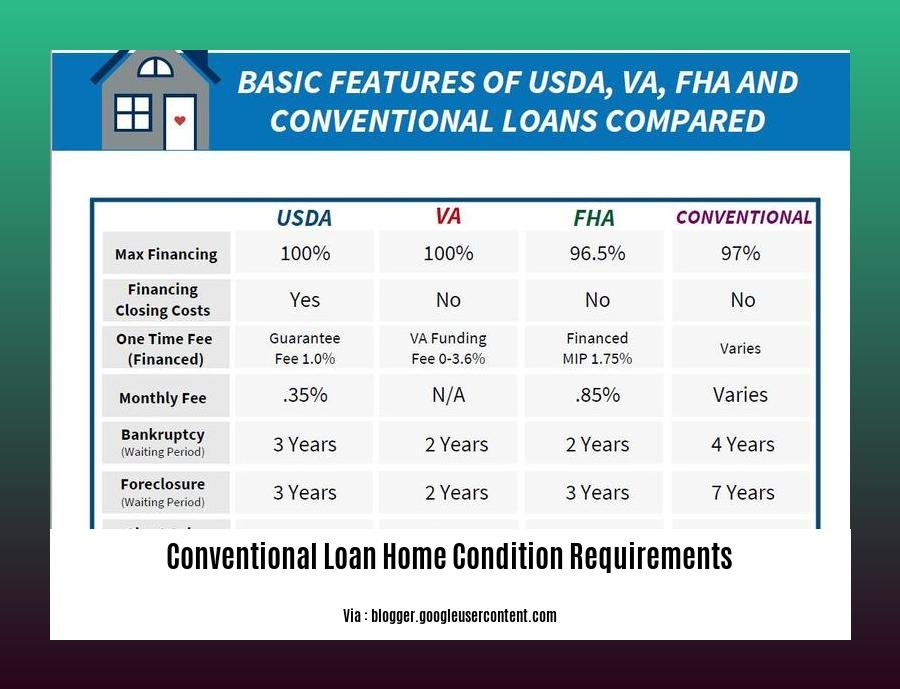

Welcome to our comprehensive guide, [1. Conventional Loan Home Condition Requirements: A Guide for Homeowners and Real Estate Professionals]. Whether you’re buying, selling, or refinancing a home, understanding the condition requirements set by Fannie Mae and Freddie Mac for conventional loans is essential. This article will provide valuable insights and practical guidance to navigate this process successfully.

Key Takeaways:

-

Eligible Properties: Single-family homes and multi-unit homes (up to four units) are eligible for conventional loans.

-

Property Use: Conventional loans are only available for residential properties, not commercial ones.

-

Property Condition: Properties must be structurally sound, have no claims against them, and require an appraisal. They should be located in the U.S., Guam, Puerto Rico, or the U.S. Virgin Islands, be residential in nature, and securable as real estate with a good title. Additionally, they must pass a home inspection to assess their overall condition.

-

Additional Eligibility Requirements: In addition to the property requirements, borrowers must meet certain credit score, debt-to-income ratio, and down payment requirements.

Conventional Loan Home Condition Requirements

You may be seeking to purchase a home through a conventional loan. In such cases, it’s crucial to understand the conventional loan home condition requirements. These requirements are set by Fannie Mae and Freddie Mac, the two government-sponsored enterprises that back most conventional loans. Meeting these requirements ensures that the property is a sound investment, not only for you but also for the lender.

What are Conventional Loan Home Condition Requirements?

These requirements assess the overall condition of the property and evaluate its structural integrity, mechanical systems, and cosmetic aspects. The goal is to ensure the home meets minimum safety and habitability standards.

Why are Conventional Loan Home Condition Requirements Important?

These requirements serve several important purposes:

-

Protecting Lenders: The lender wants to ensure the property is worth the loan amount and that it’s not a financial risk.

-

Protecting Homeowners: These requirements ensure the property is safe and habitable. It helps prevent homeowners from purchasing properties with costly repairs or potential health hazards.

-

Maintaining Property Values: By ensuring properties meet certain standards, these requirements help maintain property values within a neighborhood.

What are Common Conventional Loan Home Condition Requirements?

-

Structural Integrity: The foundation, roof, and major structural components must be in good condition. Structural defects can compromise the safety and value of the property.

-

Mechanical Systems: Heating, plumbing, and electrical systems must be functional and safe. These systems are essential for a comfortable and habitable living environment.

-

Cosmetic Issues: While cosmetic issues like peeling paint or outdated décor might not affect the safety or habitability of the home, they should be addressed before getting the home appraised.

How to Meet Conventional Loan Home Condition Requirements

-

Hire a Home Inspector: A home inspection is a crucial step in the homebuying process. A qualified home inspector can identify issues that may not be visible to the untrained eye and help you determine if the property meets the conventional loan home condition requirements.

