Uncover the secrets to maximizing tax savings with the comprehensive guide to mastering the Home Office Deduction Worksheet. This ultimate resource provides a step-by-step approach, meticulously crafted to simplify the process and ensure accurate deductions of eligible expenses. Whether you’re a seasoned tax professional or a homeowner exploring tax benefits, this guide empowers you to navigate the complexities of the tax code confidently. Dive in and optimize your tax savings strategy with the expert insights found within [-Master the Home Office Deduction Worksheet: A Comprehensive Guide for Maximizing Tax Savings]

Key Takeaways:

-

The home office deduction lets small business owners deduct part of home-related expenses, including mortgage interest, insurance, utilities, repairs, and depreciation.

-

To calculate the deduction, determine the percentage of your home used for business purposes.

-

Use the actual expenses method to deduct the real costs for your home office, up to the net income from your business.

-

Use the simplified method to deduct a $5 per square foot flat rate for the business part of your home.

Home Office Deduction Worksheet

Navigating the complexities of the home office deduction worksheet can be daunting, but it doesn’t have to be. With careful planning and a clear understanding of the rules, you can maximize your tax savings and streamline the process. Let’s break it down step by step:

1. Eligibility: Are You Qualified?

- Evaluate your business operations. Is your home office your primary place of business? Ensure it’s not merely a place where you occasionally handle paperwork.

- You must use part of your home regularly and exclusively for business activities. A spare bedroom converted into a home office meets this criterion.

2. Choosing the Calculation Method:

- Actual Expenses Method:

- Calculate your home’s percentage used for business. Divide the area dedicated to business by the total square footage.

- Deduct the percentage of eligible expenses, such as mortgage interest, insurance, utilities, repairs, depreciation, and maintenance.

-

Keep meticulous records of all expenses and receipts.

-

Simplified Option:

- A simpler approach, allowing you to deduct $5 per square foot for business use, up to a maximum of 300 square feet.

- Convenient, but may not be as advantageous if you have substantial home expenses.

3. Calculating the Business-Use Percentage:

- Define the area of your home used for business.

- Divide the business area square footage by the total square footage of your home.

