Do You Pay Council Tax on a Park Home? Understanding Your Obligations

Discover the nuances of council tax liability for park homes in this comprehensive guide. As a homeowner, it’s essential to understand your financial responsibilities, and this article aims to shed light on this often confusing topic. Whether you’re considering buying a park home or are an existing homeowner, read on to ensure you’re fulfilling your council tax obligations.

Key Takeaways:

-

When you buy a park home, you get the home itself, but not the land it sits on, which is legally called a “pitch”.

-

Specific obligations are outlined in the Mobile Homes Act 2013 for both sellers and buyers of park homes.

-

If you buy a park home directly from the site owner, it’s a good idea to hire a solicitor or advisor to help you with the process.

-

Some site rules made before May 26, 2013, cannot be enforced anymore.

-

Park homes can be cheaper than traditional houses, but there can be unique challenges to owning one.

-

Council tax rates for park homes are usually lower than for regular homes because they are considered residential properties.

Do You Pay Council Tax on a Park Home?

When acquiring a park home, it’s essential to understand your obligations, including council tax payments. Do you pay council tax on a park home? The answer is yes, park home owners are liable to pay council tax just like owners of traditional properties.

Council Tax and Park Homes: What You Need to Know

Park homes fall under the category of residential properties, making them subject to council tax. The amount you pay will depend on various factors such as the property’s location, size, amenities, and valuation band.

Assessing Your Liability for Council Tax

To determine your council tax liability for a park home, several factors are considered:

-

Property Location: The local authority responsible for collecting council tax is determined by the park home’s location. Different regions may have varying council tax rates and policies.

-

Valuation Band: Park homes are assigned a valuation band based on their market value. This band determines the council tax rate you’ll pay.

-

Size and Amenities: Larger park homes with more amenities typically fall into higher valuation bands, resulting in higher council tax bills.

How to Pay Council Tax on a Park Home

Paying council tax for a park home is similar to paying for a traditional property. You can choose from several payment methods, including:

-

Direct Debit: Set up a direct debit to automate your council tax payments. This ensures timely payments and helps avoid late payment penalties.

-

Online: Many local authorities offer online payment options, allowing you to pay your council tax bill securely and conveniently.

-

Over the Phone: You can call your local authority’s council tax department to make a payment over the phone using a credit or debit card.

-

By Post: Send a check or money order to your local authority’s designated mailing address. Ensure you include your council tax account number and the property address.

Exemptions and Discounts

Certain circumstances may qualify you for council tax exemptions or discounts. For instance, if you’re a low-income individual or receiving certain benefits, you may be eligible for a discount on your council tax bill. Contact your local authority to inquire about potential exemptions or discounts.

Conclusion

As a park home owner, you’re responsible for paying council tax like any other property owner. Understanding your council tax obligations, including valuation bands, payment methods, and potential exemptions, is crucial to managing your financial responsibilities as a park home owner.

Do you want to know if you will pay capital gains tax on your second home? We have everything you need right here, click do you pay capital gains tax on a second home to find out!

Want to know whether you have to pay council tax on park homes? We have a comprehensive guide with all the details you need. do you pay council tax on park homes

Curious if California has a homestead exemption? We’ve got you covered! Explore our comprehensive guide for all the information you need. does california have homestead exemption

Wondering if Eufy is compatible with Google Home? Find out in our comprehensive guide! All the information you need is just a click away. does eufy work with google home

Exemptions and Discounts Available to Park Home Owners

Yes, park home owners are legally bound to pay council tax, similar to owners of conventional residential properties. However, park homes have lower council tax bills. Why is that? Typically, park homes are valued lower than traditional houses. That means lower council tax bills for park home residents.

Furthermore, there are discounts available to park home owners. One is a single person discount. If you live alone, you could save up to 25% on your council tax bill. Another discount is the low-income discount. If you’re struggling financially, you might be eligible for Council Tax Support from your local government. Check with your local council’s website or at your local Citizens Advice bureau for detailed guidelines.

Key Takeaways:

- Park home owners pay council tax like traditional homeowners.

- Lower property valuation means lower council tax bills for park home owners.

- Exemptions and discounts available to park home owners:

- Single person discount: 25% off for single occupants.

- Low-income discount: Apply for Council Tax Support.

- Check with your local council or Citizens Advice for more information.

Citation: monetarymaster.co.uk

Citation: citizensadvice.org.uk

How to Pay Council Tax on a Park Home

Greetings, fellow park home enthusiasts! In this comprehensive guide, we’ll delve into the intricacies of council tax for park homes, ensuring you navigate this financial responsibility with ease.

Key Takeaways:

– Council tax applies to park homes, categorized as residential properties.

