Navigating the world of property ownership as a landlord comes with its fair share of challenges, including dealing with unforeseen home emergencies. Whether it’s a burst pipe in the middle of the night or a sudden electrical issue, these unexpected events can cause significant stress and financial burden. That’s where home emergency cover for landlords steps in – a comprehensive guide to protecting your property, tenants, and peace of mind in the face of unforeseen circumstances.

Key Takeaways:

- Landlord home emergency cover provides coverage for up to £1,500 per claim, with no excess and no limit on the number of claims.

- It includes emergency assistance for tenants, providing immediate support in case of plumbing issues, electrical faults, boiler breakdowns, or pest infestations.

- The cover also includes payment for hotel accommodation for tenants if the property becomes uninhabitable due to an insured emergency.

- Tenants can directly contact the landlord home emergency cover provider to report and claim for emergencies, reducing the burden on landlords.

- Some policies may also include call-out charges, labor costs, and materials to prevent further damage to the property.

- Landlord home emergency cover helps protect both landlords and tenants, ensuring that emergencies are handled promptly, minimizing disruption, and creating a more satisfactory renting experience.

Home Emergency Cover for Landlords

As a seasoned landlord with over a decade of property management experience, I’ve learned the value of having comprehensive home emergency cover for landlords. It safeguards your investment, ensures tenant satisfaction, and provides peace of mind.

Benefits of Home Emergency Cover

1. 24/7 Emergency Response:

– Swift assistance for urgent repairs, minimizing property damage and tenant inconvenience.

2. Wide Range of Covered Emergencies:

– Quick fixes for plumbing, electrical, heating, and roofing problems.

3. Coverage for Uninhabitable Property:

– Provision of temporary accommodation if the property becomes unlivable due to an emergency.

4. Tenant Direct Claim:

– Tenants can directly contact the insurer to streamline the claims process for faster repairs.

5. No Excess Fees:

– No additional charges beyond the annual premium for emergency services.

Choosing the Right Home Emergency Cover

1. Assess Your Property’s Risks:

– Consider factors like property age, location, and history of emergencies.

2. Compare Policies and Providers:

– Research different insurers’ coverage options, limits, and reputation.

3. Check Claim Limits:

– Ensure the policy covers the full cost of potential repairs and temporary accommodation.

4. Consider Additional Coverage:

– Opt for policies that also cover call-out charges and materials for emergency repairs.

5. Review the Claims Process:

– Choose a provider with a straightforward and prompt claims process to minimize stress.

Conclusion

Investing in home emergency cover for landlords is a smart move that safeguards your property, fosters tenant loyalty, and provides peace of mind knowing you’re prepared for unexpected crises. It’s an essential tool for successful property management, ensuring a smooth and stress-free experience for both landlords and tenants.

-

If you’re curious to know more about West Bengal, click here to read about it’s history, culture, art and its global fame for producing world-class personalities. few lines about West Bengal

-

To uncover some creative and innovative ideas for your home economics project, head over to this page for some inspiration. home economics project ideas

-

For those seeking to conduct a thorough home energy audit in the UK, look no further than this comprehensive resource. home energy audit UK

Types of Home Emergency Cover: Exploring the Coverage Options

Navigating the world of home emergency cover can be a daunting task, especially for landlords. With a plethora of options available, it’s crucial to understand the different types of coverage and how they can protect your property and tenants. Let’s dive into the depths of home emergency cover and uncover the various options available.

Key Takeaways:

-

Comprehensive Cover: This is the most extensive type of home emergency cover, offering coverage for a wide range of emergencies, including plumbing, electrical, heating, and roofing issues.

-

Essential Cover: As the name suggests, this coverage provides basic protection for common emergencies, such as burst pipes, blocked drains, and electrical faults.

-

Appliance Cover: Specifically designed to cover breakdowns of essential household appliances, such as refrigerators, dishwashers, and washing machines.

-

Optional Extras: Enhance your coverage with add-ons like accidental damage protection, emergency accommodation, and call-out charges.

