Discover the intricacies of home equity line of credit stated income applications with our comprehensive guide. Learn the ins and outs of leveraging your home equity under – [A Guide to Home Equity Line of Credit Stated Income Applications].

Key Takeaways:

- Stated Income HELOCs allow homeowners to borrow against home equity without income verification.

- Equity determines the credit limit.

- Convenient for self-employed individuals or entrepreneurs with difficulty documenting income.

- Lenders may still request income-related documents like pay stubs or bank statements.

Home Equity Line of Credit Stated Income

Understanding home equity line of credit stated income applications is crucial, so let’s break it down.

What is a stated income HELOC?

A home equity line of credit stated income (HELOC) lets you borrow money against your home’s equity without providing income verification documents. Lenders assess your home’s value and equity to determine your credit limit.

Who can benefit from a stated income HELOC?

This type of HELOC is suitable for self-employed individuals or business owners who may have difficulty providing traditional income documentation.

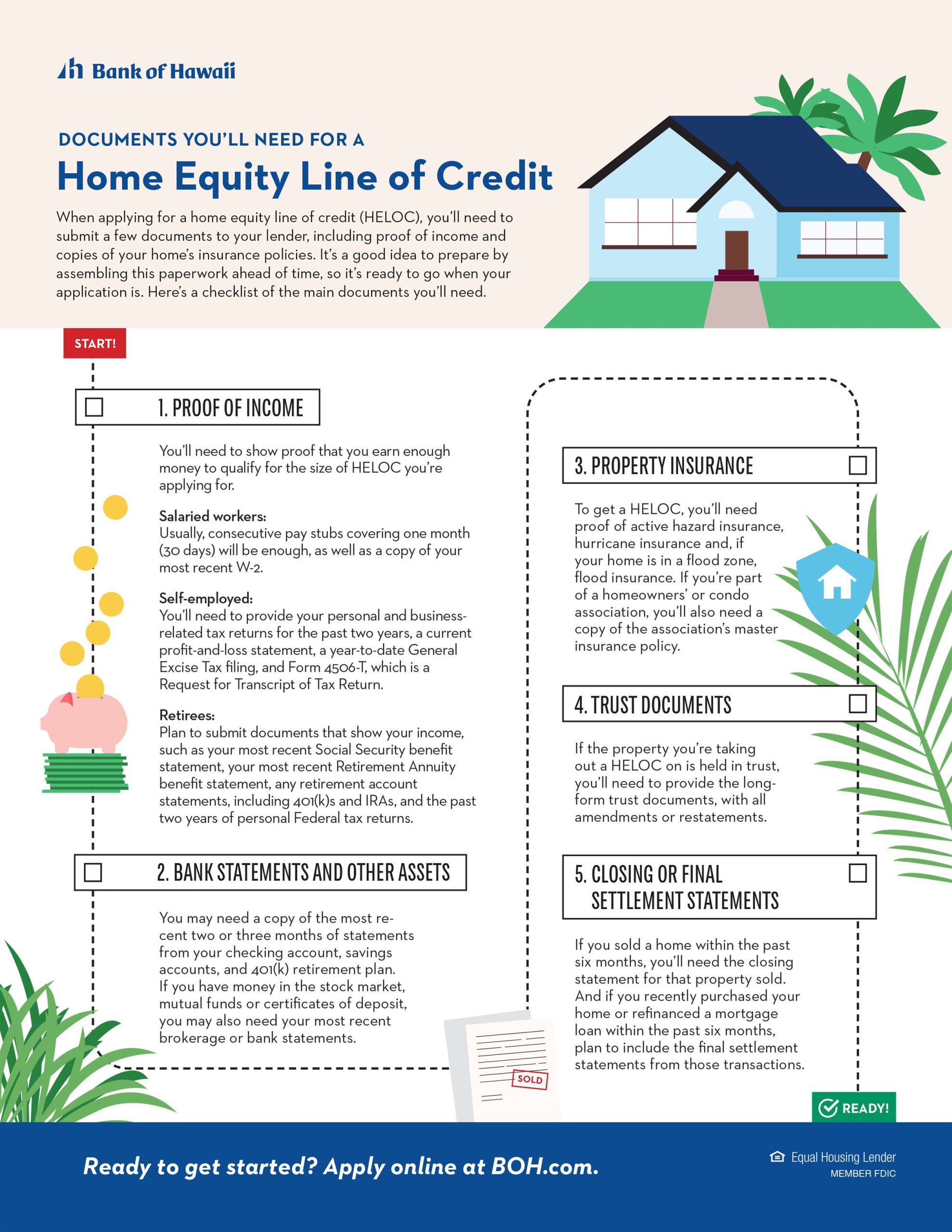

How to apply for a stated income HELOC:

- Check your credit: Lenders will check your credit score and history to assess your financial health.

- Gather documents: Collect your home’s appraisal, mortgage statement, and other relevant documents.

- State your income: Clearly state your income and sources in the application. Note that lenders may still ask for supporting documents.

- Underwrite your application: Lenders will review your information and assess your eligibility based on your stated income and home’s equity.

