Does Homeowners Insurance Cover Structural Repairs: A Comprehensive Guide: This comprehensive guide delves into the intricacies of homeowners insurance coverage for structural repairs, providing clear insights into the policies, exclusions, and claims process. Discover the extent of coverage for various types of structural damage, including foundation issues, load-bearing walls, and roof collapses. Learn how to navigate the claims process effectively, ensuring a favorable outcome and timely repairs for your property.

Key Takeaways:

-

Home insurance covers structural repairs or rebuilds due to damage from severe storms like hail and snow-induced roof damage.

-

Coverage includes repairs to the foundation, frame, walls, and roof due to a covered peril.

-

Home insurance also covers structural repairs from accidental events like vehicle crashes into your home or explosions.

Does Homeowners Insurance Cover Structural Repairs?

When disaster strikes, homeowners insurance provides a financial safety net to help you repair or rebuild your home. But what exactly does homeowners insurance cover when it comes to structural repairs?

In general, homeowners insurance covers structural repairs caused by sudden and accidental damage, such as:

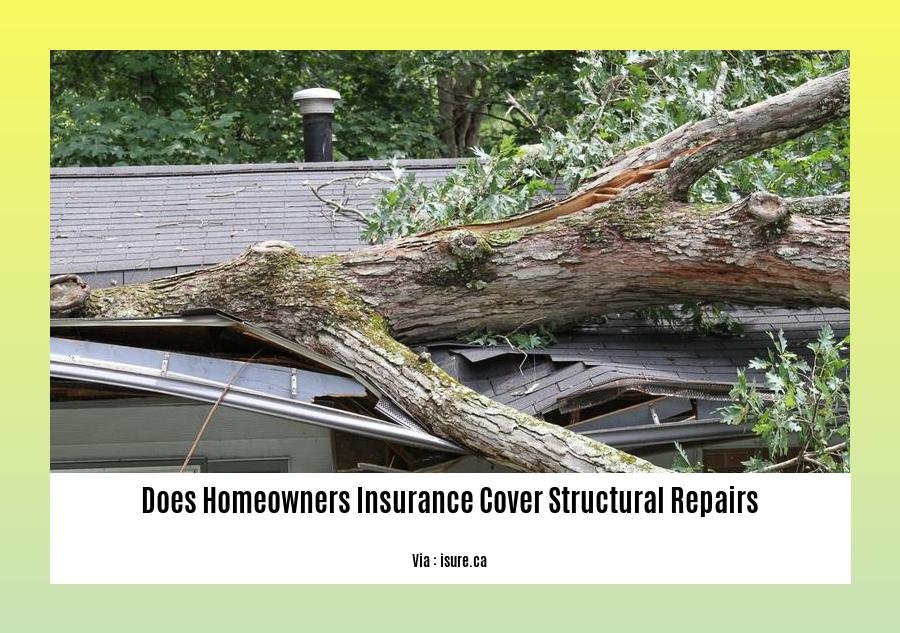

- Severe weather: Hail, wind, and lightning can all cause significant damage to your home’s structure, including the roof, siding, and foundation.

- Fire: A fire can quickly spread and cause extensive damage to your home, including the structural supports.

- Theft: If someone breaks into your home and causes damage to the structure, your homeowners insurance may cover the cost of repairs.

- Accidental damage: This could include damage caused by a car accident, a fallen tree, or a burst pipe.

What structural repairs are not covered by homeowners insurance?

Homeowners insurance typically does not cover structural repairs caused by:

- Neglect: If you fail to maintain your home properly, and this leads to damage, your homeowners insurance may not cover the cost of repairs.

- Wear and tear: Homeowners insurance is not intended to cover the cost of repairs for damage that occurs gradually over time, such as aging or deterioration.

- Earthquakes: Homeowners insurance policies typically exclude coverage for damage caused by earthquakes.

- Flooding: Homeowners insurance policies typically exclude coverage for damage caused by flooding.

How to file a claim for structural repairs under homeowners insurance

If your home has been damaged by a covered peril, you should file a claim with your homeowners insurance company as soon as possible. The claims process typically involves the following steps:

- Contact your insurance company: You can usually file a claim online, by phone, or through your insurance agent.

