Does Homeowners Insurance Cover Siding: A Comprehensive Guide for Homeowners

Have you ever wondered if your homeowners insurance policy covers siding? If so, you are not alone. This article will provide a comprehensive overview of homeowners insurance coverage for siding, helping you understand what is and is not covered under a standard policy.

Key Takeaways:

-

Homeowner’s insurance covers damage to the home’s structure and permanent attachments, including siding, which are caused by covered perils.

-

Coverage limits and deductibles outlined in the dwelling portion of the policy determine the amount of coverage provided.

-

Wear and tear or rotting siding are excluded from coverage under a homeowner’s insurance policy.

-

Siding repairs will need to be filed as part of a qualifying claim.

-

Homeowner’s insurance only covers the replacement of damaged siding, not the entire home’s siding.

Does Homeowners Insurance Cover Siding?

Often regarded as the first line of defense against the elements, siding helps safeguard your home from various hazards. However, when siding succumbs to damage, the question arises: does homeowners insurance cover siding?

Navigating Homeowners Insurance Coverage for Siding Damage

Navigating the complexities of homeowners insurance can be daunting, especially when it comes to determining coverage for siding damage. Fear not, for this guide will help you understand the ins and outs of homeowners insurance coverage for siding.

What Does Homeowners Insurance Typically Cover?

In general, homeowners insurance provides coverage for a range of perils that can inflict damage upon your home’s structure and its permanently installed components, including siding. Some common occurrences covered by homeowners insurance are:

-

Windstorms: Blustery winds can wreak havoc on your home, including the siding. Fortunately, most homeowners insurance policies provide coverage for windstorm damage.

-

Hailstorms: The relentless assault of hailstones can leave your siding battered and bruised. Homeowners insurance coverage often extends to hail damage.

-

Fire and Smoke: In the unfortunate event of a fire, homeowners insurance typically offers coverage for the subsequent damage to your home, including siding.

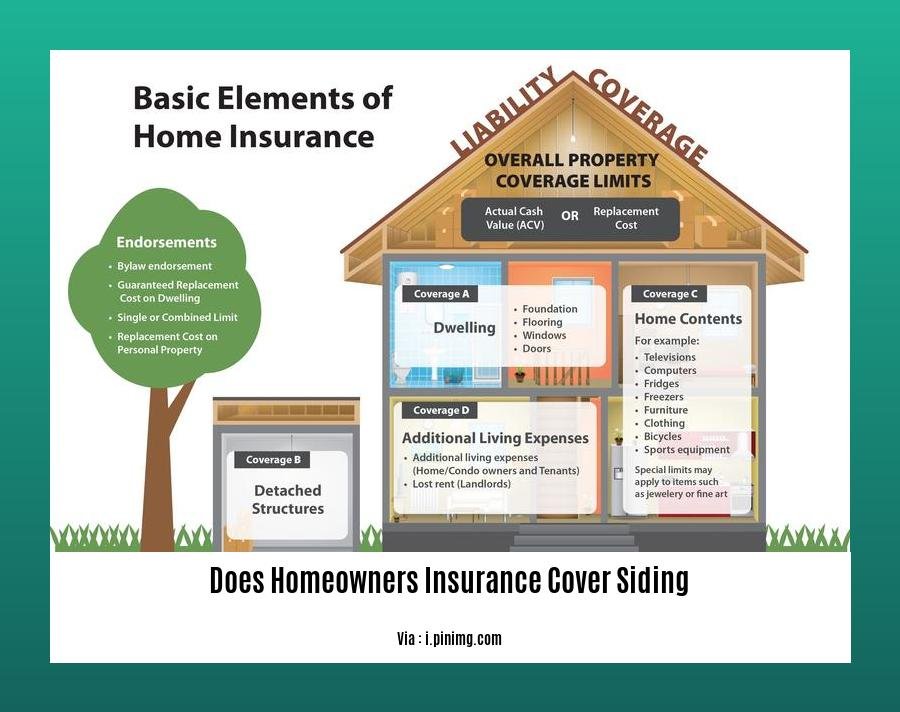

Understanding Coverage Limits and Deductibles

While homeowners insurance can provide a safety net, it’s crucial to understand the policy’s coverage limits and deductibles. The coverage limit is the maximum amount your insurance company will pay towards a covered loss. On the other hand, the deductible is the amount you’re responsible for paying before the insurance company steps in. Carefully review your policy to grasp these crucial details.

