Comparing Mezzanine Debt vs Preferred Equity: Understanding the Optimal Financing Options for Growth Initiatives

In today’s dynamic business landscape, companies constantly face the challenge of securing reliable and flexible financing options to fuel their expansion plans. Mezzanine debt and preferred equity are two popular choices that offer distinct advantages for companies seeking additional capital. However, understanding the nuances and differences between these financing options is crucial for making informed decisions. In this article, we delve into the intricacies of mezzanine debt and preferred equity, exploring their uses, benefits, and potential risks. By providing a comprehensive comparison, we aim to empower businesses with the knowledge needed to identify the optimal financing option for their growth initiatives.

Key Takeaways:

- Mezzanine debt and preferred equity are types of financing in real estate projects, positioned between senior debt and common equity in the capital stack.

- Mezzanine debt is secured by a lien on the property, while preferred equity is an equity investment in the property-owning entity.

- Mezzanine debt is less risky and more predictable, while preferred equity offers higher returns and more upside potential.

- Mezzanine debt is structured as a loan and listed on the balance sheet as debt, whereas preferred equity is listed as equity.

- Preferred equity takes priority over common shares and can have a dividend or be converted into common shares.

- Both preferred equity and mezzanine debt can provide risk-adjusted returns to investors, but in different ways.

- Mezzanine debt is suitable for minimizing risk and earning predictable returns, while preferred equity allows investors to share in potential upside but carries more risk.

- Preferred equity and mezzanine debt have different effects on valuation and returns.

- Mezzanine debt characteristics resemble debt structures, while preferred equity is more similar to equity structures.

- Mezzanine debt is subordinated to senior debt, whereas preferred equity offers lower returns compared to senior debt.

Mezzanine Debt vs Preferred Equity

When it comes to financing growth initiatives, companies often find themselves faced with a choice between mezzanine debt and preferred equity. Both options provide capital to support expansion plans, but they differ in their structure, risk, and potential returns. In this article, we will dive into the nuances of mezzanine debt and preferred equity, offering insights to help you make an informed decision on the optimal financing option for your specific needs.

Understanding Mezzanine Debt

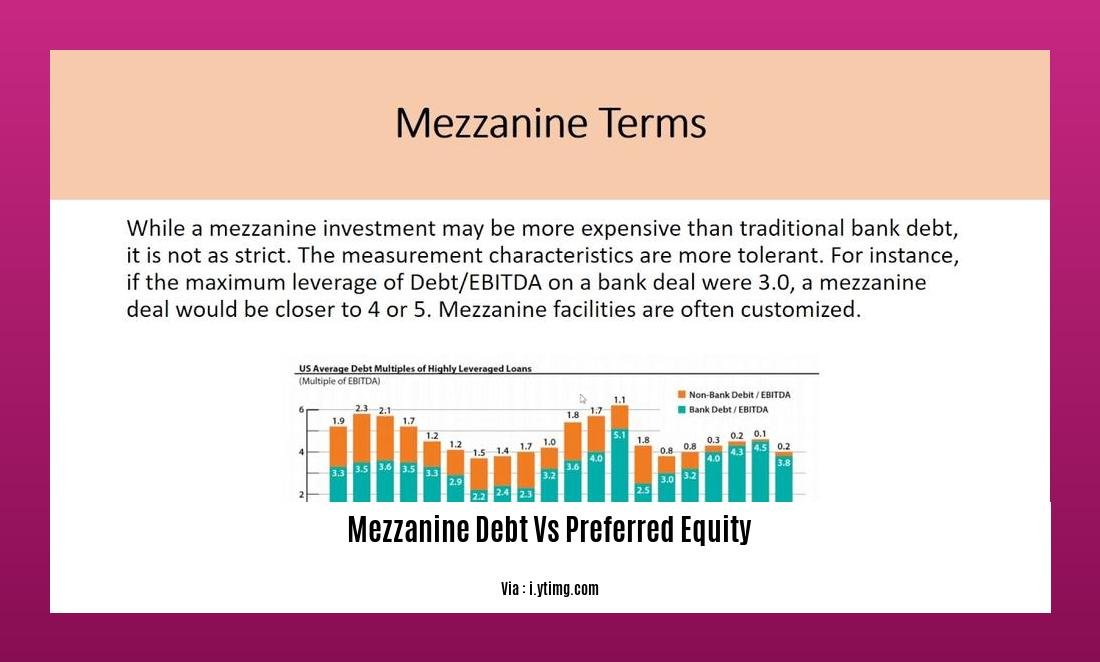

Let’s start by unpacking the concept of mezzanine debt. As the name suggests, mezzanine debt sits in the middle of a company’s capital stack, between senior debt and common equity. It is a loan that is secured by a lien on the property, providing a level of security to lenders. Mezzanine debt is listed on the balance sheet as debt, making it a more predictable and less risky financing option.

