**- Average Cost of Homeowners Insurance in Cape Coral, Florida: A Comprehensive Guide** Dive into the intricacies of homeowners insurance in Cape Coral, Florida. Discover the average costs, key factors influencing premiums, and expert insights to help you secure affordable and comprehensive coverage for your property against the unique risks of this coastal region.

Key Takeaways:

- The average cost of homeowners insurance in Cape Coral, Florida is $1,676 annually.

- The cost varies based on house value and location, with the 33993 location having an average rate of $882 per year.

- Comparing multiple quotes can save homeowners up to $3,278 per year.

Average Cost of Homeowners Insurance in Cape Coral, Florida

Understanding the average cost of homeowners insurance in Cape Coral, Florida is crucial, especially considering the area’s unique coastal location.

The average annual premium in Cape Coral is around $1,676. However, the cost can vary significantly depending on factors like the value of your home and its location. For instance, the 33993 ZIP code has an average rate of $882 per year, while other areas may have higher or lower premiums.

To ensure you secure the best coverage at an affordable price, it’s wise to shop around for multiple quotes. By comparing policies from different providers, you can potentially save up to $3,278 annually.

Additionally, consider these factors that impact your insurance costs:

- Dwelling coverage amount

- Deductible

- Age of the home

- Claims history

- Presence of a swimming pool or other high-risk features

Remember that your homeowners insurance premium is not set in stone. By actively managing your risk factors, such as installing security systems or storm shutters, you can sometimes lower your costs.

Stay proactive and work with an experienced insurance agent to find the right coverage for your needs at a competitive price. Protect your home and financial security with a comprehensive homeowners insurance policy tailored to Cape Coral’s specific risks.

If you’re curious about the credibility of home mold test kits, check out our in-depth analysis: Are home mold test kits accurate.

Considering homeowners insurance in sunny Cape Coral, FL? We’ve compiled essential information on average homeowners insurance premiums there.

Wondering about the standard dimensions of mobile home doors? Visit our detailed guide on average mobile home door size.

If you’re exploring single-wide mobile home options, be sure to consult our comprehensive article on average single-wide mobile home size.

