Embark on a comprehensive journey to uncover the intricacies of double wide manufactured home costs in [- The Cost of Double Wide Manufactured Homes: A Comprehensive Guide]. Drawing upon a decade of expertise in this niche market, we delve into the factors that shape pricing, providing invaluable insights for informed decision-making.

Key Takeaways:

- Nationwide, double wide manufactured homes cost an average of $160,400.

- Double wide homes are double the size of single wide homes.

- Double wide homes offer more customization options.

- These homes are typically transported in two parts and assembled at the home site.

- In November 2022, the average price of a double-section manufactured home was $155,200.

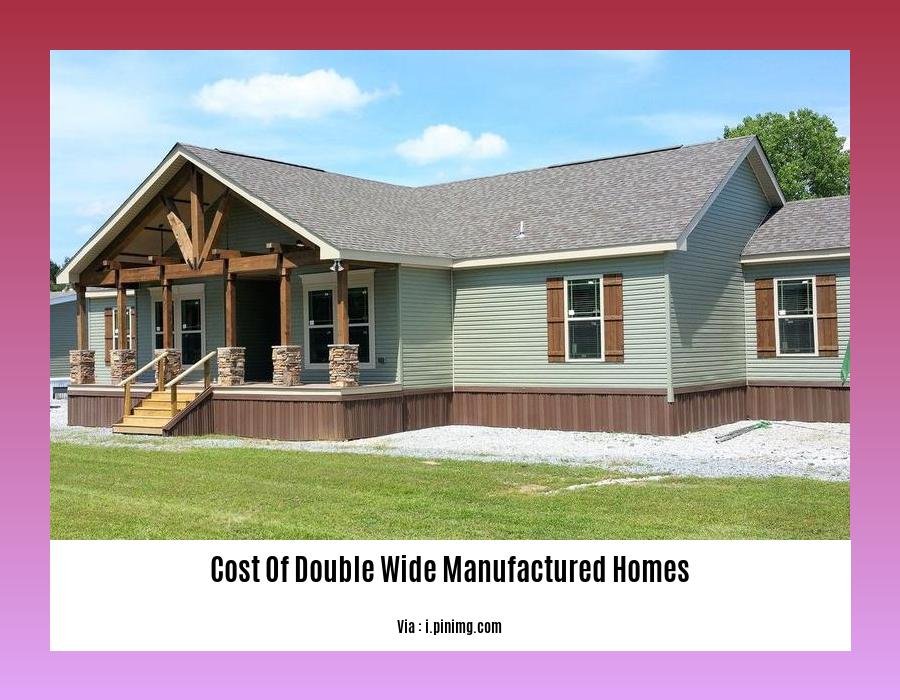

Cost of Double Wide Manufactured Homes

Hey there, eager homebuyers! Looking to dive into the realm of double wide manufactured homes? Brace yourself for a cost exploration that’ll guide you like a pro.

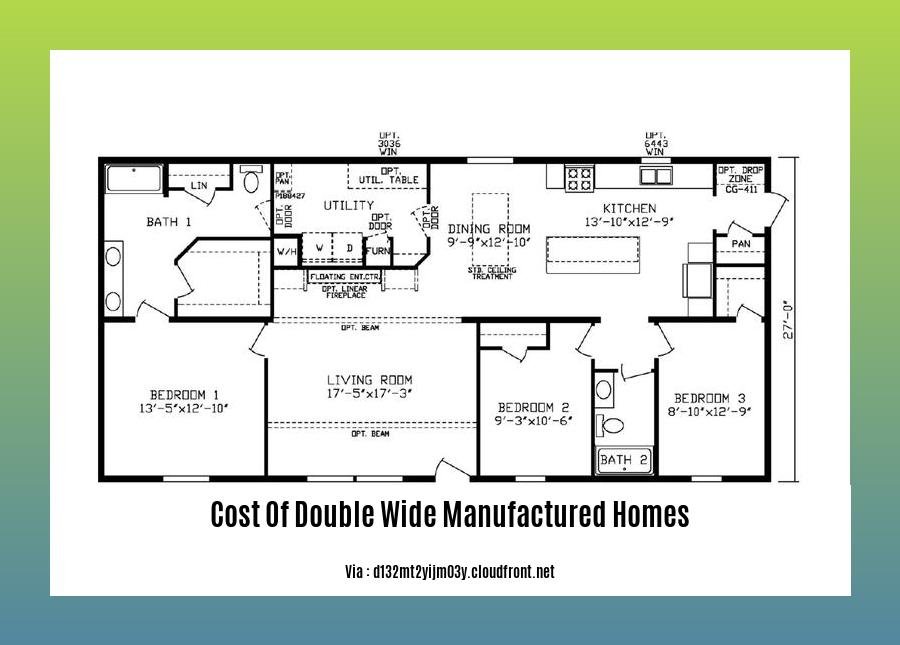

Size Matters

Double wide manufactured homes tower over single wides, boasting a spacious spread that can rival traditional stick-built homes. This extra roominess comes at a price, but don’t worry – we’ll break it down for you.

The Price Range

Nationally, you can expect to fork out between $155,200 and $250,000 for a brand-new double wide manufactured home. This range can fluctuate based on factors like size, features, and location, so keep those in mind while you’re number-crunching.

