Understanding Mezzanine Debt Interest Rates: A Comprehensive Guide for Investors

Welcome to an in-depth exploration of mezzanine debt interest rates, a crucial aspect of mezzanine financing that investors need to fully comprehend. In this comprehensive guide, we will break down the advantages and disadvantages of mezzanine debt, compare it to convertible and subordinated debt, and explore its relevance in real estate financing. Whether you are an experienced financial analyst or a novice investor, this article is designed to equip you with the knowledge and insights necessary to make informed investment decisions in the realm of mezzanine debt. So, let’s dive in and uncover the intricacies of mezzanine debt interest rates together.

Key Takeaways:

- Mezzanine loans have high interest rates, typically ranging from 20% to 30%.

- Mezzanine loans act as a middle ground between senior debt and equity, combining features of both.

- Mezzanine loans are subordinate to senior debt but have priority over preferred and common stock.

- Mezzanine loans offer higher yields than regular debt and are often unsecured.

- Mezzanine financing is considered either expensive debt or cheap equity.

- Mezzanine debt allows companies to access significant growth capital with less upfront investment.

- Refinancing mezzanine debt into a secured senior loan with lower interest rates can reduce capital commitment and increase returns without losing equity.

- Mezzanine financing is a hybrid of debt and equity, with lenders having the right to convert debt to an equity interest in case of default.

- Mezzanine loan maturity typically ranges from five years or more, depending on the specific loan.

Mezzanine Debt Interest Rates

When it comes to understanding investments, one crucial aspect to consider is the interest rates associated with different financial tools. Mezzanine debt, in particular, carries a unique set of interest rates that can significantly impact investors. In this comprehensive guide, we will delve into the intricacies of mezzanine debt interest rates and explore their implications for investors.

