Are you embarking on the exciting journey of homeownership, but feeling overwhelmed by the complexities of home loans and interest rates? Unlock the door to understanding and making informed decisions with “[1. Home Loan Interest Calculator: A Comprehensive Guide to Understanding and Using It]”. Discover how this powerful tool empowers you to evaluate loan terms, dissect monthly payments, and navigate interest rate scenarios. Delve into the factors influencing your home loan interest rate, demystify the complexities of interest calculations, and gain invaluable insights to choose the mortgage option that best suits your financial aspirations.

Key Takeaways:

- Loan EMI Calculator:

- Calculate your EMI by inputting loan amount, tenure, and interest rate.

- A longer tenure can enhance eligibility.

-

Accurate EMI calculation aids in financial planning.

-

HDFC Bank Home Loans:

- Loans available for diverse housing options, including flats, row houses, and bungalows.

- Pre-approved loans for hassle-free processing.

-

Flexible repayment plans to meet various needs and enhance eligibility.

-

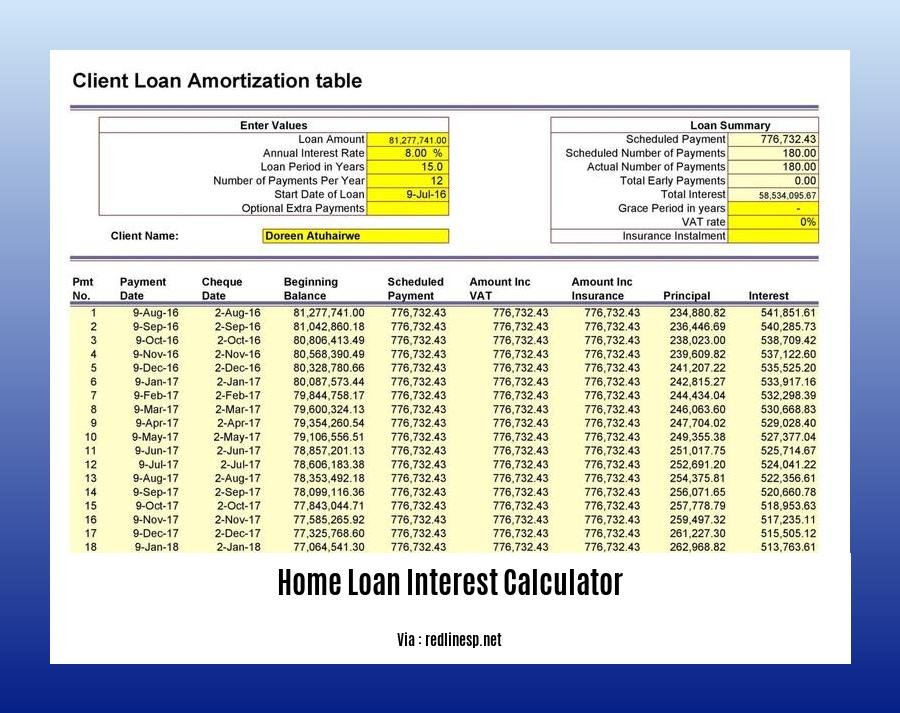

Loan Amortization Schedule:

- Regular payments over the loan period reduce debt.

-

Amortization schedule provides details of each payment, including interest and principal.

-

Repayment Plan Options:

- Step-Up Repayment Facility (SURF): Gradually increase EMI payments over time.

- Flexible Advance Payment Option (FAPO): Prepay loan at any time without penalty.

-

Balance Transfer Facility: Transfer loan balance from another bank at a lower interest rate.

-

Pre-Approved Home Loans:

- HDFC Bank provides pre-approved loans, granting in-principle approval before property selection.

- This expedites the loan process, saving time.

Home Loan Interest Calculator

In the financial maze of homeownership, navigating through mortgage options can be daunting. That’s where a home loan interest calculator emerges as your trusty guide, helping you make informed decisions about your future abode. Let’s dive into its significance and how you can harness its potential.

