In the realm of personal finance, meticulous planning and informed decision-making hold the key to achieving financial stability and success. Whether you’re an individual seeking to optimize your loan repayment strategy or a business owner navigating the complexities of managing multiple loans, the [1. Repayment Calculator Excel: A Powerful Tool for Managing Your Loans] offers a comprehensive solution.

Key Takeaways:

-

A loan involves an amount, interest rate, number of periodic payments, and payment amount.

-

PMT function in Excel calculates loan payment amounts.

-

PMT formula:

PMT ( rate, periods, - amount) -

Rate equals the annual interest rate divided by payment periods per year.

-

Periods represent the total number of loan payments.

-

Amount refers to the total loan amount.

-

Optional arguments include payment type (0 for end of period, 1 for beginning) and present value (current loan value).

Relevant Sources:

- Exceljet: Calculate Payment for a Loan – Excel Formula

- Loan Calculator Excel

Repayment Calculator Excel: A Tool to Tame Your Loans

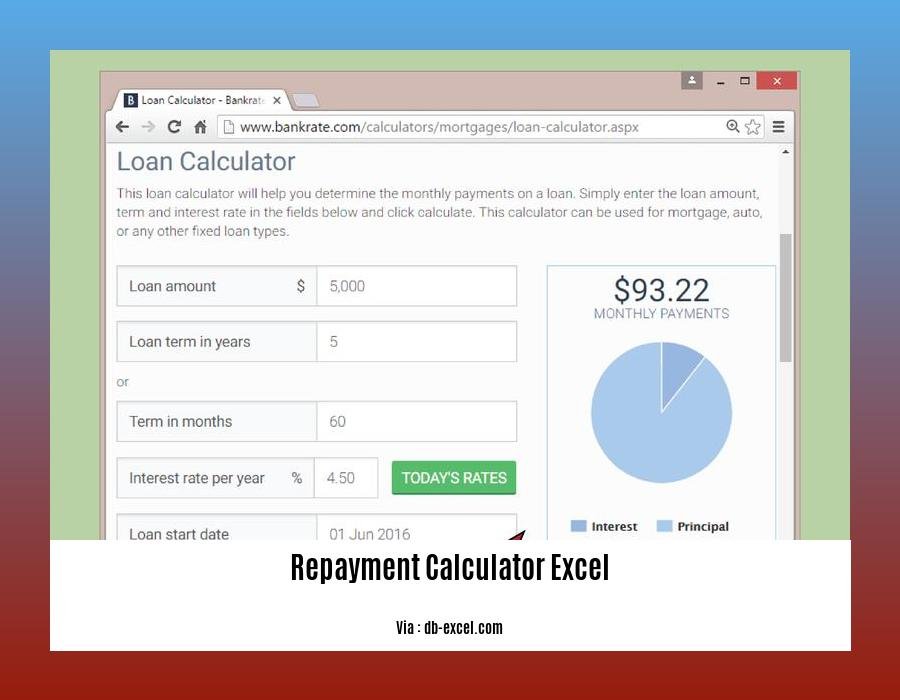

Juggling multiple loans can be a financial tightrope walk, but with the repayment calculator Excel, you can transform loan management into a walk in the park. This powerful tool helps you understand your loans, project payments, and make informed decisions about your finances.

Unveiling the Essence of Loan Repayment

To comprehend the inner workings of the repayment calculator Excel, we must first unravel the fundamental components of a loan:

-

Loan Amount: The total sum borrowed.

-

Interest Rate: The cost of borrowing money, usually expressed as an annual percentage.

-

Loan Term: The duration over which the loan is to be repaid.

-

Repayment Amount: The fixed sum paid periodically to settle the loan.

Harnessing the Power of PMT Function

The repayment calculator Excel leverages the PMT function to calculate the repayment amount for a loan. This function takes three mandatory arguments:

-

Interest Rate: The annual interest rate divided by the number of payment periods per year.

-

Number of Periods: The total number of payments to be made over the loan’s lifetime.

-

Loan Amount: The total amount borrowed, entered as a negative value.

Additional Arguments:

-

Payment Type: Specify whether payments are made at the beginning (1) or end (0) of each period (default).

-

Present Value: The current value of the loan (optional).

