When it comes to financing home improvement projects, understanding the differences between renovation loans and construction loans is crucial. [Renovation Loan vs Construction Loan: Understanding the Differences] will delve into the characteristics, benefits, and considerations associated with each type of loan, empowering you to make informed decisions about your upcoming renovation or construction project.

Key Takeaways:

- Construction loans are for building new homes, while renovation loans are for improving existing homes.

- Eligibility for construction loans may require more equity and higher interest rates.

- Benefits of renovation loans include financing based on the post-improvement value of the home.

- RenoFi is an alternative financing option that allows homeowners to borrow based on the future value of their renovated home.

Renovation Loan vs Construction Loan

Ever wondered about the difference between renovation loans and construction loans?

Let’s break it down:

Construction loans are for building a home from scratch. They typically require more equity and higher interest rates than renovation loans.

Renovation loans, on the other hand, are for remodeling or improving an existing home. They’re often more flexible and cost-effective than construction loans, and they can even finance the future value of your home after the renovation.

So, which one is right for you?

- If you’re building a new home, a construction loan is the way to go.

- If you’re renovating an existing home, a renovation loan may be a better fit.

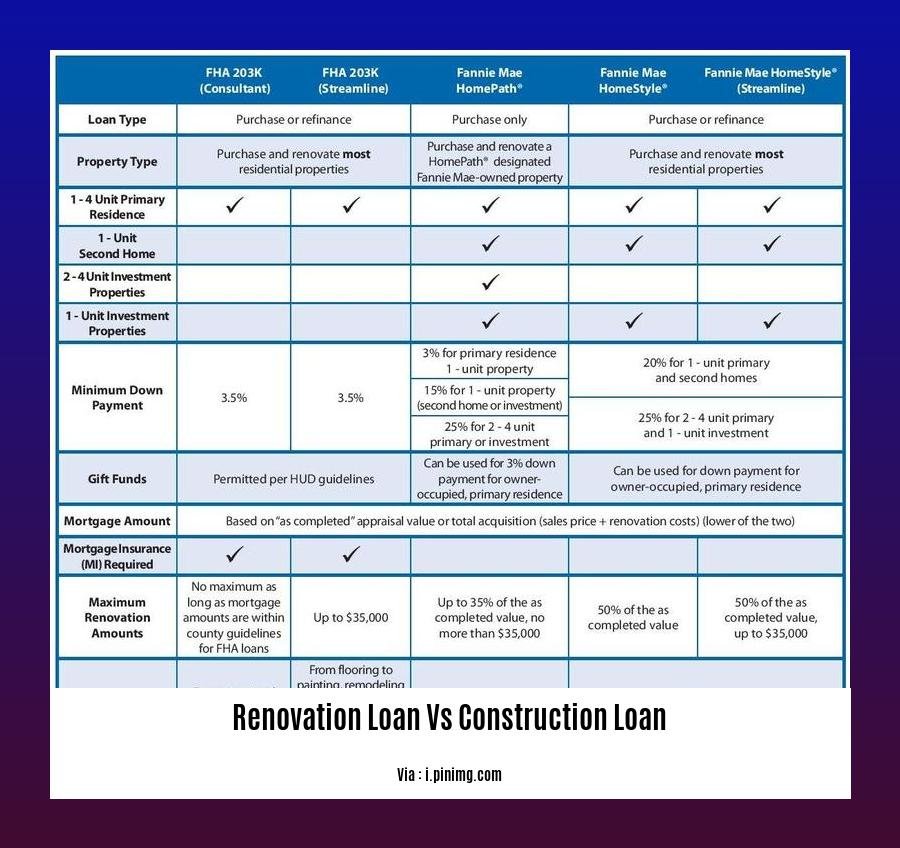

Here’s a handy table to help you compare the two:

| Feature | Renovation Loan | Construction Loan |

|---|---|---|

| Purpose | Remodeling or improving an existing home | Building a new home from scratch |

| Equity requirements | Lower | Higher |

| Interest rates | Lower | Higher |

| Flexibility | More flexible | Less flexible |

| Future value financing | Yes | No |

| Alternative options | RenoFi, FHA 203(k) | None |

Still not sure which loan is right for you? Talk to a mortgage lender or financial advisor to get personalized advice.

- Are you planning to have a commercial property? If yes, then it is highly recommended to work with a reliable commercial construction company to ensure your project’s success.

- Looking for a reliable construction company? Look no further! Our team of experts has years of experience in delivering high-quality construction services.

- Reliable Construction Pte Ltd is a leading provider of construction services in Singapore. With a team of experienced professionals and a commitment to quality, we are the perfect choice for your next project.

- Our reliable construction services will ensure that your project is completed on time, within budget, and to the highest standards of quality.

Application Process and Requirements

Navigating the application process for renovation or construction loans can be daunting. Here’s a guide to help you understand the requirements and make informed decisions:

Renovation Loans

Application Process:

- Submit a loan application, including financial documents and proof of ownership.