One of the key advantages of mezzanine debt is its risk-adjusted returns. By being subordinated to senior debt, mezzanine debt holders receive higher returns compared to traditional debt. This makes mezzanine debt a suitable choice for companies looking to minimize risk and earn stable, predictable returns.

Exploring Preferred Equity

On the other hand, preferred equity represents an equity investment in the property-owning entity. It also sits in the middle of the capital stack, but it offers a different set of characteristics compared to mezzanine debt. Preferred equity is listed on the balance sheet as equity, which reflects its closer resemblance to equity structures.

What makes preferred equity unique is its potential for higher returns and upside potential. As the name suggests, preferred equity comes ahead of common shares, giving investors certain advantages such as dividends or the ability to convert their investment into common shares. This allows investors to share in the potential upside of a deal. However, it’s important to note that preferred equity also carries more risk compared to mezzanine debt.

A Comparative Analysis

To help you discern between mezzanine debt and preferred equity, let’s delve into a comparative analysis of their key attributes.

1. Structure and Listing: Mezzanine debt, being a loan, is listed on the balance sheet as debt. On the other hand, preferred equity is listed as equity, aligning with its characteristics as an equity investment.

2. Risk and Returns: Mezzanine debt offers lower risk and more predictable returns, making it an attractive option for risk-averse investors. On the flip side, preferred equity provides higher returns and potential for upside, but it carries greater risk due to its equity-like characteristics.

3. Valuation Impact: Mezzanine debt and preferred equity impact valuation and returns differently. Mezzanine debt structures resemble debt, while preferred equity aligns more closely with equity structures.

4. Seniority and Returns: Mezzanine debt is subordinated to senior debt, meaning it has lower priority in terms of repayment. However, this subordination allows mezzanine debt holders to earn higher returns compared to senior debt.

To summarize, mezzanine debt is a safer, more predictable financing option suited for risk-averse investors. It offers stability with lower returns compared to preferred equity. On the other hand, preferred equity provides higher returns and the potential for greater upside, but it carries more risk and volatility.

Conclusion

In the world of financing growth initiatives, the choice between mezzanine debt and preferred equity requires careful consideration. By understanding the key differences and characteristics of these options, you can make an informed decision that aligns with your risk tolerance and growth objectives. Keep in mind that both mezzanine debt and preferred equity have their own merits, and the optimal choice ultimately depends on your specific needs and circumstances.

If you are looking for information on mezzanine debt interest rates, click here to discover the latest rates available in the market.

Explore a comprehensive list of reliable mezzanine debt lenders by clicking here. They can provide you with the financial support you need for your next venture.

Need funding for your business? Look no further! Click here to find reputable mezzanine debt providers who can offer you flexible and affordable financing options.

Unsure about whether to go for mezzanine debt or equity financing? Click here to understand the differences between the two and make an informed decision for your business.

Comparing the Features

Preferred equity and mezzanine debt are two hybrid forms of financing that offer unique benefits and risks for companies seeking to fund their growth initiatives. Understanding the differences between these two options is crucial for making informed decisions on the optimal financing strategy. In this article, we will compare the features of preferred equity and mezzanine debt to shed light on their distinct characteristics and help you navigate through the complexities of these financing options.

Preferred Equity: A Flexible Equity Investment

Preferred equity represents an investment in the property-owning entity and is listed as equity on the balance sheet. It sits in the middle of the capital stack and offers the potential for higher returns and upside. However, it also carries more risk compared to mezzanine debt. As a preferred equity investor, you have a higher priority in the capital stack compared to mezzanine debt lenders. This means that you will be entitled to repayment only after all debt obligations have been satisfied.

Mezzanine Debt: A Secure Debt Option

Mezzanine debt, on the other hand, acts as a form of debt and provides security to lenders. It sits between senior debt and common equity in the company’s capital stack, offering stability and lower returns compared to preferred equity. Mezzanine debt is listed as debt on the balance sheet and is subordinated to senior debt. This means that in the event of a default or foreclosure, mezzanine debt holders are paid back after senior debt holders but before equity holders.

