In the realm of financial strategies, one option that warrants exploration is the home equity loan with no income verification. This unique financial tool, appropriately titled “Unlocking Home Equity: Delving into Home Equity Loans with No Income Verification,” presents homeowners with an innovative way to leverage the value of their property without the constraints of traditional income verification processes.

Key Takeaways:

-

You can get a home equity loan without providing proof of income.

-

Having 30% equity in your home is one of the qualifications.

-

CLTV should be below 80% for a no-income-verification home equity loan.

-

A sale-leaseback is an option if you don’t qualify for a traditional home equity loan or don’t want to take on more debt.

Home Equity Loan No Income Verification

Navigating the financial landscape can be daunting, especially when it comes to homeownership. Home equity loans have traditionally required proof of income, limiting options for those facing unemployment, self-employment, or other income verification challenges. However, innovative lending solutions like home equity loans with no income verification offer a lifeline to homeowners seeking to tap into their home’s equity without the burden of income documentation. Let’s delve into the world of home equity loans without income verification, exploring their nuances and guiding you through the process.

Eligibility and Requirements

Qualifying for a home equity loan without income verification may seem like an uphill task, but it’s not insurmountable. Lenders typically evaluate your application based on your home’s equity, credit history, and debt-to-income ratio (DTI).

-

Home Equity: You typically need at least 30% equity in your home to qualify for a home equity loan without income verification. This means that the amount you owe on your mortgage should be no more than 70% of your home’s appraised value.

-

Credit History: A solid credit history demonstrates your ability to manage debt responsibly. Lenders prefer borrowers with a FICO score of 620 or higher, but some may consider lower scores with compensating factors.

-

Debt-to-Income Ratio (DTI): Your DTI is the percentage of your monthly income that goes towards debt payments. Lenders typically prefer a DTI below 43%, but some may consider higher DTI ratios if you have a strong credit history and a stable employment history.

Benefits and Drawbacks

Benefits:

-

No Income Verification: The primary advantage of a home equity loan with no income verification is the elimination of the need to provide income documentation. This can be a significant benefit for self-employed individuals, gig workers, retirees, and those with irregular income sources.

-

Access to Cash: Home equity loans provide access to a lump sum of cash that can be used for various purposes, such as home renovations, debt consolidation, education expenses, or emergency funding.

-

Competitive Interest Rates: Home equity loans typically offer competitive interest rates compared to other forms of unsecured loans. The interest rates may be fixed or variable, depending on the lender and the loan terms.

Drawbacks:

-

Risk of Foreclosure: Home equity loans are secured loans, meaning your home serves as collateral. Failure to repay the loan could result in foreclosure and the loss of your home.

-

Higher Interest Rates: Home equity loans without income verification may carry higher interest rates than traditional home equity loans. This is because lenders perceive borrowers with no income verification as higher risk.

-

Loan Limits: Lenders may impose loan limits on home equity loans without income verification. The maximum loan amount may be lower compared to traditional home equity loans.

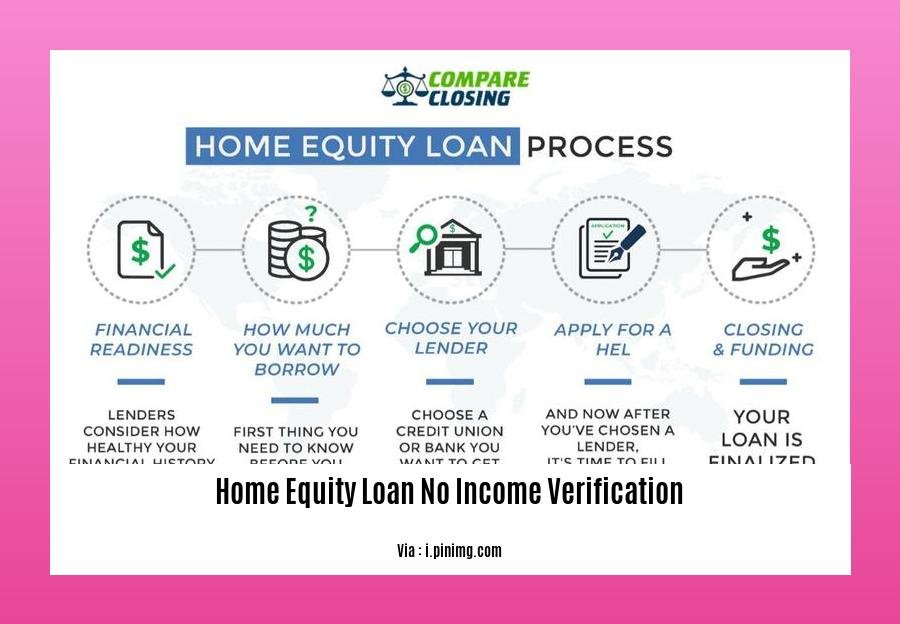

Step-by-Step Guide to Obtaining a Home Equity Loan Without Income Verification

-

Research and Compare Lenders: Research different lenders offering home equity loans with no income verification. Compare interest rates, fees, terms, and eligibility requirements.

