Embark on a comprehensive journey through the intricacies of home loan interest rates in Singapore with our in-depth guide, [- Home Loan Interest Rate in Singapore: A Comprehensive Guide for Informed Decisions]. We delve into the intricacies of interest rate trends, unravel the impact of government policies, and navigate the ever-shifting landscape of the housing market. Our expert insights will empower you with the knowledge to make informed decisions, navigate the complexities of the mortgage process, and secure the best possible home loan terms.

Key Takeaways:

- Singapore’s major banks increased fixed home loan interest rates in November 2022.

- As of January 8th, 2024, the interest rates for a 30-year fixed home loan for private properties and HDB’s are at 2.95%.

- MortgageWise.sg offers home loans from major lenders in Singapore.

- Foreigners can apply for bank loans for private properties, but not for HDB loans.

- SORA replaced SIBOR and SOR as the benchmark SGD interest rate for floating rate home loans.

References:

1. CNA Explains: As fixed home loan interest rates rise, should you take floating instead?

2. Best Home Loan Deals Singapore (2024) ᐈ Compare Rates – ROSHI]

Home Loan Interest Rate in Singapore: Navigating Borrowing Costs

Navigating the complexities of home loan interest rates in Singapore can be a daunting task for prospective homeowners and investors alike. Interest rates play a pivotal role in determining the overall cost of your home loan, significantly impacting your monthly mortgage payments and long-term financial obligations. This comprehensive guide delves into the intricacies of home loan interest rates in Singapore, empowering you with the knowledge to make informed decisions and secure the best possible rate for your home financing needs.

Understanding Home Loan Interest Rates

Home loan interest rates are the fees charged by financial institutions for borrowing money to purchase a property. These rates vary depending on several factors, including the prevailing economic conditions, the type of loan, and the creditworthiness of the borrower. In Singapore, home loans are typically offered with either fixed or floating interest rates.

Types of Home Loan Interest Rates in Singapore:

-

Fixed Home Loan Interest Rates: Under this arrangement, the interest rate remains constant throughout the loan tenure. This provides stability and predictability in your monthly mortgage payments, shielding you from potential fluctuations in the market.

-

Floating Home Loan Interest Rates: With floating rates, the interest rate is subject to change during the loan period. These rates are usually pegged to a benchmark rate, such as the Singapore Overnight Rate Average (SORA), and can fluctuate based on prevailing economic conditions.

Home Loan Interest Rate Trends in Singapore:

Over the years, home loan interest rates in Singapore have experienced fluctuations influenced by various internal and external factors. Economic growth, inflation, monetary policies, and global financial markets all play a role in shaping the interest rate landscape. It’s important to stay informed about these trends to make strategic borrowing decisions.

Factors Affecting Home Loan Interest Rates

Several factors can influence home loan interest rates in Singapore:

-

General Economic Conditions: Strong economic growth and a stable financial system usually lead to lower interest rates. Economic downturns, on the other hand, can push rates higher.

-

Government Policies: Monetary policies implemented by the Monetary Authority of Singapore (MAS) can impact interest rates. The MAS uses various tools to manage inflation and maintain economic stability, which can indirectly affect home loan interest rates.

-

Demand and Supply: The balance between the demand for home loans and the supply of funds available from financial institutions can influence interest rates.

-

Creditworthiness: Your credit score, income stability, and debt-to-income ratio are all factors that lenders consider when determining your interest rate. A higher credit score and a lower debt-to-income ratio typically lead to lower interest rates.

Choosing the Right Home Loan Interest Rate for You

Selecting the appropriate home loan interest rate is a crucial decision that can have a lasting impact on your finances. Here are some tips to help you choose the best rate:

-

Compare Rates from Multiple Lenders: Don’t settle for the first rate offered to you. Shop around and compare interest rates from several lenders to ensure you’re getting the most competitive deal.