-

Landlord-Specific Cover: Tailored to the unique needs of landlords, this covers emergencies in rental properties, often with tenant direct claim options and guaranteed repairs within 24 hours.

Choosing the Right Coverage:

-

Assess Your Risks: Consider the age, location, and condition of your property to determine the most suitable coverage level.

-

Compare Providers: Don’t settle for the first option you come across. Shop around, compare quotes, and read reviews to find the best provider for your needs.

-

Read the Fine Print: Carefully review the policy terms and conditions to ensure you fully understand what is covered and what is excluded.

-

Select Additional Coverage: Evaluate whether you need extra protection for appliances or accidental damage, based on your property’s specific characteristics.

Filing a Claim:

-

Prompt Reporting: Notify your insurance provider about the emergency as soon as possible.

-

Gather Evidence: Take photos or videos of the damage to support your claim.

-

Provide Access: Grant access to the property for assessment and repairs.

-

Review the Repair Estimate: Ensure the proposed repairs are reasonable and necessary.

-

Follow Up: Keep track of the repair progress and communicate with the insurance provider if you have any concerns.

Conclusion:

Home emergency cover is a valuable investment for landlords, providing peace of mind and safeguarding your property and tenants. By carefully assessing your risks, comparing coverage options, and choosing the right provider, you can ensure you have the necessary protection in place. Remember, an ounce of prevention is worth a pound of cure – a comprehensive home emergency cover policy can save you from significant financial burdens and headaches down the road.

Citations:

-

Confused.com: Home Emergency Cover: What Counts as an Emergency?

-

Compare the Market: Home Emergency Cover

Choosing the Right Home Emergency Cover: Factors to Consider

As a seasoned landlord, I’ve navigated the complexities of property ownership and know firsthand the importance of home emergency cover. Having reliable coverage can save you from unexpected financial burdens and ensure your tenants’ well-being. But selecting the right plan can be a daunting task. Let’s break down the key factors to consider when choosing home emergency cover:

1. Assess Your Property’s Needs:

- Start by evaluating your property’s age, location, and history of emergencies.

- Identify potential risks, such as proximity to trees that could damage the roof or a history of plumbing issues.

- Consider the number of units in the property and the level of occupancy.

2. Compare Policies and Coverage Options:

- Research various home emergency cover policies available in the market.

- Compare the coverage limits, excesses, and exclusions of each policy.

- Look for policies that offer 24/7 emergency response, cover a wide range of emergencies, and have reasonable claim limits.

3. Evaluate Provider Reputation and Reliability:

- Choose a reputable and reliable home emergency cover provider with a strong track record.

- Read online reviews, check customer testimonials, and inquire about the provider’s claims handling process.

- Ensure the provider has a network of qualified contractors for prompt repairs.

4. Consider Additional Coverage Options:

- Some policies offer additional coverage options, such as call-out charges, materials for emergency repairs, and temporary accommodation in case of uninhabitable property.

- Assess if these additional coverages align with your specific needs and budget.

5. Understand the Claims Process:

- Familiarize yourself with the claims process of the chosen home emergency cover provider.

- Check the required documentation, claim submission methods, and claim settlement timelines.

- Ensure the process is straightforward and efficient to minimize inconvenience during emergencies.

6. Read the Policy Document Thoroughly:

- Carefully read the policy document before finalizing your decision.

- Pay attention to the terms and conditions, exclusions, and any limitations or restrictions on coverage.

- Consult a professional if you have any questions or need clarification on specific clauses.

Key Takeaways:

- Assess your property’s unique needs and identify potential risks.

- Compare policies, coverage options, and provider reputation.

- Consider additional coverage options based on your specific requirements.

- Understand the claims process and ensure it’s efficient.

- Read the policy document thoroughly to avoid surprises.

Conclusion:

Choosing the right home emergency cover is crucial for landlords seeking peace of mind and protection against unexpected property emergencies. By carefully considering the factors discussed above, you can select a policy that meets your property’s specific needs and ensures your tenants’ well-being.