-

Estimate Your Home Equity: Determine the amount of equity you have in your home by subtracting the outstanding mortgage balance from the appraised value.

-

Gather Supporting Documents: While income verification is not required, lenders may ask for other supporting documents, such as tax returns, bank statements, and proof of employment (if applicable).

-

Apply for the Loan: Complete the loan application with the chosen lender, providing the necessary personal and financial information.

-

Await Loan Approval: The lender will review your application and assess your credit history, equity, and DTI. The approval process may take several days or weeks.

-

Loan Closing: Once approved, you’ll need to attend a loan closing, where you’ll sign the loan documents and receive the loan proceeds.

-

Repayment: Make regular monthly payments towards the loan principal and interest, as per the loan terms.

Additional Considerations

-

Alternatives to Home Equity Loans: If you don’t qualify for a home equity loan with no income verification, consider alternative financing options such as home equity lines of credit (HELOCs), cash-out refinancing, or sale-leasebacks.

-

Consult a Financial Advisor: If you’re unsure about whether a home equity loan is the right choice for you, consult with a financial advisor who can assess your financial situation and provide personalized guidance.

-

Carefully Evaluate Loan Terms: Before signing the loan agreement, carefully review the terms and conditions, including the interest rate, fees, repayment schedule, and prepayment penalties (if applicable).

With careful planning and consideration, a home equity loan with no income verification can be a valuable financial tool for homeowners seeking to unlock their home’s equity without the burden of income documentation. By understanding the eligibility requirements, benefits, drawbacks, and application process, you can make an informed decision that aligns with your financial goals and circumstances.

-

Find out how to get a home equity loan without income and learn how it can help you.

-

Are you looking for home essentials contact number? Get in touch with us today and let us know.

-

Discover the costs associated with installing a home EV charging station and make an informed decision.

-

Considering the home EV charging station price? Explore your options and make the right choice for your needs.

Can You Get A Home Equity Loan With No Income?

Yes, it’s possible to secure a home equity loan without providing proof of income. However, it’s essential to understand the intricacies and requirements associated with this type of loan. Let’s explore this topic further.

Key Takeaways:

- Home equity loans allow you to borrow against your home’s value without selling it.

- Typically, lenders require income verification to assess your ability to repay the loan, but there are lenders who may consider alternative sources of income, such as assets or investments.

- Lenders need to determine your CLTV (combined loan-to-value ratio) to assess the risk involved in lending.

- There are specific eligibility criteria, including a minimum equity requirement and debt-to-income ratio, that you need to meet to qualify.

- Sale-leasebacks offer an alternative to home equity loans for those who can’t qualify or don’t want to take on more debt.

No-Income Home Equity Loans: What Are They?

No-income home equity loans are specifically designed for individuals who might not have traditional sources of income, such as retirees, self-employed individuals, or those with irregular income patterns. These loans are secured by your home’s equity, similar to traditional home equity loans.

Eligibility Requirements for No-Income Home Equity Loans:

Lenders typically have specific criteria to assess your eligibility for a no-income home equity loan. Some common requirements include:

- Home Equity: You should have a substantial amount of equity in your home, often around 30% or more.

- Debt-to-Value (DTV) Ratio: Lenders will calculate your DTV ratio by dividing your total debt by the appraised value of your home. A DTV ratio below 80% is typically preferred.

- Credit Score: A good credit score can increase your chances of approval and potentially secure better loan terms.

Alternatives to Home Equity Loans without Income Verification:

If you’re unable to qualify for a no-income home equity loan, there are other options available:

- Sale-Leaseback: This arrangement involves selling your home to an investor and leasing it back, providing you with a lump sum payment while allowing you to remain in your home.

Weighing the Pros and Cons:

Pros:

- No income verification simplifies the application process.

- You can access funds tied up in your home’s equity.

- Potential tax benefits, as interest paid on home equity loans is often tax-deductible.

Cons:

- Interest rates on no-income home equity loans might be higher than traditional home equity loans.

- You’re borrowing against your home, putting it at risk if you default on the loan.

- There might be additional fees and closing costs associated with no-income home equity loans.

The Bottom Line:

No-income home equity loans can be a viable option for homeowners who need to tap into their home’s equity without providing proof of income. However, it’s crucial to carefully evaluate your financial situation, understand the terms and conditions of the loan, and consider alternatives like sale-leasebacks to make an informed decision.