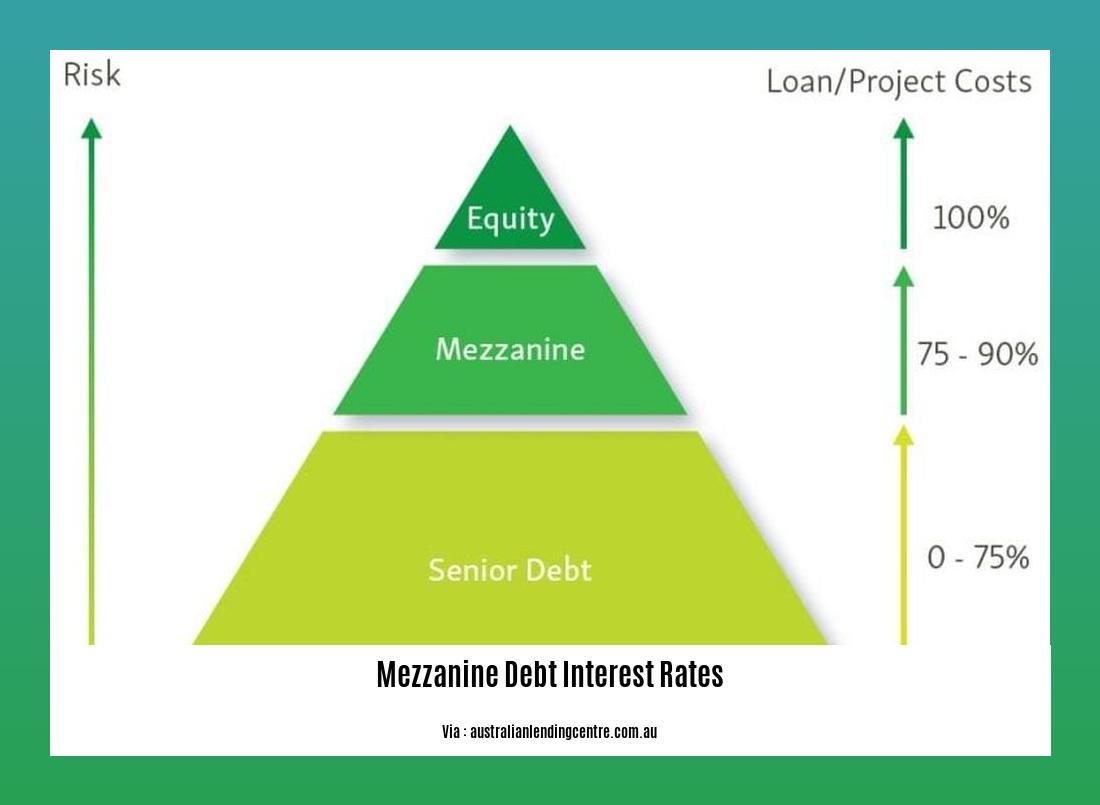

Exploring Mezzanine Debt

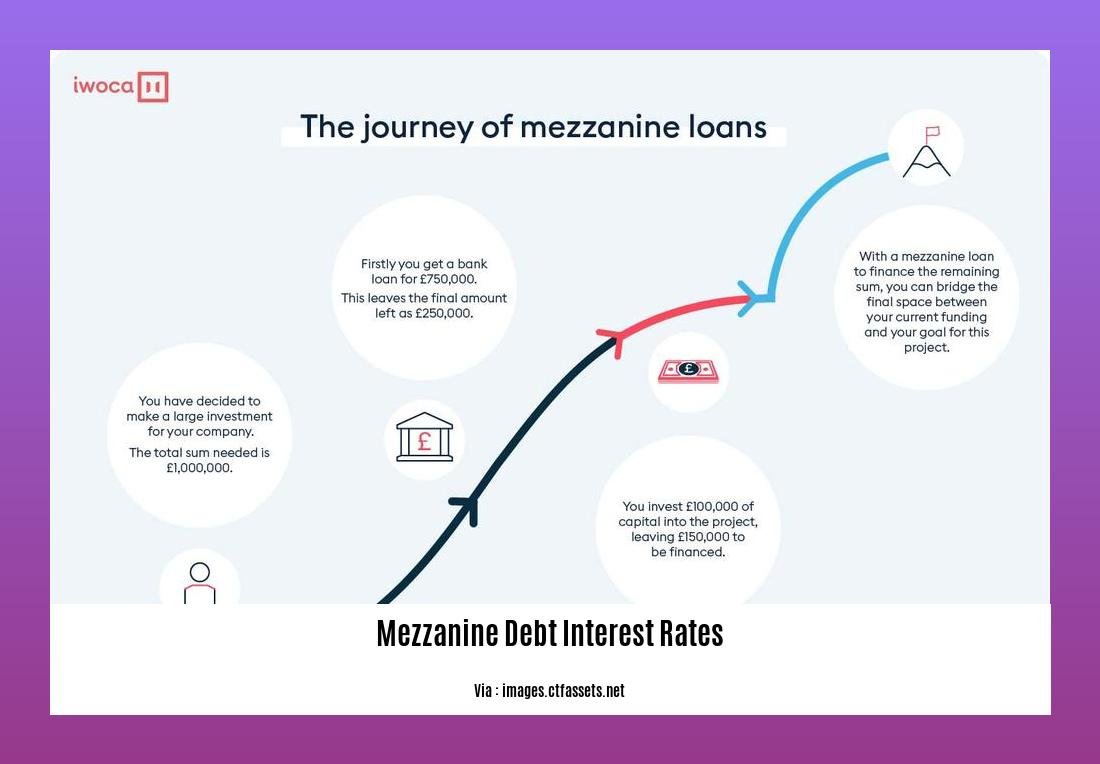

Before we dive into the details of mezzanine debt interest rates, let’s briefly recap what mezzanine debt is. Mezzanine debt is a form of financing that falls between less risky senior debt and higher risk equity. It combines features of both debt and equity, making it an attractive option for companies looking to access additional growth capital.