Pros and Cons of a Stated Income HELOC:

Pros:

- No proof of income required

- Convenient for self-employed individuals

- Access to additional funds

Cons:

- Higher interest rates than traditional HELOCs

- May require more documentation than advertised

- Risk of denial if income is overstated

Remember:

Stated income HELOCs are a useful tool for accessing funds, but it’s essential to be honest about your financial situation. Overstating your income can lead to denial or other issues down the road.

Searching for a home elevator? Concerned about the price? To learn more about the home elevator price in india, click the link! Curious about the home elevator price philippines, follow the link! Want to optimize your home entertainment experience with our professional home entertainment installation services? Click here to know more. Looking for competitive home equity loan rates huntington? Get detailed information by clicking here. Are you considering home equity loans for manufactured homes? Check out this link to explore your options!

Eligibility Requirements for Stated Income HELOCs

When applying for a stated income HELOC, it’s crucial to meet certain eligibility requirements:

- Homeownership with sufficient equity: You must own a home with enough value to qualify for a line of credit.

- Good credit score: Lenders generally seek a score above a specific threshold to assess your creditworthiness.

- Documentation of property ownership and occupancy: Proof of ownership and residency, such as a mortgage statement or property tax bill, is required.

- Meeting additional lender requirements: Lenders may have specific guidelines regarding debt-to-income ratios, employment history, or other financial factors.

Steps to Apply for a Stated Income HELOC:

- Check your credit: Obtain a copy of your credit report and address any discrepancies or errors.

- Gather documentation: Collect necessary documents such as a home appraisal, mortgage statement, and proof of income (even though it may not be verified).

- State your income and sources: Honestly disclose your income and sources, including any self-employment or business revenue.

- Lender review: Lenders will evaluate your application based on your stated income, home equity, and other financial factors.

Pros and Cons of Stated Income HELOCs:

Pros:

- No proof of income required, making it suitable for self-employed individuals.

- Convenience in accessing additional funds.

Cons:

- Higher interest rates compared to traditional HELOCs.

- May require more documentation than expected.

- Risk of denial if income is overstated.

Key Takeaways:

- Good credit score, home equity, and documentation are essential for eligibility.

- Stated income HELOCs offer convenience but come with higher interest rates.

- It’s crucial to be honest about your income and financial situation.

Citations:

- Dream Home Financing: Stated Income HELOC Options for 2024

- The Mortgage Reports: Home Equity Line Of Credit Requirements | HELOC Guidelines