Key Takeaways:

- Preferred equity represents an equity investment in the property-owning entity, while mezzanine debt is listed as debt on the balance sheet.

- Preferred equity offers the potential for higher returns and upside, but carries more risk compared to mezzanine debt.

- Mezzanine debt provides stability and lower returns, making it suitable for risk-averse investors.

- Preferred equity investors have a higher priority in the capital stack compared to mezzanine debt lenders.

- Mezzanine debt is subordinated to senior debt and offers higher returns compared to senior debt.

Sources:

1. Thomson Reuters. Mezzanine Loan and Preferred Equity Comparison Chart.

2. Lev. Preferred Equity vs Mezzanine Debt: What’s the Difference?

Considerations for Choosing

When it comes to financing growth initiatives, companies have options to consider. Two common choices are mezzanine debt and preferred equity. These funding options have distinct characteristics, and understanding the key considerations can help companies make the right choice for their specific needs. In this article, we’ll explore the factors that should be taken into account when deciding between mezzanine debt and preferred equity.

Mezzanine Debt: Balancing Risks and Returns

Mezzanine debt is a type of financing that combines elements of both debt and equity. It sits between senior debt and equity in terms of priority and risk. For risk-averse investors, mezzanine debt offers stability and lower returns compared to preferred equity. Mezzanine debt is typically subordinated to senior debt, which means it is repaid after senior debt holders but before equity holders in the event of default or foreclosure.

Some key considerations when choosing mezzanine debt:

-

Security and Recovery Rights: Mezzanine debt is secured by a property and is senior to any equity, but junior to the senior loan on the property. In the event of foreclosure, mezzanine debt lenders have a higher likelihood of recovering their investment compared to preferred equity investors.

-

Interest Rates and Returns: Mezzanine debt generally has a higher interest rate compared to preferred equity. This is to compensate the investor for potential increased risk. However, the rate of return on mezzanine debt is lower compared to preferred equity.

-

Cash Flow Distribution: Cash flow is distributed first to the mezzanine debt holder and secondly to the preferred equity investor. Mezzanine debt holders have priority in receiving cash flow payments.

-

Term and Tax Advantages: Mezzanine debt can have a shorter term compared to a senior secured debt loan. It also offers some tax advantages, which can be beneficial for companies seeking tax efficiency.

Preferred Equity: Potential Upside and Flexibility

Preferred equity represents an equity investment in the property-owning entity. It is listed as equity on the balance sheet and offers the potential for higher returns and upside compared to mezzanine debt. However, it also carries more risk and volatility.

Consider these factors when choosing preferred equity:

-

Position in the Capital Stack: Preferred equity sits in the middle of the capital stack, subordinate to all debt obligations. This means that preferred equity investors are not entitled to repayment until all debt obligations have been satisfied. However, they have a higher priority compared to mezzanine debt lenders.

-

Flexibility in Deal Structuring: Preferred equity deals are more flexible compared to senior or mezzanine debt. This flexibility allows for creative deal structures that can be tailored to specific needs and circumstances.

-

Risk and Returns: Preferred equity offers the potential for higher returns compared to mezzanine debt. However, it also carries more risk. Companies considering preferred equity should carefully evaluate their risk appetite and weigh it against the potential upside.

-

Ownership Rights in Foreclosure: In the unfortunate event of a commercial real estate foreclosure, preferred equity investors have lower ownership rights compared to mezzanine debt lenders. This means that mezzanine debt lenders are more likely to recover their investment if foreclosure occurs before the property is sold.

Key Takeaways:

- Mezzanine debt combines characteristics of both debt and equity, offering stability and lower returns.

- Preferred equity represents an equity investment with the potential for higher returns but carries more risk.

- Considerations for choosing between mezzanine debt and preferred equity include security and recovery rights, interest rates and returns, cash flow distribution, term and tax advantages.

- Preferred equity offers flexibility in deal structuring and potentially higher returns, but also carries more risk.

- Mezzanine debt lenders have higher ownership rights in the event of foreclosure compared to preferred equity investors.

Sources:

1. Lev – Preferred Equity vs Mezzanine Debt: What’s the Difference?

2. Thomson Reuters – Mezzanine Loan and Preferred Equity Comparison Chart

Comparing Mezzanine Debt vs Preferred Equity: Understanding the Optimal Financing Options for Growth Initiatives

Real-life Examples

When it comes to financing real estate investments, two popular options are mezzanine debt and preferred equity. These financing options have their own characteristics, advantages, and considerations. By exploring real-life examples, we can gain a better understanding of how these options work and how they can impact real estate investments.