Citation:

Home Equity Loan With No Income Verification – EasyKnock

How To Get a Home Equity Loan if You’re Unemployed – The Balance

What you need to qualify for home equity loans without income verification

Let’s talk about home equity loans. Imagine tapping into your home’s hidden wealth without the hassle of traditional income verification. These specialized home equity loans offer homeowners a unique way to unlock their home’s potential, opening up a world of financial possibilities. Whether you dream of home improvements, education expenses, or debt consolidation, a home equity loan without income verification could be your key to financial freedom.

Key Takeaways:

- Home equity loans without income verification can provide access to funds using your home’s equity without traditional proof of income.

- Eligibility often depends on factors like home equity percentage, credit score, and debt-to-income ratio.

- Explore no-income home equity loan options such as stated income, stated assets (SISA) or no income, no assets (NINA) loans.

- Weigh the pros and cons carefully before deciding on a no-income home equity loan.

- Consider alternative financing options, like a sale-leaseback, if you don’t meet the criteria for a no-income home equity loan.

Eligibility Criteria:

Unveiling the secrets to qualifying for a home equity loan without income verification, let’s dive into the essential requirements:

- Home Equity:

-

30% or more: This equity cushion in your home is crucial for securing a no-income home equity loan.

-

Debt-to-Income (DTI) Ratio:

-

Below 80%: Keep your DTI low to demonstrate your ability to manage additional debt.

-

Credit Score:

-

Favorable credit history: A solid credit score reflects your responsible borrowing behavior and boosts your chances of approval.

-

Alternative Sources of Income:

- Consider including: Explore non-traditional income sources like freelancing, rental income, or investment earnings.

Types of No-Income Home Equity Loans:

Navigating the various types of no-income home equity loans, you’ll encounter these options:

- Stated Income, Verified Assets (SIVA) Loans:

- Stated Income: Provide a declared income amount without traditional income documentation.

-

Verified Assets: Prove your financial strength through bank statements or investment account statements.

-

Stated Income, Stated Assets (SISA) Loans:

-

No Asset Verification: Unlike SIVA loans, SISA loans eliminate the need to verify your assets.

-

No Income, No Assets (NINA) Loans:

- No Income or Asset Verification: These loans offer the most relaxed criteria but often come with higher interest rates and fees.

Pros and Cons of No-Income Home Equity Loans:

Weighing the advantages and disadvantages of no-income home equity loans is essential:

Pros:

– Simplified Application: Say goodbye to the rigorous income verification process.

– Access to Home Equity: Unlock the value tied up in your home without selling it.

– Potential Tax Benefits: Interest paid on home equity loans may offer tax deductions.

Cons:

– Higher Interest Rates: Expect interest rates typically higher than traditional home equity loans.

– Risk of Foreclosure: Defaulting on the loan could lead to losing your home.

– Additional Fees: Prepare for potential fees and closing costs associated with the loan.

Alternative Financing Option:

If no-income home equity loans don’t align with your financial situation, consider a sale-leaseback:

- Sale-Leaseback:

- Selling Your Home: Involve selling your home to a third-party investor with an agreement to lease it back.

- Tax-Free Proceeds: Enjoy tax-free proceeds from the sale while retaining occupancy.

Conclusion:

No-income home equity loans present a unique opportunity to leverage your home’s equity, yet careful evaluation of your financial circumstances is crucial. Explore your options, understand the risks involved, and seek professional advice if needed. The key to unlocking your home’s potential lies in informed decision-making, empowering you to embark on your financial journey with confidence.

Citations:

- Home Equity Loan With No Income Verification – EasyKnock

- How To Get a Home Equity Loan if You’re Unemployed – The Balance

FAQ

Q1: How can I qualify for a no-income verification home equity loan?

A1: Typically, to qualify you need at least 30% equity in your home, proof of assets, and a good credit score. Some lenders may also require a co-signer or co-applicant.

Q2: What are the benefits of getting a no-income verification home equity loan?

A2: No-income verification home equity loans offer flexible repayment terms, the interest paid is usually tax-deductible, and can be used for any purpose, such as home improvements, education, or debt consolidation.

Q3: Are there any risks associated with getting a no-income verification home equity loan?

A3: Yes, there are risks. Variable interest rates can lead to higher monthly payments, and if the home value decreases, you may owe more than the home is worth.

Q4: What are the different types of no-income verification home equity loans?

A4: There are three main types:

– Stated income, verified assets (SIVA) loans

– Stated income, stated assets (SISA) loans

– No income, no assets (NINA) loans

Q5: Which type of no-income verification home equity loan is right for me?

A5: The best type of loan for you will depend on your individual circumstances and financial goals. It’s important to compare interest rates, fees, and repayment terms from multiple lenders before making a decision.

- Does 100% Polyester Shrink? A Complete Guide to Washing & Drying - April 16, 2025

- Elegant Drapery Solutions for Arched Windows: A Complete Guide - April 16, 2025

- The Best Dining Room Tables with Drop Leaves: A Buyer’s Guide - April 16, 2025