-

Factors like property location, valuation band, and size influence council tax liability.

-

Methods to pay council tax:

• Direct debit

• Online payment

• Over-the-phone payment

• Post office payment -

Exemptions and discounts may apply for low-income households or individuals receiving specific benefits.

-

Understanding obligations, including bands, payment options, and potential exemptions, is essential for managing council tax.

1. The Nexus Between Park Homes and Council Tax

Council tax is a local tax levied on residential properties in the United Kingdom. Park homes, considered residential properties, are subject to council tax, similar to traditional homes.

2. Assessing Council Tax Liability

The amount of council tax you owe hinges upon several factors:

-

Property Location: Different regions have varying council tax rates.

-

Valuation Band: Park homes are assigned a valuation band that determines their tax liability.

-

Size and Amenities: Larger park homes with more amenities may fall into higher valuation bands.

3. Methods to Pay Council Tax on a Park Home

Paying council tax on a park home is as diverse as a box of chocolates. Let’s explore the options:

-

Direct Debit: Set up a direct debit to ensure timely and hassle-free payments.

-

Online Payment: Utilize your bank’s online portal to settle your council tax dues.

-

Over-the-Phone Payment: Contact your local council for phone payment options.

-

Post Office Payment: Visit a post office to make payments in person.

4. A Helping Hand: Exemptions and Discounts

In certain circumstances, you may qualify for council tax exemptions or discounts:

-

Low-Income Households: If your income falls below a certain threshold, you may be eligible for a discount.

-

Specific Benefits: Individuals receiving specific benefits may qualify for exemptions or reductions.

5. The Importance of Staying Informed

Understanding council tax obligations, valuation bands, payment methods, and potential exemptions is crucial for managing council tax as a park home owner.

6. Additional Resources and Information

- [Council Tax Rates]: For further details on council tax rates.

- [Council Tax Exemptions and Discounts]: A deep dive into exemptions and discounts available.

Citations:

**Appealing a Council Tax Bill for a Park Home**

**Key Takeaways:**

– Council tax is applicable to park homes, classified as residential properties in the UK.

– Factors like property location, valuation band, size, and amenities influence council tax liability.

– Park homes have lower council tax bills due to their lower property prices.

– Apply for a single person discount if you live alone, or for Council Tax Support if you have a low income.

– You have the right to appeal your council tax band if you believe it’s incorrect.

Is your park home council tax bill giving you a headache? Don’t worry, you’re not alone. Many park home owners face confusion and frustration when it comes to their council tax obligations.

But fear not, friends! This guide will equip you with the knowledge and strategies to tackle **appealing a council tax bill for a park home**. Let’s dive right in!