Deciphering Home Loan Interest Calculators

A home loan interest calculator is your financial compass, providing a clear picture of the interest you’ll pay over your loan tenure. It works by crunching numbers like loan amount, interest rate, and loan term to project your monthly installments and total interest payable.

Unveiling the Secrets of Interest Rates

Interest rates, the cornerstone of home loan calculations, are influenced by various factors:

- Credit Score: A glowing credit score opens doors to favorable interest rates, while a blemished score may attract higher rates.

- Loan Amount: Generally, larger loans command higher interest rates compared to smaller ones.

- Loan Term: Opting for a shorter loan term usually means lower interest rates, while longer terms often come with slightly higher rates.

Harnessing the Power of Home Loan Interest Calculators

-

Loan Comparison: Pit different loan offers against each other to identify the one that suits your financial landscape best.

-

Budget Planning: Gauge your monthly payments and project your total interest burden, ensuring your financial stability.

-

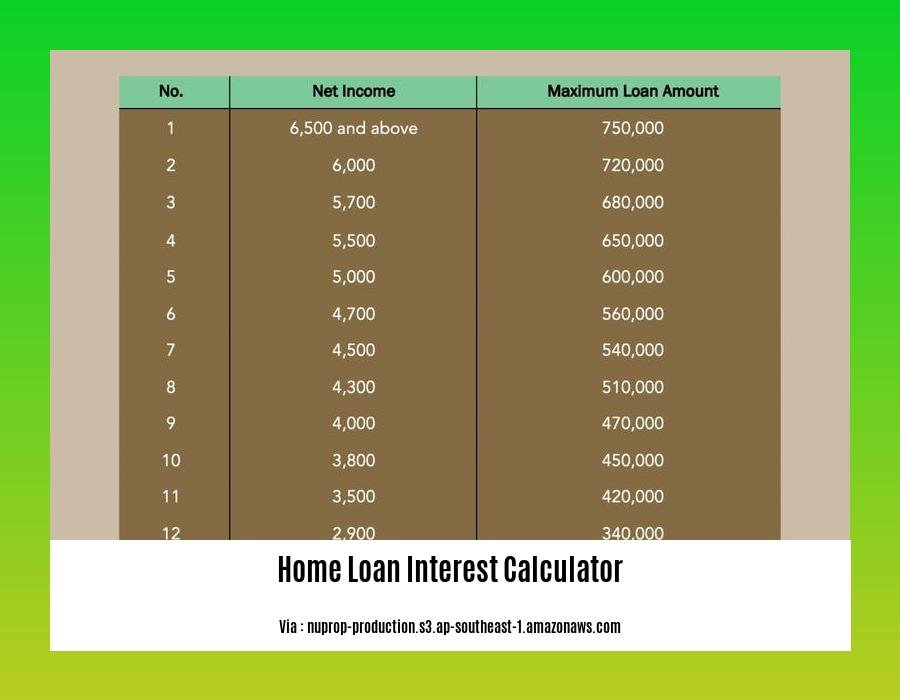

Affordability Assessment: Determine the maximum loan amount you can comfortably handle based on your income and expenses.

-

Prepayment Strategies: Explore scenarios where prepaying your loan can save you money in interest.

- Loan Restructuring: Evaluate the impact of refinancing or restructuring your loan to potentially secure better terms.

Conclusion

A home loan interest calculator is an indispensable tool for homebuyers, providing clarity and control over their financial journey. Empower yourself with this knowledge and make confident decisions towards your dream home.

-

For the lowest mortgage rates in Singapore, browse through our list of bank and HDB home loan interest rates.

-

Consult our curated selection of home loan private finance companies to find the best rates and terms for your mortgage.

-

Visualize the entire process with our comprehensive home loan process flow chart, ensuring you navigate the steps smoothly.

-

Discover the details of home loans, including eligibility criteria, interest rates, and application procedures, to make an informed decision.

How home loan interest calculators work

When purchasing a home, understanding the interest you’ll pay on your mortgage is crucial. A home loan interest calculator is a valuable tool that can help you estimate these costs and make informed decisions about your mortgage options.