Key Takeaways:

- Real-life examples provide practical insights into the differences and benefits of mezzanine debt and preferred equity in real estate financing.

- Examining specific case studies helps investors understand the potential risks, returns, and structure associated with each option.

- Real-life examples showcase how mezzanine debt and preferred equity are used in different real estate projects, such as residential developments or commercial properties.

Real-life Examples: Mezzanine Debt vs Preferred Equity

1. Residential Development Project:

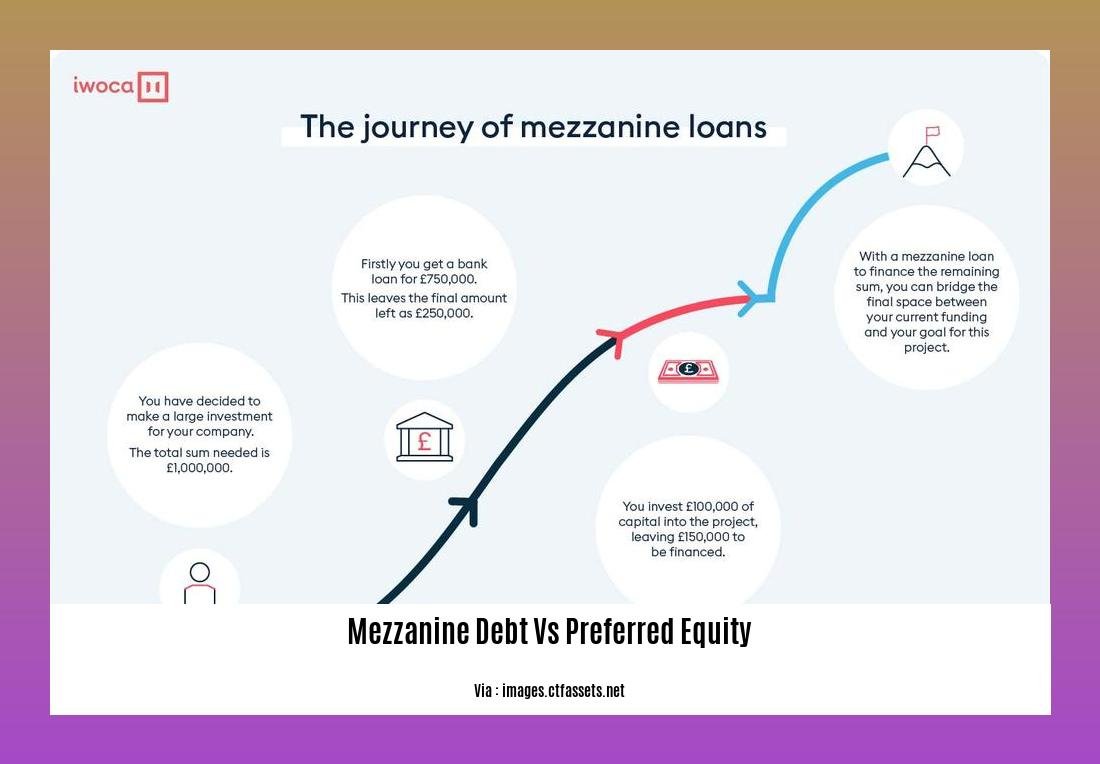

In a residential development project, the developer secured mezzanine debt to bridge the gap between senior debt and common equity. The mezzanine debt provided a flexible financing option with a favorable interest rate. This allowed the developer to proceed with the project while minimizing the need for additional equity investment. The mezzanine debt was secured by the property and offered investors a risk-adjusted return. This real-life example demonstrates how mezzanine debt can be a suitable choice for developers seeking stability and lower returns while minimizing their overall equity requirement.

2. Commercial Property Acquisition:

For a commercial property acquisition, preferred equity was utilized as part of the financing strategy. The preferred equity investors received a fixed return and had priority over common equity holders. In this case, the investors were willing to accept a slightly higher rate compared to mezzanine debt to compensate for the potential increased risk. By structuring the financing with preferred equity, the property owners were able to tap into a broader pool of capital and secure the necessary funds for the acquisition. This example showcases how preferred equity can be an attractive option for investors seeking higher returns and potential upside in real estate investments.