Understanding Mezzanine Debt Interest Rates

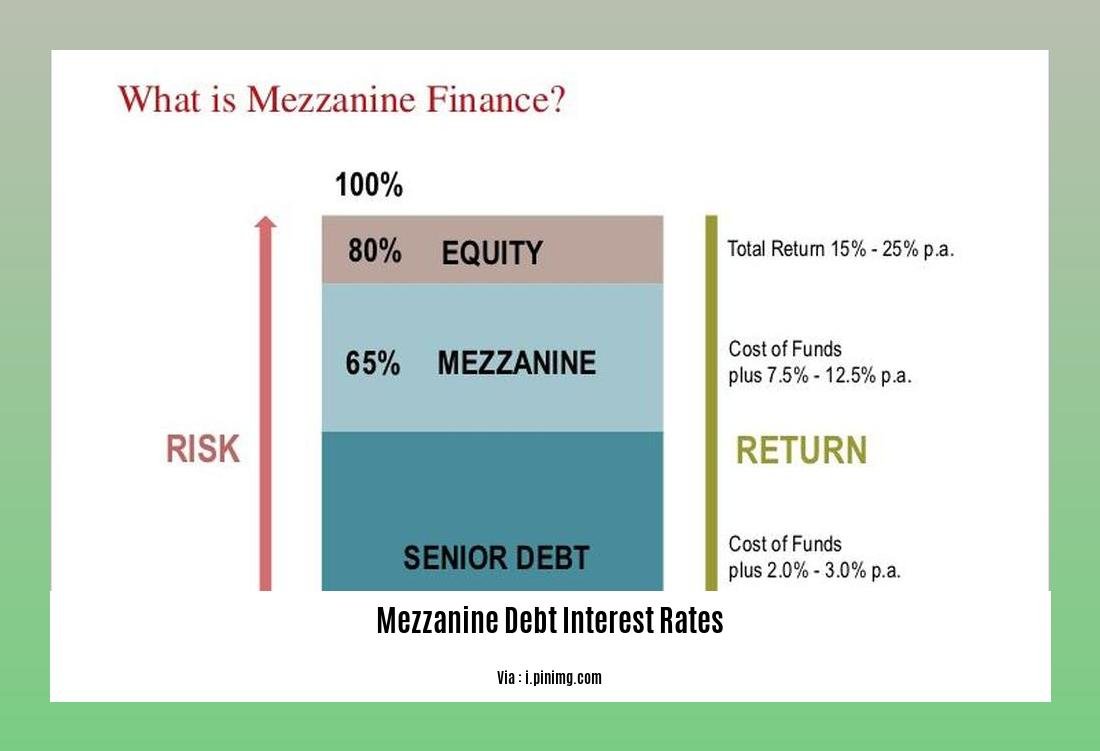

Mezzanine loans command significantly higher interest rates compared to other forms of financing. Typically falling within the range of 20% to 30%, mezzanine debt interest rates can appear daunting at first glance. However, it’s essential to remember that these rates reflect the increased risk associated with mezzanine loans. As investors take on a more subordinate position compared to senior debt lenders, the higher interest rates compensate for this additional risk.

Pros and Cons of Mezzanine Debt Interest Rates

Let’s take a closer look at the pros and cons of mezzanine debt interest rates:

Pros:

- Access to substantial capital: Mezzanine debt allows companies to access significant amounts of additional growth capital, enabling them to pursue expansion opportunities that may have otherwise been out of reach.

- Reduced upfront costs: By requiring less money down upfront, mezzanine debt allows businesses to conserve their initial capital commitment while still securing the funds they need.

- Balanced cost of capital: While mezzanine debt carries higher interest rates than senior debt, it is often a more cost-effective option compared to equity financing. This balanced cost of capital makes it an attractive choice for companies looking to optimize their financial structure.

Cons:

- Higher interest rates: The most apparent disadvantage of mezzanine debt interest rates is their relatively high cost. These rates may present a significant financial burden for companies, particularly those already grappling with debt obligations.

- Subordinate position: Mezzanine debt holders rank below senior debt lenders in the capital structure. In the event of default or bankruptcy, this subordinate position means that mezzanine debt investors may face greater challenges in recovering their investment.

Refinancing and its Impact on Mezzanine Debt Interest Rates

It’s worth noting that businesses have the opportunity to refinance mezzanine debt into a single, secured senior loan with a lower interest rate. This strategy allows companies to reduce their initial capital commitment and potentially increase their rate of return without sacrificing equity. However, the feasibility and success of such refinancing arrangements depend on various factors, such as market conditions and the specific terms of the mezzanine debt.

Key Takeaways

To wrap up, understanding mezzanine debt interest rates is crucial for investors looking to evaluate potential investment opportunities. Mezzanine debt carries higher interest rates to compensate for the additional risk associated with this type of financing. While the rates may seem high, mezzanine debt can provide companies with access to substantial capital that can drive growth. It’s important to weigh the pros and cons, consider refinancing options, and assess the overall impact of mezzanine debt interest rates on the financial health of a business.

