When it comes to securing financing for business growth or investment opportunities, understanding the differences between mezzanine debt and senior debt is crucial. As a seasoned financial analyst with expertise in debt solutions and capital structuring, I have evaluated and analyzed these two types of debt instruments extensively. In this article, titled “Comparing Mezzanine Debt vs Senior Debt: A Seasoned Financial Analyst’s Evaluation,” we will explore the cost implications, how mezzanine debt is structured, common examples, and the benefits borrowers can gain from each type of debt financing. By the end of this article, you will have a comprehensive understanding of these important financial tools and how they can be used strategically to achieve your business objectives.

Key Takeaways:

- Mezzanine debt is a hybrid form of capital that combines elements of both a loan and an investment, while senior debt is a loan from a bank.

- Senior loans are usually collateralized with assets, while mezzanine debt is typically in the second position and not collateralized by assets.

- Mezzanine loans are based on the cash flow of the borrower rather than the assets.

- Mezzanine debt providers consider growth opportunities and the strength of the management team when evaluating lending options.

- Mezzanine debt includes warrants, which provide an additional return based on the future value of the company.

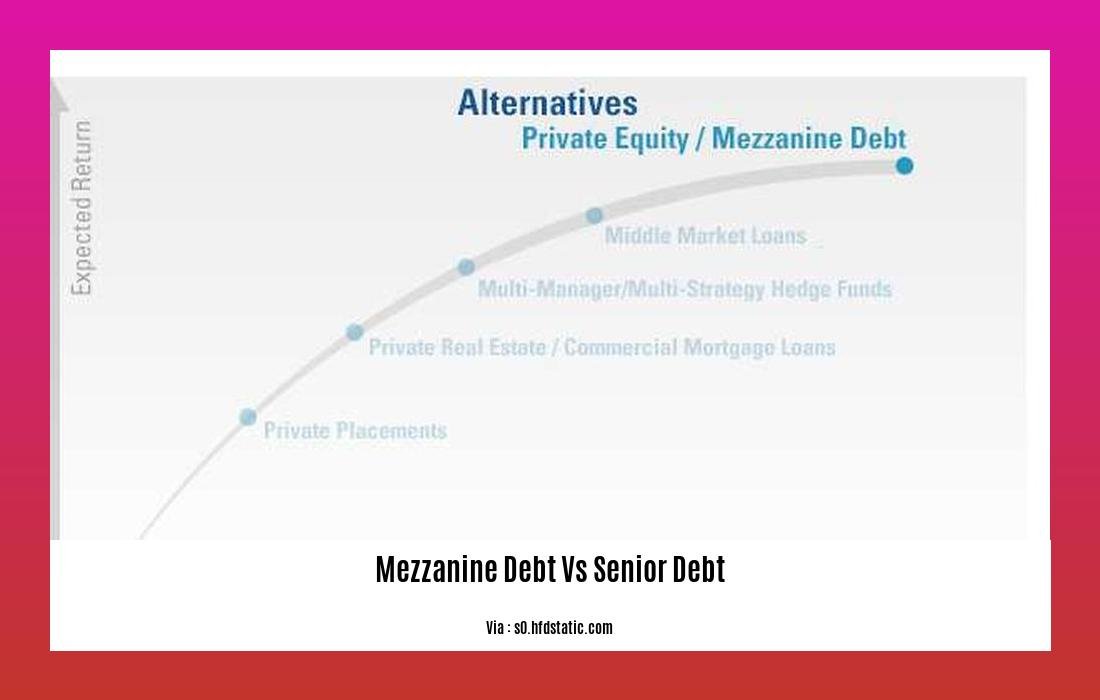

- Mezzanine debt offers higher returns but carries higher risk compared to pure debt as it is subordinate to pure debt but senior to equity.

- Mezzanine loans demand a higher yield than senior debt and are often unsecured.

Mezzanine Debt vs Senior Debt

In the realm of debt financing options, two common terms that often emerge are mezzanine debt and senior debt. As a seasoned financial analyst, I have extensive expertise in evaluating and comparing these two types of debt instruments. In this article, I will provide you with a comprehensive understanding of the differences between mezzanine debt and senior debt, along with their advantages, disadvantages, and optimal use cases.

