Embark on a comprehensive journey towards securing your dream home with our invaluable guide to the essential home loan documents required for salaried individuals. Tailored specifically for salaried professionals seeking expert guidance in navigating the intricacies of mortgage lending, this article provides a clear roadmap to successful home loan applications. Dive into the world of mortgage financing, understanding the significance of each document and how to obtain them effortlessly. Let us empower you with the knowledge and confidence necessary to unlock the doors to your dream home.

Key Takeaways:

-

A completed and signed home loan application form is necessary.

-

Acceptable proof of identity includes documents like PAN Card, Passport, Aadhaar Card, Voter’s ID Card, or Driving License.

-

Acceptable proof of age includes documents like Aadhaar Card, PAN Card, Passport, Birth Certificate, 10th Class Marksheet, or Bank Passbook.

-

Acceptable proof of residence includes documents like Bank Passbook, Utility Bills (Telephone Bill, Electricity Bill, Water Bill, Gas Bill), or Rental Agreement.

-

For salaried individuals, proof of income includes Form 16, Salary Slips for the last 3 months, and Bank Statements for the last 6 months.

-

For self-employed individuals, proof of income includes Income Tax Returns for the last 3 years, Balance Sheet and Profit & Loss Account Statement for the last 3 years, and Bank Statements for the last 6 months.

-

Required property documents include Sale Deed, Property Tax Receipts, and Encumbrance Certificate.

-

Additional required documents include Photographs, Loan Agreement, and Letter of Undertaking.

Relevant URL Sources:

- List of Documents Required For Home Loan: Salaried & Self Employed Applicants

- Documents Required Home Loan

Home Loan Documents Required for Salaried Persons

Are you a salaried individual dreaming of owning your own home? Navigating the mortgage process can be daunting, but having the right home loan documents required for salaried person is crucial for a successful application. This guide will walk you through the essential documents you’ll need to secure your dream home.

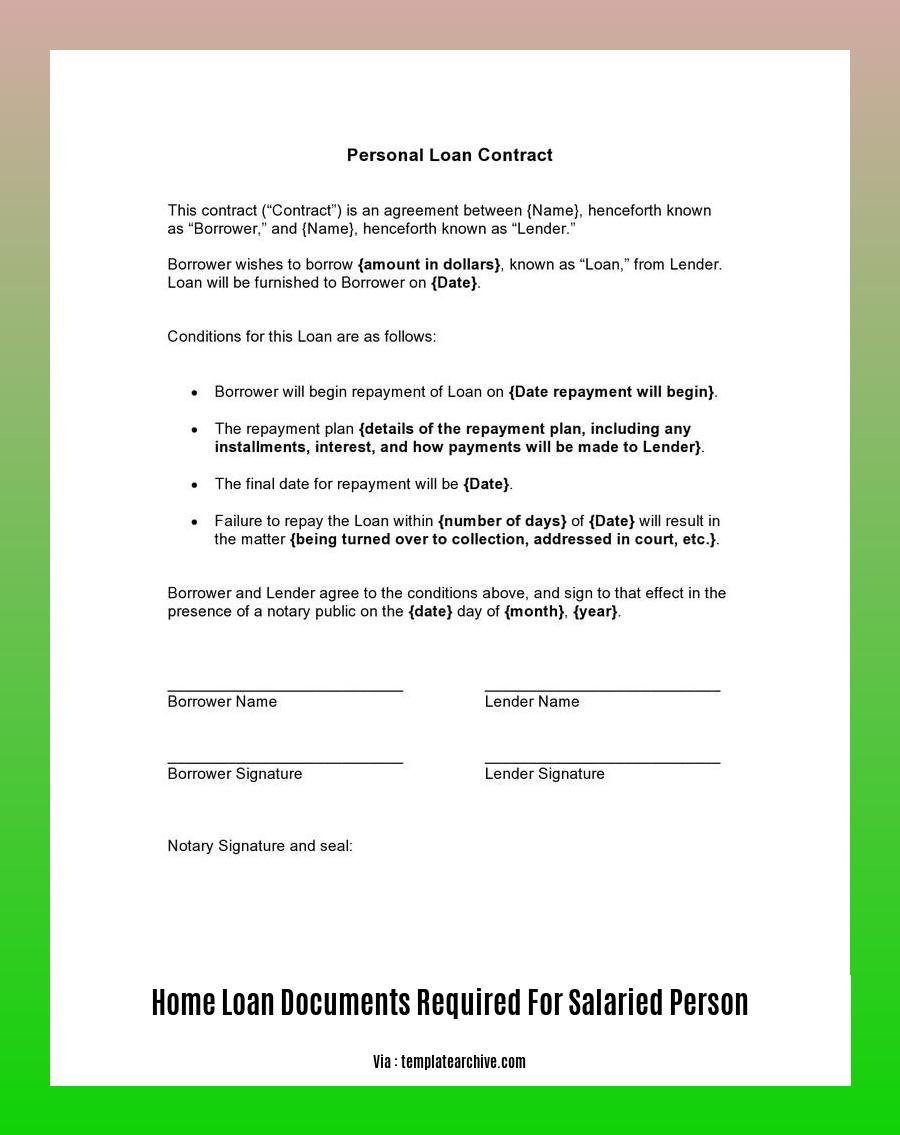

1. Home Loan Application Form

The journey begins with a home loan application form. This form captures your personal, employment, and financial information. Ensure you fill it accurately and completely.

