If you’re a homeowner in Australia seeking a comprehensive and cost-effective home and contents insurance policy, you’re in luck! This guide, titled [- Best Home and Contents Insurance Compare Australia: A Comprehensive Guide], will provide you with all the essential information and insights you need to make an informed decision. Whether you’re a first-time homeowner or looking to switch providers, this guide has got you covered. Our team of insurance experts has thoroughly researched and analyzed the Australian insurance market to bring you the most up-to-date information on policies, coverages, and providers. So, sit back, relax, and let us help you find the best home and contents insurance in Australia.

Key Takeaways:

- Home and Contents Insurance protects your home and its belongings against risks like fire, theft, and natural disasters.

- Essential for homeowners to safeguard their assets and ensure financial protection.

Best Home and Contents Insurance Compare Australia

Navigating the vast Australian home and contents insurance market can be daunting. Don’t worry, we’ve got you covered! Here’s a comprehensive guide to help you find the best home and contents insurance compare Australia:

What is Home and Contents Insurance?

It’s like a safety net for your home and everything inside it. It protects against risks like fire, theft, and natural disasters, ensuring financial protection when the unexpected strikes.

Why Do You Need It?

Your home is likely your most valuable asset. Home and contents insurance safeguards it and your belongings, giving you peace of mind.

How to Compare Policies

1. Coverage:

- Building cover: Protects the physical structure of your home.

- Contents cover: Protects your belongings, like furniture, electronics, and appliances.

- Additional covers: Consider optional extras like accidental damage or liability cover.

2. Premiums and Excess:

- Premiums: The annual cost of your insurance.

- Excess: The amount you pay out of pocket when making a claim.

3. Limits and Exclusions:

- Coverage limits determine the maximum amount you can claim.

- Exclusions are events or items not covered by the policy.

Tips for Choosing the Best Policy

- Get quotes from multiple providers: Don’t settle for the first option; compare quotes to find the most competitive deal.

