Seeking answers to the enigma of whether homeowners insurance covers window leaks? Step into the labyrinthine world of insurance policies and discover the intricacies of water damage claims. Embark on a journey to decipher the coverage intricacies for leaking windows, illuminating the murky depths of insurance intricacies. [Does Homeowners Insurance Cover Window Leaks: Unraveling the Insurance Maze] unveils the secrets, guiding homeowners toward clarity amidst the complexities.

Key Takeaways:

-

Window leaks are generally viewed as maintenance issues rather than covered incidents under standard homeowners insurance policies.

-

Repair costs for leaking windows are typically not covered by home insurance, but there’s a chance that ensuing water damage may be covered.

-

It’s crucial to carefully review your insurance policy and consult with your insurance provider to determine the extent of coverage for window leaks and associated damages.

Does Homeowners Insurance Cover Window Leaks: Unraveling the Insurance Maze

Navigating the Enigma of Window Leaks and Homeowners Insurance Coverage

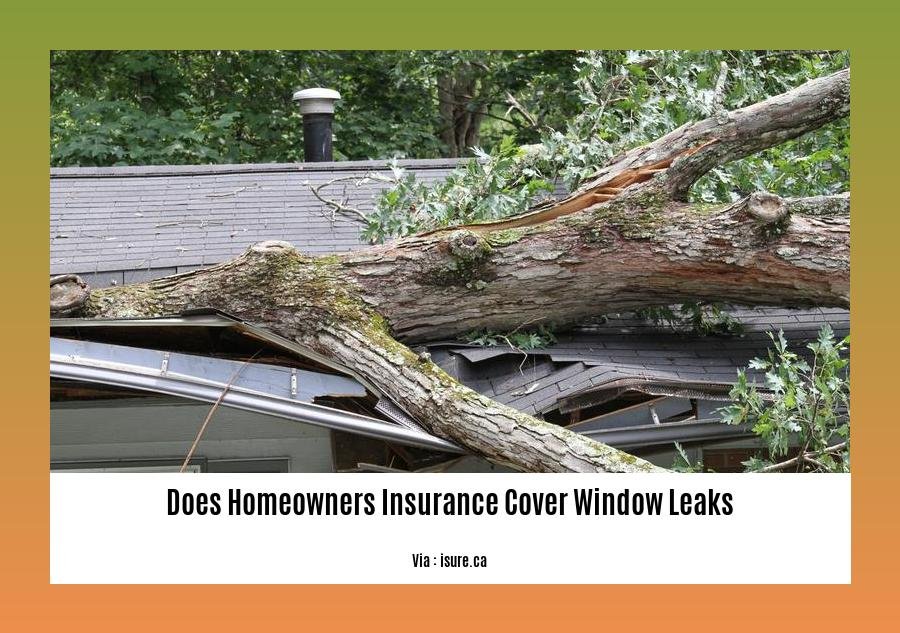

As a homeowner, you take pride in your property and understand the significance of routine maintenance. Windows play a pivotal role in your home’s safety, aesthetics, and energy efficiency. Yet, they can also be a source of concern when leaks arise. What if these leaks cause extensive water damage? Does homeowners insurance cover window leaks and the repairs that come with them? Let’s delve into this often-confusing aspect of insurance coverage.

Understanding the Dynamics of Coverage

Homeowners insurance policies can vary, and the coverage for window leaks is no exception. Generally, insurance companies categorize window leaks as maintenance issues, deeming them the homeowner’s responsibility. This means that repairs and replacements related to window leaks are usually not covered by standard homeowners insurance policies.

However, there may be a silver lining. In certain instances, homeowners insurance policies may provide coverage for water damage caused by window leaks. If a window leak leads to water damage inside your home, such as ruined flooring, damaged furniture, or compromised walls, your insurance company might offer coverage for the resulting damage.

Assessing Your Policy: A Case-by-Case Analysis

To accurately determine if your homeowners insurance covers window leaks, it’s essential to thoroughly review your policy. Look for sections that address water damage coverage. Policies often specify exclusions related to maintenance issues, but they may provide coverage for subsequent damages caused by those issues.

Documenting the Damage: A Critical Step

In the unfortunate event of a window leak, prompt action is crucial. Document the damage thoroughly, taking detailed photographs and videos. Contact your insurance company as soon as possible to initiate a claim. Thorough documentation strengthens your case and helps ensure a smoother claims process.

Preventing Leaks: A Proactive Approach

While insurance can provide a safety net, prevention is always better than cure. Regularly inspect your windows for signs of wear and tear, such as cracks, loose caulking, and damaged weatherstripping. Timely maintenance and repairs can go a long way in preventing leaks and the associated hassles.