-

Make Necessary Repairs: Before closing on the loan, you’ll need to make any necessary repairs identified by the home inspector. These repairs may include fixing structural defects, upgrading outdated systems, or addressing cosmetic issues.

-

Obtain a Certificate of Occupancy: In some areas, a certificate of occupancy is required to prove a property meets local building codes and safety standards. This certificate may be required by the lender to approve the loan.

What Happens If a Home Doesn’t Meet Conventional Loan Home Condition Requirements?

If a home does not meet the requirements, you have a few options:

-

Negotiate with the Seller: You can negotiate with the seller to make the necessary repairs before closing on the loan.

-

Provide a Repair Escrow: You can set up a repair escrow account with the lender. Funds from this account will be used to make the necessary repairs after closing on the loan.

-

Look for Another Property: If the repairs are too extensive or costly, you may need to look for another property that meets the conventional loan home condition requirements.

-

Interested in comparing home loan rates in Singapore? If so, check out our detailed guide to learn how to get the best deals on home loans in Singapore.

-

You can cook at home and enjoy a delicious meal without leaving the comfort of your own home.

-

Looking for information about the cost of home heating oil in NH? Our comprehensive guide provides all the details you need to make an informed decision.

-

Find out how much it costs to install an EV charger at home in Canada and learn about the different factors that affect the installation cost.

Describe the typical home condition requirements set by Fannie Mae and Freddie Mac.

Hi there! If you’re planning to apply for a conventional loan, you must know Fannie Mae’s and Freddie Mac’s home condition requirements. These requirements ensure that the property you’re buying is safe, habitable, and worth the money you’re borrowing.

Why do these requirements exist? Well, they protect lenders from financial risks, ensure safety for homeowners, and maintain property values in neighborhoods. After all, no one wants to invest in a home that’s falling apart, right?

Now, let’s dive into the specific requirements you need to meet:

1. Structural Integrity:

The foundation, roof, and major structural components of the property should be in good condition. No one wants to live in a house with a wobbly foundation or a leaky roof, trust me.

2. Mechanical Systems:

The heating, plumbing, and electrical systems must be functional and safe. You don’t want to move into a home where the furnace doesn’t work in the middle of winter, do you?

3. Cosmetic Issues:

While cosmetic issues like peeling paint or outdated fixtures don’t affect safety or habitability, they’re still worth addressing before the appraisal. Remember, these issues can affect the property’s value.

How to Meet the Requirements:

-

Hire a qualified home inspector: They’ll identify issues and determine if the property meets Fannie Mae’s and Freddie Mac’s requirements.

-

Make necessary repairs before closing: If there are any issues, get them fixed before you close on the loan.

-

Obtain a Certificate of Occupancy: If required by local building codes, make sure you have one.

What if the Home Doesn’t Meet the Requirements?:

-

Negotiate with the seller: See if the seller is willing to make repairs before closing.

-

Set up a repair escrow account: You can set up an account with the lender to pay for repairs after closing.

-

Look for another property: If the issues are too severe or the seller isn’t willing to fix them, you might have to look for another property that meets the requirements.

Key Takeaways:

- Structural integrity: The foundation, roof, and major structural components must be in good condition.

- Mechanical systems: Heating, plumbing, and electrical systems must be functional and safe.

- Cosmetic issues: While they don’t affect safety or habitability, they should be addressed before appraisal.

- Hire a qualified home inspector: Identify issues and determine if the property meets the requirements.

- Make necessary repairs before closing: Get issues fixed before closing on the loan.

- Obtain a Certificate of Occupancy: If required by local building codes, make sure you have one.

Freddie Mac Home Possible Mortgage | 2024 Guidelines

Conventional Loan Home Requirements & Inspection

Provide Guidance on How to Meet Conventional Loan Home Condition Requirements

When it comes to conventional loans, meeting home condition requirements is crucial. Knowing these guidelines can help you avoid potential roadblocks in your home-buying journey. Let’s break it down into simple steps so you can ace this process:

1. Inspection Preparation:

- Choose a qualified home inspector. They’ll provide a detailed report highlighting any issues.

- Be present during the inspection. Ask questions and take notes.

- Pay attention to the inspector’s findings. They’ll point out areas that need attention.

2. Addressing Issues:

- Prioritize repairs. Tackle safety hazards first. Then, address cosmetic issues.

- Get quotes from multiple contractors. Compare prices and choose the best option.

- Make repairs before closing on the loan. Some lenders may allow you to set up an escrow account for repairs after closing.

3. Documentation:

- Keep detailed records of repairs and replacements. These documents will be helpful if you ever need to sell the property.

- Obtain a Certificate of Occupancy if required by local building codes.

4. Working with the Seller:

- If major repairs are needed, negotiate with the seller to make them before closing.

- You can also ask for a credit toward closing costs or a reduced purchase price.

5. Be Proactive:

- Don’t wait until the last minute to address repairs. The sooner you start, the smoother the process will be.