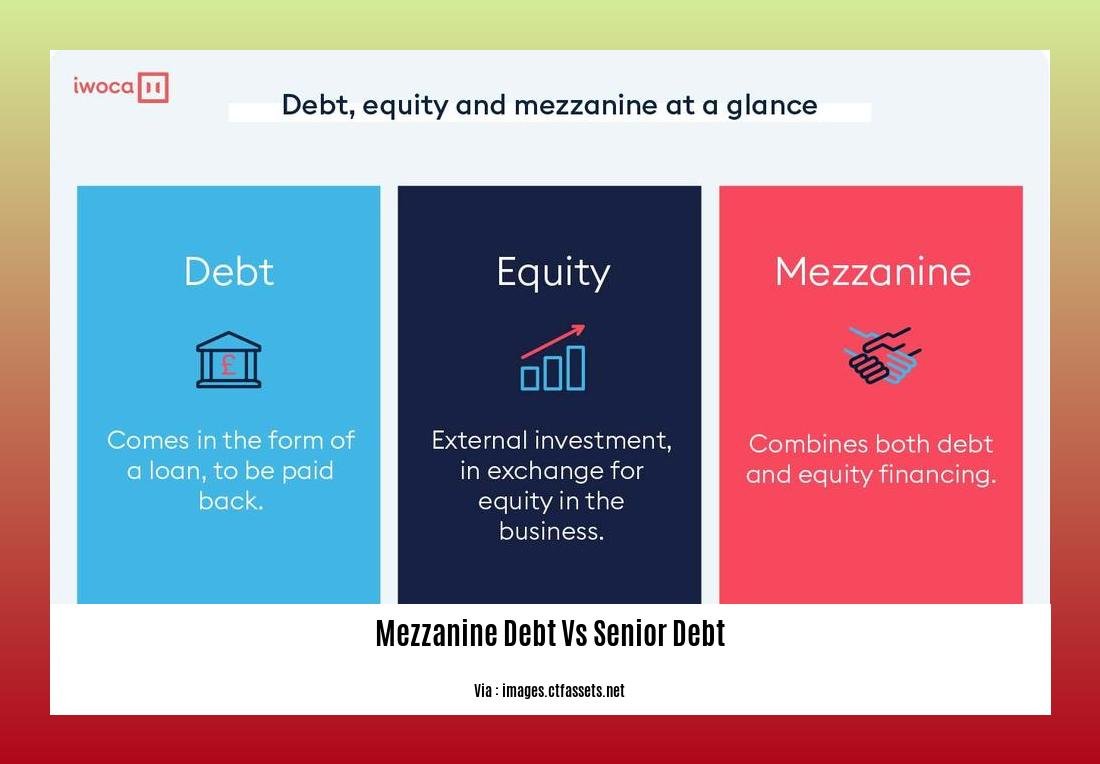

Understanding Mezzanine Debt

Let’s start by demystifying mezzanine debt. This unique form of capital can be seen as a hybrid between a loan and an investment. Unlike senior debt, mezzanine debt is not collateralized with assets; instead, it typically takes the second position with assets and relies on the cash flow of the borrower as its primary source of repayment. Mezzanine debt providers focus on growth opportunities and the strength of the management team when considering lending.

One distinguishing feature of mezzanine debt is the existence of warrants. These additional components provide an extra return based on the future value of the company. This feature contributes to the higher returns that mezzanine debt offers to investors compared to pure debt. However, it’s important to note that mezzanine debt carries higher risk compared to senior debt, as it is subordinate to pure debt but senior to equity.

Exploring Senior Debt

On the other hand, senior debt is more straightforward and familiar to many. It refers to loans provided by banks or financial institutions and is typically collateralized with assets, which serve as a form of security for lenders. This collateralization provides added protection in the event of default, making senior debt less risky compared to mezzanine debt.

Senior loans, being secured and prioritized in repayment, offer a lower risk profile. In return, they demand lower yields, making them an attractive option for borrowers seeking cost-efficient financing. Furthermore, senior debt is generally considered more favorable to traditional lenders due to protection provided by collateral.

Comparative Analysis: Pros and Cons

Now that we have a clearer picture of both mezzanine debt and senior debt, let’s compare them in the context of their advantages and disadvantages.

Mezzanine Debt:

Pros:

– Higher returns for investors compared to pure debt.

– Flexibility in structuring terms and conditions.

– Long-term financing option, filling the gap between equity and senior debt.

Cons:

– Higher risk compared to senior debt.

