Step into the world of financial opportunities with [- Home Equity Line of Credit No Income Verification: Unlocking Your Home’s Hidden Financial Potential]. This article delves into the intricacies of leveraging your home equity, providing a comprehensive guide to accessing funds without the burden of income verification. Discover the possibilities that arise when you tap into your home’s untapped value, transforming it into a financial asset that works for you.

Key Takeaways:

- No Income Verification:

- A stable income is not the primary requirement for a home equity loan application.

-

Lenders may ask for income information, but they often rely on the applicant’s word without verification.

-

Bank Statement Analysis:

- Lenders may qualify buyers based on bank statement analysis instead of tax returns.

- This benefits self-employed individuals or those without traditional income documentation.

[Relevant URL Sources]

Home Equity Line of Credit (HELOC) No Income Verification: Unveiling Your Home’s Financial Power

Hola, and welcome to our home equity line of credit (HELOC) headquarters, where we’re all about empowering homeowners to tap into their property’s hidden financial potential. We understand that sometimes life throws curveballs, leaving you in need of a financial boost without the traditional income verification hassle. Say hello to the game-changing HELOC without income verification – your gateway to financial freedom. Let’s dive right in and see how you can leverage your home equity without income scrutiny.

HELOC 101: The Basics

Let’s break down what a HELOC is in simple terms. It’s like a credit card, but for your home. You get approved for a credit limit based on your home’s value, minus any outstanding mortgage balance. Then, you can borrow against that credit limit as needed, paying interest only on what you borrow. It’s a flexible tool that offers steady access to cash, making it a popular option for home improvements, debt consolidation, education expenses, and other significant financial needs.

Why Opt for a HELOC with No Income Verification?

If you’re self-employed, have irregular income, or are facing temporary financial challenges, a HELOC without income verification can be a lifeline. Here’s why:

- No Income Proof Required: Say goodbye to the traditional income verification process, which often involves submitting pay stubs, tax returns, and W-2 forms. With a no-income-verification HELOC, lenders may simply take your word for your income, making the approval process faster and simpler.

- Greater Accessibility: This type of HELOC opens doors for individuals who may not qualify for traditional loans due to non-traditional employment or income fluctuations. It levels the playing field and allows more homeowners to access their home’s equity.

- Streamlined Application: The application process for a HELOC with no income verification is typically streamlined, requiring fewer documents and less paperwork. This means less stress and a quicker turnaround time.

How to Secure a HELOC with No Income Verification

Now that you’re convinced, let’s walk you through the steps to secure a HELOC without income verification:

- Choose a Lender Wisely: Not all lenders offer HELOCs with no income verification, so it’s crucial to shop around and compare different options. Look for lenders specializing in this type of loan and have a solid reputation for customer satisfaction.

- Prepare Your Application: Gather your basic financial information, including bank statements, proof of employment (if applicable), and an estimate of your home’s value. While income verification is not required, lenders may still want to see evidence of your financial stability.

- Submit Your Application: Once you’ve chosen a lender and gathered the necessary documents, submit your application online or in person. Be prepared to provide additional information if requested.

- Await Approval: The approval process for a HELOC with no income verification is generally faster than traditional HELOCs. However, lenders may still need time to review your application and assess your creditworthiness.

- Enjoy Your Financial Flexibility: Once approved, you’ll have access to a credit line that you can tap into as needed. Make sure to use the funds responsibly and make timely payments to avoid any financial pitfalls.

HELOCs with No Income Verification: Pros and Cons

Like any financial product, HELOCs with no income verification come with their own set of advantages and disadvantages. Let’s weigh them out:

Pros:

- No income verification required, making it accessible to a broader range of borrowers.

- Streamlined application process with fewer documents and less paperwork.

- Faster approval times compared to traditional HELOCs.

- Flexibility to borrow against your home equity as needed.

Cons:

- Interest rates may be higher compared to traditional HELOCs due to the added risk.

- Lenders may require a higher credit score and stricter underwriting guidelines.

- You’re using your home as collateral, which means you could lose it if you default on the loan.