Factors Impacting Coverage

-

Policy Type: Dwelling coverage within your homeowners insurance policy provides protection for the structure of your home, which often includes siding.

-

Peril Causing Damage: If the damage stems from a covered peril, such as a windstorm or a hail storm, it’s likely covered under your homeowners insurance.

-

Siding Material: The type of siding material may influence coverage. Standard siding materials like wood and vinyl are typically covered, while specialized materials might require additional coverage.

When Homeowners Insurance Won’t Cover Siding Damage

Homeowners insurance, while comprehensive, has its limitations, as certain types of siding damage may not be covered.

-

Wear and Tear: The gradual deterioration of siding due to natural aging or lack of maintenance is typically not covered by homeowners insurance.

-

Improper Maintenance: Neglecting to maintain your siding properly, leading to damage, can void coverage. Therefore, regular maintenance and prompt repairs are crucial.

-

Insect or Rodent Damage: Homeowners insurance typically doesn’t cover damage caused by pests, like insects or rodents, unless the damage results from a covered peril.

Conclusion

Understanding whether homeowners insurance does cover siding can be the difference between being financially protected and bearing the cost of repairs alone. By delving into the details of your policy, you can ensure you’re adequately covered in the event of siding damage. Remember, staying proactive with maintenance and repairs can help minimize the risk of siding damage and maximize your insurance coverage.

Wondering if your homeowners insurance has coverage for replacing your main water line? Learn more about main water line replacement coverage and protect your home from unexpected expenses.

Want to know if your homeowners insurance covers the cost of upgrading your windows? Discover the details of homeowners insurance coverage for replacement windows and make informed decisions about your home improvement projects.

Are you curious about whether your homeowners insurance covers the repair or replacement of a slab leak? Delve into the nuances of homeowners insurance coverage for slab leak repair to ensure your property is protected against costly water damage.

Seeking clarity on whether your homeowners insurance policy extends to structural repairs? Explore the intricacies of homeowners insurance coverage for structural repairs to safeguard your home against major damage.

Types of Siding Typically Covered

Homeowners insurance policies are complex, and It’s crucial to understand what your policy actually covers when it comes to your home’s siding. Imagine this: You come home from work to find a tree crashed into your house, damaging the siding. Thankfully, you have homeowners insurance, but will it cover the repair or replacement of your siding?

Let’s explore the details you need to be aware of regarding siding coverage:

Covered Perils

Homeowners insurance generally covers damages resulting from specific perils, including:

- Natural disasters: Windstorms, hailstorms, hurricanes, and wildfires.

- Fire: Accidental or intentional fires.

- Vandalism: Intentional damage to your property.

- Theft: Theft of your siding materials.

Types of Siding Typically Covered

Different types of siding materials are covered by homeowners insurance, depending on the policy’s terms and conditions. Some common types of siding typically covered include:

-

Vinyl siding: Vinyl is a widely used, low-maintenance siding material resistant to moisture and insect damage.

-

Wood siding: Wood siding is a classic material that adds warmth and character to a home. However, it’s more susceptible to rot and insect damage.

-

Fiber cement siding: Fiber cement siding is a durable, fire-resistant option that emulates the look of wood without the associated risks.

-

Metal siding: Metal siding is a sturdy, long-lasting material that can withstand harsh weather conditions.