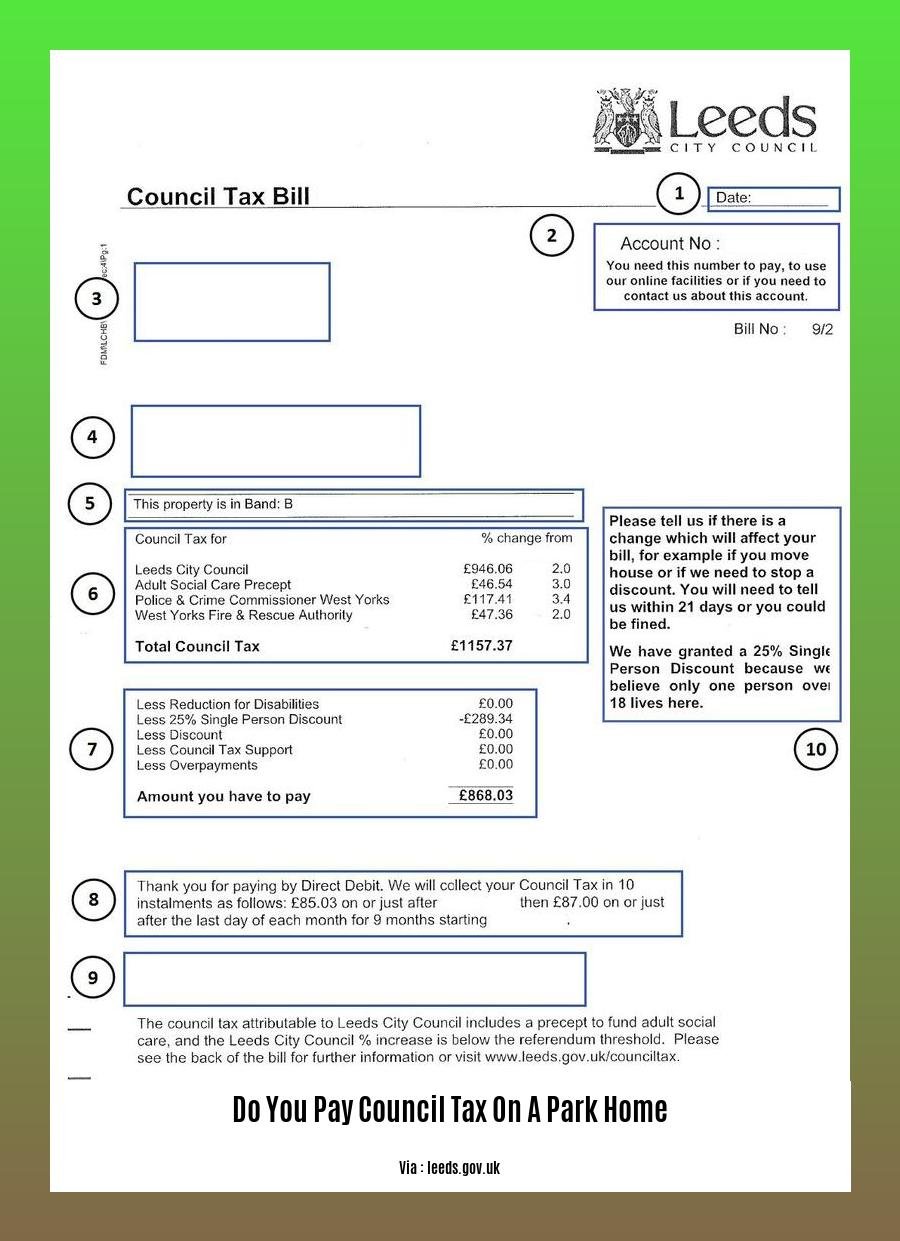

1. Understanding Your Council Tax Bill:

Unraveling the mystery of your council tax bill is the first step towards a successful appeal. Your bill should include details like your property’s valuation band, the amount of council tax due, and any discounts or exemptions you may be entitled to.

2. Check Your Valuation Band:

Valuation bands determine the amount of council tax you pay. If you believe your park home is in the wrong band, you can challenge it. Contact the Valuation Office Agency to initiate the review process.

3. Applying for Discounts and Exemptions:

Good news! You may be eligible for discounts or exemptions that can reduce your council tax bill. Single person discounts are available if you live alone, while low-income households can apply for Council Tax Support. Research and apply for any applicable discounts or exemptions to ease your financial burden.

4. Preparing Your Appeal:

Appealing a council tax bill requires a well-prepared case. Gather evidence to support your claim, such as photos of your park home, details of any relevant discounts or exemptions, and a clear explanation of why you believe the valuation band is incorrect.

5. Lodging Your Appeal:

Once you’re armed with evidence and a solid argument, it’s time to lodge your appeal. Contact your local council to initiate the process. Remember to submit your appeal within the specified timeframe to avoid missing out.

6. Attending a Valuation Tribunal Hearing:

If your appeal is accepted, you may be invited to a valuation tribunal hearing. Prepare yourself by presenting your evidence clearly and concisely. The tribunal will consider your case and make a decision on whether to adjust your council tax band.

Remember, appealing a council tax bill can be a complex process, so don’t hesitate to seek professional advice if you need it. With careful preparation and a compelling case, you can increase your chances of a successful appeal and save money on your council tax bill.

Sources:

– [Council tax on a park home](https://www.monetarymaster.co.uk/housing/council-tax-on-a-park-home)

– [Buying a Park Home: Factsheet](

FAQ

Q1: Do I need to pay council tax on my park home?

A1: Yes, park homes are considered residential properties in the UK, so they are subject to council tax. However, council tax rates for park homes are typically lower than for conventional residences due to their lower property prices.

Q2: What is the single person discount for council tax on a park home?

A2: Single individuals living alone in a park home are eligible for a 25% discount on their council tax bill.

Q3: How can I reduce my council tax bill on my park home?

A3: In addition to the single person discount, individuals with low incomes can apply for Council Tax Support from their local council to reduce their tax bill.

Q4: Is there a maximum limit for how much I can be charged in council tax?

A4: No, there is no cap or maximum limit on the council tax you may be charged for a park home.

Q5: Who is responsible for paying council tax on a park home?

A5: The owner of the park home is responsible for paying the council tax bill. The site owner may collect the council tax and forward it to the local council on behalf of the park home owner.

- Dora the Explorer Wipe-Off Fun: Safe & Mess-Free Activities for Little Explorers - April 18, 2025

- Does Lemongrass Repel Mosquitoes? Fact vs. Fiction + How to Use It - April 18, 2025

- Do Woodchucks Climb Trees?Fact vs. Fiction - April 18, 2025