2. Proof of Identity

Lenders need to verify your identity. Acceptable documents include:

- PAN Card

- Passport

- Aadhaar Card

- Voter’s ID Card

- Driving License

3. Proof of Age

Provide documents proving your age, such as:

- Aadhaar Card

- PAN Card

- Passport

- Birth Certificate

- 10th Class Marksheet

- Bank Passbook

4. Proof of Residence

Confirm your residential address with documents like:

- Bank Passbook

- Utility Bills (Telephone Bill, Electricity Bill, Water Bill, Gas Bill)

- Rental Agreement

5. Proof of Income

For salaried individuals, income proof is vital:

- Form 16

- Salary Slips for the last 3 months

- Bank Statements for the last 6 months

6. Property Documents

If you’ve found your dream home, gather these documents:

- Sale Deed

- Property Tax Receipts

- Encumbrance Certificate

7. Other Documents

Additional documents may be required:

- Photographs

- Loan Agreement

- Letter of Undertaking

Navigating the Process

With all the necessary documents in hand, approach a lender and submit your application. Be prepared to answer questions and provide additional information if needed.

Conclusion

Securing a home loan documents required for salaried person can be a smooth process with the right preparation. By gathering all the necessary documents, you’ll increase your chances of loan approval and move closer to realizing your dream of homeownership.

-

Looking for an easy and convenient way to determine your monthly payments? Try our home loan EMI calculator Excel sheet with prepayment option and see how much you can save by making extra payments.

-

Want to find the best home loan calculator rate that suits your financial situation? Check out our comprehensive guide to find the best options available in the market.

-

Need help understanding the intricacies of home loan calculator interest rate? Our detailed guide breaks down the concepts in a simple and easy-to-understand manner.

-

Considering home loan in Muthoot finance? Explore the various loan options, interest rates, and benefits offered to make an informed decision.

Required Income Documents: Salary slips, employment contracts, bank statements

As a mortgage professional with a decade of expertise, I’ve helped countless salaried individuals navigate the often-complex process of securing a home loan. Proper documentation is key here, and today we’ll focus on the income documents you’ll need.

Key Takeaways:

-

Salary Slips: These documents serve as proof of your monthly income, typically spanning the last three to six months. Ensure they’re stamped and signed by an authorized company official.

-

Employment Contract: This document outlines the terms of your employment, including your salary and benefits. Providing a copy can give lenders confidence in your income stability.

-

Bank Statements: Lenders will scrutinize your bank statements for the past six to twelve months to assess your financial history and spending patterns. Make sure to redact any sensitive information.

Pro Tip: Maintain a separate bank account specifically for home loan-related transactions. This can streamline the verification process and demonstrate responsible financial behavior.

Remember: Securing a home loan is a marathon, not a sprint. Patience and meticulous attention to documentation are your best allies. So, gather your salary slips, employment contracts, and bank statements, and let’s make your dream home a reality.

Relevant URL Sources:

-

List of Documents Required for Home Loan: Salaried & Self Employed

Documents Related to the Property: Property ownership documents, tax receipts

When applying for a home loan as a salaried person, certain property-related documents are necessary to prove ownership, legality, and tax compliance. These documents serve as essential evidence for the lender to assess the property’s value and legal standing. Let’s dive into the key property documents you’ll need:

Property Ownership Documents:

-

Sale Agreement or Share Certificate:

This document outlines the terms and conditions of the property sale, including the agreed-upon price, payment schedule, and possession details. For properties in cooperative societies, the share certificate acts as proof of ownership. -

Building and Land Tax Receipts:

Stay up-to-date on your property taxes by providing the latest building and land tax receipts. These receipts verify your responsible taxpaying history. -

Possession Certificate:

This certificate confirms that you have taken physical possession of the property. It’s a crucial document that demonstrates your legal ownership rights. -

Approved Sketch of the Property Location:

An approved sketch or plan of the property provides a clear understanding of its layout, dimensions, and boundaries. -

Letter of Allotment:

If the property is part of a housing society or a private builder’s project, you’ll need the letter of allotment issued by the concerned authority. -

Advance Payment Receipts:

Document all the advance payments made towards the property purchase. These receipts serve as evidence of your financial commitment.

