In the realm of homeownership, navigating the complexities of mortgage rates can be a daunting task. In this comprehensive guide, [- Uncover the Secrets of Home Loan Calculator Rates: A Comprehensive Guide for Homeowners and Buyers], we delve into the intricacies of home loan calculator rates, empowering you with the knowledge to make informed decisions about your mortgage options.

Key Takeaways:

-

HDFC Bank offers various repayment plans, including the Step Up Repayment Facility (SURF), to make home loans more accessible.

-

HDFC Bank offers pre-approved home loans, allowing individuals to secure financing before finding their dream home.

-

Loan amortization is the method of reducing debt through regular payments over a specified period, and an amortization schedule provides details of these payments.

Navigating the Labyrinth of Home Loan Calculator Rates: A Comprehensive Guide

Mortgage matters can often feel like deciphering a foreign language. One crucial aspect that can make or break your homeownership dreams is the home loan calculator rate. It’s not just a number; it’s a key factor that dictates your monthly payments, total interest paid, and overall affordability. This guide will unravel the complexities of home loan calculator rates, equipping you with the knowledge to make informed decisions about your mortgage.

Step 1: Understanding the Basics

The home loan calculator rate is the interest rate used to calculate your monthly mortgage payments. It’s typically expressed as an annual percentage rate (APR). The APR includes not just the interest rate but also other fees associated with the loan, such as points, origination fees, and mortgage insurance. A lower home loan calculator rate means lower monthly payments and less interest paid over the life of the loan.

Step 2: Factors Influencing Home Loan Calculator Rates

Several factors can influence the home loan calculator rate you’re offered:

-

Credit Score: A higher credit score generally qualifies you for a lower home loan calculator rate. Lenders see borrowers with high credit scores as less risky, making them more likely to offer favorable terms.

-

Loan-to-Value (LTV) Ratio: The LTV ratio is the percentage of the home’s purchase price you’re borrowing. A higher LTV ratio typically results in a higher home loan calculator rate because it’s seen as a riskier loan for the lender.

-

Loan Term: The length of your mortgage also affects the home loan calculator rate. Shorter-term loans (e.g., 15 years) usually have lower rates than longer-term loans (e.g., 30 years).

Step 3: Types of Home Loan Calculator Rates

There are two main types of home loan calculator rates:

-

Fixed Rate: With a fixed-rate mortgage, the home loan calculator rate remains the same throughout the life of the loan. This provides stability and predictability in your monthly payments.

-

Adjustable Rate: An adjustable-rate mortgage (ARM) has a home loan calculator rate that can change periodically, typically after an initial fixed-rate period. ARMs can offer lower initial rates, but they come with the risk of higher rates in the future.

Step 4: Shopping for the Best Home Loan Calculator Rate

Getting the best home loan calculator rate requires some legwork. Here’s how:

-

Compare Rates: Don’t settle for the first rate you’re offered. Shop around and compare rates from multiple lenders. Online mortgage marketplaces make this process easier.

-

Consider Lender Fees: In addition to the home loan calculator rate, pay attention to lender fees. Some lenders charge higher fees to compensate for lower rates.

-

Negotiate: Don’t be afraid to negotiate for a better home loan calculator rate. Lenders are often willing to work with borrowers who are willing to provide documentation supporting their financial strength.

Step 5: The Impact of Home Loan Calculator Rates on Your Mortgage

The home loan calculator rate you choose can have a significant impact on your mortgage. A lower home loan calculator rate can mean:

- Lower monthly payments

- Less interest paid over the life of the loan

- More equity in your home sooner

Conclusion

Navigating home loan calculator rates can be daunting, but it’s essential to understand how they work to make informed decisions about your mortgage. By following the steps outlined in this guide, you can increase your chances of securing the best home loan calculator rate for your financial situation. Remember, a little research and comparison can go a long way in saving you money and achieving your homeownership goals.

-

Looking for the best home loan interest rates? Look no further than our home loan calculator. home loan calculator interest rate

-

Buying a home can be a daunting task, but we’re here to help. Find out all the home loan documents required for a salaried person in India. home loan documents required for salaried person

-

The home loan EMI calculator Excel sheet with prepayment option is the perfect tool to help you plan your home loan payments. home loan EMI calculator Excel sheet with prepayment option

-

Muthoot Finance offers a variety of home loan options to suit your needs. Find out more about home loan in Muthoot finance. home loan in Muthoot finance

Using a Home Loan Calculator Rate: Step-by-Step Guide

When buying a home, understanding how to use a home loan calculator rate is crucial for making informed decisions about your mortgage. This guide will walk you through the steps to help you navigate this essential tool effectively.