3. Mixed-Use Development Project:

A mixed-use development project involved a combination of residential and commercial spaces. Mezzanine debt was utilized to provide additional capital for the project, offering a competitive interest rate compared to senior debt. The mezzanine debt loan had a shorter term than the senior debt loan, aligning with the project timeline and cash flow projections. This example highlights how mezzanine debt can be structured to meet the specific needs of a mixed-use development, providing the necessary funds at the right time to support the project’s growth.

4. Redevelopment of Historic Building:

In the redevelopment of a historic building, preferred equity was used to finance the project. The value of the property was enhanced through the redevelopment, creating opportunities for higher returns. The preferred equity investors had priority over common equity holders and benefited from the potential upside of the project. This real-life example demonstrates how preferred equity can be an attractive option in situations where the property has significant growth potential.

By examining these real-life examples, we can see how mezzanine debt and preferred equity are utilized in different real estate projects. Each option offers its own advantages in terms of risk-adjusted returns, security, and priority in the capital structure. These examples highlight the importance of carefully considering the project’s specific needs, risk appetite, and desired returns when choosing between mezzanine debt and preferred equity as financing options.

Citations:

– Lev. Preferred Equity vs Mezzanine Debt: What’s the Difference?

– Smartland. Preferred Equity vs. Mezzanine Debt for Real Estate

FAQ

Q1: What is the main difference between mezzanine debt and preferred equity?

A1: The main difference is that mezzanine debt acts as debt, while preferred equity acts as equity. Mezzanine debt is a loan secured by a lien on the property, while preferred equity is an equity investment in the property-owning entity.

Q2: What are the benefits of mezzanine debt and preferred equity for buyers?

A2: Both mezzanine debt and preferred equity offer the potential for higher returns compared to senior debt, the ability to participate in the upside potential of a project, and flexibility in structuring deals.

Q3: How is mezzanine debt structured?

A3: Mezzanine debt sits in between senior debt and equity in terms of priority and risk. It is typically subordinated to senior debt, meaning it is paid back after senior debt holders but before equity holders in the event of a default or foreclosure.

Q4: What happens to preferred equity and mezzanine debt in the event of a foreclosure?

A4: In the event of a commercial real estate foreclosure, mezzanine debt lenders have a higher likelihood of recovering their investment compared to preferred equity investors. Preferred equity investors are subordinate to all debt and have a lower priority in the capital stack.

Q5: How do mezzanine debt and preferred equity affect the capital stack and returns?

A5: Mezzanine debt is subordinated to senior debt but has higher returns compared to senior debt. Preferred equity is subordinate to mezzanine debt and has lower returns compared to senior debt. Both financing options have different effects on valuation and returns, allowing investors to choose the option that aligns with their risk tolerance and potential upside.

Mezzanine Debt vs Preferred Equity: Analyzing Key Differences in Investment Instruments

When it comes to investment instruments, mezzanine debt and preferred equity are two crucial options that every investor should be familiar with. In this article, we will delve into the key differences between mezzanine debt and preferred equity, exploring the intricacies of these financial tools. Understanding the nuances of these two investment instruments is essential for making informed decisions in the world of finance. So, let’s dive in and analyze the key differences between mezzanine debt and preferred equity.

Key Takeaways:

- Preferred equity and mezzanine debt are financing options that sit between senior debt and common equity in real estate projects.

- Mezzanine debt is a secured loan, while preferred equity is an investment in the property-owning entity.

- Mezzanine debt is less risky and more predictable, while preferred equity offers higher returns and potential upside.

- Mezzanine debt is listed as a loan on the balance sheet, while preferred equity is listed as equity.

- Preferred equity has a dividend that accrues and may be redeemable or convertible into common shares.

- Both preferred equity and mezzanine debt are part of the commercial real estate capital stack.

- Mezzanine debt is suitable for lower risk and predictable returns, while preferred equity allows investors to share in potential upside but carries more risk.

- The risks, valuation, benefits, and returns of each financing option can vary.

Mezzanine Debt vs Preferred Equity: Analyzing Key Differences in Investment Instruments

When it comes to financing options in real estate projects, two terms often come up: mezzanine debt and preferred equity. These investment instruments play a crucial role in the capital stack, sitting between senior debt and common equity. In this article, we will dive into the key differences between mezzanine debt and preferred equity, examining their characteristics, advantages, and disadvantages.

