Mezzanine financing and preferred equity are two alternative funding methods that investors and project sponsors often consider when seeking capital for their ventures. In this article, we will conduct a comprehensive comparison of these financing options to better understand their pros and cons. By analyzing the nuances of mezzanine financing and preferred equity, we aim to provide valuable insights for readers looking to make informed decisions about their financing strategies. Join us as we delve into the world of alternative funding methods in Mezzanine Financing vs Preferred Equity: A Comprehensive Comparison of Alternative Funding Methods.

Key Takeaways:

- Mezzanine debt and preferred equity fill the funding gap between senior debt and common equity in the capital stack.

- Both mezzanine debt and preferred equity provide additional leverage for projects.

- Mezzanine debt is structured as a loan with a lien on the property, while preferred equity is an equity investment in the property-owning entity.

- Preferred equity is prioritized ahead of common shares and offers a dividend that accumulates over time.

- Mezzanine debt is recorded as a loan on the balance sheet, whereas preferred equity is listed as equity.

- The choice between mezzanine debt and preferred equity depends on the investor’s priorities.

- If minimizing risk and ensuring predictable returns are essential, mezzanine debt is recommended.

- If investors seek to participate in the potential upside of a deal and can tolerate more risk, preferred equity may be considered.

Mezzanine Financing vs Preferred Equity

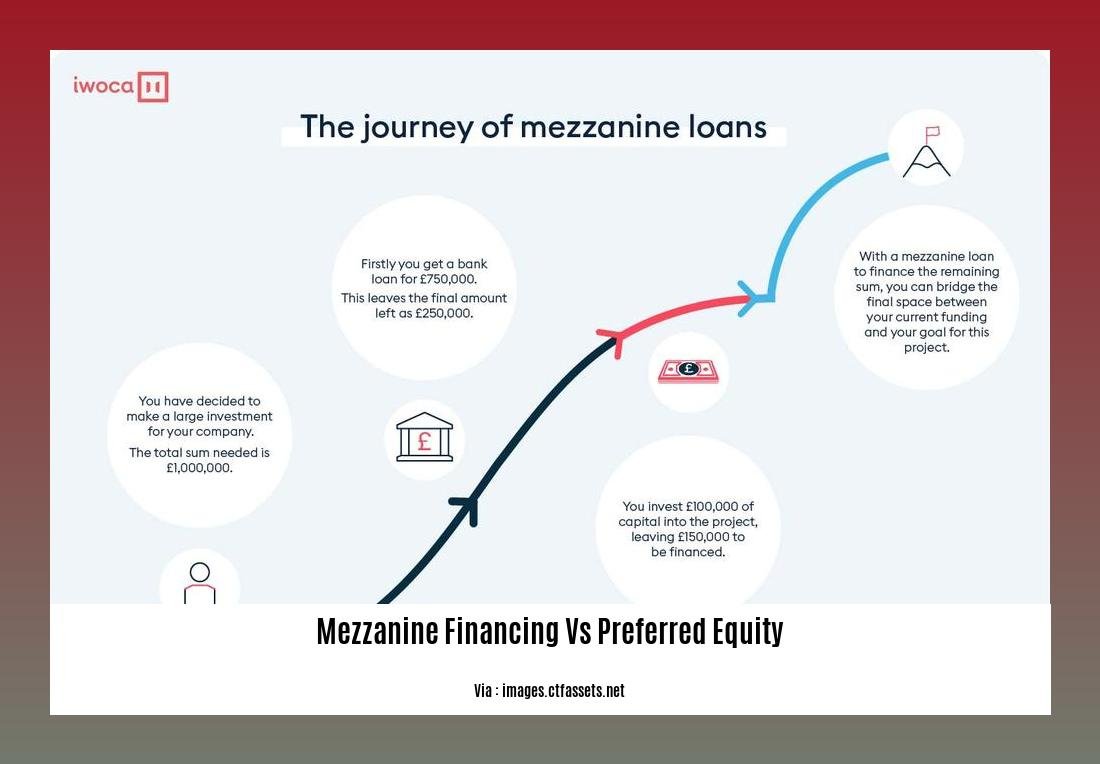

Mezzanine financing and preferred equity are two alternative funding methods that occupy a unique place in the realm of capital markets. Positioned between senior debt and common equity, these financing options serve similar purposes – bridging the funding gap and providing additional leverage for real estate projects. However, the differences between mezzanine financing and preferred equity lie in their structures, risk profiles, and potential returns.