-

Stucco: Stucco is a versatile siding material that can provide a textured or smooth finish to your home’s exterior

Siding Coverage Exclusions

Certain types of damages and scenarios are not typically covered by homeowners insurance when it comes to siding:

-

Neglect and improper maintenance: If damage to your siding is due to lack of maintenance, it’s likely not covered.

-

Wear and tear: Gradual deterioration and aging of your siding over time are not covered.

-

Pests and rodents: Damage caused by pests such as termites or rodents is generally excluded.

-

Earthquakes and floods: Unless you have additional coverage or a separate policy, earthquakes and floods are typically not covered.

Filing a Siding Damage Claim

If you suffer siding damage covered by your homeowners insurance, here’s what you should do:

-

Document the damage: Take photos and videos of the damaged siding, including close-ups and wide shots.

-

Contact your insurance company: Call your insurance provider and explain the damage. Be prepared to provide your policy number, contact information, and details about the incident.

-

File a claim: Submit a formal claim to your insurance company, including the documentation you gathered.

-

Cooperate with the claims adjuster: The insurance company will assign an adjuster to assess the damage and determine the coverage available. Provide any requested information and documentation.

-

Receive payment or repairs: Once the claim is approved, you can receive payment for repairs or have your siding repaired or replaced by the insurance company’s preferred contractor.

Key Takeaways:

-

Check your homeowners insurance policy for specific details on siding coverage and exclusions.

-

Damage to siding caused by covered perils, such as storms and fires, is typically covered.

-

Regular maintenance and prompt repairs of your siding can minimize the risk of damage and maximize coverage.

-

File a claim immediately if your siding is damaged to initiate the coverage process.

Source:

Siding and Home Insurance: What’s Covered and What’s Not?

Does Homeowners Insurance Cover Siding?

Limits and exclusions of coverage for siding

Hey there, homeowners! Here’s the scoop on what you need to know about limits and exclusions of coverage for siding in your homeowners insurance policy.

Key Takeaways:

-

Covered Perils: Typically, your insurance policy will cover damages from specific events like storms, hail, vandalism, and fire.

-

Coverage Limits: There’s usually a limit to how much your insurance will pay for siding repairs or replacements. Make sure you know this amount and coverage options.

-

Exclusions: Your policy won’t cover damage resulting from wear and tear, pests, or improper maintenance. Additional coverage or a separate policy may be needed for floods, earthquakes, and sinkholes.

-

Filing a Claim: If your siding takes a hit, contact your insurance company right away with photos and other documentation.

-

Maintenance Matters: Keep your siding in tip-top shape to minimize the risk of damage and maximize your coverage.

Let’s dive into the details, shall we?

Limits of Coverage:

Picture this: a gnarly storm rolls through, leaving your siding battered and bruised. Your insurance will step in to cover the repair or replacement costs – but only up to the policy limit. That’s why it’s crucial to review your policy’s coverage limits and make sure they match the value of your siding. Don’t let a nasty surprise catch you off guard!

Exclusions to Coverage:

Now, let’s talk about what’s not covered. Your insurance won’t cover damage caused by old age, neglect, or pests like termites. Why? Because these issues are considered preventable. Regular maintenance is your best friend in keeping your siding looking fresh and avoiding headaches with your insurance company.

Filing a Claim:

If disaster strikes and your siding takes a beating, don’t panic! Here’s what you do:

-

Document the Damage: Snap some clear photos of the damage and keep receipts for any temporary repairs you make.

-

Contact Your Insurance Company: Call your insurance company ASAP and give them the 411 on the damage. Be ready to provide details like the date and cause of the damage.

-

Prepare for an Inspection: An insurance adjuster will likely inspect the damage to assess the cost of repairs or replacements. Make sure you’re available to meet them.

-

Review the Settlement Offer: Once the adjuster submits their report, your insurance company will send you a settlement offer. Make sure you understand the terms and conditions before signing anything.

Remember, homeowners insurance is your safety net in case of unexpected events. By understanding the limits and exclusions of coverage for siding, you can protect your home and your wallet from unexpected expenses. Stay safe and keep your siding looking fly, folks!