Mezzanine Debt: A Secure Loan with Predictable Returns

Mezzanine debt is essentially a loan that is secured by a lien on the property. It is structured as a loan and listed on the balance sheet as such. This type of financing is ideal for individuals who prioritize minimizing risk and earning predictable returns. The predictability of mezzanine debt stems from its position in the capital stack, which grants it a higher priority than common equity.

Preferred Equity: Sharing in the Potential Upside

Preferred equity, on the other hand, is an equity investment in the entity that owns the property. Unlike mezzanine debt, preferred equity is listed on the balance sheet as equity. Investors who opt for preferred equity are willing to take on more risk in exchange for the potential upside that comes with it. With preferred equity, investors can share in the deal’s potential profits through dividend accrual, which may be redeemable or convertible into common shares.

Comparing Key Factors: Risk, Returns, and Structure

-

Risk profile: Mezzanine debt is generally considered less risky and more predictable compared to preferred equity. This is due to its position in the capital stack and the security provided by the lien on the property. Preferred equity, on the other hand, carries more risk but also offers the potential for higher returns.

-

Return potential: Mezzanine debt provides investors with a steady and predictable stream of income through interest payments. On the other hand, preferred equity allows investors to participate in the upside potential of the project, which may result in higher returns if the project performs well.

-

Structural differences: While mezzanine debt is structured as a loan, listed on the balance sheet as a loan, preferred equity is listed as equity. This difference in structure affects the priority of repayment and the legal rights associated with each investment instrument.

Conclusion

In summary, both mezzanine debt and preferred equity play important roles in real estate financing. Mezzanine debt offers a more secure and predictable investment option, suitable for risk-averse individuals. Preferred equity, on the other hand, allows investors to share in the potential upside of a project, but comes with a higher level of risk.

Ultimately, the choice between mezzanine debt and preferred equity depends on individual preferences, risk appetite, and investment goals. It is crucial for investors to carefully analyze the risks, valuation, benefits, and returns associated with each financing option before making a decision.

Table: Mezzanine Debt vs Preferred Equity

| Key Factors | Mezzanine Debt | Preferred Equity |

|---|---|---|

| Risk Profile | Less risky, more predictable | Higher risk, potential for higher returns |

| Return Potential | Steady interest payments | Upside potential in project profits |

| Structure | Listed on the balance sheet as a loan | Listed on the balance sheet as equity |

Remember, when considering real estate financing options, it is always advisable to consult with a financial professional with expertise in this area. They can provide personalized advice based on your specific needs and circumstances.

So, whether you prioritize security and predictability or seek to participate in the potential upside, mezzanine debt and preferred equity offer distinct paths for real estate investors.

Looking for the best mezzanine debt interest rates? Discover them here at ../mezzanine-debt-interest-rates and make informed financial decisions for your business.

Need reliable mezzanine debt lenders? Find top-notch lenders to meet your financing needs at ../mezzanine-debt-lenders. Unlock growth opportunities for your business with their assistance.

Explore a list of reputable mezzanine debt providers at ../mezzanine-debt-providers and secure the right funding options for your business expansion today. Unleash the potential of your business with their support.

Curious about the differences between mezzanine debt and equity? Find out more about their pros and cons at ../mezzanine-debt-vs-equity and make informed financial decisions for your business growth.

Comparison of Risk and Return Profiles

When it comes to real estate investment, two popular options often discussed are mezzanine debt and preferred equity. These alternative financing methods have distinct characteristics that differentiate them in terms of risk and return profiles. Let’s dive into the key differences and determine which option may suit your needs.

Mezzanine Debt: A Closer Look at Debt

Mezzanine debt functions like a traditional loan, secured by a lien on the property. It falls subordinate to senior secured debt but has priority over preferred equity and common equity. This type of debt is viewed as a safer bet for lenders, as they have the right to foreclose on the property in the event of default.

According to a comparison chart by Thomson Reuters[^1], mezzanine debt generally carries a higher interest rate compared to senior debt. However, the rate of return on mezzanine debt is lower compared to preferred equity.

Preferred Equity: A Perspective on Equity

Preferred equity, on the other hand, is viewed more as equity rather than debt. It is structured differently and is considered a capital contribution to the entity. Investors who opt for preferred equity enjoy a preferred return on their investment, similar to interest received from a mezzanine loan. They also have the potential for capital appreciation, making it an attractive option for those seeking a stake in the property.

