In the realm of homeownership, financial hurdles can often arise, especially when seeking financing options like home equity loans. Traditional income verification methods may pose challenges for some homeowners, leaving them wondering if securing a home equity loan is even possible. Discover how to navigate this obstacle in our comprehensive guide [- Home Equity Loan Without Income: How to Secure Financing Without Traditional Verification]. Learn about alternative ways to qualify for home equity loans, explore creative financing options, and gain the confidence to make informed decisions about your home equity loan journey.

Key Takeaways:

- Lenders focus on the property’s value, not income, when evaluating home equity loan applications.

- Meeting the DTI ratio requirement and demonstrating a consistent income stream are necessary for approval.

- Alternative income sources can be used to qualify for a home equity loan if traditional employment is lacking.

- Home equity loans offer access to funds for various purposes, including home improvement, debt consolidation, and emergencies.

Home Equity Loan Without Income

Navigating the world of homeownership can be challenging, especially when unexpected expenses arise. A home equity loan without income can be a lifeline for homeowners seeking to tap into the value of their property without the traditional requirement of income verification. This article demystifies the process, outlining the eligibility criteria, application process, and potential benefits and drawbacks of this financing option.

Eligibility Criteria

While the absence of an income requirement sets it apart from traditional loans, obtaining a home equity loan without income does come with certain eligibility requirements:

-

Property Value: Your property’s value and the amount of equity you have built in it play a crucial role in determining your eligibility. Lenders typically lend up to a certain percentage of the appraised value of your home, minus any outstanding mortgage balance.

-

Credit Score: A healthy credit history and a high credit score indicate your creditworthiness and repayment capability. Lenders may have minimum credit score requirements for home equity loans without income.

-

Debt-to-Income (DTI) Ratio: Even without income verification, lenders assess your DTI ratio to ensure you can comfortably repay the loan. Your DTI ratio compares your monthly debt payments to your monthly income.

Application Process

Applying for a home equity loan without income typically involves these steps:

-

Property Appraisal: An appraisal determines the current market value of your home. This assessment helps the lender determine the loan amount you qualify for.

-

Income Verification: Although traditional income verification is not required, you may need to provide alternative proof of income, such as bank statements, investment income statements, or documentation of government benefits.

-

Documentation: Lenders typically require various documents, including a completed loan application, proof of identity, property ownership documents, and insurance information.

Benefits and Drawbacks

Benefits:

-

Access to Funds: A home equity loan without income can provide access to funds for various purposes, such as home renovations, debt consolidation, or emergency expenses.

-

No Income Requirement: This type of loan does not require traditional income verification, making it an option for individuals who may not have regular employment or those who are self-employed.

-

Tax Advantages: Interest paid on a home equity loan may be tax-deductible, potentially reducing your tax liability.

Drawbacks:

-

Higher Interest Rates: Home equity loans without income typically carry higher interest rates compared to traditional home equity loans due to the perceived higher risk.

-

Risk of Default: Failing to repay the loan can lead to foreclosure, resulting in the loss of your home.

-

Loan Amount Limitations: The loan amount you qualify for may be lower compared to traditional home equity loans due to the absence of income verification.

In conclusion, a home equity loan without income can be a viable financing option for homeowners who lack traditional income verification. However, it’s crucial to carefully consider your financial situation, weigh the benefits and drawbacks, and consult with a trusted financial advisor or lender to determine if this loan type aligns with your needs and goals.

-

To learn more about home equity loans without income verification and their benefits, explore here.

-

If you have any questions or need assistance with your home essential needs, contact us at home essentials contact number.

-

Discover the cost-effective solutions for home EV charging stations and make an informed decision by clicking here.

-

Find the pricing details and compare different options for home EV charging stations by clicking here.

Required Documentation and Financing Options

When applying for a home equity loan without income, here’s what you need to know:

Required Documentation

- Proof of Income:

- Can be shown through investment income statements, child support, dividends, etc.

- Proof of Identity:

- Passport, driver’s license, or a government-issued ID

- Proof of Residence:

- Mortgage statement or a utility bill

- Credit History:

- A credit report or a credit score.

- Home Appraisal:

- To determine your home’s current value.

- Statement of Financial Position:

- Bank statements as proof of your financial status and assets.