In conclusion, a HELOC without income verification can be a powerful financial tool, providing homeowners with flexible access to cash without the traditional income verification hurdles. However, it’s crucial to weigh the pros and cons carefully and ensure you understand the risks involved before taking the plunge. Consult with financial experts, compare offers from multiple lenders, and make an informed decision that aligns with your financial goals and circumstances. Welcome to the world of HELOCs – let’s unlock your home’s hidden financial potential!

Through Portland’s home energy scores Portland, you can find assistance in understanding and improving your home’s energy efficiency.

To meet your specific needs, we at home energy services provide tailored solutions that can help you reduce your energy consumption.

Want to make your home more energy-efficient and comfortable? Look no further than our home energy solutions to save money.

With home energy solutions CT, Connecticut residents can access a range of services to improve their home’s energy efficiency and save money.

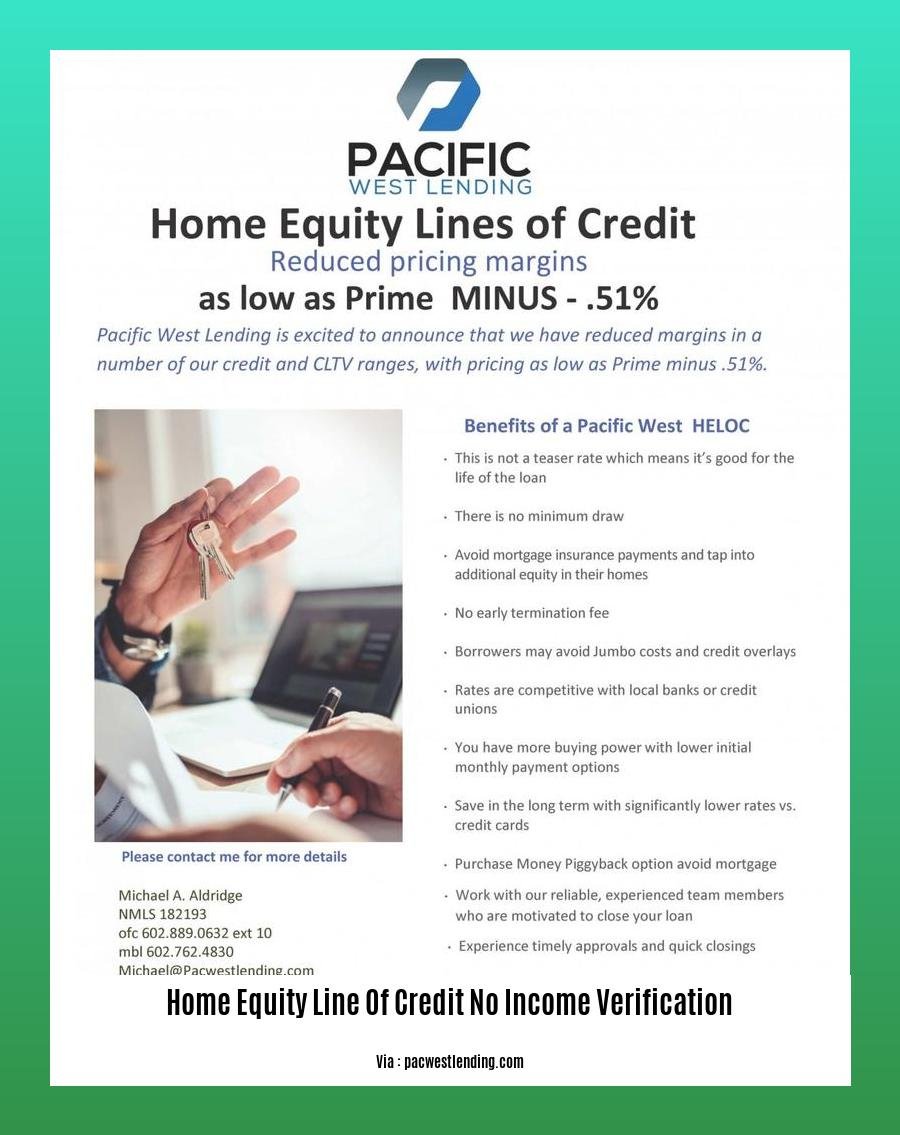

Benefits of a HELOC.

