[Best Home and Contents Insurance Western Australia: A Comprehensive Guide] – With a plethora of insurance providers in Western Australia, it’s daunting to find the best home and contents insurance for your unique needs. This guide meticulously evaluates leading insurers and policies, empowering you with the knowledge to make informed decisions about safeguarding your home and belongings.

Key Takeaways:

- Youi Home and Contents is the highest-rated provider in Western Australia, with an average rating of 3.9.

- Budget Direct Home and Contents Insurance is another highly-rated option, with an average rating of 3.8.

- QBE Home and Contents Insurance has a lower average rating of 3.2, but may still be suitable for some homeowners.

Best Home and Contents Insurance Western Australia

Navigating the Western Australian insurance market can be daunting, but finding the best home and contents insurance doesn’t have to be.

Here’s a comprehensive guide to help you make an informed decision:

Understanding Western Australia’s Unique Risks

Western Australia’s coastal location exposes homes to potential cyclones, storms, and floods. Additionally, bushfires are a concern during summer months.

Factors to Consider When Choosing Coverage

- Property Value: Ensure your policy covers the full reconstruction cost of your home.

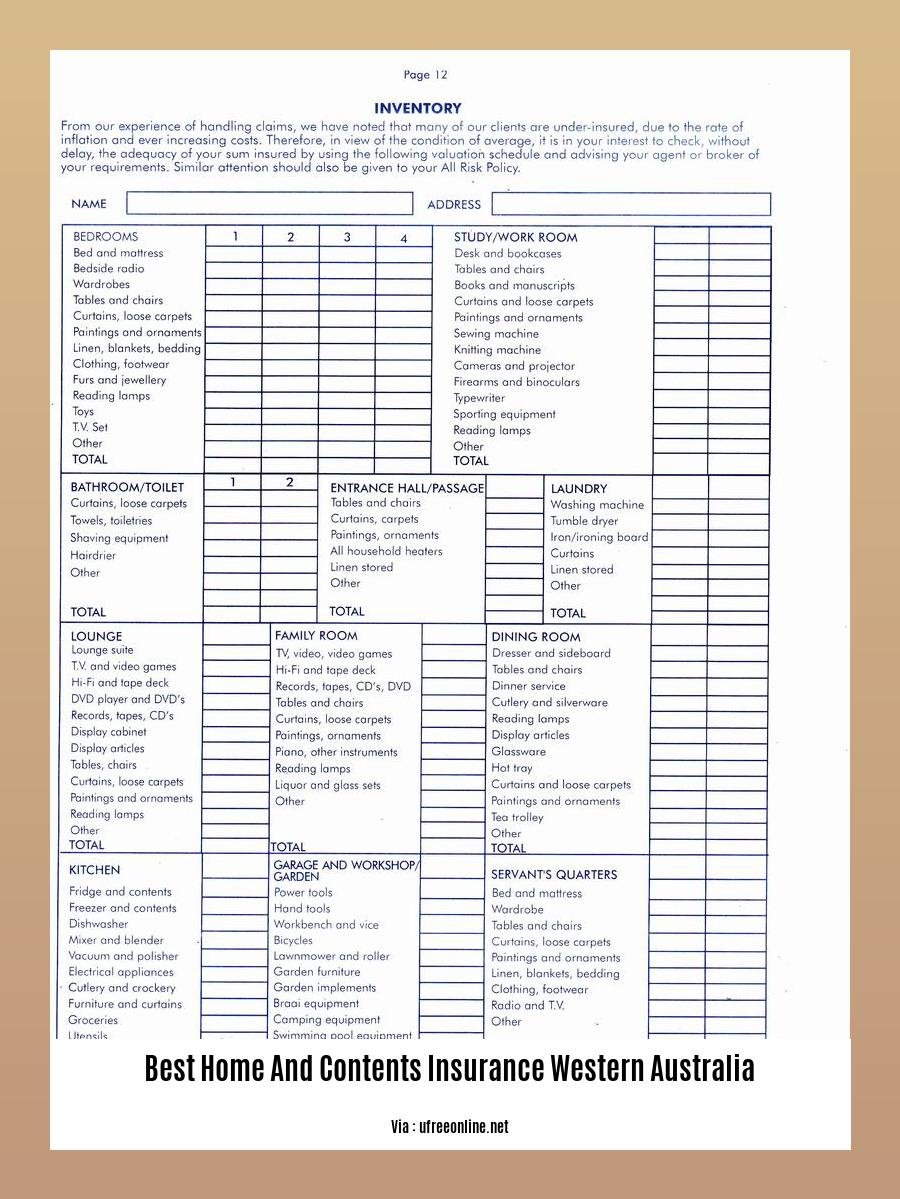

- Contents Value: Determine the total worth of your belongings, including electronics, furniture, and valuables.

- Additional Coverage: Consider optional add-ons like flood cover, accidental damage, and liability protection.

- Deductibles: Weigh the benefits of lower premiums against higher out-of-pocket costs in the event of a claim.

- Excess: Understand the additional amount you’ll need to pay above the deductible if you make a claim.

Top Insurance Providers in Western Australia

Based on customer reviews and industry ratings, here are some reputable providers:

| Provider | Rating |

|---|---|

| Youi Home and Contents | 3.9 (1,339 reviews) |

| Budget Direct Home & Contents Insurance | 3.8 (2,032 reviews) |

| QBE Home and Contents Insurance | 3.2 (536 reviews) |

Steps to Finding the Best Coverage:

- Assess Your Needs: Determine the value of your home and contents, and identify any specific risks you face.

- Compare Policies: Explore different providers and their policy offerings, paying attention to coverage details and premiums.

- Consider Deductibles and Excesses: Balance the trade-off between lower premiums and higher out-of-pocket costs.

- Read the Fine Print: Carefully review the terms and conditions of each policy to avoid surprises later on.

- Consult an Insurance Broker: If you’re overwhelmed, seek professional guidance from a broker who can help you navigate the market.