Source:

– Does Homeowners Insurance Cover Siding? | Progressive

– Is Home Siding Covered By Homeowners Insurance?

Steps to File a Claim for Siding Damage

Hey there, homeowners! Dealing with siding damage can be a real headache. But fear not, because in this guide, we’ll break down the steps involved in filing a claim with your homeowners insurance, ensuring you get the coverage you deserve. Let’s get started!

Key Takeaways:

- 📸 Document the Damage:

-

Gather evidence by taking clear photos of the siding damage from different angles.

-

📞 Promptly Contact Your Insurance Provider:

-

Don’t delay! Reach out to your insurance company as soon as possible to initiate the claim process.

-

🛠️ Insurance Adjuster Inspection:

-

An adjuster will visit your property to evaluate the damage and determine coverage eligibility.

-

📋 Obtain Repair Quotes:

-

Get estimates from qualified contractors for siding repair or replacement. Multiple quotes ensure you get competitive pricing.

-

📝 Submit Claim Forms and Documentation:

-

Fill out the necessary claim forms and attach relevant documents, such as photos, estimates, and police reports (if applicable).

-

💰 Review Settlement Offer:

-

The insurance company will present a settlement offer based on their assessment. Review it carefully before accepting.

-

🤝 Negotiate if Needed:

-

If you feel the settlement offer is inadequate, engage in negotiations with the insurance company to reach a fair settlement.

-

👷 Arrange Repairs:

-

Once the claim is approved, select a qualified contractor to handle the siding repairs or replacement.

-

🗓️ Monitor Repair Progress:

- Stay updated on the progress of the repairs and ensure they align with the agreed-upon scope of work.

Remember, filing an insurance claim can be a complex process. If you encounter challenges or have specific questions, don’t hesitate to reach out to your insurance provider for assistance. They’re there to help you navigate the process and ensure you receive the coverage you’re entitled to.

Sources:

1. Steps to File a Claim for Siding Damage | Insurance Navy

2. How to File a Homeowners Insurance Claim for Siding Damage

FAQ:

Q1: What damages to siding are typically covered by homeowners insurance?

A1: Homeowners insurance typically covers damages to siding caused by covered perils, such as storms, hail, fire, vandalism, and theft. However, coverage may vary depending on the specific policy and the cause of the damage.

Q2: What are some common exclusions to siding coverage under homeowners insurance?

A2: Common exclusions to siding coverage under homeowners insurance include wear and tear, gradual deterioration, damage caused by pests, and damage resulting from neglect or improper maintenance. Additionally, some policies may exclude damage caused by certain natural disasters, such as earthquakes or floods, unless additional coverage is purchased.

Q3: How do I file a claim for siding damage under my homeowners insurance policy?

A3: To file a claim for siding damage under your homeowners insurance policy, you should contact your insurance company and provide details of the damage, including photos and documentation. Your insurance company will assign an adjuster to assess the damage and determine the coverage available. The claims process and payout may vary depending on the insurance company and policy terms.

Q4: Can I choose my own contractor to repair or replace damaged siding?

A4: In most cases, you have the right to choose your own contractor to repair or replace damaged siding. However, it’s important to notify your insurance company about your choice of contractor before any work begins. Some insurance companies may have a preferred contractor network or specific requirements for the contractor you choose.

Q5: What should I do if my insurance company denies my claim for siding damage?

A5: If your insurance company denies your claim for siding damage, you can appeal the decision. The appeals process may vary depending on the insurance company and policy terms. You may want to consider obtaining an independent assessment of the damage or consulting with an insurance attorney if your appeal is denied.

- Are Carpenter Bees Dangerous? Stings, Damage, and Control - March 31, 2025

- How to Get Rid of Ants in the Washroom: A Complete Guide - March 31, 2025

- How Much Does Ant Extermination Cost? (2024 Guide & DIY Options) - March 31, 2025