-

Consider Your Financial Situation: Evaluate your current income, expenses, and long-term financial goals when choosing between a fixed or floating interest rate. Consider your risk tolerance and ability to handle potential fluctuations in your monthly payments.

-

Consult a Mortgage Advisor: If you’re unsure about which interest rate option is best for you, consult a qualified mortgage advisor. They can provide personalized advice based on your unique financial circumstances.

Securing a Lower Home Loan Interest Rate:

There are several steps you can take to increase your chances of securing a lower home loan interest rate in Singapore:

-

Improve Your Credit Score: Work on improving your credit score by paying your bills on time, reducing your debt, and maintaining a healthy credit utilization ratio.

-

Increase Your Down Payment: A larger down payment can reduce the amount you need to borrow, making you a less risky borrower in the eyes of lenders.

-

Choose a Shorter Loan Tenure: Opting for a shorter loan tenure can lower your overall interest payments, even if the monthly installments may be higher.

Conclusion:

Securing a home loan is a significant financial commitment, and understanding the home loan interest rate in Singapore is paramount for making an informed decision. By staying updated on interest rate trends, understanding the factors that influence rates, and exploring strategies for securing a favorable rate, you can optimize your home financing experience and position yourself for financial success.

Do you want to estimate payments up front? Find out how much interest you need to pay for a home loan with our home loan interest calculator.

Planning to apply for a home loan? Connect with a home loan private finance company and make your dream come true.

Confused about the home loan process? No worries! This home loan process flow chart will help clear out your doubts.

Home loans are a big financial decision. Make sure you know the details before you commit. Learn more about home loans here.

Factors affecting home loan interest rates

Navigating the ins and outs of home loan interest rates in Singapore can feel like walking a financial tightrope. With rates pegged to global giants like SIBOR and SORA, it’s a wild ride influenced by the world’s economic heartbeat.

Key Takeaways:

- Singapore’s home loan interest rates are influenced by global economic conditions and government policies.

- Homeowners with existing loans consider fixed interest plans to shield themselves from rising rates.

- Borrowers can secure lower interest rates by comparing multiple lenders, consulting mortgage advisors, and improving credit scores.

- Larger down payments and shorter loan tenures contribute to lower overall interest payments.

How do interest rates in Singapore work?

Picture this: SIBOR and SORA, the titans of Singapore’s interest rate world, keep a close eye on the global economic climate. When the world sneezes, they catch a cold, and the changes in their rates ripple through Singapore’s home loan interest rates. It’s a game of tag with international economies setting the pace.

What factors affect home loan interest rates?

1. Global Economic Conditions:

Just like the weather, economic conditions can be unpredictable. When the global economy catches a cold, interest rates tend to rise. When it thrives, rates might just take a dip. It’s all interconnected, so keep your eye on the global economic forecast.

2. Government Policies:

Governments, like master puppeteers, wield their power over interest rates through policies. They pull the strings, influencing rates to control inflation, stimulate economic growth, and keep the housing market dancing to their tune.

3. Demand and Supply:

Imagine a tug-of-war between supply and demand. When demand for home loans skyrockets, so do interest rates. Why? Because banks see everyone raising their hands, eager to borrow. But when supply outshines demand, rates might just take a breather.

4. Borrower’s Creditworthiness:

Your credit score, a numerical reflection of your financial history, plays a starring role in determining your interest rates. A stellar score can get you a round of applause from banks, leading to lower rates. A less-than-stellar score might raise a few eyebrows and push rates a tad higher. Fair warning: payment history, credit utilization, and credit inquiries all play a part in this game.

How can I get a lower interest rate?

1. Shop Around:

Don’t be a one-track-minded home loan hunter. Cast a wide net, compare interest rates from different banks, and see who’s offering you the best deal. You might just bag a lower rate by simply shopping around.