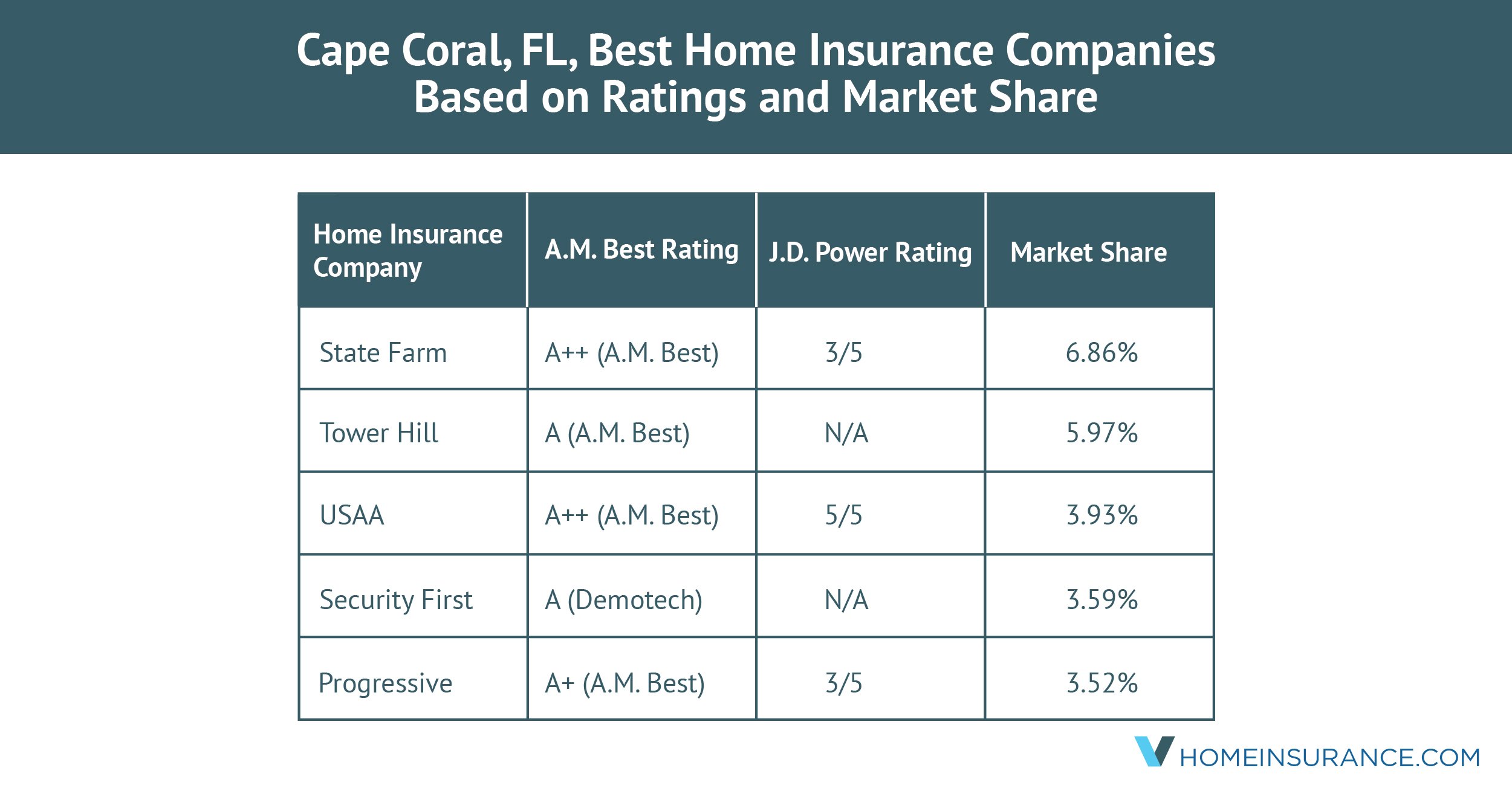

Comparison of Insurance Companies Offering Homeowners Insurance in Cape Coral, FL

When comparing insurance companies offering homeowners insurance in Cape Coral, FL, it’s crucial to assess their reputation, financial strength, coverage options, and customer satisfaction ratings.

Key Considerations:

- Reputation: Look for companies with positive reviews and a strong track record in the industry.

- Financial Strength: Choose insurers with high financial ratings from organizations like AM Best or Standard & Poor’s.

- Coverage Options: Compare policies that provide adequate coverage for your home, belongings, and potential liabilities.

- Customer Service: Ensure that the company offers responsive and helpful support in case of claims or questions.

Top Insurance Providers in Cape Coral, FL:

| Company | Financial Rating | Coverage Options | Customer Satisfaction |

|---|---|---|---|

| State Farm | A++ (Superior) | Comprehensive coverage | Above average |

| Allstate | A+ (Superior) | Customizable policies | Good |

| Nationwide | A+ (Superior) | Discounts for safety features | Excellent |

| USAA | A++ (Superior) | Specialized coverage for military members | Outstanding |

| Citizens Property Insurance Corporation | A (Excellent) | High-risk and coastal coverage | Average |

Key Takeaways:

- Research insurance companies thoroughly to find one that suits your specific needs.

- Compare multiple quotes from different providers to find the best value.

- Consider your home’s value, location, and risk factors when choosing coverage.

- Read policies carefully to understand the terms and conditions.

- Consult with an insurance agent for personalized guidance and recommendations.

Sources:

- MoneyGeek: Average Cost of Homeowners Insurance in Florida

- Clovered: Cape Coral, Florida Homeowners Insurance

Tips for reducing homeowners insurance costs in Cape Coral, FL

Here are some tips to help you reduce your homeowners insurance costs in Cape Coral, Florida:

- Get a wind mitigation inspection. This inspection can identify ways to make your home more resistant to wind damage, which can lower your premium.

- Raise your deductible. A higher deductible means you’ll pay more out of pocket if you file a claim, but it can also lower your premium.

- Ask about discounts. Many insurance companies offer discounts for things like installing a security system, being a member of a homeowners association, or bundling your home and auto insurance.

- Fortify your roof. Upgrading to a hurricane-resistant roof can lower your premium.

- Be strategic if you move. When you’re looking for a new home, consider the insurance costs before you buy. Some areas are more expensive to insure than others.

- Lower your personal property coverage. If you don’t have a lot of valuable belongings, you may be able to lower your premium by reducing your personal property coverage.

Key Takeaways:

- Homeowners insurance costs in Cape Coral, FL are higher than the national average

- Tips for reducing homeowners insurance costs in Cape Coral, FL include getting a wind mitigation inspection, raising your deductible, asking about discounts, fortifying your roof, being strategic if you move, and lowering your personal property coverage.

- Home insurance rates in Florida are generally higher than in other states due to the state’s exposure to hurricanes and other extreme weather events.

Sources:

– Kin: 1 Tip to Lower Florida Homeowners Insurance

– Insuranceopedia: Best Homeowners Insurance in Cape Coral, FL 2024

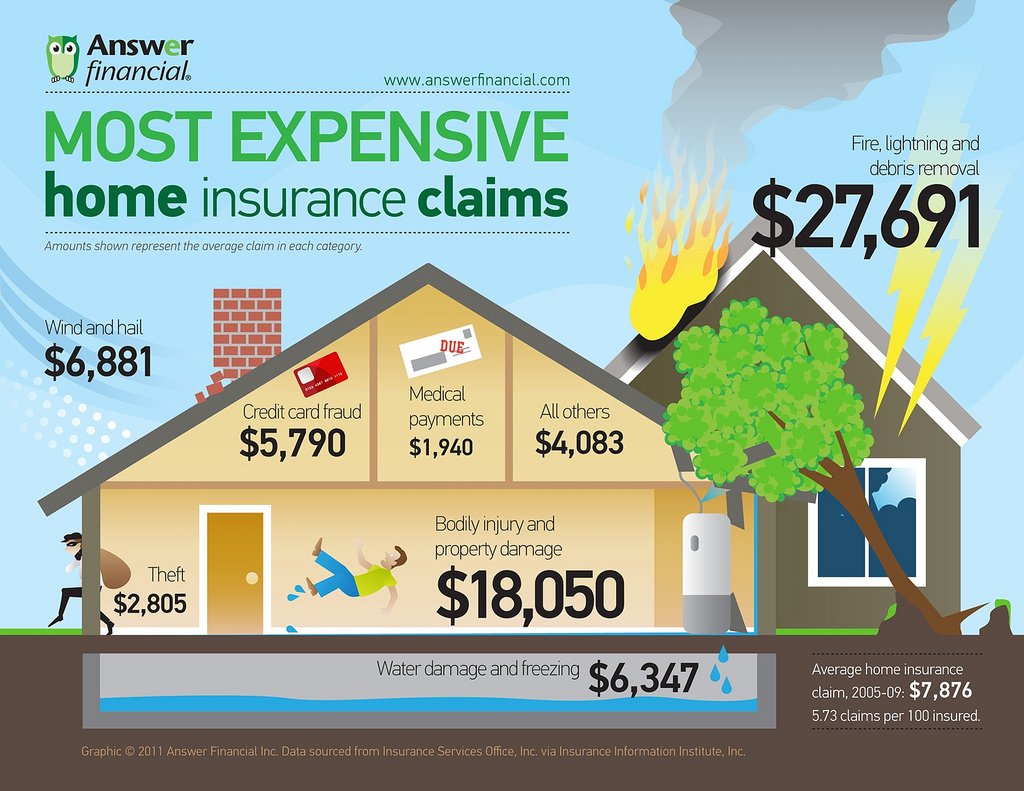

Importance of comprehensive coverage for homeowners in Cape Coral, FL

Due to its coastal location and exposure to hurricanes, Cape Coral homeowners face unique risks and challenges. Comprehensive coverage is paramount for safeguarding your valuable property from potential disasters.

Key Takeaways:

- Comprehensive coverage provides broad protection for your home, belongings, and liability.

- It covers perils like hurricanes, floods, theft, and fires.

- Cape Coral’s coastal vulnerability necessitates tailored coverage plans.

- Consider flood insurance as a supplement to protect against rising waters.

- Comprehensive coverage ensures peace of mind and financial recovery in the event of a covered loss.

Why Comprehensive Coverage Matters

Standard homeowners insurance policies may not cover certain events prevalent in Cape Coral, such as hurricanes or flooding. Comprehensive coverage fills these gaps, providing:

- Hurricane protection: Covers damage caused by wind, rain, and storm surge.

- Flood insurance: Protects against water damage from rising rivers, storm surge, or groundwater seepage.

- Extended coverage: Includes protection for additional structures, personal belongings, and liability beyond the basic limits.

Investing in comprehensive coverage is crucial for Cape Coral homeowners to safeguard their financial future. It provides peace of mind, knowing that your property is protected against the unexpected.

Citation:

- Importance of Homeowners Insurance in Cape Coral, FL

- Home Insurance in Cape Coral, FL

FAQ

Q1: What is the average cost of homeowners insurance in Cape Coral, Florida?

A1: The average cost of homeowners insurance in Cape Coral, Florida, is $1,517.4 per year, which is higher than the national average.

Q2: Why are home insurance rates higher in Cape Coral, Florida than in other parts of the country?

A2: Home insurance rates in Cape Coral, Florida are higher than in other parts of the country due to the state’s exposure to hurricanes and other natural disasters.

Q3: What can I do to lower my homeowners insurance premium in Cape Coral, Florida?

A3: There are several things you can do to lower your homeowners insurance premium in Cape Coral, Florida, such as:

- Increasing your deductible

- Installing a security system

- Fortifying your roof against hurricanes

- Bundling your home and auto insurance

Q4: What are the different types of coverage available for homeowners insurance in Cape Coral, Florida?

A4: There are several different types of coverage available for homeowners insurance in Cape Coral, Florida, including:

- Dwelling coverage

- Personal property coverage

- Liability coverage

- Additional living expenses coverage

Q5: How can I find the best homeowners insurance policy for my needs in Cape Coral, Florida?

A5: The best way to find the best homeowners insurance policy for your needs in Cape Coral, Florida, is to compare quotes from multiple insurance companies.

- The Best Battery Picture Lamps for Effortless Artwork Illumination - April 1, 2025

- Double Sink Bath Vanity Tops: A Buyer’s Guide - April 1, 2025

- Bath Towel Measurements: A Complete Guide to Choosing the Right Size - April 1, 2025