Understanding Mezzanine Financing

Mezzanine financing is structured as a loan that is secured by a lien on the property. In simple terms, it is a debt instrument that allows investors to provide additional capital to a project. When examining the balance sheet of a real estate development, mezzanine debt is listed as a loan, reflecting its debt-like characteristics.

The primary advantage of mezzanine debt lies in its priority of repayment. In the event of a default or liquidation, mezzanine debt holders have a higher claim on the project’s assets compared to equity investors. This means that in times of distress, mezzanine debt holders have a greater chance of recouping their investment. Furthermore, Mezzanine debt accrues interest at a fixed rate, providing investors with predictable returns.

The Benefits of Preferred Equity

On the other hand, preferred equity involves an investment in the property-owning entity itself. Unlike mezzanine debt, which is listed as a loan, preferred equity is reflected on the balance sheet as equity. Preferred equity holders have a higher claim on the project’s equity compared to common shareholders, making it a more secure investment option.

Preferred equity offers the potential for higher returns compared to mezzanine debt. It comes with a dividend that accrues over its life, providing investors with a share of the project’s profits. This potential upside appeals to investors who are willing to take on more risk in exchange for the possibility of greater rewards.

Deciding Between Mezzanine Financing and Preferred Equity

The choice between mezzanine debt and preferred equity ultimately depends on the investor’s priorities and risk appetite. If minimizing risk and ensuring predictable returns are the primary concerns, mezzanine debt is recommended. Its position in the capital stack and secured nature make it a safer bet in the event of a project default or liquidation.

On the other hand, if investors are more interested in participating in the upside potential of a project and can tolerate higher risk, preferred equity may be considered. By investing in the property-owning entity, preferred equity holders can benefit from the project’s success and enjoy a share of the profits.

Conclusion

Mezzanine financing and preferred equity present distinct financing options for real estate projects. Mezzanine debt provides a secure and predictable avenue for investment, allowing investors to minimize risk and ensure a steady stream of returns. On the other hand, preferred equity offers the possibility of higher returns, with investors sharing in the potential upside of a project.

The choice between mezzanine financing and preferred equity ultimately depends on the investor’s risk appetite and their desired level of involvement in the project. Understanding the intricacies of these alternative funding methods is crucial when making decisions that can have a significant impact on investment outcomes.

Ultimately, by thoroughly analyzing the nuances of mezzanine financing and preferred equity, investors can tailor their financial strategies to maximize returns and mitigate risk in the ever-changing landscape of real estate investment.

If you’re wondering about the key differences between mezzanine debt and senior debt, click here to find out more.

To explore the calculations involved in designing a mezzanine floor, check out our guide on mezzanine floor design calculations.

Looking for a PDF resource on mezzanine floor design calculations? Download our comprehensive guide here.

For a helpful guide on designing a mezzanine floor, click here and discover valuable insights and tips.

Risk and Return Considerations for Investors

In the world of real estate financing, investors have an array of options to choose from. Two popular alternatives to traditional bank loans are mezzanine financing and preferred equity. These alternative funding methods offer unique advantages and disadvantages that can significantly impact an investor’s risk and expected return. In this article, we will provide a comprehensive comparison of mezzanine financing and preferred equity, focusing on the risk and return considerations that investors should keep in mind when evaluating these options.

Mezzanine Financing: A Closer Look

Mezzanine financing is a form of secondary financing that bridges the gap between the project sponsor’s equity investment and the senior debt provided by a traditional lender. It is structured as a loan, typically secured by a lien on the property. The key characteristic of mezzanine financing is that it ranks lower in priority of repayment compared to senior debt but higher than the equity investors in the project.

Pros of Mezzanine Financing:

-

Additional Leverage: Mezzanine financing allows investors to increase their leverage by providing access to additional funds beyond their equity investment. This can potentially amplify the returns on the investment if the project performs well.

-

Fixed Interest Rate: Mezzanine debt accrues interest at a fixed rate, providing investors with predictable returns. This aspect appeals to risk-averse investors who prioritize stability in their investment returns.

-

Lower Risk of Capital Loss: Due to its higher priority of repayment compared to equity investors, mezzanine debt holders have a greater chance of recouping their investment in the event of default or liquidation. This characteristic makes mezzanine financing a relatively safer investment option compared to equity investments.

