– Heritage Home Loan Rates: A Comprehensive Guide for Preservation and Investment

Key Takeaways:

- Heritage Bank offers home loans designed specifically for preserving heritage homes.

- The Heritage Home Program provides low-interest loans for maintenance and improvements.

- Heritage Bank’s fixed-rate loans offer competitive rates and terms ranging from 1 to 5 years.

- Interest-only repayment options are available for up to five years on fixed and variable loans.

- Heritage Bank’s Living Equity line of credit loan allows borrowers to skip principal payments for up to 10 years.

Heritage Home Loan Rates

Heritage home loan rates can be an important part of determining your affordability and budget when it comes to purchasing or refinancing a historic home.

Heritage home loans are designed to help homeowners finance the purchase or refinance of historic homes. They typically offer competitive interest rates and flexible repayment options.

Factors that affect heritage home loan rates:

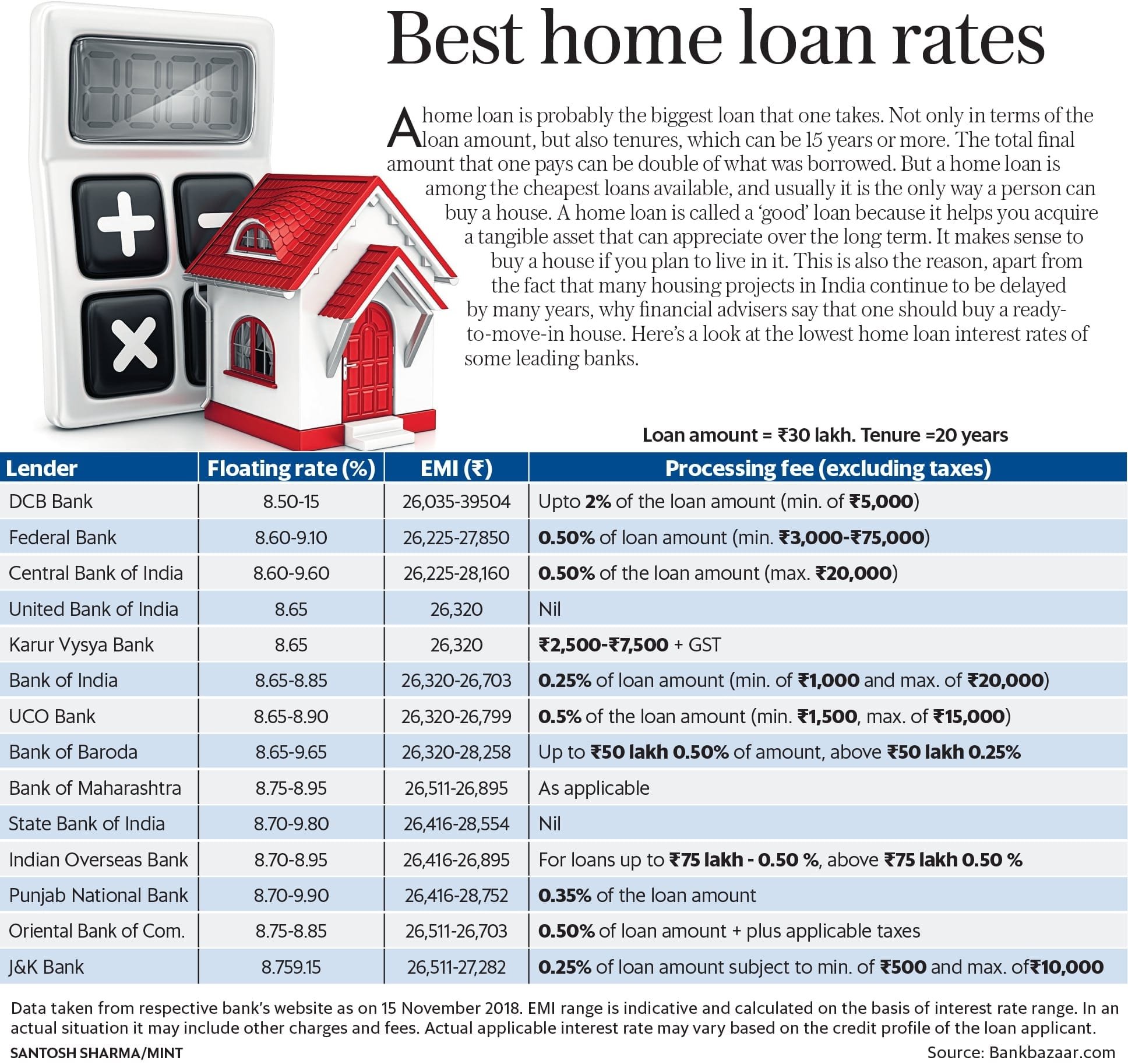

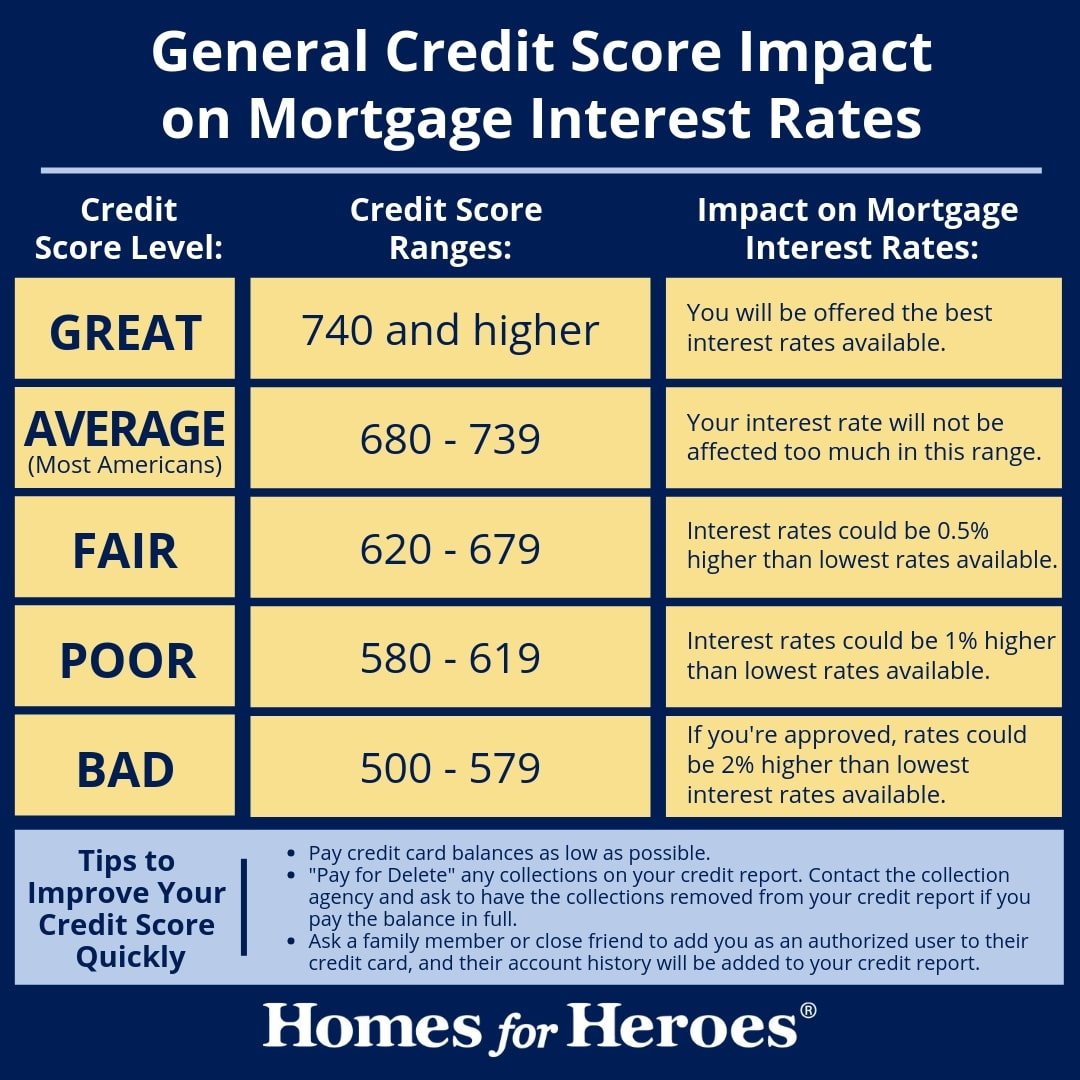

- Your credit score: Your credit score is a key factor in determining your interest rate. The higher your credit score, the lower your interest rate will be.

- The loan amount: The amount of money you borrow will also affect your interest rate. The larger the loan amount, the higher your interest rate will be.