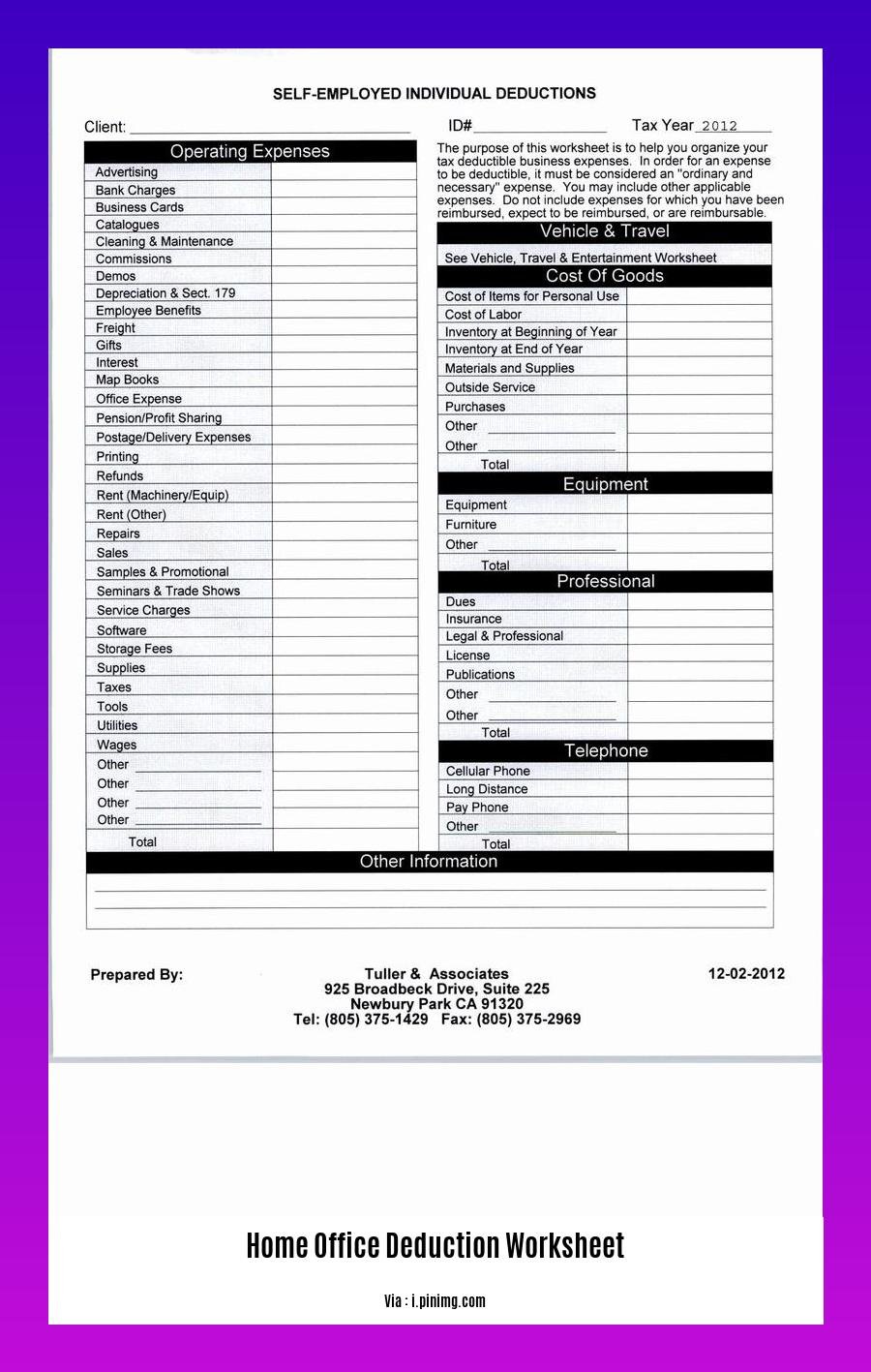

4. Direct and Indirect Expenses

- Direct Expenses:

- Costs directly related to the business portion of your home. Examples include mortgage interest, insurance, repairs, maintenance, and utilities.

- Calculate the percentage of direct expenses you can deduct based on the business-use percentage.

- Indirect Expenses:

- Costs shared between personal and business use, such as property taxes, depreciation, rent, and utilities.

- Allocate a portion of these expenses to business use based on the business-use percentage.

5. Record Keeping and Documentation:

- Gather receipts, bills, and invoices related to your home office expenses.

- Keep a detailed log of all business activities conducted in your home office.

6. Form 8829: The Key to Claiming Your Deduction

- Use Form 8829 to report your home office deduction worksheet calculations.

- Attach Form 8829 to your individual income tax return.

7. Common Pitfalls to Avoid:

- Don’t deduct expenses for personal use.

- Keep personal and business expenses separate.

- Avoid claiming a home office deduction if you don’t meet the requirements.

By following these steps and understanding the home office deduction worksheet, you can ensure accurate and compliant deductions, maximizing your tax savings while maintaining adherence to IRS guidelines.

-

Want to connect with the Home Office in the comfort of your own home? Look no further! Discover the dedicated home office contact number to address all your immigration-related queries, ensuring efficient communication from the convenience of your living room.

-

Searching for a direct line to the Home Office in Leeds? Your quest ends here! Reach out to the home office contact number leeds to connect with knowledgeable representatives who will assist you in navigating immigration processes seamlessly, ensuring your queries are answered promptly.

-

Wondering how much you need to shell out for a spouse visa? Uncover the home office fee for spouse visa and plan your finances accordingly. Avoid surprises and stay informed to make this crucial step towards family unity a smooth and successful journey.