Cons of Mezzanine Financing:

-

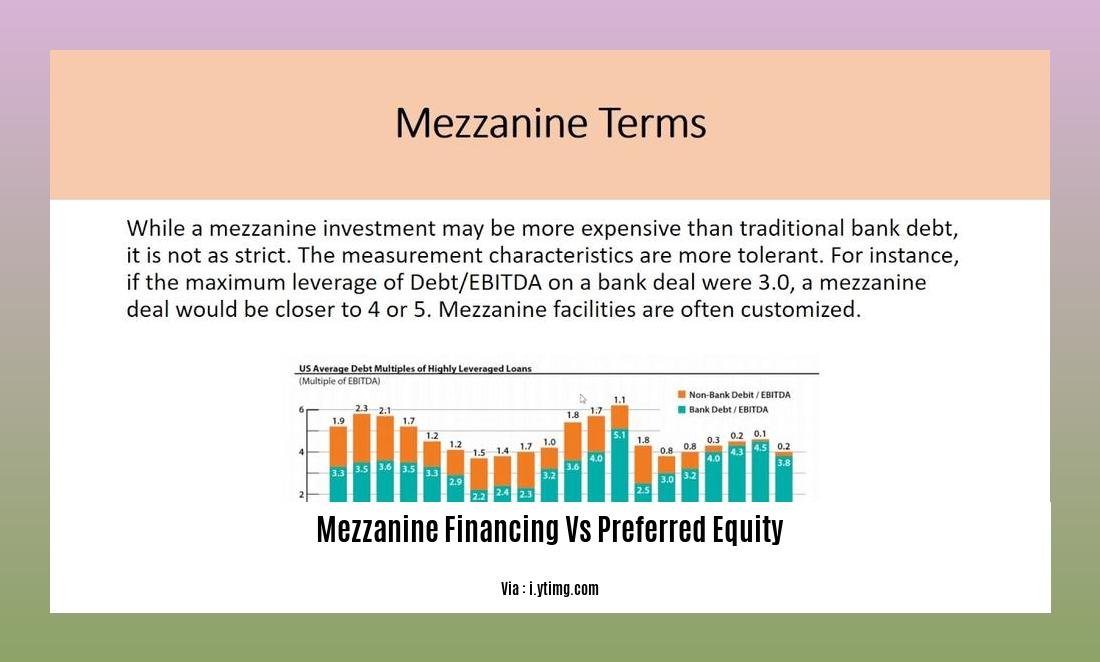

Higher Interest Rate: Mezzanine loans typically come with higher interest rates compared to senior debt. This increased cost of capital can reduce the overall profitability of the project, potentially impacting the investor’s return on investment.

-

Secured by Real Estate: Mezzanine loans are often secured by the underlying real estate, which means that in the event of default, the lender can foreclose on the property. While this provides some level of protection for the investor, the risk of losing the property still exists.

Preferred Equity: An Alternative Perspective

Preferred equity, on the other hand, is structured as an equity investment rather than a loan. It is often used alongside mezzanine financing to provide additional funds for real estate projects. As an equity investment, preferred equity holders have a higher claim on the project’s equity compared to both mezzanine debt and common equity investors.

Pros of Preferred Equity:

-

Higher Potential Returns: Preferred equity holders have the potential to earn higher returns compared to mezzanine debt holders. This is because preferred equity holders receive dividends based on a predetermined rate, allowing them to participate in the project’s cash flow.

-

Flexibility in Cash Flow Distribution: Preferred equity can offer more flexibility in distributing cash flow compared to traditional debt payments. This can be advantageous for investors who want to receive income from the project on an ongoing basis.

-

No Collateral Requirement: Unlike mezzanine loans, preferred equity investments are not secured by any collateral. This means that the investor’s capital is not tied directly to the property, potentially reducing the risk of losing their investment in the event of default.

Cons of Preferred Equity:

-

Lower Priority of Repayment: In the event of default or liquidation, preferred equity holders rank below both senior debt and mezzanine debt holders in the priority of repayment. This means that if the project falters, there is a higher risk of partial or complete loss of the investment.

-

Lower Rate of Return: Preferred equity typically offers a lower rate of return compared to mezzanine debt. This aspect may make it less attractive to investors seeking higher potential rewards.

Key Takeaways:

- Mezzanine financing provides additional leverage and predictable returns through fixed interest rates. It is secured by real estate but comes with a higher interest rate. Mezzanine debt can appeal to risk-averse investors seeking stability and lower risk of capital loss.

- Preferred equity, structured as an equity investment, offers higher potential returns through dividends and flexibility in cash flow distribution. It does not require any collateral but ranks lower in priority of repayment and offers a lower rate of return.