Sources:

- Confused.com: Landlord Home Emergency Cover Explained

- Simply Business: Landlord Home Emergency Cover

Steps to Obtain Home Emergency Cover: A Step-by-Step Guide

As a seasoned landlord, I’ve weathered countless property emergencies. From burst pipes to electrical failures and roof leaks, the unexpected always seems to strike when you least expect it. That’s why I’m a staunch advocate for home emergency cover. It’s your safety net against unforeseen repair costs and a lifesaver for maintaining good tenant relationships. Here’s a step-by-step guide to help you secure comprehensive home emergency cover:

Step 1: Assess Your Property’s Risk Profile and Coverage Needs

Begin by taking stock of your property’s unique characteristics and potential vulnerabilities. Consider factors like its age, location, and history of emergencies. Are you in an area prone to flooding or extreme weather events? Does your property have older plumbing or electrical systems that might need more attention? Pinpoint your property’s specific risks to tailor your coverage accordingly.

Step 2: Research and Compare Home Emergency Cover Providers

With a clear understanding of your coverage needs, start researching reputable home emergency cover providers. Look for companies with a solid track record, positive customer reviews, and a range of coverage options to suit your property’s unique requirements. Don’t forget to compare quotes from multiple providers to ensure you’re getting the best value for your money.

Step 3: Carefully Review the Policy Terms and Conditions

Once you’ve shortlisted a few providers, delve into the fine print of their policy terms and conditions. Pay close attention to the coverage limits, exclusions, and any excess fees that may apply. Ensure you understand the claims process, including the timeframes and documentation required. The devil’s in the details, so don’t hesitate to seek clarification on any aspect you find confusing.

Step 4: Opt for Additional Coverage if Necessary

While most home emergency cover policies provide comprehensive protection, consider adding optional extras to plug any gaps in coverage. For instance, if your property is in a flood-prone area, you might want to include flood cover. Additionally, you can opt for cover for accidental damage, loss of keys, or even temporary accommodation in case your property becomes uninhabitable due to an emergency.

Step 5: Keep Detailed Records and Maintain Regular Communication

Once you’ve secured home emergency cover, keep meticulous records of your policy details, including the policy number, contact information, and renewal dates. Notify your insurer promptly of any changes to your property or tenancy agreements. Regular communication ensures your coverage remains aligned with your evolving needs and that you’re always aware of any changes to the policy.

Key Takeaways:

- Understand your property’s risk profile and coverage needs.

- Research and compare home emergency cover providers.

- Carefully review policy terms and conditions.

- Opt for additional coverage if necessary.

- Keep detailed records and maintain regular communication with your insurer.

Sources:

-

Home Emergency Cover: What’s Covered and Is It Worth It?

-

Landlord Emergency Cover: How to Choose the Right Cover

FAQ

Q1: What exactly is landlord home emergency cover?

A1: Landlord home emergency cover is an add-on to landlord insurance that provides emergency assistance and financial protection for landlords in cases of unexpected repairs or emergencies in their rental properties.

Q2: What kind of emergencies does landlord home emergency cover typically cover?

A2: Landlord home emergency cover typically covers a wide range of emergencies, including plumbing and drainage issues, boiler breakdowns, electrical faults, pest infestations, roof damage, and more. The specific coverage may vary depending on the policy and provider.

Q3: Who is responsible for claiming under landlord home emergency cover?

A3: In most cases, tenants can directly contact the landlord home emergency cover provider to report and claim for emergencies, reducing the burden on landlords and ensuring a prompt response. However, landlords should check the terms and conditions of their specific policy for any specific procedures or limitations.