With this comprehensive guide, you now have a clearer understanding of mezzanine debt interest rates and their significance for investors. Armed with this knowledge, you can make more informed investment decisions and navigate the complex world of mezzanine financing with confidence.

Mezzanine debt lenders are crucial for businesses seeking additional funding. Check out our list of reputable mezzanine debt lenders and explore the opportunities they provide. Visit here for more information.

For businesses in need of financing, finding reliable mezzanine debt providers is essential. Discover our curated list of reputable providers that can help you achieve your financial goals. Click here to explore further.

When considering financing options, it’s important to understand the differences between mezzanine debt vs equity. Discover the pros and cons of each and make informed decisions for your business’s growth. Learn more by clicking here.

Curious about the distinctions between mezzanine debt vs preferred equity? Delve into the nuances of these financing options and make educated choices for your business. Visit here to learn more.

Mezzanine Debt Vs Subordinated Debt

When it comes to financing options, mezzanine debt and subordinated debt are two terms that often get mentioned. While they share some similarities, it’s important to understand the key differences between the two. In this article, we will explore the distinctions between mezzanine debt and subordinated debt, shedding light on their unique characteristics and benefits. So let’s dive in and explore the world of mezzanine debt versus subordinated debt.

Mezzanine Debt: A Closer Look

Mezzanine debt is often referred to as a hybrid financing option that sits between traditional debt and equity. It serves as a bridge, allowing companies to secure additional capital beyond what is available through senior debt. Mezzanine debt holders are subordinate to senior lenders but have priority over equity investors in case of default. This positioning offers investors the potential for higher returns while providing companies with the flexibility to access growth capital.

Now, you might be wondering about the interest rates associated with mezzanine debt. While it varies depending on the specific deal, mezzanine debt interest rates typically range between 12% and [^1].

Subordinated Debt: Understanding the Basics

Subordinated debt, on the other hand, refers to a form of debt that ranks below senior debt in terms of repayment priority. It carries higher risk than senior debt but is still considered less risky than equity. Subordinated debt holders have a lower priority claim in the event of default, making it a riskier investment compared to mezzanine debt.

When it comes to interest rates, subordinated debt may have slightly higher rates than senior debt but generally lower rates than mezzanine debt. However, this can vary depending on the specific terms of the arrangement. It’s also worth noting that subordinated debt is often used in leveraged buyouts and other complex financial transactions.

Key Differences and Considerations

Now that we have a basic understanding of mezzanine debt and subordinated debt, let’s compare their key differences.

-

Risk: Mezzanine debt is considered riskier than subordinated debt, but it also offers higher potential returns. Investors in mezzanine debt are often compensated for taking on additional risk.

-

Positioning: Mezzanine debt is a hybrid form of financing, sitting between traditional debt and equity. It offers companies more flexibility and the ability to access additional capital for growth. Subordinated debt, on the other hand, is subordinate to both senior debt and mezzanine debt, making it a riskier investment.

-

Interest Rates: Mezzanine debt generally carries higher interest rates compared to subordinated debt. The higher rates reflect the higher risk profile and potential returns associated with mezzanine debt.

-

Investor Considerations: Investors in mezzanine debt often have the opportunity to convert their debt into equity in the event of default. This potential equity upside is not typically available with subordinated debt.

In summary, mezzanine debt and subordinated debt are both important financing tools with distinct characteristics. Mezzanine debt offers higher potential returns but comes with higher risk. Subordinated debt, on the other hand, is less risky but offers lower returns. When considering which option is right for you, it’s essential to evaluate your risk appetite and investment objectives.

Key Takeaways:

- Mezzanine debt serves as a bridge between debt and equity financing, offering high potential returns.

- Subordinated debt ranks below senior debt but above equity in repayment priority.

- Mezzanine debt typically carries higher interest rates compared to subordinated debt.

- Mezzanine debt offers more flexibility and potential for equity conversion, while subordinated debt is a less risky investment option.

Sources:

1. Investopedia: Mezzanine Debt

2. PocketSense: Difference Between Mezzanine Debt & Subordinated Debt

Mezzanine Financing Real Estate

Mezzanine financing is a powerful tool used in real estate transactions to bridge the funding gap between senior debt and equity. In this comprehensive guide, we will explore a crucial aspect of mezzanine financing: interest rates. Understanding these rates is essential for investors looking to maximize returns while managing risk. So, let’s dive in and demystify mezzanine debt interest rates in the context of real estate investments.

