[- Home Loan Process Flow Chart: A Comprehensive Guide for Borrowers] gives you the ultimate key to understanding how the pieces fit together in the home loan process. With this flowchart, you’ll gain a clear view of each step, from the initial application to the final closing, along with tips for navigating the process smoothly.

Key Takeaways: Home Loan Process Flow Chart – A Comprehensive Guide for Borrowers

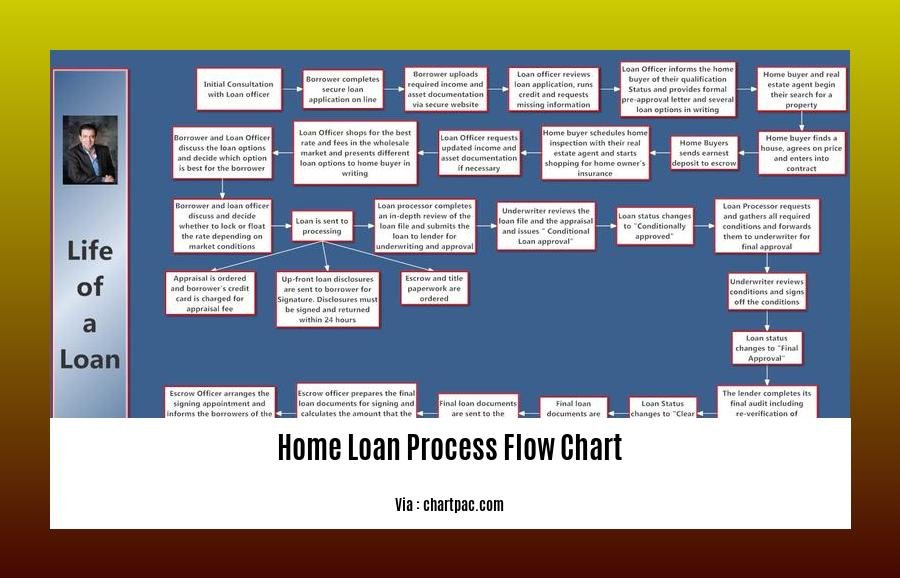

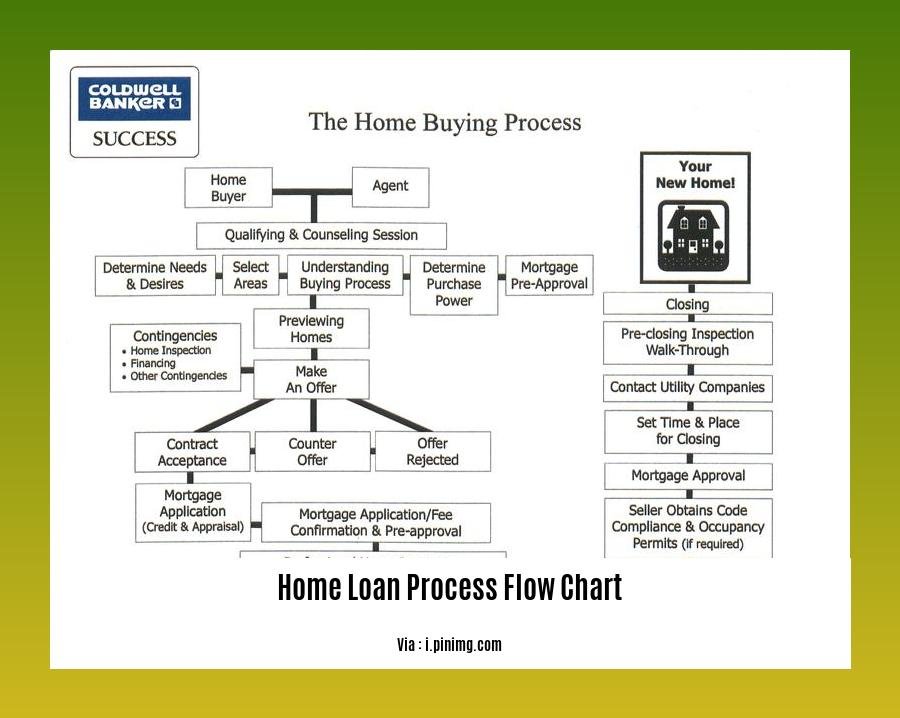

- A mortgage loan process flowchart provides a clear visual representation of the loan application and approval process, making it easier to understand and follow.

