Do You Pay Council Tax on Park Homes? A Legal Expert’s Perspective

Key Takeaways:

- Park homes are classified as residential properties and are subject to council tax.

- Council tax for park homes is typically lower than traditional houses due to lower property values.

- In addition to council tax, park home residents typically pay a pitch fee for the occupation of the pitch and may pay separately for utilities.

- The Mobile Homes Act 1983 regulates the contract between park home residents and site owners, setting out their respective rights and obligations.

- Park home residents should comply with any rules set forth by the site owner.

[Relevant Sources]

- Buying a park home: factsheet – GOV.UK

- Park Home FAQs | Parkhome.org.uk

Do you pay council tax on park homes?

Navigating the complexities of property ownership can be daunting, especially when it comes to understanding the intricacies of taxation. One common question that arises is whether or not park homes are subject to council tax.

In this article, we’ll delve into the world of council tax and park homes, providing you with the essential information you need to know. Whether you’re a prospective park home owner or simply interested in understanding your tax obligations, this guide will help clarify the matter.

Council Tax and Park Homes: A General Overview

Park homes, similar to traditional residential properties, are generally subject to council tax. The amount of council tax you pay will depend on the value of your property, the local council’s tax rates, and any exemptions or discounts you may qualify for.

It’s important to note that council tax bills for park homes are typically lower compared to those for traditional houses, owing to their generally lower property prices.

Factors Determining Council Tax Liability for Park Homes

Several factors play a role in determining whether or not a park home is subject to council tax. These include:

-

Permanency of Residence: If your park home is your primary residence and you live there year-round, it is likely to be subject to council tax.

-

Classification as a Residential Property: Park homes are typically classified as residential properties, which makes them liable for council tax. However, if your park home is classified as a non-residential property, such as a holiday home, it may be exempt from council tax.

-

Location of the Park Home: The location of your park home within the local council’s boundaries determines which council tax rates apply.

Exemptions and Discounts for Park Home Owners

Certain circumstances may allow park home owners to qualify for exemptions or discounts on their council tax bills. These may include:

-

Single Person Discount: If you’re a single person living in your park home, you may be eligible for a 25% discount on your council tax bill.

-

Disability Exemptions: If you or someone living in your park home has a disability, you may be entitled to a council tax exemption or reduction.

-

Low-Income Exemptions: If you have a low income or receive certain benefits, you may qualify for council tax support or exemption.

Conclusion

Understanding your council tax obligations as a park home owner is crucial to ensure compliance and avoid any potential penalties. By familiarizing yourself with the relevant regulations and seeking professional advice if needed, you can navigate the complexities of park home taxation with confidence.

-

Wondering if you need to pay capital gains tax on your second home? Explore this insightful article to find out. Do you pay capital gains tax on a second home

-

Curious about whether you need to pay council tax on your park home? Find all the answers you need in this comprehensive guide. Do you pay council tax on a park home

-

Learn everything you need to know about homestead exemptions in California in this informative article. Does California have homestead exemption

-

Discover the compatibility between Eufy and Google Home in this detailed exploration. Does Eufy work with Google Home

How much council tax is payable on park homes?

Navigating the complexities of council tax can be tricky, especially for park home owners. Here’s a comprehensive guide to understanding your council tax obligations if you reside in a park home:

Key Takeaways:

-

Park homes are subject to council tax like traditional residential properties.

-

The amount of council tax payable depends on various factors, including the property’s value, local council tax rates, and any applicable exemptions or discounts.

-

Factors determining council tax liability include the permanency of residence, classification as a residential property, and the location of the park home.

-

Park home owners may be eligible for exemptions or discounts on their council tax bills, such as single person discount, disability exemptions, and low-income exemptions.

-

Understanding your council tax obligations as a park home owner is crucial to ensure compliance and avoid penalties.

Who is Liable to Pay Council Tax on Park Homes?

Generally, if you reside in a park home and consider it your primary residence, you are responsible for paying council tax. This applies similarly to traditional residential properties. The liability for council tax is determined by several key factors:

-

Permanency of Residence: Your park home must be your main or sole residence to be liable for council tax. If it’s a holiday home or occasionally used, you may be exempt from paying council tax.

