Prepare to safeguard your residential construction projects with this comprehensive guide to home warranty insurance for builders. Dive into the intricacies of warranty insurance, including considerations, definitions, and mechanisms. Understand how it protects you against liabilities and ensures homeowner satisfaction. Empower yourself with the knowledge to mitigate risks and deliver exceptional homes that stand the test of time. [- Home Warranty Insurance for Builders: A Comprehensive Guide] is your essential resource for navigating the complexities of insurance policies and ensuring the success of your construction endeavors.

Key Takeaways:

- Builders home warranty insurance protects homeowners from financial losses caused by incomplete or defective workmanship.

- It is legally required for new or renovated homes.

- Coverage includes workmanship and materials for specific time periods, ranging from one to ten years.

- The insurance ensures that the home is livable and meets homeowners’ expectations.

Home Warranty Insurance for Builders

Home warranty insurance for builders is a crucial safeguard that protects builders from financial losses due to incomplete or defective workmanship. It’s a mandatory requirement for newly built or renovated homes, ensuring homeowners’ peace of mind and satisfaction.

Coverage Details

Home warranty insurance typically covers:

- Workmanship and materials for specific limited periods (e.g., one to two years for specific areas, ten years for major structural components)

- Habitable conditions of the home

- Meeting homeowner expectations

Benefits of Home Warranty Insurance

- Protection from unexpected costs due to defects or incomplete work

- Enhanced credibility and reputation as a reliable builder

- Assurance to homeowners of the quality and durability of their homes

- Increased marketability of your properties

How to Obtain Home Warranty Insurance

- Select a reputable insurance provider: Research companies with a strong track record in home warranty insurance for builders.

- Gather necessary documentation: Provide detailed project plans, building specifications, and financial statements.

- Review the policy thoroughly: Ensure you understand the coverage terms, limits, and exclusions.

- Negotiate premiums: Engage in discussions with the insurer to determine a competitive premium that meets your budget.

- Renew promptly: Maintain your coverage by renewing the policy before its expiration date.

Conclusion

Home warranty insurance for builders is an essential investment that safeguards your business and provides homeowners with the security they deserve. By understanding the coverage details, benefits, and process of obtaining this insurance, you can proactively manage risks and deliver high-quality homes that meet customer expectations.

Thinking about building your own home? Make sure it’s protected with home warranty insurance for owner builders that covers accidents, unforeseen mishaps, and repairs.

Are you looking for ways to protect your home while you’re away? We’ve got you covered with home watch services that provides peace of mind with timely inspections, maintenance, and emergency response services at competitive home watch services prices.

Harness the power of nature with a home wind generator that can reduce your energy costs and provide sustainable backup power. Home wind turbine price might vary depending on the model and size, but it’s an investment worth considering for long-term savings and environmental benefits.

How Does Warranty Insurance Work?

Imagine embarking on the thrilling journey of constructing a beautiful home, only to encounter unforeseen hurdles that threaten to derail your dreams. As a savvy builder, you understand the importance of protecting your project and ensuring the satisfaction of your clients. That’s where warranty insurance steps in!

Unveiling the Essence of Warranty Insurance

In the realm of residential construction, warranty insurance serves as a safety net for homeowners, providing coverage against potential issues that may arise during the construction process. How Does Warranty Insurance Work? Simply put, it’s like an insurance policy specifically tailored to safeguard builders and homeowners.

Ensuring Project Completion

Picture this: during construction, the unthinkable happens—the builder encounters unforeseen circumstances that hinder them from completing the work. Homeowners can rest assured knowing that warranty insurance will step in to cover the remaining expenses, ensuring the timely completion of their dream home.

Protecting Against Hidden Defects

Sometimes, despite meticulous planning and craftsmanship, construction projects can face unexpected challenges. Warranty insurance provides peace of mind by covering hidden defects that may emerge after the construction is finished. This ensures that homeowners can enjoy their new abode worry-free for years to come.

Safeguarding Against Liability

As a builder, you’re constantly striving to deliver quality work. However, unforeseen events can occur, leaving you vulnerable to legal claims. Warranty insurance acts as a shield, protecting you from financial setbacks and preserving your reputation.

Key Takeaways:

- Warranty insurance provides coverage for homeowners in case of incomplete or defective construction.

- It protects builders from liability and ensures project completion.

- Warranty insurance covers hidden defects that may arise after construction is finished.

Sources:

- What is home warranty insurance | Queensland Home Warranty Scheme

- Home Builders Warranty Insurance Explained – ibuildnew.com.au

FAQ

Q1: What is warranty insurance in construction?

A1: Warranty insurance for builders protects homeowners against financial losses due to incomplete or defective workmanship. It is mandatory for homes being built or extensively renovated.

Q2: How does warranty insurance work?