Key Takeaway

- Home loan calculator rates are influenced by factors like credit score, loan-to-value ratio, and loan term.

- It’s essential to shop around and compare rates from multiple lenders to get the best deal.

- A lower home loan calculator rate can lead to significant savings over the life of your loan.

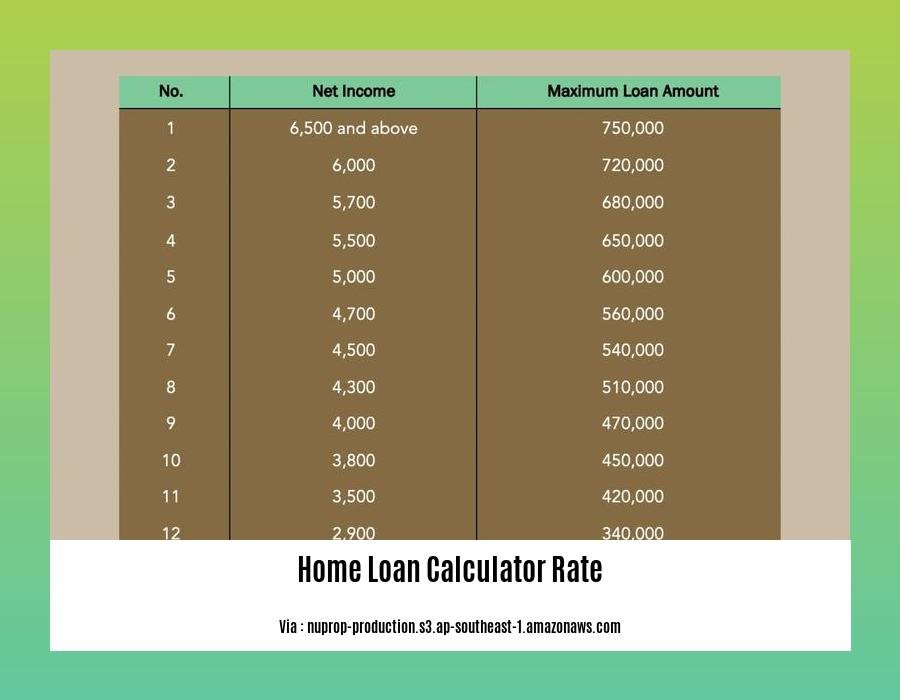

Step 1: Gather your Financial Information

Before you begin using a home loan calculator, ensure you have all the necessary financial information at hand. This includes your credit score, annual income, and the amount of down payment you can afford. Having this information ready will allow you to provide accurate details when using the calculator.

Step 2: Choose a Reputable Home Loan Calculator

Selecting a reliable home loan calculator is essential to ensure accurate results. Look for calculators provided by reputable financial institutions, mortgage lenders, or independent financial websites known for providing trustworthy information.