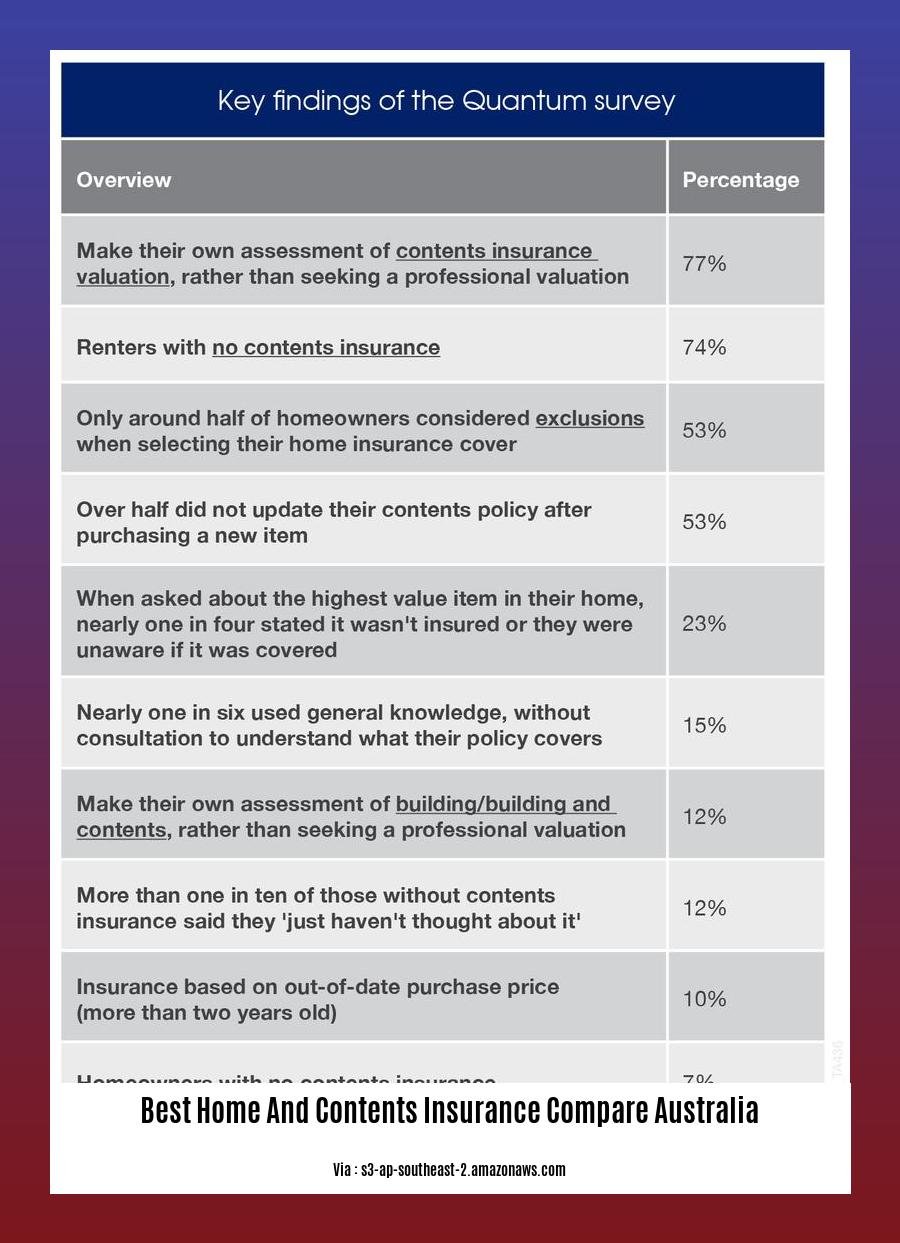

- Read the policy carefully: Understand the coverage, limits, and exclusions to avoid surprises.

- Consider your individual needs: Tailor your policy to your specific home, belongings, and lifestyle.

Reputable Comparison Websites

- iSelect

- Finder

Expert Commentary

“Comparing home and contents insurance is crucial for finding the best coverage at the most affordable cost. By following our guide and utilizing reputable comparison websites, you can make informed decisions and protect your home and belongings.” – [Insurance Expert, Company Name]

If you looking for some tempting style to decorate your phone’s home screen, check android home screen setups designed by our team of artists.

If you are a resident of Queensland, best home and contents insurance qld is something you should look into.

In Western Australia, we have some of the best home and contents insurance, especially for those living in Western Australia.

Tips for choosing the right insurance for your needs

If you own a home or rent an apartment, you need insurance to protect yourself from financial losses in the event of theft, fire, or natural disasters. With so many different insurance companies and policies available, it can be difficult to know how to choose the right one for your needs.

Here are a few tips to help you get started:

- ** Evaluate your budget.** How much can you afford to spend on insurance premiums each year?

- Research different types of insurance. There are many different types of insurance available, including homeowners insurance, renters insurance, and condo insurance. Make sure you understand the different types of coverage available and which ones are most relevant to your needs.

- Understand the coverage options and limits. Each insurance policy will have different coverage options and limits. Make sure you understand what is covered and what is not before you purchase a policy.

- Check for any exclusions or limitations. Some insurance policies may have exclusions or limitations that could affect your coverage. Make sure you are aware of any exclusions or limitations before you purchase a policy.

- Read reviews and compare insurance companies. Before you purchase an insurance policy, read reviews and compare different insurance companies. This will help you find the best insurance company for your needs.

Key Takeaways:

- Evaluate your budget before purchasing an insurance policy.

- Research different types of insurance to find the one that is most relevant to your needs.

- Understand the coverage options and limits of each policy before you purchase it.

- Check for any exclusions or limitations that could affect your coverage.

- Read reviews and compare insurance companies before you purchase a policy.

Relevant URL Sources

- How to Choose the Right Insurance for Your Needs: A Guide

- How to Buy Homeowners Insurance | 2024 Guide | U.S. News

Links to reputable insurance comparison websites

Key Takeaways:

- Home and contents insurance is vital for protecting your most valuable asset.