- The flowchart guides borrowers through the various steps involved in the home loan process, from pre-approval to closing.

- It helps borrowers stay organized and track their progress, ensuring that all necessary steps are completed on time.

- By identifying potential delays or obstacles in the process, borrowers can address them promptly, avoiding setbacks.

- The flowchart facilitates communication between borrowers and lenders, promoting transparency and understanding throughout the loan application process.

Home Loan Process Flow Chart: A Comprehensive Guide for Borrowers

The home loan process can often appear intimidating. A home loan process flow chart offers a simplified illustration of the steps involved, ensuring a more organized and seamless experience for borrowers. Let’s break down the key stages:

1. Pre-Approval:

– Pre-approval provides a clear estimate of the loan amount you can secure.

– Reach out to a mortgage lender to initiate the pre-approval process.

2. House Hunting:

– Explore properties that align with your needs and budget.

– Make an offer on a suitable property once you find one.

3. Mortgage Application:

– Submit a formal loan application with the chosen lender.

– Include all required documents, such as tax returns and pay stubs.

4. Loan Processing:

– The lender reviews your application for completeness and accuracy.

– Any discrepancies or missing documents will be requested.

5. Underwriting:

– Underwriters assess your financial history, property value, and credit score.

– They determine the risk level associated with your loan and set the loan terms accordingly.

6. Closing:

– Once loan approval is granted, prepare for the closing.

– Sign the loan documents and finalize the property transfer.

Benefits of a Home Loan Process Flow Chart:

-

Simplified Understanding: The flowchart provides a visual representation, making the complex loan process easy to grasp.

-

Organized Tracking: Borrowers can monitor their progress, ensuring timely completion of each step.

-

Potential Delays: Identifying potential delays or obstacles allows for prompt action to address them.

-

Enhanced Communication: It facilitates effective communication between borrowers and lenders, promoting transparency and clarity.

By utilizing a home loan process flow chart, borrowers can navigate the journey towards homeownership with confidence, ensuring a smooth and successful experience.

-

Are you planning to buy a home? Calculate your potential monthly home loan interest payments using our comprehensive home loan interest calculator.

-

Stay updated on the latest home loan interest rates in Singapore with our extensive research-based article on home loan interest rate in Singapore.

-

Explore a diverse range of home loan options offered by various home loan private finance company in Singapore to find the best fit for your financial needs.

-

Learn about various home loan options, including HDB loans, bank loans, and private loans, to make an informed decision when taking out a home loan.

Steps Involved in the Home Loan Process

Planning to own your dream home? Navigating the home loan process can seem like walking through a maze. But don’t fret; we’ll break it down into simple steps like a cake recipe, leaving you feeling confident along the way.

Step 1: Assemble Your Dream Team

Kickstart your home loan journey by choosing the right lender. Think of them as your financial superheroes, ready to guide you through the process. Remember, a great lender makes all the difference.

Step 2: Document Your Worth

Prepare your financial documents like a chef preparing a gourmet meal. Gather pay stubs, bank statements, and tax returns. These documents are your proof of financial prowess and stability.

Step 3: Pre-Approval: Your Key to Confidence

Get pre-approved for a loan to know exactly how much you can borrow. This not only empowers you as a buyer but also impresses sellers, showing that you’re a serious contender.

Step 4: Find Your Perfect Match

With pre-approval in hand, it’s time to go house hunting. Picture yourself in your dream home. Imagine the laughter and joy filling every room. Let your heart lead the way while staying mindful of your budget.

Step 5: Make Your Move

Found your dream home? Time to make a move! Craft an offer that reflects your love for the property while keeping your financial capabilities in mind. Negotiations might be necessary, but remember, patience is a virtue, and compromise is key.