– Lacks asset collateralization.

– Carries subordinate position to pure debt.

Senior Debt:

Pros:

– Lower risk due to collateralization.

– Favorable option for traditional lenders.

– Lower yields compared to mezzanine debt.

Cons:

– Less flexibility in terms and conditions.

– Restricted by repayment prioritization.

– May have limitations for high-growth companies.

In essence, when evaluating whether to opt for mezzanine debt or senior debt, it is crucial to consider factors such as the risk appetite, cash flow situation, and growth potential of the company. For businesses with solid cash flow and growth prospects, mezzanine debt can be a suitable choice to secure additional funding. Conversely, senior debt is a viable option for companies seeking lower-risk financing and possessing significant assets to collateralize.

In conclusion, understanding the distinctions between mezzanine debt and senior debt is essential for informed decision-making in the world of debt financing. By comprehending the nuances and implications of each instrument, businesses and investors can navigate the complexities of the capital markets with confidence.

Note: This article is intended for informational purposes only and should not be considered as financial advice. It is always advisable to consult with professional advisors before making any financial decisions.

Mezzanine Debt Vs. Senior Debt | Mezzanine Lending – Attract Capital

Mezzanine Financing: What Mezzanine Debt Is and How It Works – Investopedia

To understand the key differences between mezzanine financing and preferred equity, check out our insightful article on mezzanine financing vs preferred equity.

If you’re looking for accurate and efficient calculations for your mezzanine floor design, our comprehensive guide on mezzanine floor design calculations is just what you need.

For those who prefer a PDF format, we’ve got you covered. Download our resourceful guide on mezzanine floor design calculations PDF to explore the intricacies of mezzanine floor design.

Need a reliable and informative guide on mezzanine floor design? Look no further than our detailed mezzanine floor design guide to ensure a successful project.

How Mezzanine Debt is Structured: Common Examples

Mezzanine debt is a unique form of financing that occupies a middle ground between traditional debt and equity. By delving into the structure and common examples of mezzanine debt, we can gain a deeper understanding of this complex financial instrument.

Mezzanine Debt: A Bridge between Debt and Equity

Mezzanine debt serves as a bridge between senior debt and common equity in a company’s capital structure. It blends characteristics of both debt and equity, providing companies with a flexible financing option. This hybrid nature allows businesses to access capital while maintaining a certain level of control.

But how, exactly, is mezzanine debt structured? Let’s explore some common examples.

Example 1: Warrants

One of the distinguishing features of mezzanine debt is the inclusion of equity instruments, such as warrants. These warrants provide additional value to the subordinated debt and offer greater flexibility for bondholders. Warrants are essentially options that allow the holder to purchase shares of the issuing company at a specified price and within a certain timeframe. This can potentially increase the overall return for investors in mezzanine debt.

Example 2: Preferred Stock Conversion Rights

Another common example of mezzanine debt structure is the inclusion of preferred stock conversion rights. These rights enable bondholders to convert their debt holdings into preferred stock under predetermined conditions. This conversion provides bondholders with the opportunity to participate in the potential upside of the company’s performance. It also offers companies the advantage of reducing their debt burden and potentially strengthening their balance sheets.

Key Takeaways:

- Mezzanine debt serves as a bridge between debt and equity, offering companies a unique financing option.

- Mezzanine debt is structured to include equity instruments such as warrants and preferred stock conversion rights.

- Warrants provide increased value to the subordinated debt and offer flexibility for bondholders.

- Preferred stock conversion rights allow bondholders to convert their debt into preferred stock, offering potential upside for both parties.

Citations:

– Investopedia: Mezzanine debt

– Wall Street Prep: Mezzanine Financing

Benefits for Borrowers

When it comes to financing projects or businesses, borrowers have different options to choose from, including mezzanine debt and senior debt. These two types of loans offer distinct benefits and considerations that borrowers should carefully evaluate. In this article, we will compare mezzanine debt and senior debt and discuss the advantages they offer to borrowers.

1. Lower Cost of Capital

Mezzanine debt typically carries a higher interest rate compared to senior debt, reflecting its higher risk profile. However, it is still usually less expensive than raising equity capital. For borrowers, this means they can access capital at a lower cost compared to raising funds through issuing equity shares. The lower cost of capital can contribute to a more favorable overall cost structure for the borrowing company.