Hey there, savvy reader! Are you curious about the impressive advantages of tapping into your home’s equity with a Home Equity Line of Credit (HELOC)? Strap in, because I’m about to unveil a treasure trove of benefits that might just change your financial game.

Key Takeaways:

- Tax Deductions: Unlike personal loans, the interest paid on HELOCs is tax-deductible, potentially saving you a bundle at tax time. Consult with a tax advisor to confirm eligibility.

- Lower Interest Rates: HELOCs often come with lower interest rates compared to other types of loans, making them a cost-effective way to borrow money.

- Flexibility: With a HELOC, you can access funds as needed, making it a versatile tool for unexpected expenses, home improvements, or debt consolidation.

- Home Value Appreciation: As your home’s value increases over time, so does your borrowing power with a HELOC. This means you can access more funds if needed.

- No Income Verification: No-income verification HELOCs offer accessibility to those who may not have traditional income sources or face income fluctuations.

So, let’s dive a little deeper into each of these benefits, shall we?

-

Tax Advantages: With a HELOC, the interest you pay is tax-deductible, potentially saving you money come tax season. This deduction can significantly reduce the overall cost of borrowing.

-

Lower Interest Rates: Compared to other loans, HELOCs typically have lower interest rates, making them an attractive option for those seeking affordable financing.

-

Flexibility and Convenience: A HELOC functions like a credit card with a revolving line of credit. Access funds as needed, whether it’s for home renovations, education expenses, or consolidating debt.

-

Home Equity Growth: As your home’s value increases, so does your available credit line. This means you can potentially access more funds over time if you need them.

-

No Income Verification: No-income verification HELOCs cater to individuals who may not have traditional income sources or face fluctuating income. This option offers greater accessibility to those who might not qualify for traditional loans.

With these incredible advantages, it’s no wonder why HELOCs have become increasingly popular among homeowners seeking financial flexibility and cost-effective borrowing solutions. If you’re a homeowner looking to harness the power of your home equity, a HELOC might just be the key to unlocking your financial potential.

Relevant URL Sources:

- No-Income Verification HELOCs: A Guide for Homeowners

- HELOC: Pros and Cons

Risks of a HELOC

Unlocking Your Home’s Hidden Financial Potential

In the realm of home equity opportunists, the HELOC (Home Equity Line of Credit) emerges as a potent tool that can materialize your vision and turn your aspiration for financial stability into reality. But alongside its many benefits, It’s not without its risks that need in-depth consideration. It’s like walking a tightrope, balancing the liberating access to funds against the potential pitfalls that can await the unwise.

Key Takeaways:

-

Mortgaging Your Home: With a HELOC, you’re effectively mortgaging your home, potentially exposing it to foreclosure if you’re unable to repay the loan.

-

Interest Rate Pitfalls: No income verification HELOCs often come with higher interest rates, adding to your financial burden and potentially leading to a cycle of debt.

-

Domino Effects: If the housing market takes a downturn, it can potentially reduce your home’s value, making it difficult to repay your HELOC and putting your home at risk.

-

Loan Defaults: Defaults on your HELOC can have severe consequences, including damaged credit, difficulty securing future loans, and ultimately, the loss of your home.

-

Overborrowing Trap: Without income verification, it’s easy to get caught in the trap of overborrowing, leading to financial distress and an overwhelming debt burden.

The High-Interest Conundrum:

No income verification HELOCs often bear higher interest rates compared to traditional income-verified HELOCs. It’s like paying a premium for the convenience of bypassing the income verification process. This can significantly increase your borrowing costs and make it more challenging to manage your finances.

Temptation’s Allure:

The ease of accessing funds through a HELOC can sometimes lead to overborrowing. With a stroke of a pen, you can tap into your home’s equity, fostering the temptation to spend beyond your means. This can be especially true for individuals who are struggling financially.

House Price Plunges:

The value of your home is of paramount importance when it comes to a HELOC. If the housing market takes a downturn, your home’s value could decline. This can put you in a precarious situation, where you owe more on your HELOC than your home is worth.

Facing Foreclosure’s Haunting Reality:

Failure to repay your HELOC can lead to the dreaded foreclosure, resulting in the loss of your home. This can have catastrophic consequences, not only financially but also emotionally.