Navigating PMT Function with Examples

Let’s embark on a practical journey to illustrate the PMT function’s prowess. Consider a loan of $10,000 with an annual interest rate of 5% over five years. With monthly payments, the PMT function would be:

=PMT(5%/12, 5*12, -10000)

Evaluating this formula yields a monthly repayment amount of $215.07.

Benefits of Repayment Calculator Excel:

-

Accurate Calculations: Precisely computes loan payments, interest, and total repayment.

-

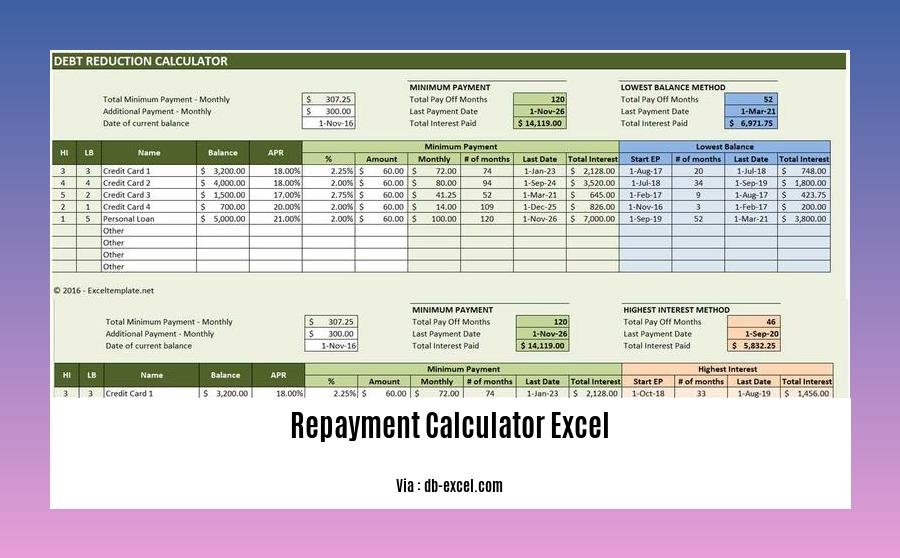

Scenario Analysis: Explore different interest rates, loan terms, and payment amounts to optimize your repayment strategy.

-

Budget Planning: Project future loan payments to create a realistic budget.

-

Debt Management: Keep track of multiple loans, ensuring timely payments and avoiding penalties.

In conclusion, the repayment calculator Excel is an invaluable tool that empowers you to take control of your loans. Its user-friendly interface and accurate calculations make it a must-have for anyone seeking to manage their finances effectively.

-

You can find more details about your home loan serv customer service here.

-

Learn more about home made dog ear cleaning solution here.

-

For superior home maintenance services, check out our selection here.

-

We’ve got the best home maintenance services in Dubai here.

Amortization Calculator Excel Formula

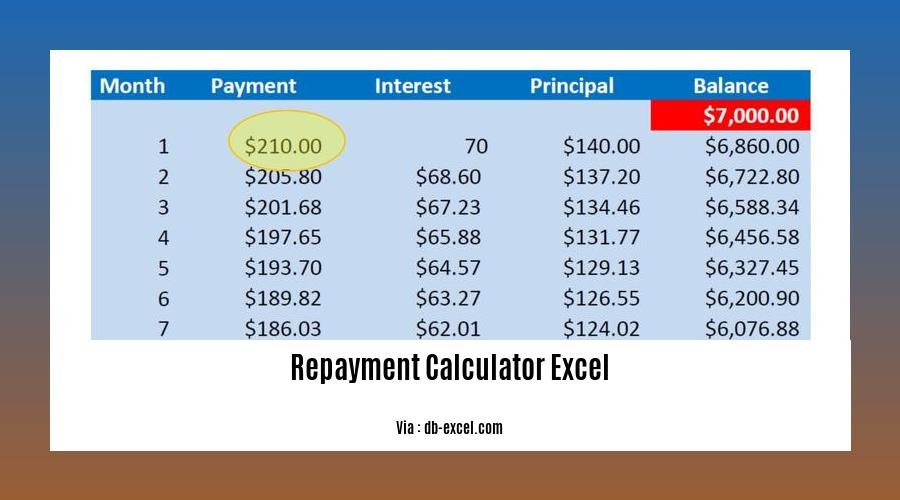

Navigating the complexities of loan repayment schedules can be daunting, especially if you’re juggling multiple loans with varying terms and interest rates. Fortunately, Excel’s amortization calculator formula simplifies this process, providing a clear breakdown of your loan payments, interest, and principal balances over time.