A2: Warranty insurance provides coverage for a limited time, typically one to two years for certain areas and 10 years for major structural components. It ensures the home is habitable and meets the homeowner’s expectations.

Q3: What does warranty insurance cover?

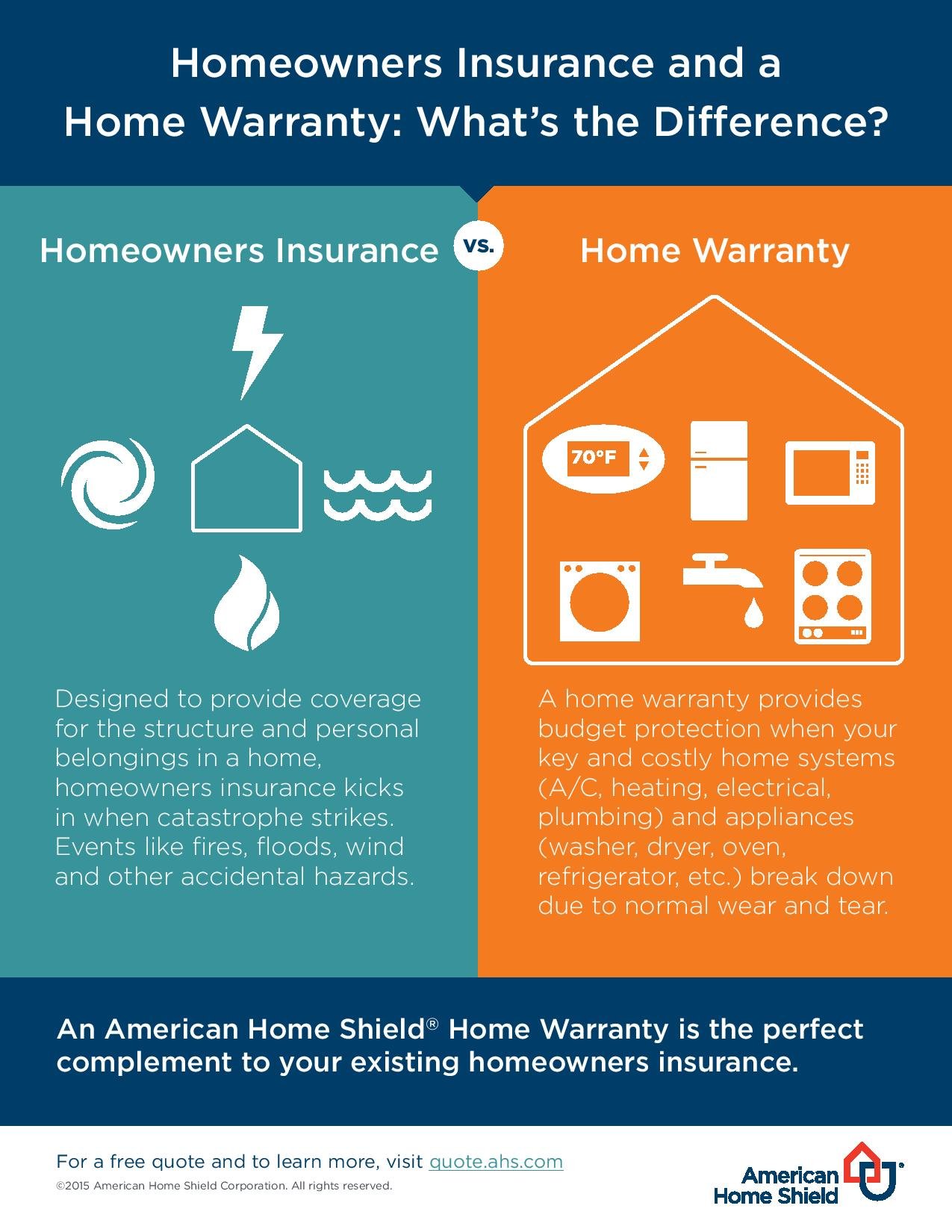

A3: Warranty insurance covers issues related to workmanship and materials, including structural defects, water damage, and electrical problems. It does not typically cover appliances.

Q4: Why is warranty insurance important for builders?

A4: Warranty insurance protects builders from potential liabilities and ensures homeowner satisfaction. It can also enhance a builder’s reputation and credibility.

Q5: How can builders choose the right warranty insurance policy?

A5: Builders should consider factors such as the coverage limits, terms, and exclusions when selecting a warranty insurance policy. It is recommended to consult with an insurance professional to determine the most suitable coverage for their needs.

- Dora the Explorer Wipe-Off Fun: Safe & Mess-Free Activities for Little Explorers - April 18, 2025

- Does Lemongrass Repel Mosquitoes? Fact vs. Fiction + How to Use It - April 18, 2025

- Do Woodchucks Climb Trees?Fact vs. Fiction - April 18, 2025