Navigating the HELOC Maze:

It’s imperative to tread cautiously and navigate the HELOC maze with prudence. Before delving into this financial odyssey, seek the counsel of financial advisors and experts who can help you assess your financial situation, determine if a HELOC is the right fit, and guide you towards a path of financial well-being.

Sources:

How to get a HELOC without income verification.

Home equity lines of credit (HELOCs) are a great way to access cash when you need it. They’re secured loans, meaning you use your home as collateral. The amount of money you can borrow is based on your home’s equity, which is the difference between your home’s value and the amount you owe on your mortgage.

In the past, you would have to provide proof of income to get a HELOC. But now, there are lenders who offer HELOCs with no income verification. This means that you can qualify for a HELOC even if you don’t have a traditional job.

Key Takeaways:

- HELOCs with no income verification are loans secured by your home equity, allowing you to borrow funds without providing documentation of income.

- No income verification HELOCs offer simplified application processes and quicker approval times, making them accessible to individuals with non-traditional employment or income sources.

- While offering more flexible qualification criteria, no income verification HELOCs may come with higher interest rates and stricter underwriting guidelines.

- It’s essential to assess your financial situation and repayment capacity before opting for a HELOC to ensure responsible borrowing and avoid potential risks.

How do you get a HELOC without income verification?

The process of getting a HELOC without income verification is similar to the process of getting a traditional HELOC. You’ll need to:

- Find a lender who offers HELOCs with no income verification.

- Apply for a HELOC. You’ll need to provide the lender with your personal information, financial information, and information about your home.

- Get approved for a HELOC. The lender will review your application and decide whether or not to approve you for a HELOC.

- Close on your HELOC. Once you’re approved for a HELOC, you’ll need to close on the loan. This involves signing the loan documents and paying any closing costs.

What are the benefits of a HELOC with no income verification?

There are several benefits to getting a HELOC with no income verification. These benefits include:

- Easier to qualify for. If you don’t have a traditional job, or if you have irregular income, you may not be able to qualify for a traditional HELOC. A HELOC with no income verification can be a good option for you.

- Faster approval process. The application process for a HELOC with no income verification is typically faster than the application process for a traditional HELOC. This is because the lender doesn’t have to verify your income.

- More flexible repayment options. HELOCs with no income verification often have more flexible repayment options than traditional HELOCs. This can make it easier for you to repay the loan.

Citation:

FAQ

Q1: What are the advantages of a home equity line of credit (HELOC) without income verification?

A1: A HELOC with no income verification provides homeowners with flexible access to funds based on their home equity, potentially at lower interest rates than other loans. It eliminates the need for traditional income documentation, making it more accessible to self-employed individuals or those with non-traditional income sources.

Q2: How can I qualify for a HELOC without income verification?

A2: To qualify for a HELOC without income verification, lenders typically assess factors such as your loan-to-value (LTV) ratio, credit history, and available home equity. A good credit score, a history of timely debt payments, and sufficient equity in your home are generally required.

Q3: Are there risks associated with a HELOC without income verification?

A3: Yes, there are potential risks associated with a HELOC without income verification. Due to the perceived increased risk, these HELOCs often come with higher interest rates compared to traditional HELOCs. Additionally, there’s a risk of overborrowing, unpredictable monthly payments due to variable interest rates, and the possibility of losing your home if you can’t repay the loan.

Q4: Can I still get a HELOC if I don’t meet the income verification requirements?

A4: If you don’t qualify for a no-income verification HELOC, there are alternative loan options available. These may include stated income loans, stated income verified asset (SIVA) loans, no income, no asset (NINA) loans, and reverse mortgages. Each option has its own eligibility criteria and requirements.

Q5: What are the typical interest rates for a HELOC without income verification?

A5: HELOCs without income verification often have higher interest rates than traditional HELOCs due to the perceived increased risk. The exact interest rate you qualify for will depend on your creditworthiness, LTV ratio, and the current market conditions. Be sure to compare rates from multiple lenders to find the best deal.

- Black Backsplash Ideas: Stylish Kitchen Transformations to Inspire You - November 8, 2025

- Dark Backsplash Ideas: Drama and Depth for Your Kitchen - November 7, 2025

- Black Backsplash Tile: Find The Perfect Style For Your Kitchen - November 6, 2025