-

Need to get in touch with the Home Office located in the vibrant city of Glasgow? Look no further! Save time and effort with the home office glasgow contact number, providing direct access to a knowledgeable team ready to guide you through your immigration concerns with expertise and efficiency.

Calculate Your Direct Expenses

Let’s delve into the nitty-gritty of calculating direct expenses related to your home office, a crucial component of maximizing tax savings as a self-employed business owner.

To begin the calculation process, gather all relevant documentation, including receipts, bills, and invoices associated with expenses directly attributable to your home office. These expenses may include mortgage interest, property taxes, utilities, repairs and maintenance, and insurance. Keep in mind that expenses related to personal use are not deductible.

Once you have gathered the necessary documentation, follow these steps to calculate your direct expenses:

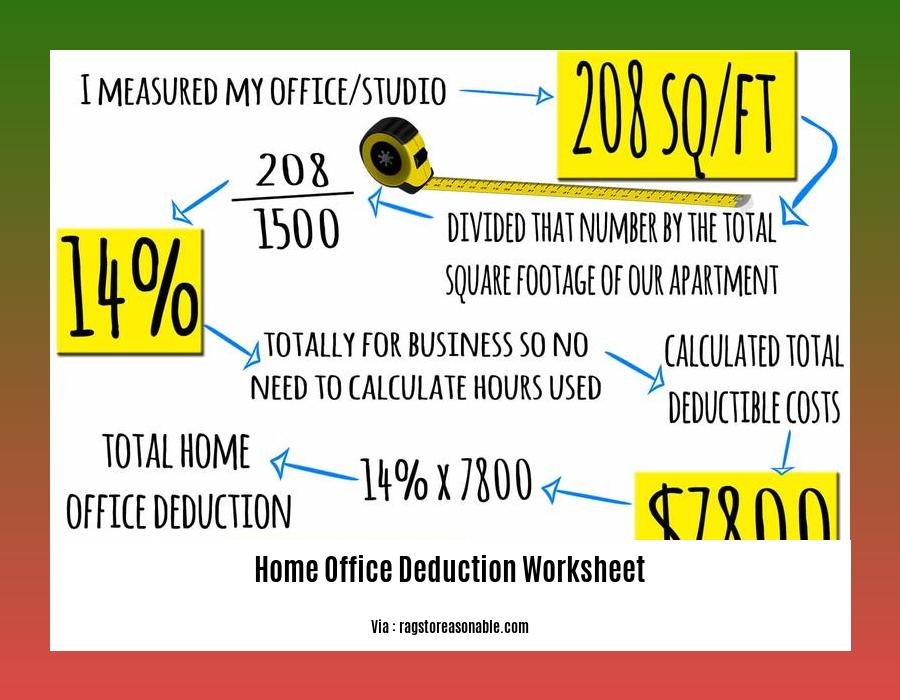

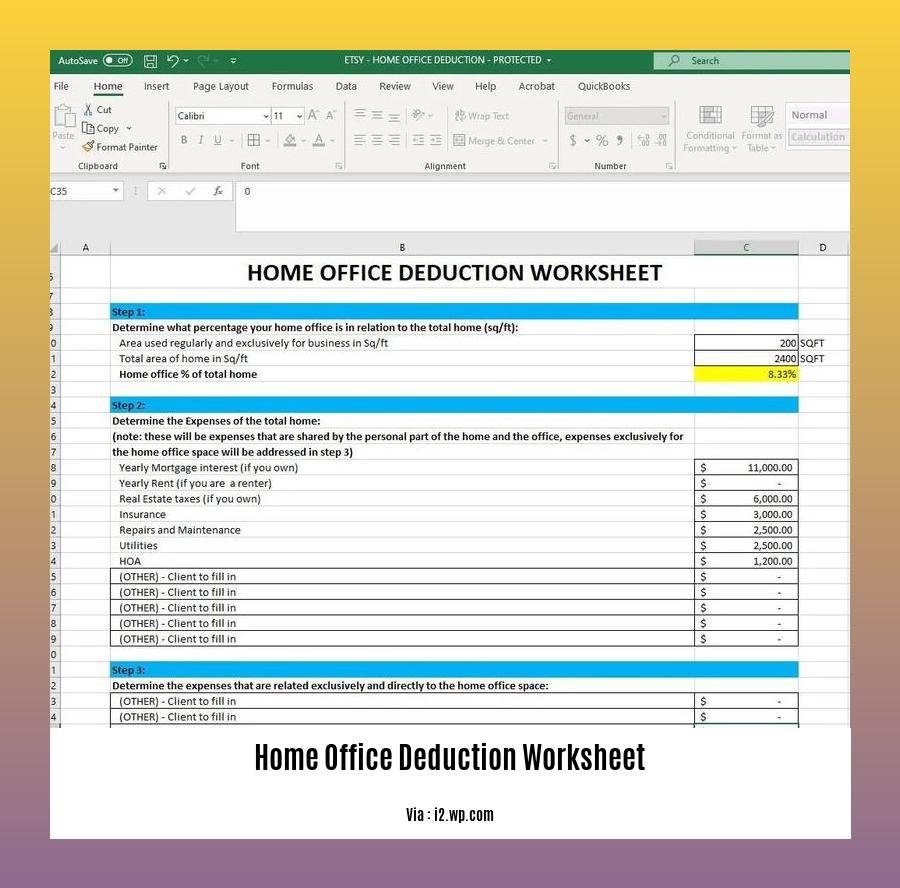

Step 1: Determine the Percentage of Home Used for Business

Divide the area square footage of your home office by the total square footage of your home to determine the percentage of your home used for business purposes.

Step 2: Calculate Direct Expenses

Multiply each eligible direct expense by the percentage calculated in Step 1 to determine the deductible portion of the expense.

For example, if your mortgage interest for the year is $12,000 and your home office occupies 20% of your home, you can deduct 20% of the mortgage interest, which is $2,400.

Step 3: Total Direct Expenses

Sum up all the deductible portions of each direct expense to arrive at the total direct expenses for your home office.

Step 4: Use Form 8829

Utilize IRS Form 8829 to report your home office deduction calculations. Attach this form to your individual income tax return to claim the deduction.