Understanding the components of a mortgage payment is the first step in grasping how home loan interest calculators work. Your monthly mortgage payment consists of three main parts:

- Principal: The amount of money you borrowed that you are repaying with each payment

- Interest: The fee you pay the lender for borrowing the money

- Taxes and insurance: Depending on your mortgage terms, you may also have to pay property taxes and homeowners insurance as part of your monthly payment.

Here’s a step-by-step guide on how home loan interest calculators work:

- Provide loan details:

-

Specify the loan amount, interest rate, and loan term. Some calculators may also ask for additional details like property value and down payment.

-

Input payment frequency:

-

Select whether you’ll be making monthly, semi-monthly, or weekly payments.

-

Calculate your monthly payment:

-

The calculator uses these details to determine your estimated monthly payment. This includes the principal, interest, and any taxes and insurance.

-

Explore different scenarios:

-

Adjust the loan details and observe how it impacts your monthly payment. This helps you compare various offers and choose the best one.

-

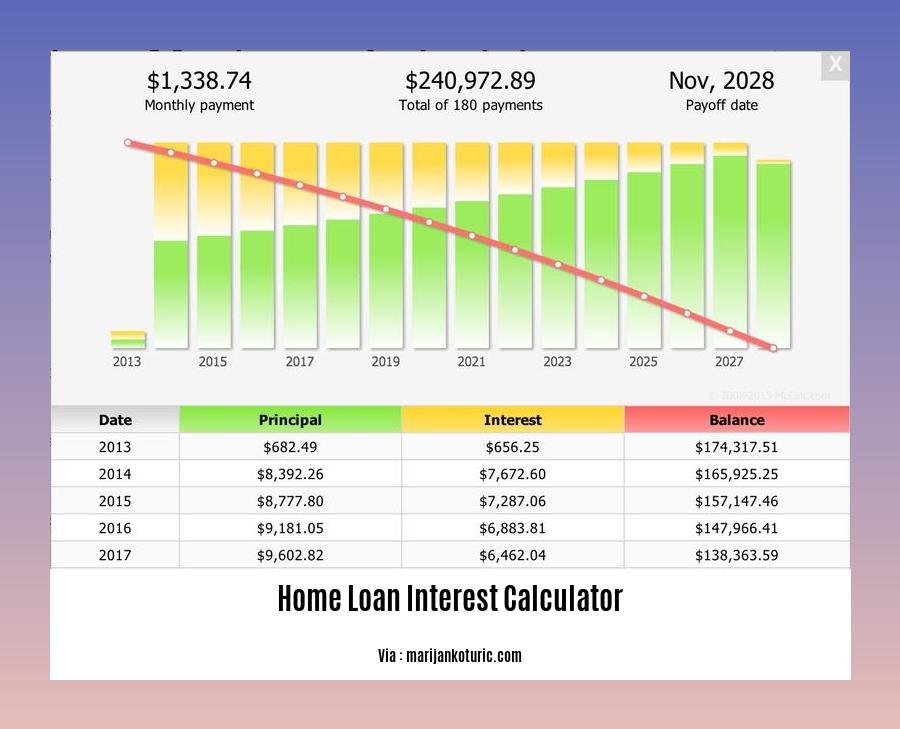

Project total interest and repayment timeline:

- Some calculators provide projections of the total interest you’ll pay over the loan term and a detailed repayment schedule.

Key Takeaways:

- Home loan interest calculators estimate your monthly mortgage payments and total interest paid over the loan term.

- Factors considered include the loan amount, interest rate, loan term, taxes, and insurance.

- Experiment with different loan scenarios to see how they affect your monthly payments and total interest.

- Utilize home loan interest calculators to compare multiple loan offers and make informed decisions about your mortgage.

Sources:

1. Rocket Mortgage: How Do Mortgage Calculators Work?

2. NerdWallet: How Do Mortgage Calculators Work?

Understanding more about how interest is calculated on a home loan

Navigating the complexities of homeownership is a significant endeavor, and it all starts with understanding how interest is calculated on a home loan, which we’ll break down in this guide.