- Communicate with your lender throughout the process. They’ll guide you through each step.

6. Consider Getting Pre-Approved:

- Getting pre-approved for a conventional loan can give you a better idea of how much you can afford.

- Pre-approval can also strengthen your offer when you find a home you want to buy.

Key Takeaways:

-

Adhere to Conventional Loan Guidelines: Conventional loans follow strict home condition requirements set by Fannie Mae and Freddie Mac.

-

Inspection is Paramount: Schedule a professional home inspection to identify and address any issues before closing.

-

Prioritize Repairs: Focus on safety hazards first, then address cosmetic issues.

-

Negotiate with the Seller: If major repairs are needed, negotiate with the seller for repairs or a reduced purchase price.

-

Documentation is Key: Keep detailed records of repairs and replacements for future reference.

-

Communicate with the Lender: Maintain open communication with your lender throughout the process for guidance and support.

-

Consider Pre-Approval: Getting pre-approved for a conventional loan can streamline the home-buying process.

Citations:

Conventional Loan Home Requirements & Inspection

Freddie Mac Home Possible Mortgage | 2024 Guidelines

Discuss the implications of not meeting conventional loan home condition requirements.

Conventional loans are offered by banks and credit unions, and they’re not backed by the government. These loans are more flexible than government-backed loans, but they also have stricter requirements. One of the most important requirements is that the home must be in good condition.

Borrowers must ensure the property they intend to purchase meets conventional loan home condition requirements. These requirements protect lenders from financial risks and ensure safety and habitability for homeowners. Neglecting to meet these requirements can lead to various implications that may hinder the homebuying process and impact the property’s value.

Key Takeaways:

- Failing to meet conventional home loan requirements can result in loan disapproval, preventing the property’s purchase.

- Required repairs or upgrades to meet the standards may incur additional costs, potentially straining the budget.

- Delays in the homebuying process due to necessary repairs and renovations can disrupt timelines and cause inconvenience.

- Failure to address property condition issues may compromise safety and habitability, affecting the property’s value and long-term enjoyment.

- Neglecting home condition requirements could lead to future legal disputes between the buyer, seller, and lender, creating unnecessary complexities.

What Happens If a Home Doesn’t Meet Conventional Loan Home Condition Requirements?

Fannie Mae and Freddie Mac have specific guidelines for home condition requirements. If a home doesn’t meet these requirements, the lender may:

- Require the seller to make repairs before the loan can be approved. This can delay the closing of the loan and increase the cost of the home.

- Allow the buyer to take out a loan to make the repairs. This can also increase the cost of the home and may require a higher down payment.

- Deny the loan altogether. This is the most severe consequence of not meeting conventional loan home condition requirements.

How to Avoid the Implications of Not Meeting Conventional Loan Home Condition Requirements

The best way to avoid the implications of not meeting conventional loan home condition requirements is to have a home inspection done before you make an offer on a home. A home inspection will identify any major problems with the home that could prevent it from meeting conventional loan home condition requirements.

Citation:

- Conventional Loan Home Requirements & Inspection

- Freddie Mac Home Possible Mortgage | 2024 Guidelines

FAQ

Q1: What is the purpose of a home inspection for a conventional loan?

A1: While conventional loans do not require a comprehensive home inspection, it is highly recommended to uncover potential issues that may affect the property’s value or habitability. A home inspection can identify necessary repairs or upgrades to meet lender standards.

Q2: What are the consequences of failing to meet conventional loan home condition requirements?

A2: Not meeting conventional loan home condition requirements may result in the loan being denied or the property being appraised at a lower value. This can have a significant impact on the borrower’s ability to secure financing or the amount of money they can borrow.

Q3: What are some typical home condition issues that may be identified during an inspection for a conventional loan?

A3: Common issues include structural defects, plumbing or electrical problems, roof damage, pest infestations, and health or safety hazards. The appraiser will evaluate the property’s condition and assign a rating based on Fannie Mae and Freddie Mac guidelines.

Q4: Can I make repairs or upgrades to my home before the appraisal to improve my chances of meeting conventional loan home condition requirements?

A4: Yes, making necessary repairs or upgrades before the appraisal can help ensure that the property meets lender standards. It is important to consult with a qualified contractor or home inspector to identify areas that need attention and to ensure that the work is done to a satisfactory level.

Q5: What are some additional tips for homeowners to prepare their property for a conventional loan home inspection?

A5: Homeowners should ensure that the property is clean, well-maintained, and free of clutter. All appliances and systems should be in working order, and any necessary repairs or upgrades should be completed. Addressing potential issues proactively can help expedite the loan approval process.

- Dora the Explorer Wipe-Off Fun: Safe & Mess-Free Activities for Little Explorers - April 18, 2025

- Does Lemongrass Repel Mosquitoes? Fact vs. Fiction + How to Use It - April 18, 2025

- Do Woodchucks Climb Trees?Fact vs. Fiction - April 18, 2025