Here’s a breakdown:

| Home Type | Average Cost |

|---|---|

| Single Wide | $81,400 |

| Double Wide | $160,400 |

| Triple Wide/Multi Wide | Up to $250,000 |

Location, Location, Location

Where you decide to settle down plays a significant role in the cost of double wide manufactured homes. Some areas demand higher prices due to land value, local regulations, and transportation costs. So, research your potential neighborhood thoroughly before you sign on the dotted line.

Customization Conundrum

Double wide manufactured homes offer a wide range of customization options to suit your lifestyle. These upgrades, however, come with an additional cost. From sleek appliances to spacious floor plans, the more you personalize, the more you’ll pay.

Tips to Tame the Costs

Pinching pennies? Here are some clever tips to save a buck on your dream double wide manufactured home:

- Shop around for the best deals from different manufacturers and dealerships.

- Consider buying a pre-owned home, which can save you a substantial amount.

- Opt for energy-efficient appliances and features to minimize long-term expenses.

- Look into government assistance programs or financing options that cater to manufactured homes.

Want to know more about the cost of home care? Read our article about the cost of 24 hour home health care and cost of 24 hour nursing care at home.

Thinking about installing an air conditioning unit at home? Check out our article about cost of home air conditioning units for an estimated budget.

Pros and cons of buying a double wide manufactured home

Buying a double wide manufactured home comes with advantages and potential drawbacks. Let’s dive into the key points to help you make an informed decision:

Pros:

- Affordability: Manufactured homes offer significant cost savings compared to traditional site-built homes due to their efficient construction methods.

- Faster Build Timeline: They are built in factory-controlled environments, allowing for a faster assembly process.

- Customization Options: You have the flexibility to choose from various floor plans and add personal touches to create your desired home.

Cons:

- Depreciation: Unlike traditional homes, manufactured homes typically depreciate in value over time.

- Resale Challenges: They may be harder to resell due to market perception and potential stigma associated with mobile homes.

Key Takeaways:

- Manufactured homes offer affordability and faster construction times.

- Be mindful of potential depreciation and resale challenges.

- Customization options enhance your home’s appeal.

Sources:

- Manufactured Home Living – Pros and Cons of Manufactured Homes

- Pros and Cons of Buying a Double Wide Manufactured Home

Financing Options for Double Wide Manufactured Homes

Navigating the Financing Landscape

When it comes to financing a double wide manufactured home, navigating the options can be a bit different than with traditional homes. Let’s explore the available financing options and what you need to know:

Types of Financing

-

FHA Title I Loans: These loans are insured by the Federal Housing Administration (FHA) and are available for single- and double-wide manufactured homes that meet certain criteria. They often have lower down payment requirements and more flexible income guidelines.

-

FHA Title II Loans: These loans are also insured by the FHA, but they are specifically designed for land and manufactured homes that are permanently affixed to the land.

-

VA Loans: Available to eligible military veterans and active-duty personnel, these loans offer competitive interest rates and no down payment requirements, making them an attractive option for those who qualify.

-

USDA Rural Development Loans: These loans are available in designated rural areas and offer low interest rates and low down payment requirements. They are designed to make homeownership more affordable for low- and moderate-income families in rural communities.

Eligibility Requirements

The eligibility requirements for each type of loan vary, but generally, you will need a good credit score, a stable income, and a down payment of at least 3.5% – 5%. Some lenders may also have additional requirements, such as age or location restrictions.

Interest Rates

Interest rates for manufactured home loans can be higher than traditional home loans due to the perceived risk. However, the actual rate you qualify for will depend on factors such as your credit score, loan term, and down payment.

Key Takeaways:

- Explore financing options specifically designed for manufactured homes, such as FHA Title I and Title II loans.

- Consider government-backed loans, such as VA and USDA loans, which offer low interest rates and flexible requirements.

- Shop around and compare interest rates from multiple lenders to secure the best deal.

- Prepare for a down payment, as it is typically required for all types of manufactured home financing.

Citation:

- The Mortgage Reports: Manufactured Home Mortgage Loans

- Timothy P. Livingston: The 6 Best Lenders for Manufactured Home Loans

Tips for saving money on Double Wide Manufactured Homes

Double-wide manufactured homes offer a spacious and affordable housing option. Here are some tips to help you save money on your purchase:

Shop around: Compare prices from multiple dealers to find the best deal.

Buy pre-owned: Used double-wide manufactured homes can be found at a significant discount compared to new ones.

Choose energy-efficient features: Energy-efficient appliances and insulation can help you save on utility bills.

Explore government assistance or financing options: Certain government programs and low-interest loans can make double-wide manufactured homes more affordable.

Key Takeaways:

- Double-wide manufactured homes offer significant cost savings compared to traditional homes.

- Location, size, and features impact the cost of a double-wide manufactured home.

- Pre-owned homes, energy-efficient features, and government assistance can help you save money.

Relevant URL Sources:

FAQ

Q1: What are the primary factors that influence the cost of a double wide manufactured home?

Q2: Are there any regional variations in the pricing of double wide manufactured homes?

Q3: What are the advantages and disadvantages of purchasing a double wide manufactured home?

Q4: What mortgage options are available for double wide manufactured homes, and what are the eligibility requirements?

Q5: How does the cost of a double wide manufactured home compare to that of a site-built home?

- Best Foldaway Poker Tables of 2024: Buyer’s Guide & Reviews - April 22, 2025

- Greenhouse Storage Shed Combos: Your Guide to Combining Growing and Storage - April 21, 2025

- Greenhouse Shed Combo: Design, Build & Grow Year-Round - April 21, 2025