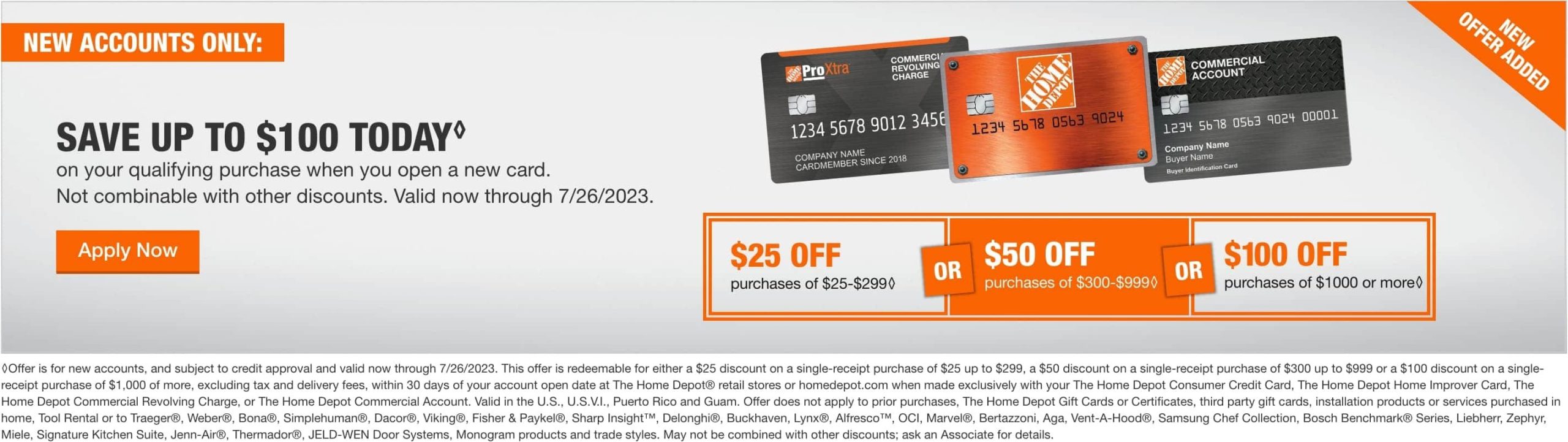

Embark on a seamless home improvement journey with our comprehensive guide to navigating Home Depot project loan requirements. Whether you’re a seasoned homeowner or a first-time renovator, understanding these requirements is crucial for securing the financing you need to transform your living space. Our expert insights will empower you to assess your creditworthiness, optimize your borrowing strategies, and make informed decisions that lead to a successful project outcome. So, let’s dive right into [- Navigating Home Depot Project Loan Requirements for a Successful Home Improvement Journey].

Key Takeaways:

- Purchases must be made within 6 months of loan approval.

- Loans can only be used for purchases made at Home Depot.

- Prequalification is unavailable.

- Interest rates vary.

- Benefits include fixed monthly payments and no prepayment penalty.

- Fees may apply.

- Loan approvals take 3-5 business days.

- Credit line is up to $40,000.

- Loans are intended for home improvement expenses only.

Home Depot Project Loan Requirements

If you’re planning a home improvement project and considering a Home Depot project loan, here’s what you need to know:

Eligibility Criteria

To qualify for a Home Depot project loan, you’ll typically need:

- Good credit history

- Steady income

- Homeowners insurance

Note: Prequalification is unavailable for Home Depot project loans.

Loan Terms

- Loan Term: Purchases can only be made within the first six months of account opening.

- Loan Exclusivity: Purchases must be made at Home Depot.

- Interest Rates: Not publicly disclosed.

- Benefits:

- Fixed monthly payments

- No prepayment penalty

- Fees: Not specified.

- Loan Approval: Can take 3-5 business days.

- Loan Amount: Up to $40,000.

- Intended Use: Home improvement expenses.

Steps to Apply

- Gather Required Documents: Proof of income, credit history, and homeowners insurance.

- Apply in-Store or Online: Visit a Home Depot store or apply online at homedepot.com.

- Review Loan Agreement: Carefully review the loan terms and conditions before signing.

- Await Approval: Once your application is submitted, you’ll receive a decision within 3-5 business days.

- Make Purchases: If approved, you can start making purchases at Home Depot using your project loan.

Pros and Cons of Home Depot Project Loans

Pros:

- No prepayment penalty

- Fixed monthly payments

- Can be used for a variety of home improvement expenses

Cons:

- Interest rates may be higher than other loan options

- Purchases must be made exclusively at Home Depot

- Loan amount may not cover all project costs

By understanding the Home Depot project loan requirements, you can make an informed decision about whether this loan is right for you and your home improvement project.

Searching for the perfect flooring for your home? Look no further than The Home Depot’s extensive selection of tile flooring prices.

If you’re looking for a new toilet bowl, The Home Depot has a wide variety of options to choose from at toilet bowl prices that won’t break the bank.

The Home Depot is your one-stop shop for all your home improvement needs. Visit their Southwest Military Drive location in San Antonio, Texas today and see how they can help you get your next project done right.

Home Depot Project Loan Credit Requirements

Fulfilling your home renovation dreams often requires financial assistance, and the Home Depot Project Loan is a popular choice for many. To ensure a successful borrowing experience, it’s crucial to understand the home depot project loan credit requirements.

Steps to Prepare:

-

Credit Score: A minimum credit score of 620 is typically required. Maintaining a healthy credit history with on-time payments and low credit utilization is essential.

-

Income and Employment: A stable income and employment history are crucial. Lenders will evaluate your ability to repay the loan based on your income and employment status.

-

Debt-to-Income Ratio: Ideally, your debt-to-income ratio should be under 40%. This indicates your ability to manage your existing debt and take on additional borrowing.

-

Credit History: Lenders will review your credit history, including any derogatory marks or delinquencies. A consistent pattern of responsible credit management will increase your chances of loan approval.

Additional Tips:

- Consider prepaying existing debt to improve your debt-to-income ratio.

- Check your credit report for errors and dispute any inaccuracies.

- Build your credit score over time by making timely payments and keeping credit utilization low.

Key Takeaways:

- Maintain a credit score of 620 or higher.

- Establish a stable income and employment history.

- Aim for a debt-to-income ratio below 40%.

- Demonstrate responsible credit management through a positive credit history.

Sources:

- Home Depot Project Loan in 2024 – The Complete Guide

- Home Depot Project Loan Review | Intuit Credit Karma

FAQ

Q1: What are the Home Depot project loan credit score requirements?

A1: The minimum credit score requirement for a Home Depot project loan is 620.

Q2: What other financial factors are considered for Home Depot project loan approval?

A2: In addition to credit score, Home Depot also considers stable income, employment history, and a low debt-to-income ratio (ideally under 40%).

Q3: Can I get pre-qualified for a Home Depot project loan?

A3: Prequalification is not available for Home Depot project loans.

Q4: What is the maximum credit line I can get with a Home Depot project loan?

A4: The maximum credit line for a Home Depot project loan is $55,000.

Q5: What can I use a Home Depot project loan for?

A5: Home Depot project loans are intended for home improvement expenses only.

- How to Get Rid of Mushrooms in Your Lawn: A Complete Guide - April 24, 2025

- How to Get Rid of Ground Hornets: A Safe and Effective Guide to Eliminating Nests - April 24, 2025

- How to Get Rid of German Roaches Fast: DIY Methods for Quick Control - April 24, 2025