Step 6: Loan Application: The Final Countdown

Submit your formal loan application, like sending off a rocket into space. This is your chance to showcase your financial strength and commitment to securing the loan.

Step 7: Underwriting: The Scrutiny Phase

Lenders will meticulously examine your application like detectives solving a mystery. This is to ensure you’re a responsible borrower and minimize their risk. Be prepared to answer questions and provide additional documents if needed.

Step 8: Closing: The Grand Finale

Prepare for the closing, the moment when you officially receive the keys to your new home. Review all documents carefully, ensuring everything is in order. Sign on the dotted line, and let the celebration begin!

Key Takeaways:

- Preparation is Key: Gather your financial documents like a master chef preparing a feast.

- Pre-Approval: Get pre-approved for a loan to boost your confidence and impress sellers.

- Dream Home Hunting: Let your heart guide you, stay mindful of your budget, and don’t be afraid to negotiate.

- Loan Application: Submit your formal application like a rocket launch, presenting your financial strength.

- Underwriting: Prepare for scrutiny, answer questions, and provide additional documents as needed.

- Closing: Review documents carefully, sign on the dotted line, and celebrate your new home!

Sources:

Home Loan Process: A Step-by-Step Guide for First-Time Homebuyers

How to Get a Home Loan: A Step-by-Step Guide

Timeline and milestones of the home loan process:

We’ve all marveled at the sight of a magnificent home, fueled by an insatiable desire to call it our own. The path to homeownership, however, is paved with financial milestones, each one bringing you closer to your dream home. Let’s embark on this journey, shall we?

Key Takeaways:

-

Step 1: Pre-approval: Kick-start your home loan adventure by reaching out to your trusted mortgage lender or broker. They’ll assess your financial situation and give you an estimated loan amount.

-

Step 2: House Hunting: With your pre-approval in hand, you now enter the thrilling world of house hunting. Visit properties, envision your life within those walls, and when you find “the one,” make an offer.

-

Step 3: Mortgage Application: It’s time to formalize your intentions. Fill out a mortgage application with your chosen lender, providing them with a detailed financial snapshot.

-

Step 4: Loan Processing: Your lender will meticulously review your application, verifying every piece of information and gathering necessary reports. This phase typically takes 1 to 2 weeks.

-

Step 5: Underwriting: Enter the realm of underwriters, the gatekeepers of your loan. They’ll scrutinize your application, assessing your creditworthiness and determining your loan eligibility. This step can also take 1 to 2 weeks.

-

Step 6: Loan Approval: If you’ve impressed the underwriters, congratulations! You’ll receive a loan commitment letter outlining the terms and conditions of your loan. Keep an eye out for any conditions that need to be fulfilled.

-

Step 7: Closing: The grand finale of your home loan journey! Schedule a closing date and gather at the agreed-upon location to sign the final loan documents and pay any closing costs. Once that’s done, the keys to your dream home are yours!

Remember, the timeline for your home loan process may vary depending on factors like the lender’s workload, the complexity of your application, and any unforeseen challenges that may arise. But with careful planning and patience, you’ll navigate this journey successfully, and the rewards will be oh-so-sweet!

Sources:

- How Long Does the Mortgage Process Take? Bankrate

- The Home Loan Process: A Step-by-Step Guide Forbes Advisor

Home Loan Approval and Disbursement

Are you on the path to homeownership and navigating the complexities of securing a mortgage? Let’s break down the [home loan approval and disbursement] process, step by step, to demystify the journey and help you move closer to your dream home.

Key Takeaways:

-

Pre-approval kicks off your home loan journey, giving you a clear picture of your borrowing capacity and strengthening your position as a serious buyer.

-

Choose your mortgage lender wisely, considering factors like interest rates, fees, and customer service to ensure a smooth loan experience.

-

Gather your financial documents, including pay stubs, tax returns, and bank statements, to support your loan application.

-

Embrace transparency with your lender, providing accurate and complete information to expedite the loan approval process.

-

Be prepared for property appraisals and credit checks, as lenders assess the value of your desired home and your creditworthiness.

-

After loan approval, the closing process involves signing loan documents, paying fees, and finalizing the property transfer.

