthly payments, including PMI, taxes, insurance, and HOA fees.

Understanding Mortgage Components

Loan Term: This is the length of your loan, typically 15 or 30 years. A longer term means lower monthly payments but higher interest costs.

Interest Rate: This is the percentage lenders charge for borrowing money. It affects your monthly payments and total interest costs.

Loan Amount: This is the amount of money you borrow to purchase your home. It influences your monthly payments and the size of your down payment.

Calculate Your Monthly Mortgage Payment

- Gather Your Information: Collect your loan amount, interest rate, and loan term.

- Use the Clayton Homes Mortgage Calculator:** Enter these values into the calculator and calculate your estimated monthly payment.

- Consider Other Costs: Factor in additional costs like PMI, taxes, insurance, and HOA fees using Zillow’s mortgage calculator.

Ready to Start?

Our Clayton Homes mortgage calculator empowers you to make informed decisions about your financing options. Don’t hesitate to contact us for personalized assistance and a tailored approach to homeownership.

Want to discover one of the greatest manufactured housing providers in Waco, Texas? Explore our extensive inventory of quality-built homes now at Clayton Homes in Waco, Texas.

Searching for Clayton Homes in different locations? You’re in luck! Take a tour of our many locations by clicking on Clayton Homes Locations.

Curious about how your new home is made? Delve into the fascinating world of home manufacturing by visiting our Clayton Homes Manufacturing Plants.

How the Clayton Homes Mortgage Calculator Can Help You Make Informed Decisions

Visualize your dream home and take the crucial first step towards making it a reality by using Clayton Homes’ mortgage calculator. This helpful tool empowers you to understand your financial options, plan for expenses, and make informed decisions throughout your homeownership journey.

Key Takeaways:

- Estimate Monthly Payments: Get a clear picture of your projected monthly mortgage payments, including principal, interest, taxes, and insurance premiums.

- Adjust Variables: Experiment with different loan terms, interest rates, and down payment amounts to find the combination that aligns with your financial goals.

- Estimate Down Payment: Determine the necessary down payment based on the home’s value, empowering you to save and prepare effectively.

- Understand Costs: The calculator provides a snapshot of additional expenses, such as property taxes, homeowner’s insurance, and private mortgage insurance (PMI), helping you budget accurately.

- Make Informed Decisions: With the Clayton Homes mortgage calculator at your fingertips, you can compare loan options, estimate affordability, and make confident decisions about your home financing.

How to Use the Clayton Homes Mortgage Calculator

- Gather Information: Determine the home’s value, estimated interest rate, loan term, and any applicable closing costs.

- Input Data: Enter the gathered information into the calculator’s designated fields.

- Review Results: Analyze the estimated monthly payment and additional expenses displayed in the results section.

- Make Adjustments: If necessary, adjust the loan variables to explore different scenarios and identify the most suitable option for your financial situation.

Empower Yourself

The Clayton Homes mortgage calculator is a valuable tool that can guide you through every phase of your homeownership journey. By leveraging its capabilities, you can:

- Plan for the Future: Estimate future expenses and prepare accordingly.

- Compare Options: Evaluate multiple loan scenarios and choose the one that best suits your needs.

- Make Informed Decisions: Understand the financial implications of your mortgage and make confident choices.

Additional Resources:

- MoneyGeek: Maximizing the Power of Mortgage Payment Calculators

- Clayton Homes: Mortgage Calculator

Advanced Features of the Clayton Homes Mortgage Calculator

As a mortgage expert, I’ve seen how the Advanced Features of the Clayton Homes Mortgage Calculator help borrowers make informed decisions. It’s like having a financial advisor in your pocket, empowering you to explore your homeownership options with precision.

What Makes It Stand Out?

- Save and Share Floor Plans: Store your favorite home designs and share them with others hassle-free.

- Get Detailed Cost Estimates: See a comprehensive breakdown of your potential loan amount, down payment, monthly payments, and closing costs.

- Track Your Progress: Stay on top of your homeownership journey with real-time updates on your mortgage application.

- Personalized Assistance: Connect with knowledgeable home loan specialists for expert guidance and tailored solutions.

How to Use It Effectively

- Gather Your Information: Have your annual income, down payment amount, and estimated home value ready.

- Explore Loan Options: Experiment with different loan terms, interest rates, and down payment percentages to compare your monthly payments.