Sources:

1. Mezzanine Debt vs. Preferred Equity – Fundrise

2. Preferred Equity vs Mezzanine Debt: What’s the Difference? – Lev

Key Factors to Consider When Choosing Between Mezzanine Financing and Preferred Equity

When it comes to funding real estate projects, there are two primary options to consider: mezzanine financing and preferred equity. Each option has its own characteristics and considerations that investors must evaluate. In this article, we will delve into the key factors to consider when choosing between these two alternatives.

Recovery Rights and Cash Flow Distribution

One crucial distinction between mezzanine financing and preferred equity lies in their recovery rights and cash flow distribution. Mezzanine debt is structured as a loan to the project and typically has higher priority in terms of repayment. This means that in the event of default or liquidation, mezzanine debt holders have a greater chance of recouping their investment compared to preferred equity investors. Cash flow distribution also follows a similar order, with mezzanine debt holders receiving payments before the preferred equity investors. This priority in recovery and cash flow distribution should be carefully evaluated when selecting a financing option.

Rates and Returns

The rates and returns associated with mezzanine financing and preferred equity are also key considerations. Mezzanine debt often carries a fixed interest rate, providing borrowers with predictable returns. On the other hand, preferred equity returns are typically tied to the performance of the company or project, which can be more uncertain. While rates on preferred equity may be slightly higher than mezzanine debt, these rates serve as compensation for potential increased risk. It is important to assess your risk appetite and your desired level of return when considering these financing options.

Tax Implications and Benefits

Another factor to evaluate when choosing between mezzanine financing and preferred equity is the tax implications and benefits associated with each option. Mezzanine debt usually has a fixed interest rate, providing borrowers with greater certainty in terms of their repayment obligations and tax treatment. However, preferred equity returns are often tied to the performance of the company, potentially offering tax advantages if the company performs well. Understanding the tax implications and benefits of each option is crucial for making informed investment decisions.

Risk and Control

Considering the level of risk and control associated with mezzanine financing and preferred equity is vital. Mezzanine debt carries higher risk compared to preferred equity due to its subordinate nature to senior debt. While mezzanine debt offers potential for higher returns, it also comes with limited control for the borrower. Preferred equity, on the other hand, provides investors with a higher claim on the project’s equity and potential dividends but may come with increased risk. Assessing your risk tolerance and desired level of involvement and control in the project is crucial when making a choice between these two financing options.

Negotiation Terms and Risks

Lastly, when considering mezzanine financing or preferred equity, it is important to carefully evaluate the negotiation terms and potential risks. Understanding the terms of funding, such as prepayment penalties, covenants, and other terms, is essential to make an informed decision. Mezzanine debt and preferred equity also have their own inherent risks, and it is crucial to evaluate these risks carefully. Mezzanine debt is recommended for minimizing risk and ensuring predictable returns, while preferred equity appeals to investors seeking higher potential rewards. Proper due diligence and risk assessment are essential in making the right choice.

In conclusion, understanding the key factors involved in choosing between mezzanine financing and preferred equity is crucial for real estate investors. Recovery rights, rates, cash flow distribution, tax implications, benefits, negotiation terms, risk, and control are all aspects that should be considered. By carefully evaluating these factors and conducting proper due diligence, investors can make informed decisions that align with their risk appetite and investment goals.

Key Takeaways:

– Recovery rights and cash flow distribution differ between mezzanine financing and preferred equity, with mezzanine debt holders having higher priority.

– Rates on preferred equity may be higher, compensating for potential increased risk compared to mezzanine debt.

– Tax implications should be considered, with mezzanine debt providing more certainty and preferred equity potentially offering benefits based on performance.

– Risk and control vary, with mezzanine debt carrying higher risk but less control for the borrower, and preferred equity providing a higher claim on equity.

– Negotiation terms and inherent risks associated with each option should be carefully evaluated before making a decision.

Sources:

1. Smartland – Preferred Equity vs. Mezzanine Debt for Real Estate

2. Debt.to – Mezzanine Debt vs Preferred Equity

Case Studies Illustrating Successful Uses of Mezzanine Financing and Preferred Equity

When it comes to funding real estate projects, two popular options that bridge the funding gap are mezzanine financing and preferred equity. Both methods provide additional leverage for real estate owners to obtain capital from nonbank financial institutions and hedge funds. Understanding the differences and benefits of each option is essential for making informed investment decisions. In this article, we will provide a comprehensive comparison of mezzanine financing and preferred equity, highlighting case studies that illustrate their successful uses.

Mezzanine Financing: The Best of Both Worlds

Mezzanine financing is a form of financing that combines features of both equity and debt. It is structured as a loan secured by a lien on the property, offering a higher priority of repayment in the event of default or liquidation. This characteristic provides mezzanine debt holders with a greater chance of recouping their investment.