Key Takeaways:

- Calculate direct expenses using the percentage of home used for business purposes.

- Eligible direct expenses include mortgage interest, property taxes, utilities, repairs, and maintenance, and insurance.

- Use IRS Form 8829 to report home office deduction calculations.

Citation:

[1] The Balance: What Is the Home Office Tax Deduction (and How To Calculate It)

[2] Keeper: The Best Home Office Deduction Worksheet for Excel [Free Template]

Calculate Indirect Expenses

Calculating indirect expenses for your home office deduction can be a bit tricky, but it’s definitely doable. Here are the steps you need to take:

-

Categorize Your Expenses: Start by dividing your home-related expenses into two categories: direct and indirect. Direct expenses are those that are exclusively used for your home office, such as a dedicated internet connection or a new desk. Indirect expenses are those that are shared between personal and business use, such as utilities or property taxes.

-

Determine Your Business-Use Percentage: Once you’ve categorized your expenses, you need to figure out what percentage of your home is used for business. This is called your business-use percentage. To calculate this, you can use the following formula:

Business-Use Percentage = (Square Footage of Home Office ÷ Total Square Footage of Home) x 100%

For example, if your home office is 200 square feet and your total home is 2,000 square feet, your business-use percentage would be 10%.

-

Allocate Indirect Expenses: Now, it’s time to allocate your indirect expenses based on your business-use percentage. To do this, simply multiply each indirect expense by your business-use percentage. For example, if your electric bill is $100 per month and your business-use percentage is 10%, your deductible indirect expense would be $10 ($100 x 10%).