- Provide information about the damage: You will need to provide your insurance company with information about the damage, such as the date and cause of the damage, and the extent of the damage.

- Get an estimate for repairs: You will need to get an estimate for repairs from a qualified contractor.

- Submit your claim: Once you have obtained an estimate for repairs, you can submit your claim to your insurance company.

- Your insurance company will review your claim: Your insurance company will review your claim and determine if it is covered under your policy.

- If your claim is approved: If your claim is approved, your insurance company will issue you a check for the amount of the repairs.

Tips for filing a claim for structural repairs

Here are a few tips for filing a claim for structural repairs under homeowners insurance:

- File your claim as soon as possible: The sooner you file your claim, the sooner you will receive your money.

- Be prepared to provide documentation: You will need to provide your insurance company with documentation of the damage, such as photos and receipts.

- Get multiple estimates for repairs: This will help you ensure that you are getting a fair price for the repairs.

- Be patient: The claims process can take some time, so be patient and work with your insurance company to get your claim resolved.

Conclusion

Homeowners insurance can provide valuable coverage for structural repairs in the event of a covered peril. By understanding what is and is not covered under your policy, you can be prepared to file a claim if your home is damaged.

Have a leaky water main causing your water bill to skyrocket? If so, check if homeowners insurance covers main water line replacement.

Thinking about updating your home’s exterior? Find out does homeowners insurance cover replacement windows before you start shopping.

Does your home have outdated siding? If so, does homeowners insurance cover siding may be able to help you replace it.

Are you dealing with a slab leak? Learn does homeowners insurance cover slab leak repair to see if you can get help fixing it.

Claims process for structural repairs

Hey there, folks! Let’s dive into the world of homeowners insurance and see if it covers structural repairs. Many policies cover sudden and accidental damage caused by events like storms, fires, theft, and accidents. But it’s important to note that gradual wear, tear, earthquakes, and floods are often excluded.

Filing a Claim:

-

Prompt Action: Don’t delay; report the damage to your insurer ASAP!

-

Damage Documentation: Gather evidence: photos, videos, repair estimates – the works!

-

Claim Submission: Reach out to your insurance provider, submit the details, and be ready to provide supporting documents.

-

Patience is Key: It’s a process, so hang tight while your claim is being reviewed.

Key Takeaways:

- Coverage: Homeowners insurance generally covers sudden and accidental damage, not gradual wear and tear.

- Promptness: When filing a claim, act fast and gather necessary documentation.

- Patience: The claims process takes time, so be patient while your claim is being processed.

Relevant URL Sources:

Tips and advice for filing a claim for structural repairs

Let’s face it, dealing with structural repairs can be stressful, but with the right guidance and some preparation, you can navigate the claims process smoothly. Let’s jump right in with essential tips and advice to help you file a successful claim for structural repairs:

Key Takeaways:

- Know Your Policy:

- It’s important to understand your coverage and exclusions before filing a claim. Your policy might have specific requirements for filing a claim, so make sure you’re familiar with them.

-

If you are unsure about something, don’t hesitate to contact your insurance agent for clarification.

-

Document the Damage:

- Gather evidence to support your claim by taking photos and videos of the damage. If possible, keep receipts for any temporary repairs or expenses incurred due to the damage.

-

Create a detailed inventory of damaged items and include the estimated value of repairs.

-

Act Quickly:

- Notify your insurance company as soon as possible after the damage occurs. Most policies don’t have a strict time limit for filing a claim, but it’s advisable to do so within a reasonable time frame.

-

Prompt action can help ensure that the damage doesn’t worsen and lead to more extensive repairs.

-

Hire a Qualified Contractor:

- To assess the damage accurately, it’s crucial to hire a qualified contractor or engineer. They can determine the extent of the damage and provide a detailed estimate for repairs.

-

Make sure you obtain multiple estimates from different contractors to ensure you get a fair and competitive price.

-

Be Prepared for an Inspection:

- Your insurance company may send an adjuster to inspect the damage. Cooperate with the adjuster and provide any requested information or documentation.