- The loan term: The loan term is the length of time you have to repay the loan. The longer the loan term, the higher your interest rate will be.

How to get the best heritage home loan rate:

- Shop around: Compare interest rates from multiple lenders before you apply for a loan.

- Get pre-approved: Getting pre-approved for a loan can give you a better idea of your interest rate and monthly payments.

- Improve your credit score: If your credit score is not as high as you would like, there are steps you can take to improve it.

- Make a larger down payment: Making a larger down payment can help you get a lower interest rate.

Pros of heritage home loan rates:

- Competitive interest rates: Heritage home loan rates are typically competitive with other types of home loans.

- Flexible repayment options: Heritage home loans offer flexible repayment options, such as interest-only payments and extended loan terms.

- Can help you preserve a historic home: Heritage home loans can help you finance the purchase or refinance of a historic home, which can help preserve the home for future generations.

Cons of heritage home loan rates:

- May require a larger down payment: Heritage home loans may require a larger down payment than other types of home loans.

- May have higher closing costs: Heritage home loans may have higher closing costs than other types of home loans.

- May not be available in all areas: Heritage home loans may not be available in all areas.

Planning a trip to the serene beaches of Digha? Look no further! Explore our exclusive range of holiday homes at Digha, featuring a kitchen facility for your convenience. Visit holiday home at digha with kitchen facility to explore our options.

For those seeking a comfortable and affordable place to stay in Rosenberg, Texas, look no further than the Hernandez Funeral Home in Rosenberg TX, providing quality funeral services with a touch of warmth and compassion.

If you’re considering a trip to the beautiful New Digha, be sure to check out our range of holiday homes with kitchen facilities. Our holiday home at new digha with kitchen offers the perfect blend of comfort and convenience for a memorable stay.

Heritage Home Loan Rates Calculator

Heritage Bank offers a range of home loan rates to meet your unique financial needs. Their Heritage Home Loan Rates Calculator can help you estimate your monthly payments and compare loan options to find the right fit for your heritage property.

How to Use the Heritage Home Loan Rates Calculator

- Visit Heritage Bank’s website.

- Navigate to the “Loans” tab and select “Home Loans.”

- Click on the “Calculate Your Repayments” button.

- Enter your loan details, including the loan amount, loan term, and interest rate.

- Click on “Calculate” to see your estimated monthly payments.

Factors that Affect Heritage Home Loan Rates

- Loan type (fixed or variable)

- Loan term

- Loan-to-value ratio

- Your credit score

- The bank’s assessment of your financial situation

Key Takeaways:

- Heritage Bank’s Heritage Home Loan Rates Calculator provides a quick and easy way to estimate your monthly payments and compare loan options.

- Interest rates for heritage home loans may vary depending on your specific situation and the bank’s assessment of your affordability.

- It’s important to shop around and compare rates from multiple lenders before making a decision on a heritage home loan.

Relevant URL Sources:

FAQ

Q1: What home loans does Heritage Bank offer?

A1: Heritage Bank offers a variety of home loans, including variable-rate loans, fixed-rate loans, interest-only loans, and lines of credit. Their Heritage Home Program provides low-interest fixed-rate home equity loans specifically for the maintenance and improvement of older homes.

Q2: How are Heritage Bank home loans rated?

A2: Heritage Bank’s home loans are generally rated as competitive in the market. They offer a range of features and options, such as fixed terms of 1, 2, 3, or 5 years, and an interest-only repayment option for up to five years.

Q3: Where can I find the Heritage Home Loan Rates Calculator?

A3: You can find the Heritage Home Loan Rates Calculator on Heritage Bank’s website: https://www.heritage.com.au/loans/home-loans/home-loan-calculator

Q4: How do I compare Heritage’s home loans with other financial institutions?

A4: Heritage Bank provides personalized Key Fact Sheets that you can generate to compare their home loans with those offered by other financial institutions.

Q5: Does Heritage Bank consider my interest rate affordability at the time of my loan application?

A5: Yes, Heritage Bank may use an interest rate that is higher than the current rate to assess your loan application and determine your affordability.

- Dora the Explorer Wipe-Off Fun: Safe & Mess-Free Activities for Little Explorers - April 18, 2025

- Does Lemongrass Repel Mosquitoes? Fact vs. Fiction + How to Use It - April 18, 2025

- Do Woodchucks Climb Trees?Fact vs. Fiction - April 18, 2025