- Provide detailed plans for renovations, including estimated costs and timelines.

- Undergo a property inspection to assess the condition and value of your home.

Requirements:

- Good credit score (typically 620 or higher)

- Stable income and employment history

- Sufficient home equity (typically at least 20%)

- Acceptable debt-to-income ratio

- Clear title to the property

Construction Loans

Application Process:

- Submit a loan application with comprehensive construction plans.

- Provide detailed budget and timeline for construction.

- Secure a qualified contractor and building permits.

Requirements:

- Excellent credit score (typically 680 or higher)

- Strong financial reserves to cover construction costs

- Construction experience or supervision (may be required for certain loans)

- High debt-to-income ratio may be accepted with strong financial compensation

- Building permit and insurance coverage

Key Takeaways:

- Renovation loans are for improving existing properties, while construction loans are for building new homes.

- Both loan types have specific application processes and requirements.

- Good credit, stable income, and home equity are essential for renovation loan applications.

- Construction loans require detailed construction plans, qualified contractors, and high credit scores.

Citations:

- Bankrate

- Lamont Bros

Benefits of choosing a renovation loan or a construction loan

Confused about selecting a renovation loan or a construction loan? This guide explains the distinct advantages of each loan type to help you make an informed decision.

Renovation Loan

- Benefits:

- Lower interest rates than construction loans

- More flexible eligibility requirements

- Can finance both labor and materials

- Can increase your home’s value

Construction Loan

- Benefits:

- Designed specifically for building a new home

- Can provide financing for land acquisition

- Allows for construction costs to be paid as the project progresses

- Can be refinanced into a permanent mortgage after construction is complete

Key Takeaways:

- Renovation loans are ideal for remodeling or repairing existing homes.

- Construction loans are designed for building new homes from the ground up.

- Renovation loans offer lower interest rates and more flexible eligibility requirements.

- Construction loans provide financing for land acquisition and ongoing costs.

Relevant URL Sources:

- Arkansas Federal Credit Union: Construction Loan vs. Renovation Loan

- Great Midwest Bank: Comparing Loans: Renovation Loans vs Construction Loans

Tips for choosing the best loan option

Choosing between a renovation loan and a construction loan can be a daunting task. Both types of loans have their own unique benefits and drawbacks, so it’s important to understand the differences before making a decision.

Renovation Loans

Renovation loans are designed to finance major renovations or repairs to an existing home. These loans can be used to cover a wide range of projects, including:

- Kitchen and bathroom remodels

- Additions

- Structural repairs

- Energy-efficient upgrades

Pros of Renovation Loans:

- Lower interest rates than construction loans

- More flexible than construction loans

- Can be used to finance a wider range of projects

Cons of Renovation Loans:

- May require a higher down payment than construction loans

- May not cover all of the costs of your project

- Can be difficult to get approved for if you have bad credit

Construction Loans

Construction loans are designed to finance the construction of a new home or the complete renovation of an existing home. These loans are typically more expensive than renovation loans, but they can also be more flexible.

Pros of Construction Loans:

- Higher loan amounts

- More flexible than renovation loans

- Can be used to finance the construction of a new home

Cons of Construction Loans:

- Higher interest rates than renovation loans

- May require a larger down payment than renovation loans

- Can be difficult to get approved for if you have bad credit

How to choose the best loan option

The best way to choose the best loan option for your needs is to talk to a mortgage lender. A lender can help you compare the different types of loans and find the one that’s right for you.

Here are a few things to keep in mind when choosing a loan:

- The cost of your project: The cost of your project will determine the amount of money you need to borrow.

- Your financial situation: Your financial situation will determine how much you can afford to borrow.

- Your credit score: Your credit score will affect the interest rate you qualify for.

Key Takeaways:

- Renovation loans are designed to finance major renovations or repairs to an existing home.

- Construction loans are designed to finance the construction of a new home or the complete renovation of an existing home.

- The best way to choose the best loan option for your needs is to talk to a mortgage lender.

Relevant URL Sources:

- Bankrate: What Are Construction Loans and How Do They Work?

- Renovation Construction Loan Process: A Step By Step Guide

FAQ

Q1: What is the main difference between a renovation loan and a construction loan?

Q2: Which is a better option if I need to make minor updates to my home, a renovation or construction loan?

Q3: Is it possible to get a loan if I do not have enough equity in my home?

Q4: Are there any limitations or restrictions associated with renovation or construction loans?

Q5: What is the loan application process like for both renovation and construction loans?

- Kitchen Counter Corner Ideas: Style Your Awkward Angles Now - December 31, 2025

- Best Finish for Butcher Block Countertops: Choosing the Right Option - December 30, 2025

- Seal for butcher block: Find the best food-safe finish - December 29, 2025