The comparison chart by Thomson Reuters[^1] states that preferred equity holders enjoy a preferred return and potential capital appreciation. This makes preferred equity a relatively lower-risk investment option compared to mezzanine debt.

Key Differences in Risk and Return

The primary difference between mezzanine debt and preferred equity lies in their classification and the risk they carry:

- Mezzanine debt is structured as a loan secured by a lien on the property, while preferred equity is considered a capital contribution to the entity.

- Mezzanine debt takes repayment priority over preferred equity and common equity, whereas preferred equity holders enjoy a preferred return and potential capital appreciation.

- Mezzanine debt carries a higher interest rate than senior debt but a lower rate of return than preferred equity.

- Mezzanine debt is not secured by the real property itself, posing more risk for lenders in the event of default.

- Preferred equity offers lower risk compared to mezzanine debt but potentially lower returns as well.

Key Takeaways:

- Mezzanine debt is seen as debt, while preferred equity is seen as equity.

- Mezzanine debt provides steady and predictable income through interest payments, while preferred equity allows investors to participate in the project’s potential profits.

- Mezzanine debt is structured as a loan, while preferred equity is structured as equity, affecting repayment priority and legal rights.

- Mezzanine debt carries more risk due to its position in the capital stack and the lack of security provided by the property lien.

- Preferred equity offers a potentially lower-risk investment option with less predictable returns compared to mezzanine debt.

In conclusion, understanding the nuances between mezzanine debt and preferred equity is essential for real estate investors looking for alternative financing options. Each option carries its own set of risks and benefits, and investors must carefully consider their strategies, investment goals, and risk tolerance before making a decision.

Sources:

1. Thomson Reuters, Mezzanine Loan and Preferred Equity Comparison Chart, PDF File

Analysis of Tax Implications and Capital Structure Considerations

When it comes to real estate investment, two alternative financing methods often discussed are mezzanine debt and preferred equity. While both options have their merits, analyzing the tax implications and capital structure considerations is crucial for making informed investment decisions. In this article, we will delve into the key differences between mezzanine debt and preferred equity, with a focus on their tax implications and how they impact a company’s capital structure.

Mezzanine Debt: A Debt Perspective

Mezzanine debt, classified as debt, is a loan secured by a lien on the property. It bears similarity to traditional debt financing, with lenders having the right to foreclose on the property in the event of default. However, it falls subordinate to senior secured debt, taking priority over preferred equity and common equity in the repayment hierarchy.

From an analysis of tax implications, mezzanine debt offers potential benefits such as tax deductibility of interest expenses, which can reduce a company’s taxable income. Additionally, the interest paid on mezzanine debt is typically considered a business expense, further reducing the tax burden. However, it is essential to consult a tax professional to understand the specific tax rules and regulations applicable to each scenario.

Preferred Equity: An Equity Perspective

Preferred equity, on the other hand, is categorized as equity rather than debt. It represents a capital contribution to the entity rather than a loan. Preferred equity holders enjoy a preferred return on their investment, similar to interest received from a mezzanine loan. They also have the potential for capital appreciation, making it an enticing option for investors seeking a stake in the property.

Unlike debt, preferred equity’s tax implications are more aligned with equity investments. Generally, the preferred return received is treated as a dividend for tax purposes. Depending on the jurisdiction, dividends may have distinct tax treatment, including potential preferential tax rates or eligibility for tax credits. It is crucial to understand the tax laws specific to each jurisdiction to fully assess the tax implications of preferred equity.

Key Considerations and Analysis of Tax Implications

When analyzing tax implications and capital structure considerations, several factors come into play:

-

Interest Deductibility: Mezzanine debt allows for the deductibility of interest expenses, reducing the company’s taxable income. On the other hand, preferred equity does not offer the same tax benefits, as the preferred return is treated as a dividend and may not qualify for interest deductibility.

-

Capital Gain Opportunities: Preferred equity provides the potential for capital appreciation, which may lead to favorable tax treatment if held for a certain period. Capital gains tax rates can vary, so it’s crucial to consider the tax impact when assessing the advantages of preferred equity.

-

Debt-to-Equity Ratio: The capital structure of a company, including the proportion of debt and equity, can impact its overall tax position. Mezzanine debt contributes to the debt portion, potentially allowing for greater interest deductibility. Preferred equity, being categorized as equity, does not have the same tax advantages related to interest deductibility.

-

Risk vs. Return: Tax implications should be analyzed in relation to the overall risk and return profile of the investment. Mezzanine debt, being more closely aligned with debt, generally carries lower risk but may offer fewer tax advantages compared to preferred equity.