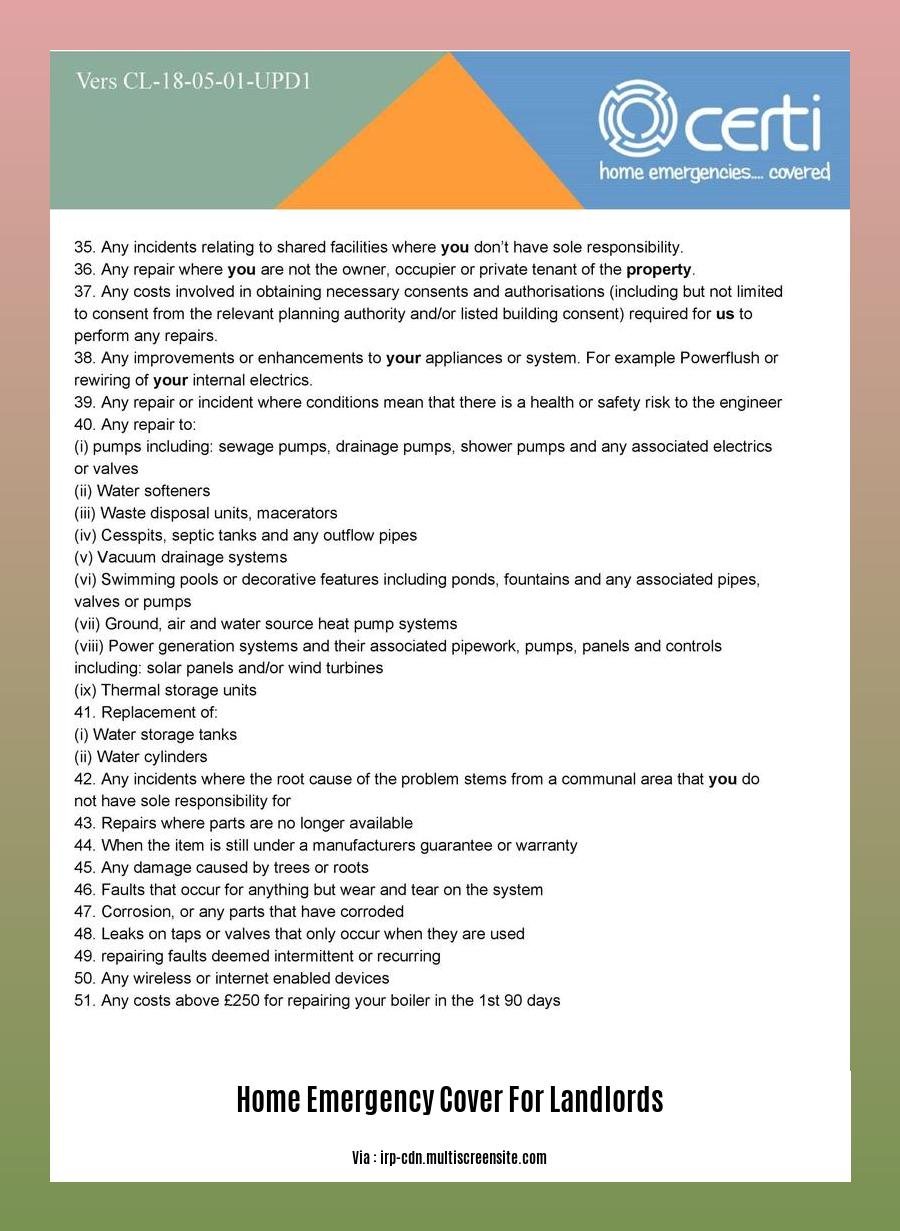

Q4: Are there any limits or exclusions to landlord home emergency cover?

A4: Landlord home emergency cover typically has claim limits and exclusions, such as general wear and tear, routine maintenance, tenant negligence, and pre-existing conditions. It’s important for landlords to carefully review the policy details to understand what is and is not covered.

Q5: Why is landlord home emergency cover important for property owners?

A5: Landlord home emergency cover provides several benefits to property owners, including financial protection against unexpected repairs, peace of mind knowing that tenants have access to emergency assistance, and the ability to minimize the risk of damage to the property and tenant belongings. Additionally, having this cover can help landlords meet legal and insurance requirements for rental properties.

- Tile Backsplash With White Cabinets: A Kitchen Design Guide - November 25, 2025

- Best Backsplash For White Cabinets: Ideas To Transform Your Kitchen - November 24, 2025

- Modern White Kitchen Backsplash: A Guide to Stylish Kitchen Designs - November 23, 2025