-

The adjuster’s report will help your insurance company determine the cause of the damage and the amount of coverage you’re entitled to.

-

Review the Settlement Offer:

- Once the insurance company reviews your claim, they will issue a settlement offer. Carefully review the offer to ensure it covers the necessary repairs and expenses.

- If you disagree with the offer, you can negotiate with the insurance company to reach a fair settlement.

Remember, filing a claim for structural repairs can be a complex process, so don’t hesitate to seek guidance from your insurance agent, a qualified contractor, or an attorney if needed.

Citations:

- Does Homeowners Insurance Cover Structural Damage?

- Does Homeowners Insurance Cover Structural Problems?

What to expect from the claims process

Navigating structural damage claims requires preparation and awareness. Knowing what to expect can make a difference. So, let’s jump in.

Filing a Claim:**

-

Prompt Action: Reach out to your insurance company ASAP after the damage. Quick reporting ensures a smooth claim process and prevents further deterioration.

-

Evidence and Documentation: Gather proof of the damage, including photos, videos, and receipts. Detailed records help your claim stand out.

-

Accurate Estimates: Obtain estimates for repair costs from qualified contractors. Accurate estimates aid in fair claim settlements.

The Inspection:**

-

Assessment: An insurance adjuster will visit your property to assess the damage and determine coverage eligibility.

-

Communication: Stay in touch with the adjuster, providing any requested information or updates. Open communication ensures a smooth process.

Approval and Payment:**

-

Claim Evaluation: The insurance company reviews the adjuster’s report and decides on the claim approval.

-

Settlement: Once approved, you’ll receive a settlement based on your policy coverage and the repair estimates.

-

Repairs: Use the settlement funds to repair the damage according to the approved estimates. Keep receipts for reimbursement.

Key Takeaway:

- Quick reporting and prompt action are crucial for a smooth claims process.

- Document everything! Photos, videos, and receipts serve as valuable evidence.

- Accurate estimates from qualified contractors help in fair claim settlements.

- Stay in communication with the insurance adjuster to ensure a smooth process.

- Understand your policy coverage and settlement options before initiating repairs.

Relevant URL Sources:

FAQ

Q1: What types of structural repairs are typically covered by homeowners insurance?

A1: Homeowners insurance generally covers structural repairs caused by covered perils such as fire, lightning, windstorm, and hail, as well as damage from accidents like vehicle crashes or explosions. Repairs to the foundation and basic structure of the home, including its frame, walls, and roof, are also typically covered if the damage is a result of a covered peril.

Q2: Are there any exclusions or limits to structural damage coverage in homeowners insurance policies?

A2: Yes, there may be exclusions and limits to structural damage coverage in homeowners insurance policies. For example, some policies may exclude damage caused by earth movement, such as earthquakes, unless a separate endorsement is purchased. Additionally, there may be limits on the amount of coverage available for structural repairs, and deductibles may apply.

Q3: What is the typical deductible amount for structural damage claims?

A3: Deductibles for structural damage claims typically range from $500 to $1,500. The specific deductible amount will vary depending on the insurance policy and the insurance company.

Q4: What should I do if my home has sustained structural damage that is covered by my homeowners insurance policy?

A4: If your home has sustained structural damage that is covered by your homeowners insurance policy, you should file a claim as soon as possible. Most insurance policies do not have a specific time limit for filing a claim, but it is best to do so within a reasonable amount of time. You should also keep receipts for any emergency repairs you make, as they may be reimbursable by your insurance company.

Q5: What if the structural damage to my home is caused by faulty workmanship or a lack of maintenance?

A5: Structural damage caused by faulty workmanship or a lack of maintenance is typically not covered by homeowners insurance. Homeowners insurance policies generally cover damage caused by sudden and accidental events, not ongoing or gradual deterioration.

- Black Backsplash With White Cabinets: A Bold Kitchen Design - November 5, 2025

- Black and White Kitchen Backsplash: Ideas for Timeless Style - November 4, 2025

- Kitchen Backsplash Ideas: Fresh Looks to Upgrade Your Space - November 1, 2025