-

Jurisdictional Differences: Tax laws can vary significantly between jurisdictions. It is essential to evaluate the tax implications based on the specific tax regulations and requirements of the relevant jurisdiction.

Key Takeaways:

- Mezzanine debt is classified as debt and offers tax advantages such as interest deductibility.

- Preferred equity is viewed as equity and may not provide the same tax benefits related to interest deductibility.

- Tax implications should be considered alongside the overall risk and return profiles of mezzanine debt and preferred equity.

- Understanding jurisdiction-specific tax laws is crucial for assessing the tax implications of these financing options.

Sources:

– Mezzanine Loan and Preferred Equity Comparison Chart – Thomson Reuters

– Preferred Equity vs Mezzanine Debt: What’s the Difference? – lev.co

Considerations for Choosing Between Mezzanine Debt and Preferred Equity

Mezzanine debt and preferred equity are two financing options that offer distinct characteristics and structures. When determining which option is best suited for your needs, there are several considerations to keep in mind.

Risk and Return Profile

- Mezzanine debt offers a more secured position compared to preferred equity, but with a higher yield to compensate for the added risk.

- Preferred equity investors enjoy potential higher returns, but may have a lower position in the capital structure.

Tax Implications

- Mezzanine debt is generally considered interest expense for the borrower and taxable income for the lender.

- Preferred equity does not have a defined tax treatment, as it is classified as an equity investment.

Capital Structure and Repayment Priority

- Mezzanine debt is structured as a loan secured by a lien on the property, while preferred equity is considered a capital contribution to the entity.

- Mezzanine debt takes repayment priority over preferred equity and common equity.

Investment Goals and Risk Appetite

- Mezzanine debt may be more suitable when seeking lower risk and predictable returns.

- Preferred equity may be preferred when seeking ownership rights and potential upside in the investment.

Project Risk Profile and Cost of Capital

- Mezzanine debt may be more suitable in situations where higher leverage and a lower cost of capital are desired.

- Preferred equity may be more suitable when considering the risk profile and cost of capital associated with the project.

Key Takeaways:

- Mezzanine debt and preferred equity offer different risk and return profiles, tax implications, and repayment priorities.

- Choosing between the two requires consideration of investment goals, risk appetite, project risk profile, and cost of capital.

- It is important to consult with a financial professional before making a decision on financing options.

Sources:

– Fundrise – Mezzanine Debt vs. Preferred Equity

– Smartland – Preferred Equity vs. Mezzanine Debt for Real Estate

FAQ

Q1: What is the difference between mezzanine debt and preferred equity?

A1: Mezzanine debt is structured as a loan secured by a lien on the property, while preferred equity is considered a capital contribution to the entity. Mezzanine debt acts more like traditional debt with a higher interest rate, while preferred equity offers a lower rate of return but potential capital appreciation.

Q2: Which option, mezzanine debt or preferred equity, is less risky?

A2: Mezzanine debt is generally considered less risky compared to preferred equity. Mezzanine debt is structured as a loan and is secured by a lien on the property, providing a higher level of security for lenders. Preferred equity, on the other hand, carries more risk as it is viewed as equity and does not have a lien on the property.

Q3: What are the benefits of mezzanine debt?

A3: Mezzanine debt offers several benefits, including lower risk compared to preferred equity, predictable returns, and a higher priority in repayment compared to other forms of equity. It is suitable for investors who prioritize minimizing risk and earning stable returns.

Q4: What are the benefits of preferred equity?

A4: Preferred equity allows investors to share in the potential upside of a real estate investment, as well as enjoy a preferred return on their investment. It offers the potential for capital appreciation and can be an attractive option for investors who want to have ownership rights in the property.

Q5: How do mezzanine debt and preferred equity impact the capital structure of a real estate project?

A5: Mezzanine debt and preferred equity both play a role in the capital stack of a real estate project. Mezzanine debt falls subordinate to senior secured debt but has priority over preferred equity and common equity. Preferred equity holders have a senior position compared to common equity but are subordinate to mezzanine debt.

- Ceramic Kitchen Wall Tiles: Style and Protection for Your Walls - December 17, 2025

- Kitchen tiling wall: Elevate your kitchen with stylish wall tiles - December 16, 2025

- Gray Kitchen Backsplash Tile: Ideas for a Stylish Upgrade - December 14, 2025