Key Takeaways:

-

Loan Amount & Term: The loan amount and loan term (duration of your mortgage) directly influence the interest paid over the loan’s life.

-

Interest Rate Impact: The interest rate, usually expressed as an annual percentage, determines how much you’ll pay in interest over the loan term.

-

Simple Interest vs. Compound Interest: Interest is either simple (charged only on the principal loan amount) or compound (charged on both the principal and accumulated interest), with the latter being more common in home loans.

-

Factors Affecting Interest: Your credit score, loan-to-value (LTV) ratio, property location, and other variables can influence the interest rate offered.

-

Monthly Payment Components: Your monthly mortgage payments consist of principal (loan amount), interest, taxes, and insurance (known as PITI).

-

Calculating Monthly Payments: Use an online home loan interest calculator or consult a mortgage lender to estimate your monthly payments based on loan details.

How are Interest Rates Determined?

Your credit score is a key factor in determining the interest rate; a higher score typically leads to better rates. Your debt-to-income (DTI) ratio, which compares your monthly debt payments to your income, also plays a role. A lower DTI generally indicates a lower risk to lenders and may lead to a better rate.

Using a Home Loan Interest Calculator

Home loan interest calculators are powerful tools that help you visualize the impact of different loan scenarios on your monthly payments and overall interest costs. Input details like the loan amount, interest rate, loan term, and property taxes to get an estimated monthly payment and total interest paid over the loan’s life. Experiment with different scenarios to find the best loan options for your situation.

Make Informed Decisions with a Home Loan Interest Calculator

Armed with a home loan interest calculator, you can make informed decisions about your mortgage. Compare loan offers from different lenders, experiment with loan terms and interest rates, and plan for additional expenses like closing costs and property taxes. By understanding how interest is calculated, you’re empowered to make choices that align with your financial goals and secure a loan that fits your budget.

Sources:

- Bankrate: How Are Mortgage Rates Determined?

- Forbes: How To Use A Mortgage Calculator To Find The Best Home Loan

FAQ

Q1: How can a home loan interest calculator help me make informed decisions about home loans?

A1: A home loan interest calculator can help you make informed decisions about home loans by allowing you to compare different loan options and understand the impact of different interest rates on your monthly payments and total interest costs. This information can help you choose the loan that best meets your financial needs and goals.

Q2: What factors affect the interest rate on a home loan?

A2: Several factors affect the interest rate on a home loan, including your credit score, debt-to-income ratio, loan-to-value ratio, and the type of loan you choose. Lenders use these factors to assess the risk of lending you money, and borrowers with higher credit scores and lower debt-to-income ratios typically qualify for lower interest rates.

Q3: How do home loan interest calculators work?

A3: Home loan interest calculators use a formula to calculate the monthly interest payment and the total interest paid over the life of the loan. The formula takes into account the loan amount, interest rate, and loan term. Some calculators also allow you to factor in additional variables, such as points and fees.

Q4: How is interest calculated on a home loan?

A4: Interest on a home loan is typically calculated daily and charged monthly. The outstanding loan amount at the end of each business day is multiplied by the interest rate, and the result is divided by 365 (or 366 in a leap year) to get the daily interest. Monthly interest is the sum of the daily interest charges over the month.

Q5: What are some tips for getting a lower interest rate on a home loan?

A5: There are several things you can do to try to get a lower interest rate on a home loan, including improving your credit score, reducing your debt-to-income ratio, making a larger down payment, and shopping around for the best interest rate. You may also be able to get a lower interest rate by choosing a shorter loan term or opting for a government-backed loan, such as an FHA or VA loan.

- Gray Kitchen Backsplash Tile: Ideas for a Stylish Upgrade - December 14, 2025

- Backsplash For Gray Cabinets: Choosing the Right Backsplash Style - December 13, 2025

- Gray And White Backsplash: Ideas For Timeless Style - December 12, 2025