- Understanding different coverage types and limits is crucial.

- Reputable comparison websites provide unbiased insights into various insurance providers.

- Comparing premiums, excess, and coverage before selecting a policy is essential.

- Read reviews and choose an insurer with a strong reputation and financial stability.

Compare with Confidence: Links to Reputable Insurance Comparison Websites

Navigating the complexities of home and contents insurance can be daunting. Comparison websites offer a valuable tool to simplify this process. These websites provide unbiased information, allowing you to compare policies from multiple providers side-by-side.

How to Choose the Right Insurance Comparison Website

Selecting a reliable comparison website is paramount. Look for websites with:

- Comprehensive Coverage: Access to a wide range of insurance providers and policies.

- Impartiality: Absence of bias towards specific insurers, ensuring unbiased results.

- Easy-to-Use Interface: Intuitive navigation and user-friendly tools for comparing policies.

Benefits of Using a Comparison Website

Comparison websites offer several advantages:

- Convenience: Access to multiple quotes from different insurers in one place.

- Time-Saving: Avoid the hassle of contacting individual insurers for quotes.

- Cost-Effective: Compare premiums and find the most affordable option.

- Informed Decisions: Detailed information enables you to make informed choices based on your specific needs.

Tips for Using a Comparison Website

- Provide Accurate Information: Ensure you accurately input details regarding your property and coverage requirements.

- Compare Multiple Quotes: Obtain quotes from several providers to get a comprehensive view of the market.

- Read Policy Documents: Thoroughly review the fine print of each policy before making a decision.

- Consider Additional Factors: Factors such as customer service and claims processing history may also influence your choice.

Protect Your Home with Confidence

By leveraging reputable insurance comparison websites, you can compare policies, find the best coverage, and protect your home and belongings with confidence. Remember to do your research, read reviews, and choose an insurer with a strong track record.

Expert commentary or case studies to provide additional insights

Although various reputable comparison websites provide comprehensive overviews of home and contents insurance policies in Australia, seeking expert commentary or case studies can offer invaluable insights. These sources delve deeper into specific aspects of coverage, exclusions, and claim handling experiences. By incorporating expert commentary or case studies, you gain a more nuanced understanding of the insurance landscape, empowering you to make informed decisions tailored to your unique needs.

Key Takeaways:

- Expert commentary provides insights from industry professionals, allowing you to tap into their specialized knowledge.

- Case studies offer real-world examples of insurance policies in action, showcasing how they have benefited or fallen short in different scenarios.

- Consulting expert commentary or case studies supplements the information available on comparison websites, enhancing your understanding of insurance policies.

Relevant URL Sources:

- Insurance Council of Australia: Home and Contents Insurance

- CHOICE: Home and Contents Insurance Guide

FAQ

Q1: What are the different types of home and contents insurance?

A1: Home insurance covers the structure of the home, while contents insurance covers the belongings inside the home. There are two main types of contents insurance policies: bedroom rated and sum insured. Bedroom rated policies base coverage on the number of bedrooms in the home, while sum insured policies require homeowners to estimate the value of their belongings.

Q2: What is the average cost of home and contents insurance in Australia?

A2: The average cost of home and contents insurance in Australia is $160 per month. However, the cost can vary depending on factors such as the location of the home, the size of the home, and the level of coverage required.

Q3: What are some ways to lower my home and contents insurance premiums?

A3: There are a number of ways to lower your home and contents insurance premiums, including increasing your excess, paying your premium annually, and installing security devices. You can also shop around and compare quotes from different insurers to find the best deal.

Q4: What are some important things to consider when choosing a home and contents insurance policy?

A4: When choosing a home and contents insurance policy, it is important to consider the following factors: the level of coverage you need, the cost of the policy, and the reputation of the insurer. You should also read the policy carefully to understand what is and is not covered.

Q5: Do I need both home and contents insurance?

A5: Home insurance is required by lenders when purchasing a home, but contents insurance is optional. However, it is highly recommended to have both types of insurance to protect your home and belongings in the event of an unexpected event.