Step 3: Input your Information

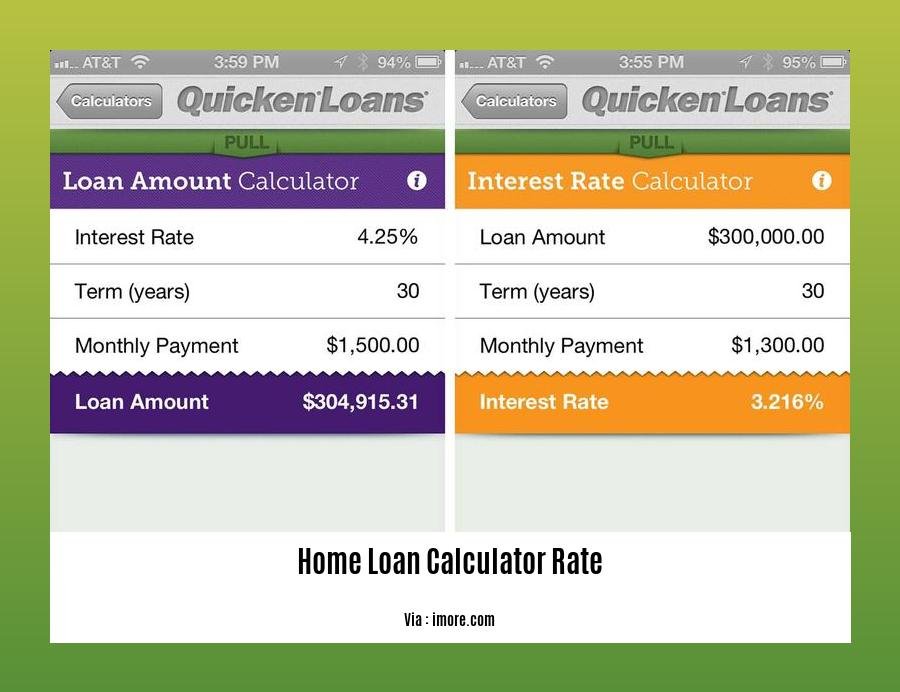

Once you have chosen a home loan calculator, input your financial information as required. This typically includes the loan amount, interest rate, and loan term. Some calculators may also ask for additional details such as property taxes, insurance, and homeowners association (HOA) fees.

Step 4: Calculate your Monthly Payments

After entering all the necessary information, click the “Calculate” button to generate your estimated monthly mortgage payments. This amount includes principal, interest, taxes, and insurance (PITI).

Step 5: Adjust the Input Parameters

Play around with different scenarios by adjusting the input parameters. Try changing the loan amount, interest rate, or loan term to see how these factors impact your monthly payments. This will help you understand how different options can affect your overall borrowing costs.

Step 6: Compare Rates from Multiple Lenders

Don’t settle for the first home loan calculator rate you see. Shop around and compare rates from multiple lenders to ensure you’re getting the best deal. Use this step to negotiate a lower rate with your preferred lender.

Step 7: Consider Additional Factors

While the home loan calculator rate is a crucial factor, consider other aspects that may influence your mortgage decision. These include lender fees, closing costs, and the type of mortgage loan you choose.

Conclusion

Using a home loan calculator is a powerful tool for understanding your mortgage options and making informed financial decisions. By following these steps, you can confidently navigate this process and find the best mortgage loan that aligns with your financial goals and needs.

Citation:

– The Balance: Calculate Mortgage Payments

– WikiHow: How to Calculate Loan Payments

Tips for Obtaining Accurate Home Loan Calculator Rate Results

Have you ever felt overwhelmed by the prospect of buying a home? The ever-changing mortgage landscape can be a complex maze of confusing terms and numbers. If you’re like many homebuyers, you’ve probably used a home loan calculator to estimate your payments. While these tools can be helpful, the accuracy of their results can vary. Here’s a step-by-step guide to help you get the most precise home loan calculator rate results:

Step 1: Choose a Reputable Calculator

Like any tool, not all home loan calculators are created equal. Opt for one offered by a trusted financial institution or reputable website. Remember, accuracy is paramount.

Step 2: Input Accurate Information

Garbage in, garbage out. The accuracy of your results hinges on the accuracy of the information you provide. Ensure you input the correct loan amount, interest rate, loan term, and other relevant details.

Step 3: Consider Additional Costs

Beyond your monthly mortgage payment, homeownership comes with other costs. Factor in property taxes, homeowner’s insurance, HOA fees, and potential closing costs. These additional expenses can significantly impact your budget.

Step 4: Understand Rate Types

There are two main types of mortgage rates: fixed and adjustable. Fixed rates remain constant throughout the loan term, providing stability. Adjustable rates start lower but can fluctuate over time, potentially leading to higher payments in the future.

Step 5: Shop Around for Rates

Don’t settle for the first rate you see. Compare offers from multiple lenders to find the best deal. Use the internet, visit banks and credit unions, and consider working with a mortgage broker to help you negotiate the best possible rate.

Step 6: Consult a Financial Advisor

Buying a home is a significant financial decision. Consider consulting a qualified financial advisor or mortgage professional. They can provide personalized advice tailored to your specific situation and help you make an informed decision.

Key Takeaways:

- Choose a reputable home loan calculator.

- Provide accurate information to ensure precise results.

- Consider additional costs associated with homeownership.

- Understand the different types of mortgage rates available.

- Shop around for the best rates from multiple lenders.

- Consult a financial advisor for personalized guidance.