-

Residential Classification: Your park home must be classified as a residential property to be subject to council tax. This typically means it has the necessary facilities and amenities for permanent living, such as a kitchen, bathroom, and bedrooms.

-

Location of Park Home: The location of your park home also plays a role in determining council tax liability. It will fall under the jurisdiction of the local council where the park home is situated, and you’ll be subject to their council tax rates and policies.

Understanding Exemptions and Discounts

Exemptions and discounts can significantly reduce your council tax liability as a park home owner. Here are some common exemptions and discounts available:

-

Single Person Discount: If you live alone in your park home, you may be eligible for a 25% council tax reduction.

-

Disability Exemption: If you or someone living in your park home has a qualifying disability, you may be entitled to a council tax exemption or reduction.

-

Low-Income Exemption: Some local councils offer council tax exemptions or reductions for low-income households. Check with your local council to see if you qualify for any of these exemptions or discounts.

Calculating Council Tax Payable on Park Homes

The amount of council tax payable on park homes is determined by several factors:

-

Property Valuation: The value of your park home is a significant factor in determining your council tax band. Park homes are typically valued lower than traditional properties, resulting in lower council tax bands.

-

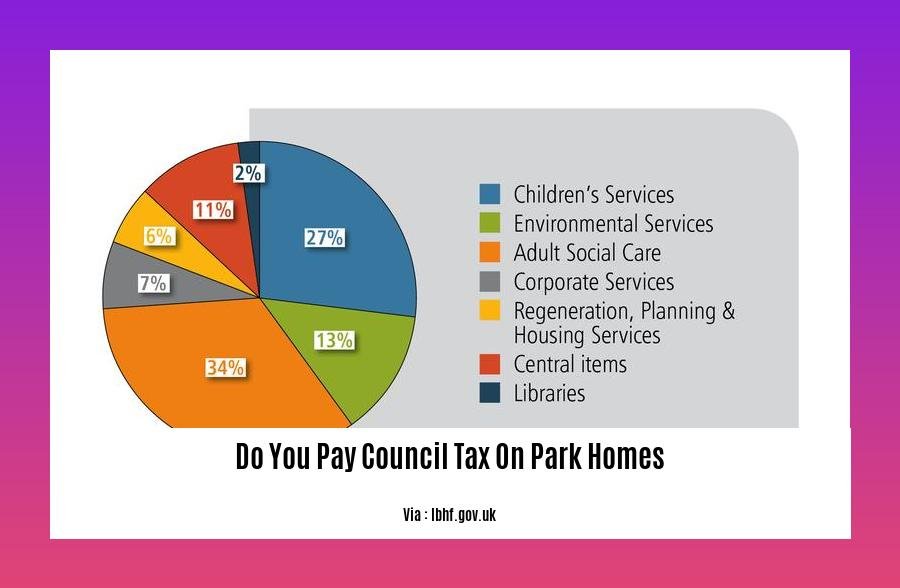

Local Council Tax Rates: Each local council sets its own council tax rates. These rates vary across different regions and can impact the amount of council tax you pay.

-

Exemptions and Discounts: If you qualify for any exemptions or discounts, these will be applied to your council tax bill, reducing the amount you need to pay.

To find out your exact council tax liability, you can contact your local council or check their website.

Conclusion

Understanding your council tax obligations as a park home owner is essential to ensure compliance and avoid penalties. By considering factors such as permanency of residence, residential classification, and location, you can determine your liability to pay council tax. Additionally, exploring available exemptions and discounts can help you reduce your council tax bill. If you have any further questions or require clarification, don’t hesitate to consult with a legal expert or your local council for more personalized guidance.

Citations:

-

Council Tax | Shelter England

-

Council tax for park homes – everything you need to know – Park Home Life

Methods of paying council tax on park homes

Council tax rules for park homes are a bit complicated. But by understanding how they work, you can ensure that you’re paying the correct amount of tax.

Do I have to pay council tax on my park home?

If you live in a park home as your primary residence, you’re liable to pay council tax. However, if you only use your park home as a holiday home, you won’t have to pay council tax.

How much council tax will I pay?

The amount of council tax you pay will depend on the value of your park home and the local council tax rates. Park homes are typically in the lowest council tax band (Band A). This means that the average council tax bill for a park home is around £1,000 per year.

