Thinking about purchasing a home? The first step is to compare home loan rates in Singapore. Through this detailed guide, we’ll take you through everything you need to know about home loans in Singapore, including the various loan options, interest rates, and repayment terms available. With this comprehensive information, you’ll be well-equipped to make an informed decision and secure the best deal on your home loan. So, whether you’re a first-time homebuyer or an experienced investor, get ready to embark on the journey toward owning your dream home in Singapore.

Key Takeaways:

- Home loan interest rates in Singapore differ based on property type, loan tenure, and borrower profile.

- Comparing home loan packages and interest rates is essential to find the best option.

- Consider loan tenure, repayment flexibility, and additional fees when choosing a home loan.

- Seek professional advice from financial experts to make an informed decision and save money.

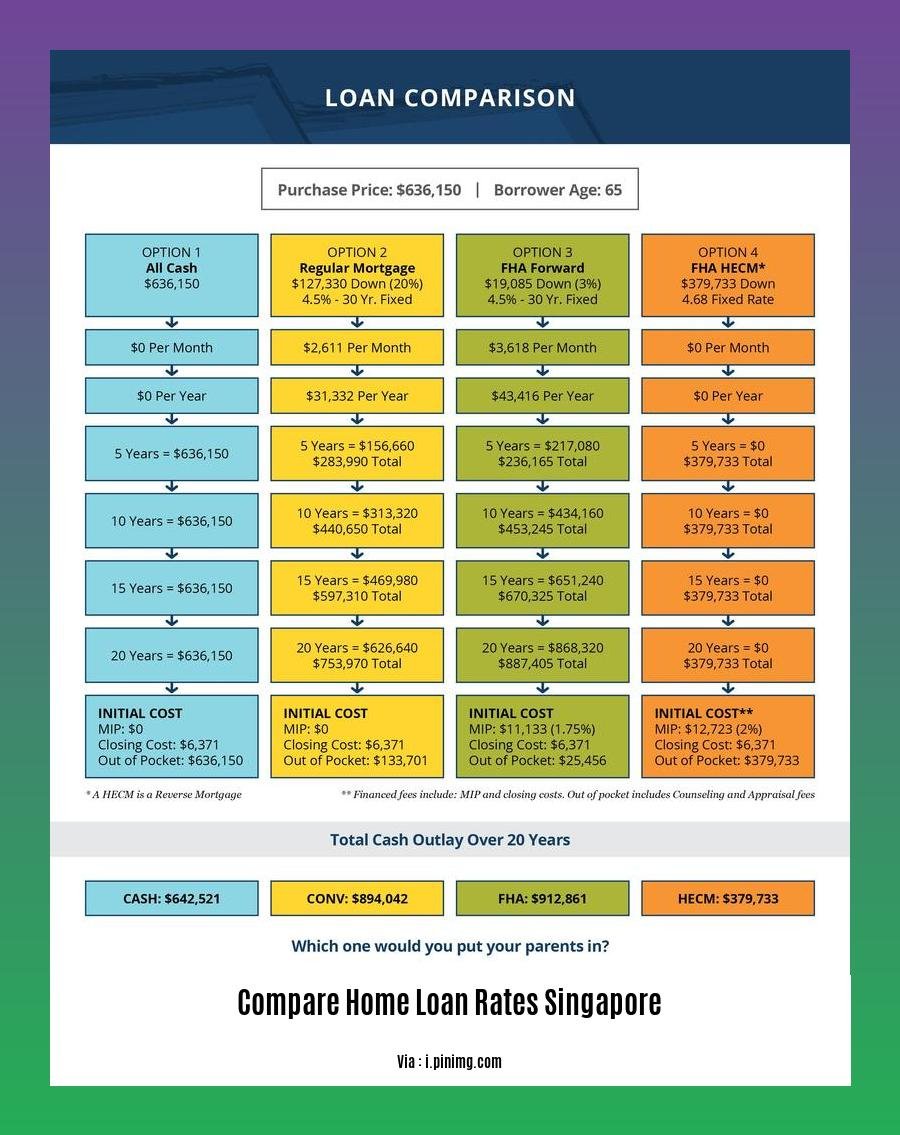

Compare Home Loan Rates Singapore:

Navigating the Singaporean home loan market can be daunting, especially when faced with a plethora of loan packages and interest rates. To make an informed decision and secure the best deal, it’s crucial to compare home loan rates. Here’s a comprehensive guide to help you compare home loan rates Singapore effectively:

A Comprehensive Walkthrough:

-

Understand Your Loan Profile:

-

Assess your financial situation, including income, debts, and credit score. This will determine your eligibility and potential interest rates.

-

Establish your loan purpose, whether it’s for a private property, HDB flat, or refinancing.

-

Research Available Home Loan Packages:

-

Visit banks and financial institutions’ websites or consult mortgage brokers to gather information on various home loan packages.

-

Pay attention to interest rates, loan tenures, repayment options, and additional fees and charges.

-

Compare Interest Rates:

-

Compare home loan rates Singapore offered by different lenders, considering both fixed and variable rates.

-

Understand the impact of loan tenure on interest rates. Longer tenures often entail higher interest rates.

-

Consider Loan Features and Flexibility:

-

Evaluate repayment flexibility, such as the ability to make extra payments or prepay without penalties.