- Calculate Your Monthly Costs: See how your mortgage payment would factor into your monthly budget, including principal, interest, taxes, and insurance.

- Estimate Closing Costs: Get a clear understanding of the upfront expenses associated with purchasing your home.

- Fine-Tune Your Search: Use the mortgage calculator to narrow down your search for homes that fit your financial goals.

Key Takeaways:

- The Clayton Homes Mortgage Calculator empowers you with accurate and detailed financial information.

- Advanced features like floor plan saving, cost estimates, and personalized assistance enhance your home financing journey.

- By experimenting with different loan scenarios, you can make informed decisions and find the best mortgage option for your needs.

Relevant Sources:

- Clayton Homes Mortgage Calculator

- Investopedia Mortgage Calculator

Comparison of the Clayton Homes Mortgage Calculator with Other Tools

Clayton Homes, a renowned provider of affordable housing, offers a user-friendly mortgage calculator to help you estimate your monthly payments and determine if homeownership is within your reach. To make an informed decision, let’s explore how the Clayton Homes mortgage calculator compares with other available tools:

Functionality

The Clayton Homes mortgage calculator is a straightforward tool that allows you to input your loan amount, interest rate, and loan term to get an estimate of your monthly payments. It also provides a breakdown of your principal, interest, taxes, and insurance (PITI). Other mortgage calculators offer similar functionality, but some may include additional features such as:

- Refinancing options

- Adjustable-rate mortgages (ARMs)

- Down payment assistance programs

Accessibility

The Clayton Homes mortgage calculator is easily accessible on the company’s website and mobile app. It’s free to use and requires no registration. Other mortgage calculators are also widely available online, but some may restrict access to certain features for non-registered users.

Customization

The Clayton Homes mortgage calculator allows you to customize your loan options to some extent. You can adjust the loan amount, interest rate, and loan term to see how they impact your monthly payments. However, it may not offer as many customization options as some other tools.

Accuracy

The Clayton Homes mortgage calculator is generally accurate in providing estimates of your monthly payments. However, it’s essential to note that these estimates are based on the information you provide and may not account for all potential costs associated with homeownership, such as closing costs, homeowners insurance, and property taxes.

Key Takeaways:

- The Clayton Homes mortgage calculator is a user-friendly tool for estimating monthly payments.

- It’s easily accessible and free to use.

- It offers limited customization options compared to some other calculators.

- It provides accurate estimates but may not include all potential homeownership costs.

- It’s recommended to use multiple mortgage calculators and consult with a financial professional for a comprehensive analysis.

Relevant URL Sources:

- Clayton Homes Mortgage Calculator

- MoneyGeek: Maximizing the Power of Mortgage Payment Calculators

FAQ

Q1: How accurate are the estimates provided by the Clayton Homes mortgage calculator?

A1: The Clayton Homes mortgage calculator provides estimates based on the information you provide, including the home price, loan amount, loan term, and interest rate. These estimates are approximate and may vary from actual costs.

Q2: What are the benefits of using the Clayton Homes mortgage calculator?

A2: The Clayton Homes mortgage calculator is a user-friendly tool that allows you to estimate your monthly mortgage payments, including principal, interest, property taxes, and insurance. It can help you budget for your home purchase and make informed decisions about your financing options.

Q3: What if I have a low credit score? Can I still use the Clayton Homes mortgage calculator?

A3: Yes, you can still use the Clayton Homes mortgage calculator even if you have a low credit score. However, your interest rate and loan terms may be less favorable.

Q4: Can I use the Clayton Homes mortgage calculator to compare different loan options?

A4: Yes, you can use the Clayton Homes mortgage calculator to compare different loan options, such as fixed-rate and adjustable-rate mortgages. This can help you determine which loan is right for your needs and budget.

Q5: How often should I use the Clayton Homes mortgage calculator?

A5: You can use the Clayton Homes mortgage calculator as often as you like to estimate your monthly mortgage payments and compare different loan options. It’s a valuable tool that can help you throughout the homebuying process.

- Gray Kitchen Backsplash Tile: Ideas for a Stylish Upgrade - December 14, 2025

- Backsplash For Gray Cabinets: Choosing the Right Backsplash Style - December 13, 2025

- Gray And White Backsplash: Ideas For Timeless Style - December 12, 2025