How can I pay my council tax?

There are a few different ways to pay your council tax on a park home. You can:

- Pay online

- Pay by Direct Debit

- Pay by phone

- Pay by post

Can I get a discount on my council tax?

Yes, you may be eligible for a discount on your council tax if you’re:

- On a low income

- Living alone

- Disabled

- A student

Key Takeaways:

- If you live in a park home as your primary residence, you’re liable to pay council tax.

- The amount of council tax you pay will depend on the value of your park home and the local council tax rates.

- Park homes are typically in the lowest council tax band (Band A).

- You can pay your council tax online, via Direct Debit, phone, or post.

- You may be eligible for a discount on your council tax if you’re on a low income, living alone, disabled, or a student.

Sources:

Council Tax Reduction: Who can get it and how to apply

Available Exemptions and Discounts for Park Home Owners

Hello there, fellow park home dwellers! I know navigating council tax matters can be a bumpy road, especially with all the rules and regulations. Let’s explore the exemptions and discounts you may be eligible for as a proud park home owner.

Single Person Discount:

Living solo in your park home? You’re in luck! You can apply for a 25% discount on your council tax bill. If you’re the only resident registered at that address, all it takes is filling out a simple form and soaking in the savings.

Low-Income Exemptions:

Are you struggling financially? Fear not! If your income falls below a certain threshold, you might qualify for a council tax reduction. This lifesaver can significantly ease the burden of your tax bill. Just get in touch with your local council to find out if you meet the criteria and get the support you deserve.

Disability Exemptions:

For those living with disabilities, park homes offer a safe haven. And there’s good news—you may be eligible for a council tax exemption or reduction. The level of support depends on the severity of your disability, but it’s worth exploring.

Band A Advantage:

Park homes typically fall under the lowest council tax band, Band A. This means you’ll likely pay less council tax compared to those residing in traditional properties. Isn’t that a breath of fresh air?

Pitch Fee Discounts:

Apart from council tax exemptions and discounts, you might be able to save on your pitch fees too. Check with your park operator to see if you qualify for any discounts through Housing Benefit, Pension Credit, or Universal Credit. Every penny counts!

Council Tax Support:

If you’re still feeling the pinch, don’t hesitate to apply for Council Tax Support from the government. This scheme lends a helping hand to individuals with low income. It’s worth investigating whether you meet the eligibility criteria.

Key Takeaways:

- Park home occupants must pay council tax like traditional homeowners.

- Available exemptions and discounts for park home owners include the single person discount, low-income exemptions, disability exemptions, and Band A advantage.

- Pitch fee discounts may be available through programs like Housing Benefit, Pension Credit, or Universal Credit.

- Applying for Council Tax Support can provide additional relief for those in financial need.

Citations:

[1] https://www.monetarymaster.co.uk/housing/council-tax-on-a-park-home/

[2]

FAQ

Q1: Do park home residents have to pay council tax?

A1: Yes, park home residents are required to pay council tax, as park homes are classified as residential properties. The amount of council tax due depends on the property’s value and the local council’s tax rates.

Q2: Are there any discounts or exemptions available for council tax on park homes?

A2: Yes, individuals who live alone in park homes can receive a 25% discount on their council tax bill. Additionally, low-income individuals may qualify for Council Tax Support from the government. Some individuals may also be eligible for a discount on the pitch fees through Housing Benefit, Pension Credit, or Universal Credit.

Q3: How is the amount of council tax for park homes determined?

A3: The amount of council tax for park homes is determined by the council tax band assigned to the property. This band is based on the property’s value, and the higher the band, the higher the council tax bill.

Q4: What is the typical council tax band for park homes?

A4: Park homes typically fall under the lowest council tax band, Band A. This is due to their generally lower property prices compared to traditional houses.

Q5: What is the process for applying for a discount or exemption on council tax for park homes?

A5: To apply for a discount or exemption on council tax for a park home, individuals should contact their local council. The council will provide information on the eligibility criteria and the application process.

- Backsplash Colors for White Cabinets: Find Your Perfect Match - November 19, 2025

- Backsplash Ideas for White Cabinets: Find Your Perfect Style - November 18, 2025

- White Tile Backsplash Kitchen: A Classic and Clean Design - November 17, 2025