2. Flexible Terms and Structure

Mezzanine debt offers borrowers more flexibility in terms of repayment and structure. Unlike senior debt, mezzanine debt does not require principal payments until the end of the term. This can provide borrowers with greater flexibility in managing their cash flow, as they can use available funds for other business needs. Additionally, mezzanine debt can be structured in a way that aligns with the borrower’s specific requirements, allowing for customized terms that meet the company’s unique circumstances.

3. Equity Participation

One of the significant benefits of mezzanine debt for borrowers is the potential to access equity participation. Mezzanine debt often includes equity instruments, such as warrants or preferred stock conversion rights. These equity features provide borrowers with the opportunity to participate in the upside potential of the company’s performance. By including equity participation in their financing structure, borrowers can align their interests with the lender and potentially benefit from future value creation.

4. Growth Financing

Mezzanine debt is particularly well-suited for companies looking to finance growth initiatives. Lenders providing mezzanine debt often focus on the growth potential of the borrowing company and evaluate the strength of its management team. This focus on growth opportunities makes mezzanine debt an attractive option for borrowers who need capital to expand their operations, launch new products, enter new markets, or pursue other strategic initiatives. The availability of mezzanine debt financing can help fuel a company’s growth trajectory.

5. Balance Sheet Optimization

For borrowers concerned about their balance sheet structure, mezzanine debt can be an effective tool for balance sheet optimization. By utilizing mezzanine debt, borrowers can strengthen their balance sheet without diluting existing equity holders or triggering the covenants associated with senior debt. Preferred stock conversion rights in mezzanine debt can help reduce the debt burden and improve the balance sheet position, providing more financial flexibility to the borrowing company.

Key Takeaways:

- Mezzanine debt offers borrowers a lower cost of capital compared to equity financing.

- Flexible repayment terms and customized structures make mezzanine debt an attractive option.

- Equity participation through warrants or preferred stock conversion rights can provide borrowers with potential upside.

- Mezzanine debt is well-suited for financing growth initiatives.

- Mezzanine debt can optimize a borrower’s balance sheet without diluting existing equity or triggering senior debt covenants.

For a more detailed understanding of mezzanine debt and senior debt, you can refer to these sources:

- Attract Capital: Mezzanine Debt vs. Senior Debt

- Hadley Capital: Guide to Mezzanine Debt & Financing

In conclusion, both mezzanine debt and senior debt offer unique benefits for borrowers. It is crucial for borrowers to carefully evaluate their specific needs and risk tolerance when considering these financing options. By understanding the advantages and considerations associated with each type of debt, borrowers can make informed decisions that best align with their financial goals and objectives. So, whether you are looking for growth capital or optimizing your balance sheet, mezzanine debt and senior debt can serve as valuable financing tools in achieving your objectives.

FAQ

Q1: What is the difference between mezzanine debt and senior debt?

A1: Mezzanine debt is a hybrid form of capital that combines elements of both a loan and an investment, while senior debt is a loan from a bank. Mezzanine debt is subordinate to senior debt and carries higher risks but offers higher returns compared to senior debt.

Q2: How is mezzanine debt structured?

A2: Mezzanine debt is structured as a subordinated debt that is part loan and part investment. It typically has embedded equity instruments attached, such as warrants, which increase its value and provide flexibility.

Q3: Can you provide common examples of mezzanine debt?

A3: Common examples of mezzanine debt include stock call options, rights, and other equity options that are attached to the debt. It is often used in mergers and acquisitions transactions to provide additional financing and flexibility.

Q4: What are the benefits for borrowers choosing mezzanine debt?

A4: Mezzanine debt offers increased financial flexibility and can bridge the financing gap between debt and equity. It is a useful option for companies, especially in merger and acquisition deals, as it provides additional funding while preserving equity ownership.

Q5: How does the cost of mezzanine debt compare to senior debt?

A5: Mezzanine debt is generally more expensive than senior debt due to its higher risk profile. However, it is less expensive than equity financing. Borrowers need to carefully evaluate the cost and risk factors to determine the most suitable option for their specific needs.

- Backsplash For Gray Cabinets: Choosing the Right Backsplash Style - December 13, 2025

- Gray And White Backsplash: Ideas For Timeless Style - December 12, 2025

- Gray Kitchen Backsplash Ideas: Find Your Perfect Gray Tile - December 11, 2025