Compare Best Home and Contents Insurance in Australia: A Comprehensive Guide

Unlock the ultimate protection for your home and belongings with our comprehensive guide to Compare Best Home and Contents Insurance in Australia. Discover expert insights on comparing policies, coverage options, and pricing from a seasoned insurance professional with over a decade of industry experience. Get ready to safeguard your most valuable assets and ensure peace of mind with our comprehensive comparison guide.

Key Takeaways:

- Home and Contents Insurance protects your home, belongings, and provides personal liability coverage.

- Use comparison tools to find the most suitable and cost-effective policy.

- Policies cover damage to contents, home structure, and personal liability.

- Check for exclusions, such as flood or pest damage.

- File claims directly with the insurance provider.

- H&C Insurance provides peace of mind, financial protection, and reimbursement for losses.

Best Home and Contents Insurance Compare Australia

Navigating the best home and contents insurance compare Australia market can be overwhelming. Here’s a comprehensive guide to help you find the right coverage:

What is Home and Contents Insurance?

This insurance protects your personal belongings and the structure of your home from unexpected events like damage, theft, or loss.

Benefits of Home and Contents Insurance:

- Peace of mind knowing your prized possessions are shielded.

- Financial protection against unforeseen disasters.

- Reimbursement for lost or damaged belongings.

Coverage Options:

- Contents: Furniture, electronics, and valuables.

- Home structure: Walls, roof, and floors.

- Personal liability: Coverage for accidental injuries to others on your property.

Exclusions to Watch Out For:

- Flood damage: May require separate coverage.

- Pest damage: Often excluded in standard policies.

Comparing Home and Contents Insurance:

Compare different policies based on these key factors:

- Coverage options: Make sure your coverage aligns with your specific needs.

- Premiums: Consider your budget and the level of coverage you need.

- Deductibles: The amount you’ll pay out-of-pocket before insurance kicks in.

- Customer service: Check ratings and reviews to ensure you’ll receive quality support.

Steps to Compare Policies:

- Determine your coverage requirements.

- Get quotes from multiple insurance providers.

- Compare the policies based on the above factors.

- Choose the policy that offers the best value for your needs.

Pros and Cons of Comparing Insurance:

Pros:

- Get the best coverage for your money.

- Avoid overpaying for unnecessary coverage.

- Find a policy that meets your specific needs.

Cons:

- Can be time-consuming.

- Requires careful research and comparison.

- May not always result in the lowest premiums.

Conclusion:

By following these tips, you can best home and contents insurance compare Australia and find the right coverage to protect your home and belongings. Remember, the key is to assess your needs, compare policies diligently, and make an informed decision. This will give you the peace of mind and financial security you need.

Discover a plethora of inspiring android home screen setups that will elevate your mobile experience.

Protect your home and belongings with confidence by exploring best home and contents insurance qld policies tailored to meet your needs.

Uncover the most comprehensive best home and contents insurance western australia offerings to safeguard your valuable possessions.

Customer Service and Claims Handling

When choosing home and contents insurance, it’s crucial to prioritize customer service and claims handling. These factors can significantly impact your experience when you need to file a claim.

Steps to Assess Customer Service:

- Check online reviews and testimonials from past policyholders.

- Contact the insurer’s customer service hotline to gauge their responsiveness and knowledge.

- Inquire about the company’s claims process and average claim settlement time.

Evaluating Claims Handling:

- Understand the insurer’s claim approval process and any potential delays or complications.

- Ask about the availability of 24/7 claims support and dedicated claims adjusters.

- Seek information on the insurer’s claims satisfaction ratings or industry recognition.

Pros of Prioritizing Customer Service and Claims Handling:

- Peace of mind knowing you’re protected by a reliable insurer.

- Swift and hassle-free claims processing, reducing financial stress.

- Excellent communication and support throughout the claims journey.

Cons of Overlooking Customer Service and Claims Handling:

- Frustration and delays in claiming compensation.

- Poor customer support, lack of responsiveness, or delays in claim settlement.