Relevant URL Sources:

Limitations and Considerations when Using a Home Loan Calculator Rate

Mortgage calculators offer convenience in approximating the potential monthly payments for your desired loan. However, these tools aren’t flawless and come with constraints that can impact the accuracy of the results. Let’s break down these limitations:

Fixed Assumptions:

Mortgage calculators work on a set of presumed data that might not always reflect your real-life circumstances. These assumptions may include:

-

Credit Score: Calculators assume a static credit score. In reality, your score can fluctuate over time, affecting the actual interest rate.

-

Loan-to-Value (LTV) Ratio: Mortgage calculators are based on a constant LTV ratio. However, a higher LTV could result in a more expensive loan due to perceived risk.

-

Interest Rate: Most calculators use a fixed interest rate, not considering variable rates. Variable rates, as their name suggests, can change, potentially affecting your monthly payments.

Dynamic Factors:

Mortgage markets are dynamic, and several factors beyond the calculator’s scope can influence your loan terms:

-

Market Conditions: Economic fluctuations, such as changes in interest rates or the housing market, can impact the availability and terms of loans.

-

Lender Variation: Different lenders may have varying policies, underwriting standards, and fees. Comparing quotes from multiple lenders is essential to find the best rates.

-

Property Location: The location of your desired property can influence the interest rate and terms of your loan.

Additional Costs:

Mortgage calculators often focus solely on the monthly payment amount. However, there are additional costs to consider:

-

Closing Costs: These are one-time expenses associated with finalizing your loan, including appraisal, title, and other fees.

-

Property Taxes: These annual taxes are not always included in mortgage calculators and vary depending on the property’s location and value.

-

Homeowners Insurance: Lenders may require you to purchase insurance to protect the property, which can add to your monthly expenses.

Consideration of Refinancing:

If you’re thinking of refinancing, the calculator may not account for the costs associated with this process. Refinancing can involve application fees, closing costs, and other potential expenses.

How to Mitigate Limitations:

Despite these limitations, you can leverage mortgage calculators effectively by:

-

Managing Expectations: Recognize that the results are estimations and could differ from your actual loan terms.

-

Consulting a Mortgage Advisor: Consult a reputable mortgage professional who can provide personalized advice and consider your unique circumstances.

-

Research and Compare: Obtain quotes from different lenders to compare interest rates, terms, and fees. This will help you choose the option that aligns with your financial situation.

Key Takeaways:

-

Mortgage calculators offer approximations of monthly payments but come with limitations.

-

Fixed assumptions, dynamic factors, additional costs, and refinancing considerations can impact the actual terms of your loan.

-

Using a mortgage calculator effectively involves managing expectations, consulting a mortgage professional, and comparing multiple loan options.

Relevant URL Sources:

-

Limitations of a Mortgage Calculator

-

Home Loan Calculator Accuracy

FAQ

Q1: How accurate are home loan calculator rates?

A1: Mortgage calculator rates provide a reliable estimate of monthly payments, considering factors like the loan amount, interest rate, and loan term. However, it’s essential to remember that actual mortgage rates and payments may vary depending on individual circumstances, such as credit score and debt-to-income ratio.

Q2: What factors should I consider when using a home loan calculator?

A2: Before using a home loan calculator, consider the loan term, interest rate, property taxes, homeowners insurance, HOA fees, and current loan rates. These factors significantly impact the overall cost of a mortgage.

Q3: What are the limitations of home loan calculators?

A3: Home loan calculators do not account for all factors that can affect the actual cost of a mortgage. They typically exclude closing costs, prepayment penalties, and potential changes in interest rates over time.

Q4: How can I ensure I get the best home loan rate?

A4: To secure the best home loan rate, it’s crucial to compare offers from multiple lenders, consider your credit score and debt-to-income ratio, and explore options for lowering your interest rate, such as making a larger down payment or choosing a shorter loan term.

Q5: When should I consult a mortgage lender or financial advisor?

A5: Consulting with a mortgage lender or financial advisor is recommended when making a decision about a mortgage. They can provide personalized advice, compare loan options based on your specific needs, and guide you through the mortgage process.

- Kitchen Backsplash For White Kitchen: Ideas To Inspire Your Renovation - November 21, 2025

- White On White Kitchen Backsplash: Is It Timeless? - November 20, 2025

- Backsplash Colors for White Cabinets: Find Your Perfect Match - November 19, 2025