Remember, the best home and contents insurance is the one that provides comprehensive protection tailored to your specific needs. By considering the factors discussed above, you can make an informed decision and safeguard your valuable assets.

Seeking inspiration for your home screen? Explore our Android home screen setups for a curated collection of aesthetics and functionality.

Compare and find the best home and contents insurance tailored to your needs in Australia. Visit our best home and contents insurance compare Australia page today.

For Queensland residents, we’ve curated a guide to the best home and contents insurance QLD. Protect your home and belongings with the right coverage.

Assessing Premiums and Discounts

When shopping for home and contents insurance, it’s essential to not only consider coverage but also the premiums and discounts. Premiums are the payments you make to your insurer, and discounts can help reduce those costs.

Factors that Affect Premiums

- Property value and age: Newer and more valuable homes usually have higher premiums.

- Contents value: The amount of coverage you choose for your belongings also impacts your premium.

- Location: Homes in high-risk areas, such as those prone to natural disasters, may have higher premiums.

- Claims history: If you have filed claims in the past, your premiums may be higher.

- Safety features: Installing security devices like smoke detectors and burglar alarms can qualify you for discounts.

Finding Discounts

Insurance providers offer various discounts to lower your premiums:

- Multi-policy discount: Insuring multiple properties or vehicles with the same insurer can often qualify you for a discount.

- Loyalty discount: Staying with the same insurer for several years without making any claims can earn you a loyalty discount.

- Green discount: Taking steps to make your home more energy-efficient, such as installing solar panels, can sometimes lead to a discount.

- Age discount: Senior citizens and those under 25 may be eligible for discounts.

Key Takeaways:

- Compare premiums and discounts from multiple insurers before making a decision.

- Consider your property’s value, contents, and location when assessing premiums.

- Ask your insurer about available discounts and take steps to qualify for them.

- Maintaining a good claims history can help keep your premiums low.

Relevant URLs:

- Finder: Best Home Insurance Australia for April 2024

- ProductReview: Best Home and Contents Insurance in Western Australia]

Choosing the Right Insurance Provider

When it comes to safeguarding your home and belongings in Western Australia, choosing the right insurance provider is crucial. With the plethora of options available, navigating the insurance market can be daunting. Here’s a comprehensive guide to help you make an informed decision:

Key Takeaways:

- Research: Investigate different insurance companies, reading reviews, comparing coverages, and assessing their financial stability.