Steps Involved in Home Loan Approval and Disbursement:

- Pre-Approval:

-

Seek pre-approval from a lender to determine your estimated loan amount and boost your credibility as a potential buyer.

-

Lender Selection:

-

Compare interest rates, fees, and lender reputation to find the best fit for your financial needs and preferences.

-

Loan Application:

-

Submit a formal loan application, providing personal and financial information, including income, assets, and debts.

-

Document Submission:

-

Gather and provide required documents, such as pay stubs, bank statements, tax returns, and property details, to support your application.

-

Loan Processing:

-

The lender reviews your application for completeness and accuracy, verifying your information and initiating the underwriting process.

-

Underwriting:

-

Underwriters assess your credit history, income stability, and property value to determine your creditworthiness and set loan terms.

-

Loan Approval:

-

If your loan application meets the lender’s criteria, you will receive a loan approval notice outlining the loan amount, interest rate, and repayment terms.

-

Home Appraisal:

-

The lender arranges for a property appraisal to determine the property’s value and ensure it meets the loan requirements.

-

Loan Closing:

-

Coordinate with the lender, title company, and other parties involved to sign loan documents, pay closing costs, and finalize the property transfer.

-

Loan Disbursement:

- Once all conditions are met, the lender disburses the loan amount to the seller or your account to pay off any existing mortgage on the property.

Whether you’re a first-time homebuyer or an experienced homeowner, understanding the home loan approval and disbursement process is crucial. approach this journey with confidence, knowing that you’re taking the necessary steps to secure your dream home.

[Source 1: TheMortgageReports.com: 65881/mortgage-loan-process | Source 2: Money.USNews.com: Complete Timeline of the Mortgage Process]

FAQ

Q1: What is a home loan process flow chart?

A1: A home loan process flow chart is a visual representation of the steps involved in securing a mortgage loan. It provides a clear and organized overview of the entire process, from pre-approval to closing, helping borrowers understand and navigate the journey to homeownership.

Q2: What are the key steps in the home loan process flow chart?

A2: The key steps in a typical home loan process flow chart include: pre-approval, house shopping, mortgage application, loan processing, loan approval, home appraisal, closing, and post-closing. Each step involves specific actions and requirements, leading to the successful completion of the home loan process.

Q3: How can a home loan process flow chart benefit borrowers?

A3: A home loan process flow chart benefits borrowers by providing several advantages:

– Clarity and Simplicity: It offers a clear and simplified visual representation of the entire home loan process, making it easy for borrowers to understand and follow the steps involved.

– Organization: The flow chart helps borrowers stay organized and track their progress throughout the loan application and approval process.

– Identification of Potential Delays: By visualizing the process, borrowers can identify potential delays or obstacles and take proactive steps to address them promptly.

– Enhanced Communication: It facilitates better communication between borrowers and lenders, ensuring transparency and understanding throughout the loan application process.

Q4: What information should borrowers have ready when applying for a home loan?

A4: When applying for a home loan, borrowers should have the following information ready:

– Personal Information: Name, address, Social Security Number, and contact information.

– Financial Information: Income, employment history, assets, debts, and credit history.

– Property Information: Property address, purchase price, and details about the property’s condition and features.

– Loan Information: Desired loan amount, loan type, and preferred loan terms.

Q5: What happens after a home loan is approved?

A5: After a home loan is approved, several steps typically follow:

– Loan Closing: The borrower and lender meet to sign the final loan documents and pay closing costs.

– Funding the Loan: The lender disburses the loan amount to the borrower or the seller of the property.

– Homeownership: The borrower takes ownership of the property and begins making monthly mortgage payments to the lender.

– Post-Closing Paperwork: The borrower may need to submit additional paperwork, such as proof of insurance and property taxes, to the lender.

- Dent and Ding Appliances: Find Discounted Appliances Near You - April 15, 2025

- How Much Does It Cost to Replace a Dishwasher in 2024? (A Complete Guide) - April 15, 2025

- Drano vs. Liquid-Plumr: Which Drain Cleaner Works Best in 2024? - April 14, 2025