2. Consult a Mortgage Advisor:

Mortgage advisors are like your financial wingmen, guiding you through the maze of home loan options and helping you find a rate that fits your budget like a glove. They’re worth their weight in gold.

3. Improve Your Credit Score:

Your credit score has the power to charm banks. Show them a high score, and they might just reward you with a lower interest rate. It’s like building a friendship—the better your score, the stronger the bond with the banks. Pay bills on time, keep your debts in check, and avoid excessive credit inquiries.

4. Make a Larger Down Payment:

Think of a down payment as a down-to-earth way to show banks you’re serious about your home loan commitment. A larger down payment signals your financial stability and can nudge banks to offer you a lower interest rate.

5. Opt for a Shorter Loan Tenure:

Just like a shorter journey means less travel time, a shorter loan tenure means paying off your loan sooner. Banks see this as a sign of financial prowess and might just reward you with a lower interest rate.

Remember, buying a home is a marathon, not a sprint. Take your time, crunch the numbers, compare rates, and make informed decisions. The right home loan interest rate is out there, waiting for you to find it.

[

[

Comparing Home Loan Interest Rates

Before embarking on your homeownership journey, understanding home loan interest rates is crucial. By comparing interest rates and selecting wisely, you can potentially save thousands of dollars over the lifetime of your loan.

Key Takeaways:

-

Shop Around: Don’t settle for the first interest rate you’re offered. Compare rates from multiple banks and financial institutions to find the best deal.

-

Fixed or Floating: Decide between a fixed interest rate, which offers consistent monthly payments, or a floating rate, which may fluctuate based on market conditions.

-

Consider Your Options: Explore various home loan types, such as HDB loans, bank loans, and SIBOR-pegged loans, to find one that aligns with your financial goals.

-

Know the Fees: In addition to interest rates, be aware of other associated costs, such as processing fees, valuation fees, and legal fees, which can impact your overall loan expenses.

-

Negotiate: Don’t hesitate to negotiate for a lower interest rate. Building a strong relationship with your lender and demonstrating good credit history can improve your chances of securing a more favorable rate.

Breaking Down Home Loan Interest Rates:

-

Fixed Rates: With a fixed interest rate, your monthly payments remain constant throughout the loan tenure, providing stability and predictability.

-

Floating Rates: Floating interest rates are subject to change during the loan period, usually pegged to benchmark rates like SORA. This can result in fluctuating monthly payments, potentially higher or lower depending on market conditions.

Home Loan Rates in Singapore:

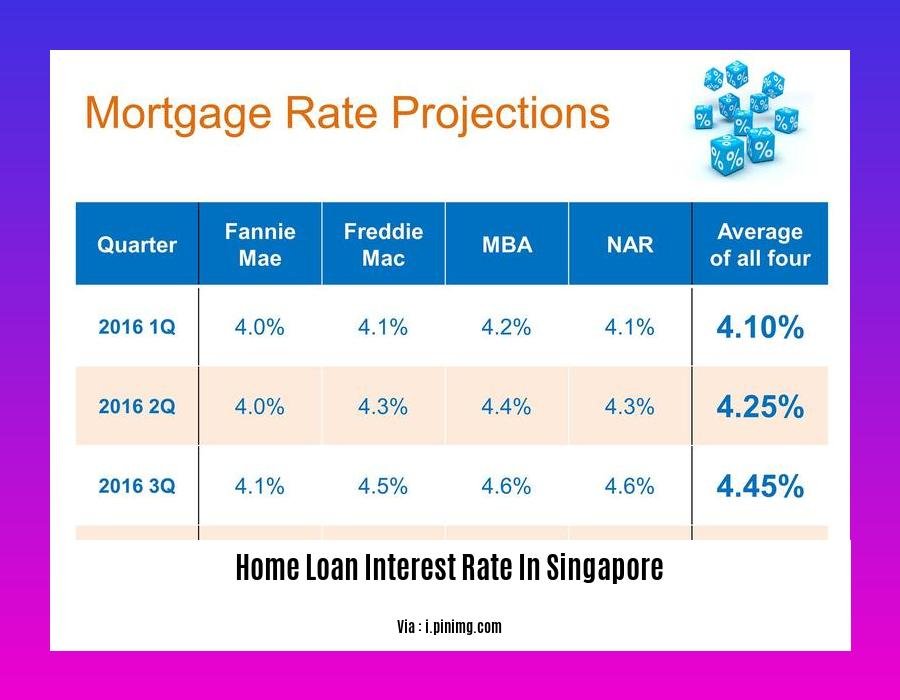

- As of January 2023:

- Private Properties: 2.9%

-

HDB Flats: 2.9%

-

Types of Home Loans:

- HDB Loans: Pegged to CPF Ordinary Account (OA) interest rate, currently at 2.5%.

- Bank Loans: Offer various interest rate options, including fixed, floating, and SIBOR-pegged rates.

Impact of Rising Interest Rates:

-

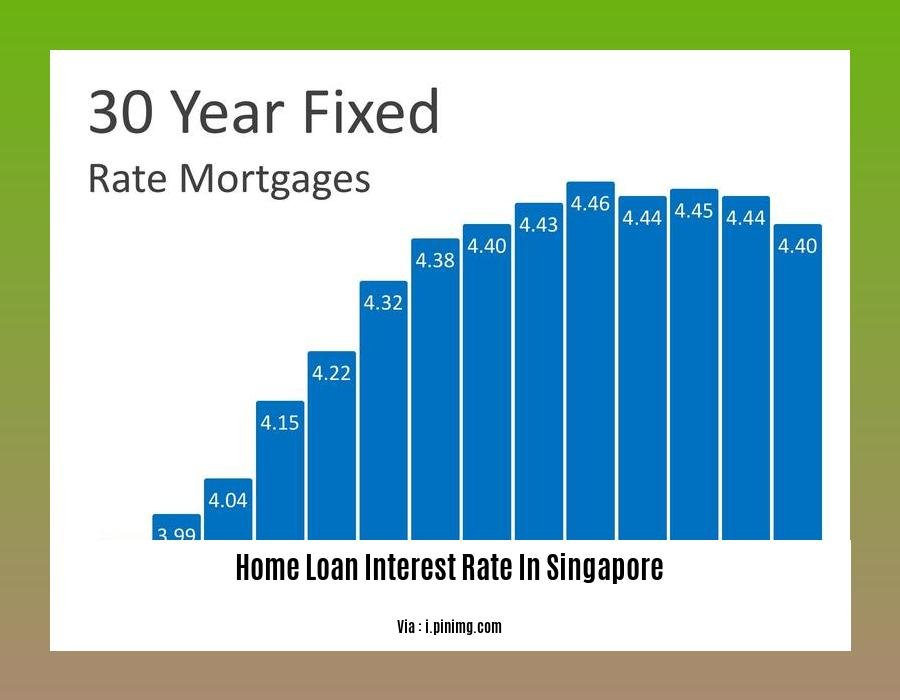

Recent Trend: Due to global economic conditions, interest rates in Singapore have been on an upward trend.

-

Fixed Rates: Fixed interest rates have climbed to around 4.5% due to the US Federal Reserve’s rate hikes and the subsequent adjustments by local banks.

-

Considerations for Existing Homeowners: Existing homeowners may consider refinancing to a fixed interest plan to mitigate the effects of rising rates.

Key Factors:

-

Economic Conditions: Interest rates can be influenced by economic factors, such as inflation, growth, and unemployment levels.

-

Government Policies: Government policies, such as quantitative easing or tightening, can impact interest rates.

-

Demand and Supply: The demand for and supply of loanable funds in the market can affect interest rates.

-

Borrower’s Creditworthiness: A borrower with a strong credit history and a high credit score may qualify for lower interest rates.