- Consider Your Needs: Determine the level of coverage you require based on the value of your property and belongings.

- Compare Policies: Meticulously examine policy details, including coverage limits, exclusions, and deductibles.

- Factor in Reputation: Choose providers with a proven track record of customer satisfaction and prompt claims settlement.

- Seek Assistance: If needed, consult an independent insurance broker for personalized guidance.

Steps Involved:

- Identify Your Needs: Assess the value of your property and belongings, considering both physical and sentimental value.

- Shop Around: Contact multiple insurance providers to compare policies, coverages, and premiums.

- Read the Fine Print: Scrutinize insurance policies thoroughly, paying close attention to the coverage details, exclusions, and conditions.

- Ask Questions: Don’t hesitate to seek clarification from insurers on any aspect of the policy that you don’t understand.

- Compare Prices: Consider the total cost of insurance, including the premium, deductibles, and any additional fees.

Pros and Cons of Different Providers:

QBE Insurance:

- Pros:

- Comprehensive coverage, including automatic flood damage cover

- Strong financial stability and customer service

- Cons:

- May be more expensive than some competitors

Youi Home and Contents Insurance:

- Pros:

- Affordable premiums

- Simple and straightforward policy wording

- Cons:

- Limited coverage options compared to some competitors

Relevant URL Sources:

- CHOICE: Home and Contents Insurance Comparison 2024

- Finder: Best Home Insurance Australia for April 2024

Additional Considerations for Western Australian Homeowners

Choosing the right home and contents insurance policy is crucial, especially for Western Australian residents facing unique risks like cyclones, storms, floods, and bushfires. Here are some additional factors to consider:

- Coverage: Ensure your policy covers all the potential risks you may encounter in your area.

- Property Value: Calculate your home’s rebuilding cost and make sure your policy provides adequate coverage.

- Contents Value: Determine the value of your belongings and include replacement costs in your policy.

- Optional Add-Ons: Consider additional coverage such as accidental damage, cellar contents, or jewelry.

- Deductibles and Excesses: Understand the deductibles and excesses associated with your policy and choose options that balance affordability with financial protection.

- Coastal Properties: Homes near the coast face higher risks of storm damage. Ensure your policy includes appropriate cover for cyclones and floods.

- Bushfire Prone Areas: If you live in a bushfire-prone area, check if your policy covers bushfire damage and the conditions attached.

- Natural Disaster Assistance: Familiarize yourself with any government assistance programs available in the event of a natural disaster.

Key Takeaways:

- Tailor your coverage to the specific risks faced by Western Australian homeowners.

- Carefully calculate the value of your property and belongings for adequate coverage.

- Explore optional add-ons to enhance your policy’s protection.

- Understand the implications of deductibles and excesses.

- Be aware of the unique risks associated with coastal and bushfire-prone areas.

- Familiarize yourself with government assistance programs for natural disasters.

Relevant URL Sources:

- Choice: Home and Contents Insurance Comparison 2024

- Finder: Best Home Insurance Australia for April 2024

FAQ

Q1: What are the key features to look for when comparing home and contents insurance policies in Western Australia?

Q2: Which insurance providers offer the most comprehensive coverage and competitive pricing for home and contents insurance in Western Australia?

Q3: What are the potential risks and hazards that homeowners in Western Australia should consider when purchasing home and contents insurance?

Q4: What are the benefits of getting home and contents insurance in Western Australia, and how can it protect homeowners from financial losses?

Q5: What steps should homeowners take to ensure they have adequate home and contents insurance coverage in Western Australia?

- Dora the Explorer Wipe-Off Fun: Safe & Mess-Free Activities for Little Explorers - April 18, 2025

- Does Lemongrass Repel Mosquitoes? Fact vs. Fiction + How to Use It - April 18, 2025

- Do Woodchucks Climb Trees?Fact vs. Fiction - April 18, 2025