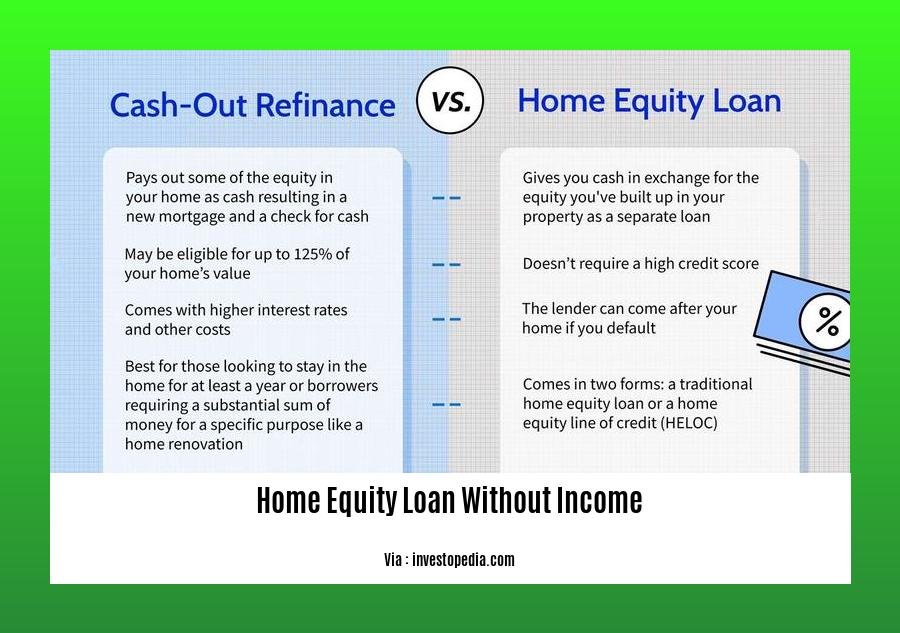

Financing Options

- Fixed-rate loans:

- Consistent interest rates throughout the loan duration.

- Adjustable-rate loans:

- Lower initial interest rates that can fluctuate later.

- Home equity lines of credit (HELOCs):

- Flexible lines of credit that allow you to borrow money as needed.

Key Takeaways:

- No Unemployment Requirement:

- Alternative income sources can be used for loan qualification.

- Home Appraisal:

- Determines the equity you can borrow against.

- Loan Documentation:

- Gather financial statements, proof of address, and home appraisal.

- Research Loans:

- Explore options like HELOCs, fixed-rate, and adjustable-rate loans.

Sources:

– Required Documentation and Financing Options for a Home Equity Loan | The Balance Money

– No-Income Home Equity Loans: How to Get One and Available Options | Point Blog

Potential Benefits and Drawbacks of Home Equity Loans Without Income

Navigating homeownership can be a dynamic journey, and financial strategies like home equity loans might come in handy. If you’re considering a home equity loan without income, it’s crucial to weigh the potential advantages and disadvantages to make an informed decision.

Key Takeaways:

- Home equity loans without income verification provide access to funds by leveraging the equity built in your property.

- These loans offer competitive interest rates compared to traditional income-based loans, allowing for substantial savings.

- Lack of income verification simplifies the application process, enabling homeowners with limited income documentation to secure financing.

- Access to substantial funds through home equity loans without income opens up opportunities for home improvements, debt consolidation, and various financial needs.

- Home equity loans without income can lead to overborrowing due to the easy access to large sums, potentially straining your budget and overall financial stability.

- There’s a risk of default and potential foreclosure if you fail to meet repayment obligations.

- Lower loan amounts might be offered compared to traditional income-based home equity loans due to the absence of income verification.

Benefits:

Flexibility: Home equity loans without income provide a flexible financial solution, accommodating homeowners with various income situations, including self-employment or irregular income sources.

Home Improvement Funding: These loans can serve as a cost-effective method to finance home renovation projects, repairs, or remodeling, enhancing the value and comfort of your property.

Debt Consolidation: Home equity loans can be leveraged to consolidate high-interest debts, potentially reducing monthly payments and simplifying your financial obligations.

Financial Contingency: Accessing funds through home equity loans without income can serve as a financial safety net during unexpected situations or emergencies, providing peace of mind.

Drawbacks:

Higher Interest Rates: Home equity loans without income verification often carry higher interest rates compared to traditional income-based loans, potentially increasing the total cost of borrowing.