-

Record Your Expenses: As you incur business-related expenses, be sure to keep detailed records. This includes receipts, invoices, and canceled checks. You’ll need these records to support your home office deduction when you file your taxes.

Key Takeaways:

- You can deduct a portion of your indirect expenses, such as utilities and property taxes, if you use part of your home for business.

- To calculate your business-use percentage, divide the square footage of your home office by the total square footage of your home.

- You can choose to use the regular method or simplified option to calculate your home office deduction.

- The simplified option allows you to deduct a flat rate of $5 per square foot of your home office, up to a maximum of 300 square feet.

Relevant URL Sources:

Complete the Home Office Deduction Worksheet

So, you’ve got a home office and you’re wondering how to make the most of it come tax time? Let’s dive into the home office deduction worksheet and uncover the secrets to maximizing your tax savings.

Key Takeaways:

- The home office deduction worksheet is the key to claiming eligible expenses related to your home office space.

- Direct expenses are 100% deductible, while indirect expenses are deductible based on the percentage of business use of your home.

- To calculate the business-use percentage, you’ll need to determine the square footage of your home office and the total square footage of your home.

- You can use either the simplified option or the regular method to calculate your home office deduction.

- Keep meticulous records of all your home office expenses and business activities for future reference.

The Nitty-Gritty:

- Direct vs. Indirect:

- Direct expenses are those solely related to your home office, such as mortgage interest or insurance, and they’re 100% deductible.

-

Indirect expenses are shared between personal and business use, such as utilities, and are deductible based on the business-use percentage.

-

Calculating Business-Use Percentage:

- Determine the square footage of your home office.

- Calculate the total square footage of your home.

- Divide the home office square footage by the total home square footage.

-

The result is your business-use percentage.

-

Choosing Your Method:

- Simplified Option: Multiply the business-use percentage by the total square footage of your home office and then multiply that number by $5. This is your deduction.

-

Regular Method: List all your home-related expenses and then multiply each expense by the business-use percentage. The total of these amounts is your deduction.

-

Record Keeping:

- Keep receipts, bills, and invoices for all your home office expenses.

-

Maintain a detailed log of all business activities conducted in your home office.

-

Form 8829:

- Use Form 8829 to calculate your home office deduction.

- Attach Form 8829 to your individual income tax return.

By following these steps and staying organized throughout the year, you’ll be able to complete the home office deduction worksheet accurately and claim the maximum allowable deduction come tax time.

Relevant Source

Relevant Source

FAQ

Q1: What are the two methods for calculating the home office deduction?

A1: The two methods are the actual expenses method and the simplified option. With the actual expenses method, you can deduct the actual expenses that you incur for your home office, up to the amount of your net income from your business. The simplified option allows you to deduct a flat rate of $5 per square foot for the part of your home that you use for business purposes.

Q2: How do I determine the percentage of my home that is used for business purposes?

A2: You can use the business-use percentage calculator section of the home office deduction worksheet to determine this. To do this, you will need to provide information about the total square footage of your home, the square footage of the space you use for business, and the number of hours you use the space for business purposes.

Q3: What expenses can I deduct using the actual expenses method?

A3: You can deduct a portion of expenses such as mortgage interest, insurance, utilities, repairs, maintenance, depreciation, rent, and insurance.

Q4: Is there a limit to the amount of home office deduction I can claim?

A4: Yes, there is a limit. The maximum deduction for the home office is $1,500. This limit applies to both the actual expenses method and the simplified option.

Q5: Who is eligible for the home office deduction?

A5: The home office deduction is available to both employees and self-employed individuals. However, in order to qualify for the deduction, you must use your home office regularly and exclusively for business purposes.

- Greenhouse Storage Shed Combos: Your Guide to Combining Growing and Storage - April 21, 2025

- Greenhouse Shed Combo: Design, Build & Grow Year-Round - April 21, 2025

- Gingham vs. Plaid: What’s the Difference? A Complete Guide - April 21, 2025