To harness the power of Excel’s amortization calculator, follow these simple steps:

- Set Up Your Loan Parameters:

- Open a new Excel spreadsheet and create a table with columns for “Month,” “Beginning Balance,” “Payment,” “Interest Paid,” “Principal Paid,” and “Ending Balance.”

- In the first row, enter the following information:

- Cell A1: “Month 0” (this represents the start of the loan)

- Cell B1: The total loan amount

- Cell C1: The monthly payment amount

- Cell D1: The monthly interest rate divided by 12 (e.g., for a 6% annual interest rate, enter 0.06 / 12)

-

Leave the remaining cells empty for now.

-

Calculate the Amortization Schedule:

- In cell B2, enter the formula

=B1. This copies the beginning balance from the previous month. - In cell C2, enter the formula

=C1. This copies the monthly payment amount. - In cell D2, enter the formula

=B2*D1. This calculates the interest paid for the month. - In cell E2, enter the formula

=C2-D2. This calculates the principal paid for the month. -

In cell F2, enter the formula

=B2-E2. This calculates the ending balance for the month. -

Complete the Amortization Schedule:

-

Drag the formulas in cells B2:F2 down to the remaining rows in the table. This will automatically populate the amortization schedule for the entire loan term.

-

Analyze Your Loan:

- Review the amortization schedule to understand how your payments are allocated towards interest and principal over time.

- Identify the month when you will reach the “break-even” point, where the majority of your payments are applied towards the principal.

- Calculate the total interest paid over the life of the loan by summing up the values in the “Interest Paid” column.

The amortization calculator Excel formula provides a comprehensive breakdown of your loan repayment schedule, empowering you to make informed decisions about your finances. Whether you’re planning for the future or refinancing an existing loan, this tool offers valuable insights into your loan’s behavior.

Key Takeaways:

- The amortization calculator excel formula generates a detailed repayment schedule, tracking loan payments, interest, and principal balances over time.

- It helps you understand how your payments are allocated, allowing you to assess the impact of different loan terms and interest rates.

- The formula is easy to use, requiring only basic Excel skills and readily available loan information.

- This tool is valuable for financial planning, budgeting, and making informed decisions about loan repayment strategies.

Relevant Sources:

[1]

[2]

FAQ

Q1: How can I create a loan repayment calculator in Excel?

A1: You can easily create a loan repayment calculator in Excel using the PMT function. The formula for PMT is:

PMT(rate, periods, amount)

where:

- rate is the annual interest rate divided by the number of periods per year.

- periods is the total number of payments to be made over the life of the loan.

- amount is the total amount of the loan.

Q2: Can I use a prepayment option in the loan calculator?

A2: Yes, you can include a prepayment option in your loan calculator. To do this, you will need to add a column for the prepayment amount and adjust the formula to include the prepayment.

Q3: How do I create an amortization calculator in Excel?

A3: To create an amortization calculator in Excel, you can use the PMT function along with other functions such as CUMIPMT and CUMPRINC. This will allow you to create a table that shows the breakdown of each payment, including the amount of interest and principal paid.

Q4: Can I use Excel to calculate the total interest paid on a loan?

A4: Yes, you can use Excel to calculate the total interest paid on a loan. To do this, you can use the SUMIF function to sum up the interest portion of each payment.

Q5: How can I compare different loan options in Excel?

A5: You can use Excel to compare different loan options by creating a table that shows the key details of each loan, such as the interest rate, loan amount, and monthly payment. You can then use conditional formatting to highlight the best option.

- Does 100% Polyester Shrink? A Complete Guide to Washing & Drying - April 16, 2025

- Elegant Drapery Solutions for Arched Windows: A Complete Guide - April 16, 2025

- The Best Dining Room Tables with Drop Leaves: A Buyer’s Guide - April 16, 2025