Risk of Default and Foreclosure: Defaulting on a home equity loan can lead to foreclosure, which involves losing your property to the lender, potentially resulting in a significant financial loss.

Limited Loan Amounts: Lenders might offer lower loan amounts for home equity loans without income verification due to the absence of traditional income documentation, potentially impacting the scope of your financial goals.

Impact on Credit Score: Applying for multiple home equity loans without income verification can result in multiple credit inquiries, potentially affecting your credit score.

Before making a final decision, it’s wise to consult with a financial advisor to assess your individual circumstances and determine if a home equity loan without income is the most suitable financial move for you.

Sources:

– Home Equity Loans Without Income: Pros, Cons, and How To Qualify

– Home Equity Loan Without Income Verification | Bankrate

Risks and Challenges Involved in Obtaining a Home Equity Loan Without Income

Pursuing a home equity loan without traditional income verification can be tricky and may come with inherent hurdles. Let’s explore the potential risks and challenges that you should be prepared for before embarking on this financial journey:

1. Scrutinized Credit Score:

– Lenders will meticulously examine your credit history and score. A less-than-stellar credit score could lead to denial or unfavorable loan terms.

2. Limited Loan Amount:

– Expect to receive a modest loan amount due to the absence of traditional income verification, which serves as a guarantee of your ability to repay the loan. Lenders will be cautious in extending large sums.

3. Higher Interest Rates:

– Brace yourself for potentially higher interest rates. Lenders often charge a premium for assuming more risk. Weigh the interest rate against the benefits you aim to achieve through the loan.

4. Risk of Default:

– Defaulting on a home equity loan is a grave concern. If you fail to make timely payments, you risk losing your home through foreclosure.

5. Restrictive Eligibility Criteria:

– Lenders have stringent guidelines when it comes to approving home equity loans without income verification. Be prepared to fulfill specific requirements, such as significant home equity and a solid credit history.

Key Takeaways:

- Credit Check: A pristine credit history and a commendable credit score are paramount to secure a home equity loan without income verification.

- Modest Loan Amount: Brace yourself for a lower loan amount compared to traditional home equity loans due to the lack of income verification.

- Higher Interest Rates: Be prepared for potentially higher interest rates to offset the perceived higher risk associated with your loan.

- Default Risk: Nonpayment of a home equity loan could lead to default and subsequently the loss of your home through foreclosure.

- Eligibility Constraints: Lenders will impose strict requirements, including substantial home equity and a solid credit profile, to approve a home equity loan without income verification.

Relevant URL Sources:

- Risks of a Home Equity Loan – The Balance

- Risks of Taking Out a Home Equity Loan | Investopedia

FAQ

Q1: How can I obtain a home equity loan without having a traditional income?

A1: Lenders may consider alternative sources of income, such as Social Security benefits, pensions, or investment income, to determine your eligibility for a home equity loan. Providing proof of consistent income from these sources can increase your chances of approval.

Q2: What are the eligibility criteria for a home equity loan without traditional income?

A2: Lenders typically evaluate your credit history, debt-to-income ratio (DTI), and the value of your home to assess your eligibility for a home equity loan. Having a good credit score and a low DTI can make you a stronger candidate even in the absence of traditional income.

Q3: What is the impact of my credit score on my home equity loan application?

A3: A strong credit score indicates your reliability in repaying debts. A higher credit score may lead to more favorable terms and interest rates on your home equity loan, while a lower score might result in higher interest rates or denial of your application.

Q4: How much money can I borrow with a home equity loan without income?

A4: The loan amount for a home equity loan is typically determined by the equity in your home and your DTI. The lender will assess your property’s value, outstanding mortgage balance, and income sources to calculate the maximum loan amount you can borrow.

Q5: What are some alternative financing options if I don’t qualify for a home equity loan?

A5: If you don’t meet the traditional requirements for a home equity loan, you might consider a home equity line of credit (HELOC) or a personal loan. These options may have more flexible qualification criteria and can provide access to funds for your financial needs.

- Does 100% Polyester Shrink? A Complete Guide to Washing & Drying - April 16, 2025

- Elegant Drapery Solutions for Arched Windows: A Complete Guide - April 16, 2025

- The Best Dining Room Tables with Drop Leaves: A Buyer’s Guide - April 16, 2025