One of the key advantages of mezzanine financing is its lower interest rates compared to traditional bank loans. This lower cost of capital allows project investors to maximize profitability and achieve higher returns. Mezzanine financing offers predictability through fixed interest rates, giving investors the peace of mind of knowing their expected returns.

A case study that highlights the successful use of mezzanine financing is a commercial real estate development project. The project required additional capital to complete construction and secure tenants. By utilizing mezzanine financing, the project sponsor was able to obtain the necessary funds and take advantage of lower interest rates, ultimately achieving a profitable return on investment.

Preferred Equity: A Different Approach

Preferred equity, on the other hand, is an alternative financing mechanism that involves an investment in the property-owning entity itself. It is structured as an equity investment rather than a loan. Preferred equity holders have a higher claim on the project’s equity and can potentially earn higher returns through dividends.

While mezzanine financing offers lower interest rates, preferred equity returns are often tied to the performance of the company. This means that if the company performs well, investors in preferred equity can benefit from higher returns. However, the performance of the company can also introduce unpredictability, and the potential rewards come with an increased level of risk.

A case study showcasing the successful use of preferred equity is a real estate development company seeking additional funds to complete a large-scale residential project. By offering preferred equity investments, the company attracted investors who were looking for higher potential rewards. The project was a success, and investors in preferred equity received favorable returns based on the project’s performance.

Key Takeaways:

- Mezzanine financing combines features of both equity and debt, offering lower interest rates and predictable returns.

- Preferred equity involves an investment in the property-owning entity, providing the potential for higher returns but introducing more risk.

- Mezzanine financing is recommended for minimizing risk and ensuring predictable returns, while preferred equity appeals to investors seeking higher potential rewards.

- Successful case studies demonstrate how mezzanine financing and preferred equity have been utilized to secure funding for real estate projects and achieve profitable returns.

(Sources: Andrew Berman, SSRN, Jae-Il Yoo, Eul-Bum Lee, Jin-Woo Choi, MDPI)

FAQ

Q1: What are the key differences between mezzanine financing and preferred equity?

A1: Mezzanine financing is structured as a loan secured by a lien on the property, while preferred equity is an equity investment in the property-owning entity. Mezzanine financing is listed as a loan on the balance sheet, whereas preferred equity is listed as equity. The choice between the two depends on the investor’s priorities, with mezzanine financing offering risk minimization and predictable returns, while preferred equity allows investors to share in the potential upside with more risk tolerance.

Q2: How do mezzanine loans and preferred equity function as secondary financing options for real estate projects?

A2: Mezzanine loans and preferred equity both serve to fill a funding gap in real estate projects. Mezzanine loans are structured as loans and provide additional leverage, while preferred equity is structured as an equity investment and offers additional funds to complete a construction project. Mezzanine loans have higher interest rates, while preferred equity has a lower rate of return. Mezzanine loans are often secured by real estate, whereas preferred equity is not secured by collateral.

Q3: What are the recovery rights and cash flow distribution differences between mezzanine debt and preferred equity?

A3: Mezzanine debt has priority in receiving cash flow, as it is distributed to the mezzanine debt holder first and then to the preferred equity investor. Preferred equity returns are often tied to the performance of the company, which can be more unpredictable compared to the fixed interest rate typically associated with mezzanine debt. This difference in recovery rights and cash flow distribution is important to consider when choosing between the two financing options.

Q4: What are the tax implications and benefits of mezzanine debt and preferred equity?

A4: Mezzanine debt typically has a fixed interest rate, providing more certainty for borrowers in terms of their repayment obligations. Preferred equity returns, on the other hand, are often tied to the company’s performance, which can be advantageous if the company performs well. When making investment decisions, it is important for investors to consider the tax implications and benefits of each option and how they align with their financial goals.

Q5: What are the risks associated with mezzanine financing and preferred equity?

A5: Mezzanine financing carries higher risk compared to preferred equity. Mezzanine debt is subordinate to senior debt, which means it has a lower priority in terms of repayment. While mezzanine debt offers potential for higher returns, it also comes with limited control for the borrower. Preferred equity, on the other hand, involves an equity investment, which can be more volatile and carries its own set of risks. Before deciding between the two financing options, it is essential to carefully evaluate and understand the risks involved.

- How to Remove Water Stains from Fabric: A Complete Guide - April 26, 2025

- How to Get Motor Oil Out of Clothes: Proven Methods & Expert Tips - April 26, 2025

- How to Get Deodorant Out of Black Shirts: Easy Stain Removal Guide - April 26, 2025