-

Assess the availability of features like lock-in periods, which secure a lower interest rate for a specific duration.

-

Factor in Additional Fees and Charges:

-

Scrutinize processing fees, legal fees, and valuation fees charged by lenders.

-

Compare these fees across different home loan packages to uncover hidden costs.

-

Consult a Mortgage Broker or Financial Advisor:

-

Engage a mortgage broker or financial advisor to gain professional insights and personalized recommendations.

-

They can help you compare home loan rates Singapore and negotiate favorable terms on your behalf.

The Takeaway:

Choosing the right home loan is a significant financial decision. By comparing home loan rates Singapore, considering loan features, and seeking expert advice, you can secure the best deal and save money in the long run. Remember, the ultimate goal is to find a home loan package that aligns with your financial situation and long-term goals.

-

Wondering what the home condition requirements are for a conventional loan? Explore the guidelines and particulars about property condition here: conventional loan home condition requirements.

-

Are you a culinary enthusiast who enjoys cooking at home? Discover a convenient and delightful option: cook at home delivery, where you can enjoy restaurant-quality meals prepared with fresh ingredients in the comfort of your own kitchen.

-

Learn more about the cost of home heating oil in NH, including factors that influence price fluctuations and strategies for reducing your energy bills during the cold winter months.

-

Thinking about installing an EV charger at home in Canada? Get informed about the cost to install an EV charger at home Canada, including factors that affect the overall expense and potential government incentives to help offset the cost.

Compare Home Loan Rates Singapore Calculator

In Singapore’s dynamic property market, getting a home loan with favorable rates is crucial. To help you make an informed decision, let’s delve into the world of home loan rates and how you can compare them effectively:

Key Takeaways:

-

Shop Around: Don’t settle for the first home loan offer you receive. Compare rates from multiple banks and financial institutions to find the best deal tailored to your needs.

-

Consider Loan Tenure: Longer loan tenures often come with lower interest rates, but they also mean paying more interest overall. Weigh the pros and cons carefully to find a balance that suits your financial situation.

-

Fixed vs. Floating Rates: Fixed rates provide stability, while floating rates may fluctuate based on market conditions. Choose the option that aligns with your risk appetite and financial goals.

-

Loan-to-Value (LTV) Ratio: The LTV ratio affects your loan eligibility and interest rates. Higher LTV ratios may require a larger down payment or incur higher interest rates.

-

Eligibility and Credit Score: Your income, credit score, and debt-to-income ratio influence your loan eligibility and interest rates. Maintaining a healthy financial profile can improve your chances of securing favorable terms.

-

Additional Fees: Scrutinize loan packages for additional fees, such as processing fees, legal fees, and valuation fees. These can add up and impact your overall borrowing costs.

-

Use a Home Loan Calculator: Leverage a [compare home loan rates singapore calculator] to estimate monthly repayments and compare loan options based on interest rates, loan tenures, and down payments.

-

Seek Professional Advice: If you’re overwhelmed by the complexities of home loans, consider consulting a qualified financial advisor or mortgage broker. They can provide tailored advice and assist you in securing the best possible deal.

Sources:

– MoneySmart: Compare the Best Mortgage Home Loan Rates in Singapore

– Roshi: Best Home Loan Deals Singapore (2024)

FAQ

Q1: What are the current home loan interest rates in Singapore?

A1: Home loan interest rates in Singapore vary depending on the type of property, loan tenure, and borrower’s profile. To get the most accurate and up-to-date information, it’s recommended to compare rates from multiple banks and financial institutions using a reliable home loan comparison tool or consulting with a mortgage broker.

Q2: What documents do I need to apply for a home loan in Singapore?

A2: Typically, when applying for a home loan in Singapore, you’ll need to provide personal documents such as your NRIC, proof of income, and CPF contribution statement. Additionally, you’ll need property-related documents like the Sale and Purchase (S&P) agreement, property valuation report, and Certificate of Title.

Q3: How can I compare home loan rates in Singapore?

A3: To compare home loan rates in Singapore, you can use a home loan comparison tool, which allows you to enter your loan details and compare interest rates and fees from multiple banks and financial institutions. You can also contact individual banks or mortgage brokers to obtain personalized quotes.

Q4: What is the maximum loan tenure for a home loan in Singapore?

A4: The maximum loan tenure for a home loan in Singapore is typically 30 years, though it can vary depending on the borrower’s age and the type of property. It’s important to consider the loan tenure carefully, as it affects your monthly repayments and the total interest you’ll pay over the life of the loan.

Q5: What are the additional fees and charges associated with a home loan in Singapore?

A5: Besides the interest rate, there are additional fees and charges associated with a home loan in Singapore, such as processing fees, legal fees, valuation fees, and fire insurance premiums. These fees can vary depending on the bank or financial institution, so it’s important to compare the total cost of the loan, including both the interest rate and the fees, when making a decision.

- Dora the Explorer Wipe-Off Fun: Safe & Mess-Free Activities for Little Explorers - April 18, 2025

- Does Lemongrass Repel Mosquitoes? Fact vs. Fiction + How to Use It - April 18, 2025

- Do Woodchucks Climb Trees?Fact vs. Fiction - April 18, 2025