Mezzanine Debt: A Strategic Financing Option

In the realm of real estate investments, mezzanine debt plays a significant role in capital structures. Unlike senior debt, which is frequently collateralized by the underlying property, mezzanine debt stands as a subordinated loan that provides additional leverage for sponsors. Think of it as the bridge that fills the gap between senior debt and the total funds needed for a transaction.

The Impact of Interest Rates

Interest rates are a primary consideration for any borrower, and mezzanine debt is no exception. Due to its subordinated nature and increased risk, mezzanine debt typically carries a higher interest rate than senior debt. These rates can vary depending on market conditions, deal specifics, and the creditworthiness of the borrower.

Factors Influencing Rates

Several factors influence mezzanine debt interest rates in the real estate sector. One notable factor is the outlook on returns and risk appetite. In times of economic uncertainty or tighter liquidity, lenders may demand higher rates to compensate for the increased risks involved. Conversely, lower leverage loans may attract more competitive rates due to reduced risk exposure.

Mezzanine Lenders: Private Equity Firms and Specialists

Mezzanine debt is often provided by private equity firms or specialized lending institutions. These entities have the expertise to evaluate complex real estate transactions and assess the risk-reward dynamics associated with mezzanine financing. Their experience enables them to set competitive interest rates that align with market conditions and investor expectations.

Mezzanine Debt Interest Rates: Crucial Considerations

For borrowers, understanding mezzanine debt interest rates is essential for making informed investment decisions. These rates directly impact the cost of capital and the potential returns on a real estate investment. It is crucial to evaluate the risk appetite, cash flow projections, and overall investment strategy to determine if the benefits of mezzanine debt outweigh the higher interest rates.

Key Takeaways:

- Mezzanine debt is a financing tool used in real estate transactions to bridge the funding gap between senior debt and equity.

- Mezzanine debt typically carries a higher interest rate than senior debt, reflecting its subordinated nature and increased risk.

- Mezzanine debt interest rates are influenced by market conditions, deal specifics, and the creditworthiness of the borrower.

- Mezzanine debt is often provided by private equity firms and specialized lending institutions with expertise in real estate transactions.

- Understanding mezzanine debt interest rates is crucial for borrowers to assess the cost of capital and potential returns on their real estate investments.

Citations:

– ArborCrowd – Mezzanine Debt in Real Estate Investments

– J.P. Morgan Asset Management – Mezzanine Debt Outlook

FAQ

Q1: What are the advantages and disadvantages of Mezzanine Financing?

A1: Mezzanine financing offers the advantage of providing access to significant amounts of growth capital with less upfront investment. However, it carries higher interest rates compared to traditional debt and involves more risk than equity financing.

Q2: What is the difference between Mezzanine Debt and Convertible Debt?

A2: Mezzanine debt and convertible debt are both hybrid financing options, but there are differences. Mezzanine debt is typically subordinated to other debt and involves higher interest rates, while convertible debt can be converted into equity.

Q3: How does Mezzanine Debt differ from Subordinated Debt?

A3: Mezzanine debt and subordinated debt share similarities as both are forms of subordinated financing. However, mezzanine debt is often unsecured, carries higher interest rates, and offers the lender the right to convert it into equity in case of default.

Q4: How is Mezzanine Financing used in Real Estate?

A4: Mezzanine financing is commonly used in real estate transactions to bridge the remaining gap between the amount financed by senior debt and the total proceeds needed. It allows sponsors to leverage their returns, but it typically comes with a higher interest rate compared to senior debt.

Q5: What are the considerations for evaluating Mezzanine Debt interest rates?

A5: When evaluating mezzanine debt interest rates, borrowers should consider factors such as the cost of capital, overall risk profile, and potential returns. Mezzanine lenders may offer better pricing due to higher rates, tighter liquidity, and reduced competition.

- Dora the Explorer Wipe-Off Fun: Safe & Mess-Free Activities for Little Explorers - April 18, 2025

- Does Lemongrass Repel Mosquitoes? Fact vs. Fiction + How to Use It - April 18, 2025

- Do Woodchucks Climb Trees?Fact vs. Fiction - April 18, 2025