Conclusion:

Comparing home loan interest rates is a crucial step in finding the best deal for your home financing needs. By being informed, comparing rates, and considering your options carefully, you can make an informed decision that can save you money and set you up for financial success in your homeownership journey.

Citations:

Best Home Loan Interest Rates in Singapore

Best Home Loans in Singapore: Calculate & Get Better Rates

Tips for Getting a Lower Interest Rate

In Singapore, home loan interest rates are rising, making it crucial for potential homeowners to explore strategies for securing a lower rate. Here are some practical tips to help you save money on your home loan:

Comprehend and Compare Interest Rate Options:

Understanding the various interest rate types, such as fixed and floating rates, is crucial. Compare rates offered by different banks and financial institutions to find the most favorable option for your situation. Online comparison tools can simplify this process.

Improve Your Credit Score:

Lenders consider your credit score when determining your interest rate. Maintaining a high credit score by paying bills on time, managing debt effectively, and keeping your credit utilization low can increase your chances of getting a lower rate.

Consider a Larger Down Payment:

Making a larger down payment reduces the loan amount you need to borrow, which can result in a lower interest rate. If possible, save up for a larger down payment to improve your loan terms.

Explore Refinancing Options:

If you have an existing home loan, refinancing to a lower interest rate can save you money. However, refinancing may involve fees, so carefully evaluate if the potential savings outweigh the costs.

Consult a Mortgage Professional:

Working with an experienced mortgage consultant can provide invaluable guidance. They can assess your financial situation, help you compare loan options, and negotiate with lenders on your behalf, potentially securing a lower interest rate.

Key Takeaways:

- Compare interest rates from various banks and lenders to find the most favorable option.

- Maintain a high credit score to increase your chances of getting a lower rate.

- Consider making a larger down payment to reduce the loan amount.

- Explore refinancing options if you have an existing home loan.

- Consult a mortgage consultant for expert guidance and negotiation assistance.

Sources:

Best Home Loans in Singapore: Calculate & Get Better Rates

Home Loan Interest Rates in Singapore 2023: A Comprehensive Guide

FAQ

Q1: What is the current prevailing interest rate for a 30-year fixed home loan in Singapore?

A1: As of January 8th, 2024, the prevailing interest rate for a 30-year fixed home loan is 2.95% for private properties and 2.95% for HDB’s, making it a good time for prospective homeowners to secure a loan.

Q2: What is the impact of rising interest rates on existing homeowners servicing home loans?

A2: Rising interest rates can lead to higher monthly loan installments and increased total interest paid over the loan tenure. To manage this, homeowners can consider refinancing their mortgage, making additional payments, reducing their loan tenure, or exploring fixed-rate mortgages.

Q3: What options do homeowners have to manage rising interest rates on their home loans?

A3: Homeowners can consider negotiating with their lender for a lower interest rate, making additional payments to reduce the outstanding loan amount, shortening the loan tenure to reduce total interest paid, or switching to a fixed-rate mortgage for protection against rising rates.

Q4: How can first-time homebuyers secure a favorable home loan interest rate?

A4: First-time homebuyers can compare interest rates from different banks and financial institutions using online comparison tools, take advantage of special promotions and discounts offered by some banks, and work with a trusted mortgage consultant to assess their financial situation and explore options for securing a favorable interest rate.

Q5: What is the difference between fixed and floating interest rates for home loans?

A5: Fixed interest rates remain constant throughout the loan tenure, providing stability and predictability in monthly installments. Floating interest rates, on the other hand, are linked to a benchmark rate and can fluctuate over time, potentially leading to variations in monthly installments.

- Gray Kitchen Backsplash Tile: Ideas for a Stylish Upgrade - December 14, 2025

- Backsplash For Gray Cabinets: Choosing the Right Backsplash Style - December 13, 2025

- Gray And White Backsplash: Ideas For Timeless Style - December 12, 2025