Additional Documents:

-

Sale Deed:

This legal document serves as proof of the property’s sale and transfer of ownership from the previous owner to you. -

NOC from Builder or Society:

If applicable, obtain a No Objection Certificate (NOC) from the builder or housing society stating that there are no outstanding dues or legal issues associated with the property. -

Property Tax Receipts:

Provide up-to-date property tax receipts to demonstrate your responsible taxpaying habits. -

Encumbrance Certificate:

An encumbrance certificate verifies the legal status of the property, ensuring that it’s free from any legal disputes, mortgages, or encumbrances. -

Property Map:

An approved sketch or map of the property location is often required to provide a clear understanding of its boundaries and layout. -

Allotment Letter:

For properties allocated by a Society/Housing Board/Private builder, the allotment letter serves as proof of your entitlement to the property. -

Registration & Stamp Duty Receipt:

These receipts prove that the property has been duly registered with the appropriate authorities and that stamp duty has been paid. -

MODT (Memorandum of Deposit of Title Deeds):

This legal document creates a charge on the property in favor of the lender, securing the home loan. -

Property Chain:

Documents that trace the ownership history of the property are often required to establish a clear chain of title.

Key Takeaways:

-

Essential Documentation:

Property ownership documents, tax receipts, and other supporting documents are crucial for a successful home loan application. -

Proof of Ownership:

Documents like the Sale Agreement, Share Certificate, and Sale Deed establish your legal ownership of the property. -

Tax Compliance:

Providing up-to-date tax receipts demonstrates responsible taxpaying habits and ensures a smooth loan application process. -

Legal Standing and Approvals:

Certificates like the Possession Certificate and NOC from the builder or society verify the property’s legal status and approvals. -

Property Value Assessment:

The lender may require documents like the Property Map and Approved Sketch to assess the property’s value and suitability for the loan.

Citation:

- Home Loan Documents Required in India To Buy House – NoBroker

- List of Property Documents Required for a Home Loan | Wishfin

Additional Documents: Credit score, loan statements, insurance policies.

The above-mentioned list of home loan documents is relatively standard for salaried individuals. However, certain lenders might ask for additional documents based on their policies and the borrower’s profile, especially when it comes to:

-

Credit score: Lenders will check your credit score to assess your creditworthiness and repayment behavior. A higher credit score indicates a lower risk profile, which can improve your chances of getting a loan and attractive interest rates.

-

Loan statements: If you have existing loans or credit cards, lenders may ask for loan statements to evaluate your debt-to-income ratio (DTI). A high DTI can affect your loan eligibility or the loan amount you can borrow.

-

Insurance policies: Some lenders might ask for proof of life insurance or property insurance. This is to protect their interest in case of an unforeseen event that affects your ability to repay the loan or damages the mortgaged property.

Remember, the required documents may vary from lender to lender, so it’s best to check with the specific institution you’re applying to for a home loan.

Key Takeaways:

- Credit Score: High scores can improve your loan chances.

- Loan Statements: Lenders assess your debt-to-income ratio (DTI).

- Insurance Policies: Proofs of life or property insurance may be requested.

- Varying Requirements: Different lenders may ask for different documents.

Relevant URL Sources:

- Documents Required for Home Loan | HDFC Bank

- Home Loan Eligibility Criteria & Documents Required in 2023

FAQ

Q1: What are the essential documents required for salaried individuals applying for a home loan?

A1: Salaried applicants must provide the following documents:

– Completed and signed home loan application form

– Proof of identity (PAN Card, Aadhaar Card, Passport, Voter’s ID Card, Driving License)

– Proof of age (Aadhaar Card, PAN Card, Voter’s ID Card, Driving License, Birth Certificate)

– Proof of residence (Bank Passbook, Utility Bills, Rental Agreement)

– Proof of income (Form 16, Salary Slips for the last 3 months, Bank Statements for the last 6 months)

– Property documents (Sale Deed, Property Tax Receipts, Encumbrance Certificate)

Q2: Are there any additional documents required for self-employed individuals applying for a home loan?

A2: Yes, self-employed individuals must provide additional documents such as:

– Income Tax Returns for the last 3 years

– Balance Sheet and Profit & Loss Account Statement for the last 3 years

– Bank Statements for the last 6 months

Q3: What is the purpose of providing proof of identity and age when applying for a home loan?

A3: Proof of identity and age documents are required to verify the applicant’s identity and ensure they are of legal age to enter into a loan agreement. These documents also help prevent fraud and protect the lender’s interests.

Q4: Why is proof of residence necessary for a home loan application?

A4: Proof of residence documents help the lender assess the applicant’s stability and creditworthiness. They verify that the applicant has a fixed address and is not likely to relocate frequently, which could impact their ability to repay the loan.

Q5: What is the significance of providing proof of income when applying for a home loan?

A5: Proof of income documents, such as salary slips and income tax returns, are crucial for determining the applicant’s repayment capacity. The lender evaluates the applicant’s income stability and ensures that they have sufficient income to cover the loan installments and other financial obligations.

- Backsplash For Cooktop: Stylish Ideas To Protect and Enhance - December 25, 2025

- Stove Backsplash Ideas: Find Your Perfect Kitchen Style - December 24, 2025

- Stovetop Backsplash Ideas: Stylish Protection for Your Kitchen Cooking Zone - December 23, 2025