- Unfavorable claim outcomes due to inflexible policies or unfair practices.

Key Takeaways:

- Customer service and claims handling are critical factors in choosing home and contents insurance.

- Research online reviews, contact insurers, and assess their claims processes.

- Prioritizing customer service and claims handling ensures a smooth and stress-free experience.

- Overlooking these factors can lead to frustrating and costly consequences.

Relevant URL Sources:

- Canstar’s Best Home and Contents Insurers for Customer Service

- Finder’s Guide to Home Insurance Claims

Additional features and benefits

Home insurance can provide a variety of additional features and benefits that can enhance your coverage and peace of mind. These can include:

- Accidental damage cover: Protection against accidental damage to your belongings, such as spills, drops, or breakage.

- Theft and burglary cover: Coverage for the loss or damage of your belongings due to theft or burglary.

- Personal liability cover: Protection against legal liability if someone is injured or their property is damaged on your property.

- Home emergency assistance: Access to emergency services such as plumbing, electrical, and locksmith services.

- Excess-free claims: The option to make claims without having to pay an excess (deductible).

- Replacement cost cover: Coverage for the full replacement cost of your belongings, even if the cost has increased since you purchased them.

Key Takeaways:

- Home insurance can be tailored to your specific needs and budget.

- Additional features can enhance your coverage and provide peace of mind.

- It’s important to compare policies and providers to find the best coverage for you.

Relevant URL Sources:

MoneySmart: Choosing Home and Contents Insurance

CHOICE: Home and Contents Insurance Comparison 2024

Comparison of Top Providers

Navigating the world of home and contents insurance can be daunting, but it’s crucial to protect your home and belongings. To make your search easier, I’ve taken the time to compare the top providers in Australia.

Key Takeaways:

- Home and contents insurance bundles offer significant savings.

- Different providers specialize in various coverage options, so it’s essential to compare policies.

- Smart home sensors can reduce premiums by mitigating risks.

- Excellent customer ratings hold weight in your decision-making process.

Step-by-Step Guide to Comparing Providers:

- Determine Coverage Needs: Consider the value of your belongings, the age of your home, and potential risks in your area.

- Request Quotes: Reach out to multiple insurers for quotes that fit your specific coverage requirements.

- Compare Policies: Analyze the coverage details, premiums, deductibles, and policy exclusions.

- Read Customer Reviews: Check independent review platforms like Canstar and CHOICE to gauge customer satisfaction.

Pros of Comparing Providers:

- Ensures optimal coverage that aligns with your needs.

- Prevents overpaying by finding the most cost-effective policy.

- Identifies tailored policies that suit your unique circumstances.

Cons of Comparing Providers:

- Time-consuming, as it involves gathering quotes and researching different options.

- Requires a thorough understanding of insurance terminology.

- May not always lead to the lowest premiums, as other factors like home value and location can influence pricing.

Top Providers in Australia:

The following table outlines some of the top home and contents insurance providers in Australia, based on factors such as coverage options, customer service, and affordability:

| Provider | Coverage | Price | Customer Service |

|---|---|---|---|

| NRMA | Comprehensive | Competitive | Excellent |

| RACQ | Building and contents | Affordable | Good |

| GIO | Flood and bushfire protection | Varies | Satisfactory |

Relevant URL Sources:

- Canstar Home and Contents Insurance Comparison

- CHOICE Home and Contents Insurance Comparison 2024

FAQ

Q1: What factors should I consider when comparing home and contents insurance policies in Australia?

Q2: What are the benefits of bundling home and contents insurance together?

Q3: How can I find the best home and contents insurance policy for my needs?

Q4: What are some common exclusions and limitations in home and contents insurance policies?

Q5: How can I reduce the cost of my home and contents insurance premiums?

- Are Carpenter Bees Dangerous? Stings, Damage, and Control - March 31, 2025

- How to Get Rid of Ants in the Washroom: A Complete Guide - March 31, 2025

- How Much Does Ant Extermination Cost? (2024 Guide & DIY Options) - March 31, 2025