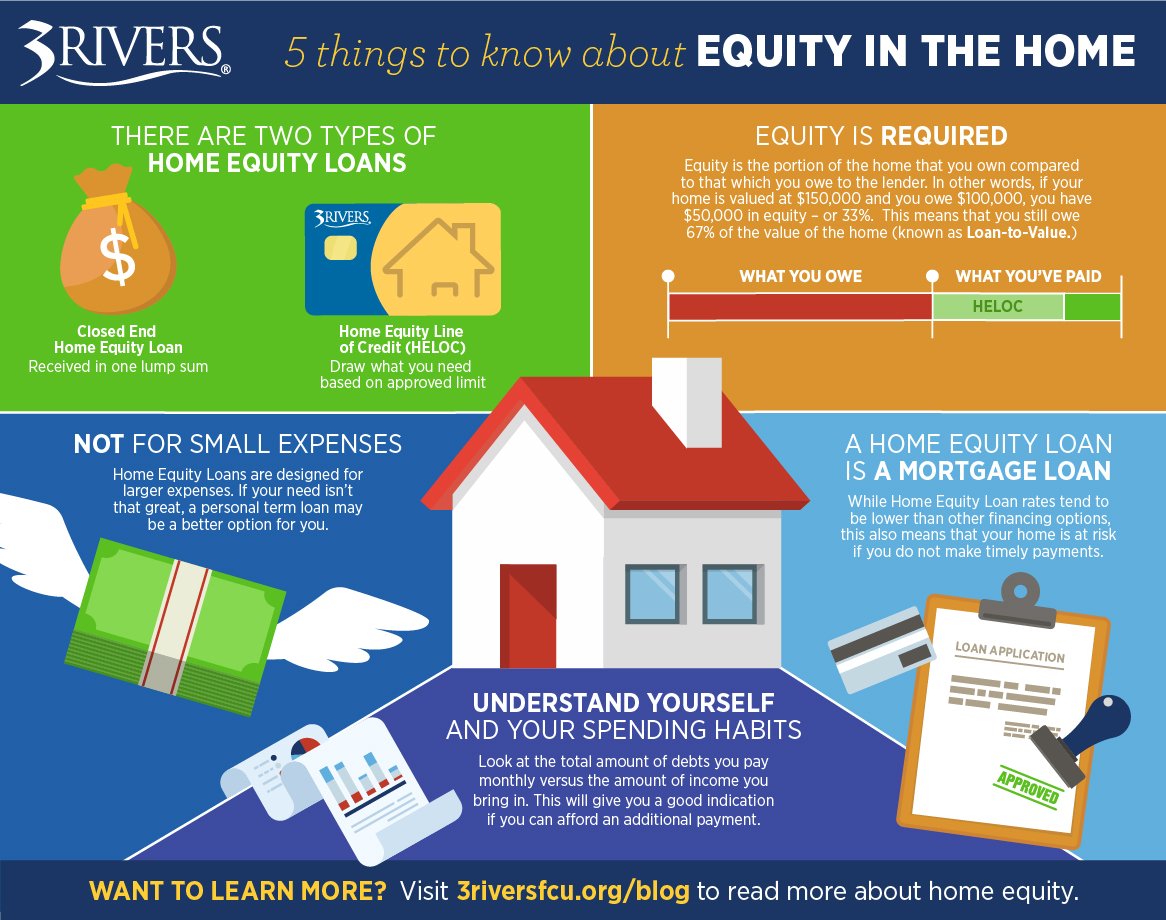

Comparison of Stated Income HELOCs with Traditional HELOCs

If you’re considering a home equity line of credit (HELOC), you’ll have two main options: stated income HELOCs and traditional HELOCs. Here’s a breakdown of each and how they stack up against each other:

Stated Income HELOCs

- Definition: A HELOC that allows you to borrow against your home equity without providing proof of income.

- Pros:

- Easier application process: No need to provide pay stubs or tax returns.

- Ideal for self-employed individuals and business owners: Can be challenging to document income for these borrowers.

- Access to funds: Use the funds for home improvements, debt consolidation, or other expenses.

- Cons:

- Higher interest rates: Lenders charge higher rates for stated income HELOCs due to the increased risk.

- Limited availability: Fewer lenders offer stated income HELOCs.

- Documentation requirements: Lenders may still require other documents, such as bank statements or asset statements.

Traditional HELOCs

- Definition: A HELOC that requires you to provide proof of income and other financial documents.

- Pros:

- Lower interest rates: Generally offer lower rates than stated income HELOCs.

- More widely available: Most lenders offer traditional HELOCs.

- Established guidelines: Eligibility requirements and underwriting process are well-defined.

- Cons:

- Lengthy application process: Requires gathering and submitting financial documents.

- Income verification: Can be a challenge for borrowers with inconsistent income.

- Limited flexibility: Lenders may have restrictions on how the funds can be used.

Key Takeaways:

- Stated income HELOCs offer a quicker and easier application process but come with higher interest rates.

- Traditional HELOCs require proof of income and have lower interest rates but involve a more extensive application process.

- The best choice for you will depend on your individual financial situation and needs.

Relevant URL Sources:

Dream Home Financing: Stated Income HELOCs

The Mortgage Reports: Home Equity Line of Credit Requirements

Tips for getting approved for a stated income HELOC

If you’re looking to tap into your home equity to finance a project or consolidate debt, a stated income HELOC could be a good option. These loans allow you to borrow against your home’s value without providing proof of income, making them a good choice for self-employed individuals or business owners who may not have traditional sources of income.

Here are a few tips to help you get approved for a stated income HELOC:

Key Takeaways:

- Provide adequate documentation to support your financial situation.

- Maintain a strong credit score.

- Build up equity in your home.

- Be honest about your financial situation.

- Consider getting pre-approved to see what you qualify for.

Sources:

– Stated Income HELOCs For 2024 – Refi.com

– The Ultimate Guide to Stated Income Loans – SmartAsset

FAQ

Q1: What are the benefits of a stated income HELOC?

A1: Stated income HELOCs offer convenience and flexibility, as they do not require proof of income. Additionally, they provide quick access to funds for various financial needs and allow homeowners to leverage their home equity without facing income verification.

Q2: Who is eligible for a stated income HELOC?

A2: Individuals with sufficient home equity, a good credit score, and meet additional lender requirements may be eligible for a stated income HELOC. Self-employed individuals or entrepreneurs who may face challenges providing traditional income documentation often find this option suitable.

Q3: Are stated income HELOCs risky?

A3: Like any financial product, stated income HELOCs carry potential risks. Missed payments or high credit utilization can impact credit scores and increase the risk of foreclosure. It is crucial to carefully consider the terms and obligations before applying for a HELOC to ensure it aligns with your financial situation and goals.

Q4: How do I apply for a stated income HELOC?

A4: The application process for a stated income HELOC typically involves providing basic personal and financial information, including proof of homeownership and occupancy. Lenders may request additional documentation to verify your financial stability, such as bank statements or asset statements.

Q5: What are the fees associated with a stated income HELOC?

A5: Fees associated with a stated income HELOC may include an application fee, an origination fee, an annual fee, and closing costs. It is essential to compare the fees offered by different lenders and factor them into your financial considerations before making a decision.

- Dora the Explorer Wipe-Off Fun: Safe & Mess-Free Activities for Little Explorers - April 18, 2025

- Does Lemongrass Repel Mosquitoes? Fact vs. Fiction + How to Use It - April 18, 2025

- Do Woodchucks Climb Trees?Fact vs. Fiction - April 18, 2025