In Summary: A Clearer Perspective

Does homeowners insurance cover window leaks? The answer can be complex and policy-dependent. While most policies exclude coverage for window leaks themselves, they may provide coverage for the resulting water damage. Homeowners should carefully review their policies, document any damage caused by window leaks promptly, and take proactive steps to prevent these leaks in the first place. By understanding your coverage and taking preventive measures, you can better protect your home and your peace of mind.

-

Wondering if a fresh coat of paint can boost your home’s value? Find out does paint increase home value.

-

In Tennessee, homeowners may be eligible for homestead exemptions. Does Tennessee have a homestead exemption?

Are Windows Covered By Home Insurance: Unraveling the Insurance Maze

Navigating the complexities of homeowners insurance can be daunting, especially when it comes to understanding coverage for window leaks. This article aims to shed light on this topic, providing homeowners with essential insights into their insurance policies and the nuances of window-related claims.

Key Takeaways:

-

Standard HO-3 policies commonly exclude coverage for broken windows as they fall under maintenance responsibilities.

-

Water damage resulting from leaking windows may be covered, but the windows’ repair or replacement might not be covered.

-

Policy provisions vary; hence, it’s crucial to thoroughly review your policy’s terms and conditions.

-

Regular maintenance, weatherproofing, and prompt repairs can help prevent leaks and subsequent damage.

-

Contact your insurance company promptly if you experience window leaks, and document the damage thoroughly.

Understanding Coverage for Window Leaks

Homeowners insurance policies typically follow an industry-standard format known as HO-3. These policies generally exclude coverage for broken windows, considering them a maintenance issue that falls under the homeowner’s responsibility. When it comes to water damage caused by leaking windows, the coverage scenario becomes a bit more nuanced.

Some insurance policies may extend coverage to water damage resulting from leaking windows, but this is subject to specific policy terms and conditions. However, it’s important to note that the policy might not cover the repair or replacement of the windows themselves. To ensure clarity, it’s essential to thoroughly review your policy and consult with your insurance company for a clear understanding of your coverage.

Preventing Window Leaks and Damage

Proactive maintenance and prompt repairs are crucial in preventing window leaks and the associated damage they can cause. Regular inspections, weatherproofing measures, and addressing any signs of deterioration can significantly reduce the risk of leaks. By taking these preventive steps, you can help safeguard your home and potentially avoid costly repairs or insurance claims.

Filing a Claim for Window Leaks

In the unfortunate event of a window leak, it’s important to act promptly. Document the damage thoroughly, taking photographs and keeping receipts for any initial cleanup or repair costs you incur. Contact your insurance company as soon as possible to initiate the claims process. Provide them with all the necessary documentation and information to support your claim. Keep in mind that your deductible will apply to any approved claim, so it’s essential to factor that into your financial considerations.

Conclusion

Understanding the coverage provided by your homeowners insurance for window leaks is crucial in protecting your property and finances. By familiarizing yourself with your policy’s terms and conditions, taking preventive measures to minimize the risk of leaks, and promptly addressing any issues that arise, you can make informed decisions and navigate the insurance process effectively.

Citations:

Does Homeowners Insurance Cover Broke…

Does Home Insurance Cover Leaking Window…

FAQ

Q1: Do homeowners insurance policies typically cover broken windows?

A1: Generally, standard HO-3 policies exclude coverage for broken windows as they are considered a maintenance issue, and the homeowner is responsible for repairs or replacements.

Q2: Can homeowners insurance cover damage caused by leaking windows?

A2: Some insurance policies may provide coverage for water damage resulting from leaking windows, but they often exclude the repair or replacement costs of the windows themselves.

Q3: How can I determine if my insurance policy covers window-related damages?

A3: Carefully review your homeowners insurance policy’s terms and conditions to understand the specific coverage provided for window leaks and water damage. If you have any questions or uncertainties, contact your insurance provider for clarification.

Q4: What should I do if I discover water damage caused by leaking windows?

A4: Document the damage thoroughly by taking photos and videos. Contact your insurance company promptly and provide them with all the necessary information. Follow the claims process outlined by your insurance provider.

Q5: Are there steps I can take to prevent future window leaks and water damage?

A5: Regular maintenance, weatherproofing, and prompt repairs can help minimize the risk of future leaks. Ensure proper drainage around your home, and consider installing window seals or weatherstripping to prevent water seepage.

- Greenhouse Storage Shed Combos: Your Guide to Combining Growing and Storage - April 21, 2025

- Greenhouse Shed Combo: Design, Build & Grow Year-Round - April 21, 2025

- Gingham vs. Plaid: What’s the Difference? A Complete Guide - April 21, 2025